We face one of the deepest crises in history. A prognosis for the economic future requires a deepening of the concepts of inflation and deflation. Without understanding their dynamic relationship and their implications is difficult to predict how things might unfold. The economic future depends on the interplay of both these forces. From the point of view of their final effects, inflation and deflation are, respectively, the devaluation and revaluation of the currency unit. The quantity theory of money developed in 1912 by the American economist Irving Fisher asserts that an increase in the money supply, all other things been equal, results in a proportional increase in the price level [1]. If the circulation of money signifies the aggregate amount of its transfers against goods, its increase must result in a price increase of all the goods. The theory must be viewed through the lens of the law of supply and demand: if money is abundant and goods are scarce, their prices increase and currency depreciates. Inflation rises when the monetary aggregate expands faster than goods. Conversely, if money is scarce, prices fall and the opposite, deflation, occurs. In this case the monetary aggregate shrinks faster than goods and as prices decrease money appreciates.

Inflation is a political phenomenon because monetary aggregates are not determined by market forces but are planned by central banks in agreement with governments. It is in fact connected with the monetary expansion to fund their deficits. Inflation raises the demand for goods and decreases the demand for money; it increases aggregate spending and money velocity as the ratio between GDP and the amount of money in circulation which expresses the rapidity with which the monetary unit is spent and respent until it remains in existence.

There is no such things as demand-pull inflation or cost-push inflation. Provided that the quantity of money does not increase, if cost or demand for some goods changes, demand for other goods must necessarily adjust, leaving unchanged the amount of spending and the money aggregate in the economic system. If some people spend more, others have to spend less, thus leaving the purchasing power unaltered. The cause of inflation is nothing but money manipulation.

Inflation is a tax affecting all real incomes. While this is obvious for the fixed ones, it is less so for the variables ones such as business income. Inflation, in fact, overstates profits by making final sale prices to rise as compared to historical sale costs. When the moment arrives that businesses renew their capital assets, the higher price they will pay for them due to inflation will absorb the extra nominal profits. Since taxes are calculated on them, real profits will be insufficient to either replace or increase capital. Hence by decumulating capital, inflation penalizes economic growth and innovation.

As an economic stimulus, inflation sets the stage for deflation. By increasing the nominal taxable economy, it reduces the real one.

Likewise, subsidies and bailouts produce the same inflationary effects because most of them are financed through monetary expansion: a money supply growing faster than the productivity of capital and labor impairs both.

If inflation accelerates and becomes extreme, hyperinflation sets in: the demand for money tends to zero and because everyone hurries to spend it to avoid the loss of purchasing power, its velocity accelerates rapidly. The monetary aggregate and prices tend to infinity and the value of money to zero. Money loses the character of a medium of exchange and the credit-debit system collapses. Because money is the prerequisite of the division of labour, its destruction implies the destruction of the latter. To avoid barter the monetary system must be redesigned. In this catastrophic state of affairs it is small comfort to acknowledge that the overall debt of a nation is repudiated.

Inflation is a precondition of extreme deflation: depression.

Deflation in itself, however, is an economic phenomenon. Economic progress has a natural tendency to lead to falling prices. By increasing production and productivity, prices decrease, signaling that the economy grows faster than the money aggregate, which means that with the same volume of expenditure more things can be bought – i.e. money has a higher purchasing power.

Because depression usually is accompanied by deflation, central banks interpret any incipient downturn in prices as a sign of crisis and try to prevent it with monetary stimulus. But a depression occurs not because the price level falls but because real output, expenditure and all incomes on which aggregate expenditure is based fall. Regardless of the causes and confusing them with the effects, central banks always inflate, opening the door to evil that they claim to cure.

True and false money

There are many definitions of monetary aggregate. Strictly speaking it is the aggregate in the narrow sense which reveals inflation because it includes only the effective means of payment excluding short term redeemable financial assets. In fact, by definition, something that must be converted into money is not itself money. No one pays necessities with short term securities. Money is only the stock or base money needed to buy goods and services. If the public holds 50 in his pocket and banks 1000 in their reserves, the monetary base equals 1050. It’s called “base” because is the foundation upon which the banking system builds a pyramid of money and credit. Whenever central banks purchase government securities either directly from governments or from banks they increase bank reserves and the monetary base setting the pace for credit expansion.

More aggregate expenditure follows, making nominal GDP grow. Because new credit corresponds to new debt, credit expansion by inducing more debt lowers the ratio between liquid assets and liabilities in the entire economy. When a deficit of liquidity follows to a credit crunch, debts repayment can only be made by deleveraging balance sheets and asset prices across the board sharply fall. Moreover part of the overall debt is cancelled by insolvencies and the combined effect of prices and debt reduction shrinks the monetary and spending aggregates triggering deflation in the form of recession. On the other hand the overall debt does not decrease because governments do not liquidate it as the private sector does. Quite to the contrary they increase debt to pay the outstanding so as to avoid default. As a matter of fact they must increase their debt to make up for debt deflation in the private sector.

Should in fact the overall debt collapse, there would be an extreme deflation or depression because the money aggregate would contract dramatically. In fact the money equivalent to the defaulted debt would literally evanish. It is for this reason that central banks monetize new debt at a lower interest rates, raising its value. Because lower interests raise also the values of all assets, the entire economy looks healthier. But debt monetization gives only the illusion of wealth. It produces inflation growing faster than GDP with the effect of diluting wealth. Real incomes fall not only because of money debasement but because by raising their nominal value, inflation pushes them into higher tax brackets. In this context only the financial sector thrives because in a context of ever growing uncertainty and unpredictability, instruments for averting risks proliferate.

All the financial bubbles and the mass of derivatives are just the consequence of debt monetization. By keeping interest rates extremely low, monetary expansion finances speculation at low cost, allowing it to shift huge amounts of money and earn risk-free profits by capturing price differentials between different markets, which, is the only way to gain returns and preserve purchasing power when interests are kept low or even negative. Because new money is dissipated through the process it must continually be recreated. Debt monetization result in a never ending process of creation and destruction of money. It discourages productive activities leaving the economic future at the mercy of speculation.

All this destabilizing process is the consequence of the creation of money out of the debt. Debt monetization is the exchange of new money for a promise to pay it in the future. Now, if money is a function of the debt it is impossible that we can settle debt permanently. Legal currencies are false money because they depend on the debt expanding and contracting accordingly. Real money cannot be a liability or a promise to pay unlimited debt of third parties subject to default.

The role of money can be discharged only by an economic good that is always in demand, preserves its value and is immune from the failure of third parties. The money with these characteristics is gold, the only financial asset which is not dependent on anybody’s promises and is not subject to debasement or default. As long as this truth is not fully recognised no structural reform whatsoever can overcome a crisis which is systemic precisely because it is immanent to an economic and financial system based on debt. Without sound money on the scene of the economic drama, inflation and deflation will continue to play their conflict until the final outcome: the monetary breakdown.

The currency cliff

In a context of false money, fiscal and monetary instruments are not only ineffective, but harmful. The first, trying to reduce the debt by increasing the tax burden results in draining resources when they are most needed. The second by refinancing the debt and boosting the monetary aggregate to prevent its collapse produces inflation. Hence debt cannot be tamed. Only hyperinflation or default can annihilate it. But the first would destroy the money system, the second would trigger a deep depression.

How will this all end? In history debt monetization has always produced hyperinflation. As long as countries are enjoying credit, fiscal deficits through inflation work. But when they incur new debt to repay the outstanding they reach the point of no return because it becomes clear that they cannot repaid it. Thence hyperinflation has always been the consequence of the inability to service the debt. Investors start to lose confidence in the country and its currency and so citizens. At this point, monetary policy can no longer defend it and a collapse ensues.

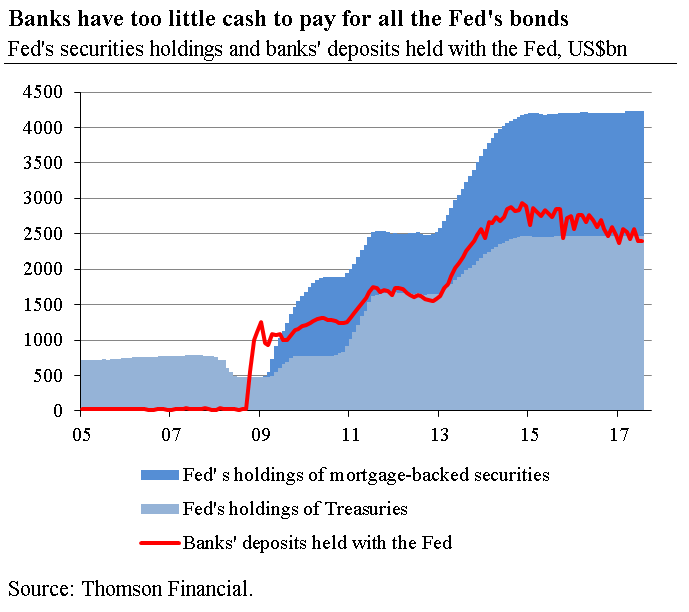

In Western countries, despite the exponential debt a runaway inflation has not yet occurred. Monetary policy has only inflated the financial sector, starving the private one, which is showing a bias towards a deflationary depression: here the demand for money increases, the velocity and prices fall but the monetary aggregate holds as long as debt monetization works. According to the quantity theory it is the money actually spent on goods and services that causes inflation. As long as liquidity is parked in the bank reserves or finances speculation it does not flow into the real economy and inflation progresses slowly. If money were suddenly released it would have the same destructive impact of a dam breaking and overthrowing water downstream. Central banks in fact control the quantity of money but not its velocity, which depends on social forces.

At the present fiscal and monetary policies try to preserve a precarious status quo, balancing inflation and deflation, a state of affairs which allows the debt perpetuation. But this balance can not be maintained for long because sooner or later inflation will be translated from the financial into the real economy via the general currency debasement taking place worldwide. It must not be forgotten that not only are currencies depreciated by debt monetization and fiscal deficits. Governments debase their currencies, destabilizing their trading relationships too by correcting trade deficits to boost exports. Hence a currency downtrend might eventually trigger a systemic collapse, because speculation causes further debasement through currency short-selling .

Ultimately the combined action of low interest rates and currency depreciation would drive investors away either from financial securities or currencies on behalf of tangible assets, notably commodities, whose prices would escalate. Demand for money would fall and so velocity and aggregate expenditure. At this point the market value of the debt securities would fall, bringing the interest rate to astronomical levels. The value of the whole debt would collapse while the price increases of critical commodities would hit the entire economy, pushing up the consumer prices dramatically.

All this process is not linear but oscillatory: massive flows of money would alternatively inflate and deflate financial and real sectors, causing vibrations in the economy that superimpose, eventually reaching a magnitude sufficient to bring down the whole economic structure. It is impossible to predict whether defaults would occur through hyperinflation or depression and where they would start first. Probably the first countries to be affected would be the ones with the weakest currency and the most fragile political setting. The outcome will also depend on the geopolitical situation. The prospect of the extension of a war would certainly make for hyperinflation. Floating currencies would disappear as suddenly as they appeared a little more the forty years ago. It is very hard to imagine the social cataclysm that it would ensue.

Managing deflation

If all the disruptive effects of inflation were understood it would be prevented. The fact is that its effects are confused with real economic growth while inflation is pure and simple currency debasement via increasing currency supply destroying money gradually and systematically. Inflation cannot be controlled. Once the currency loses value it is lost forever. Deflation, by contrast, can be controlled – avoiding its deepening into depression. The latter is like a purge whereby the economic organism expels the poisons accumulated previously with inflation. A gradual deflation induces the recovery because it realigns values with the economic reality, reducing the inflated money stock at level that makes the debt sustainable and repayable. The currency appreciation which ensues is just the antidote to depression itself. In fact, when the quantity of money tends to be measured in terms of absolute purchasing power, it corresponds to more money and therefore to more liquidity.

Note, here, the difference between the true and the false money: defaults make money disappear, while gold, the real money, never does: once in circulation it will remain – it cannot be eliminated by default. The criticism that gold causes depression is unfounded; on the contrary avoids it.

Inflation and its effects can be contended by managing deflation, and this is a political task.

First, to avoid a systemic collapse reciprocal debts have to be either renegotiated or condoned. It must be recognized that their current dimension makes it impossible to repay them, opening the way to uncontrolled defaults.

Second, government spending must be reduced as well as taxes. At the same time, all banks’ bad debts recorded in the accounts as sound credits should be written down. Without this adjustment banks will never be able to operate normally, resuming their credit activity and financing the economy, neither will they be able to attract new capital. The recognition of their losses is the prerequisite for their financial reconstruction. In order to be able to provide new credit banks must first receive it. No investor is willing to lend them funds with the fear of covering losses disguised as gains.

All this restructuring would last a few years and would give a positive signal to markets that facing true values can restore the lost confidence in the economy. Currencies would appreciate again and money would start to flow again without inflating. However, problems would not be solved and crisis would recur with a debt based money. Hence a process of readjustment must contemplate the return of the real money, gold. Since 2010 central banks have become net importers of gold. Why keep it in their coffers? It has to be used immediately to recapitalize banks, and remonetized straight after.

Unfortunately governments and banks will go for more inflation. It is well known that both usually make not only the wrong choices but the exact opposite of the right choices. As history teaches, besides money the freedom of citizens can also be the victim.

[1] The theory is summed up by the famous equation of exchange whose the simplest expression is MV = Σ pQ, where money (M) multiplied by its velocity (V) equals the sum (Σ) of assets purchased (Q) multiplied by their price (p). Although it has been subject to criticism, statistics of the last two centuries prove that is substantially true.

Tip of the hat to this article.

I would add that this will be the end for debt based money anyhow. Central banks and governments are moribund. The market is already adjusting to this new paradigm by stacking gold and silver, and with the emergence of bitcoin, which makes fiat currency and banks irrelevant. Gold will come back in some way, maybe along with these P2P currencies.

At the end of the day, gold (and silver) is money.

There is a direct connection between the theorectial errors of Irving Fisher (the obsession with the “price level” and the failure to understand that a monetary expansion, i.e. the lending out of vast sums of “money” that are not REAL SAVINGS, must lead to a boom-bust event) and the practical errors of such Federal Reserve people as Benjamin Strong and Alan Greespan (and B.B. of course).

With our hostilty to Keynes we sometimes overlook the reality that the struggle was lost before he became really influential. The stuggle was lost when Frank Fetter’s critical examination of the Irving Fisher was basically ignored by the American economics profession.

Indeed how could it be otherwise? The American Economics Association was set up by (German Historical School educated) Richard Ely with the (private) purpose of pushing out free market thought (free market people such as A.L. Perry had been well known in American economics in the 19th century).

Frank Fetter himself joined one of Richard Ely’s “academic freedom” campaigns (the one directed against Mary Stanford of Stanford University – Mary Standford having made a stand against the vicious collectivism, racist as well as economically collectivist, of E.A. Ross) failing to understand that the only “freedom” that Richard Ely was interested in was that of his own kind. His kind would, over time, drive out their foes from academia (by making sure they were never hired in the first place). Not just in economics – but (even more so) in all the humanities and “social sciences”.

What were Richard Ely’s kind? They were (and are) what the Harvard philosopher George Santayana called the “socialistic aristocracy” – the people that Herbert Croly was to push with his “New Republic” magazine.

Heaven-On-Earth “spiritulaity” – the “social gospel”, “collective salvation”, with themselves as secular saints (someone told me that the some church in America actually made a Richard Ely a saint – but even I find that hard to believe) builing the wonderful new “fundementally transformed” society of Heaven-On-Earth which, of course, will turn out ot be Hell on Earth.

No little bit of economics (such as Frank Fetter showing that Irving Fisher’s ideas were wrong) is going to effect these people. They are just going to carry on.

They are building a wonderful new world – and if we get in the way…. well we will go the way of Mary Stanford.

They have had more than a century to become dominant in the universties and in the schools – and, because of this, they dominate the media also.

They are not going to be defeated by us – they are vastly too powerful.

But they will be defeated.

They will be defeated by objective reality.

Their ideas will not work – they will lead to economic breakdown (Hell on Earth – not Heaven on Earth).

So they will be defeated – but the suffering that is going to come will be terrible.

I’m sorry to say that this is a very unsatisfactory which perpetuates wrong clichés.

It makes no sense to consider only the money supply (M) as a macroeconomic indicator, because the overall effect on the economy also depends on its velocity of circulation, according to the equation of exchange MV = PY. Note that Y on the right-hand side is for real GDP; P is for the price level (the equation thus also accounts for its variation over time, ie inflation), while what is equated is nominal GDP, which is to say, the level of aggregate demand.

Now, if we consider the change in nominal GDP after the recession in the major economies, it does not make much sense to say that “continued monetary stimulus” is happening. This does not take into account the fact that V has collapsed due to the financial crisis.

On the relation between monetary policy and interest rates, we have to dispel yet another common mistake. We generally think of monetary expansion as lower interest rates and vice versa of monetary contraction as a rise in rates. This is certainly correct operationally and in the short-run, it is the so-called “liquidity of money”. But there is another effect which acts in the opposite direction, albeit in the longer run: it is the Fisher effect, which leads instead to higher nominal interest rates when monetary circulation (i.e. nominal spending on goods and services) increases. This is because spending increases boost expectation on both inflation and returns on new business investment (John Maynard Keynes was well aware of this). Paradoxically, “lowering rates” now really means committing to raise them more in the future. We can therefore state (as Milton Friedman said re: Japan) that the real reason interest rates are so low is because monetary policy was too tight in the past.

The last consideration is about inflation. Inflation is always influenced by both real and monetary factors. Consider again the equation of exchange MV = PY. For simplicity, suppose V is unchanged. If the money supply (M) remains unchanged as well, the price level can nevertheless change due to a shock to Y, or “supply shock” (eg increased scarcity of oil due to international tensions). This is the case of “good” deflation that the article talks about: this is due to improvements in productivity.

Monetary, or “demand side” inflation or deflation is linked to changes in MV (or, if V is unchanged, changes in M). In this case, what should be avoided is sudden fluctuations, in either direction. Such fluctuations mean that pre-existing market expectations are unfulfilled, which makes decentralized economic planning much more difficult, especially when the level of prices and wages is “sticky” and may not vary without some kind of friction. In practice, however, it seems that deflation in this case is particularly damaging. These problems have been addressed by many economists including in the Austrian School, such as George Selgin in “Less than Zero”, which is recommended reading to anyone who might be interested in such matters.

A. Guest

V has not collapsed. The V is all currently in the sovereign bond market. That does not mean it is benign and that there is no monetary inflation. On the contrary. The UK sovereign bonds are in an almost 300 year record bubble. The consequences of that bursting , or of the currency being repudiated as a consequence, is far from benign.

V is a very misleading Keynesian fudge to justify more monetary inflation. When money is created is has to go somewhere. Just because it doesn’t go where you are measuring does not mean V has collapsed. By the very act of creating money V is activated somewhere.

A. Guest (a person unable to understand what “in your own name” means?)

Milton Friedman was a follower of Irving Fisher – an economist utterly refuted by Frank Fetter (something that Milton Friedman never seems to have understood).

The idea that Japanese monetary policy has ever been “too tight” is absurd. As is the idea that George Selgin is part of the Austrian School.