Together with colleagues spanning four parties – Michael Meacher (Lab), Caroline Lucas (Green), Douglas Carswell (UKIP) and David Davis (Con) – I have secured a debate on Money Creation and Society for Thursday 20 November. Here’s a quick guide to understanding the debate.

First, we have a system of paper or “fiat” money: it exists due to legal mandate as opposed to being a physical commodity like gold. Reserves, notes and coins are created by the state but claims on money are created by the banks when they lend. Most of the money we have was created by banks lending.

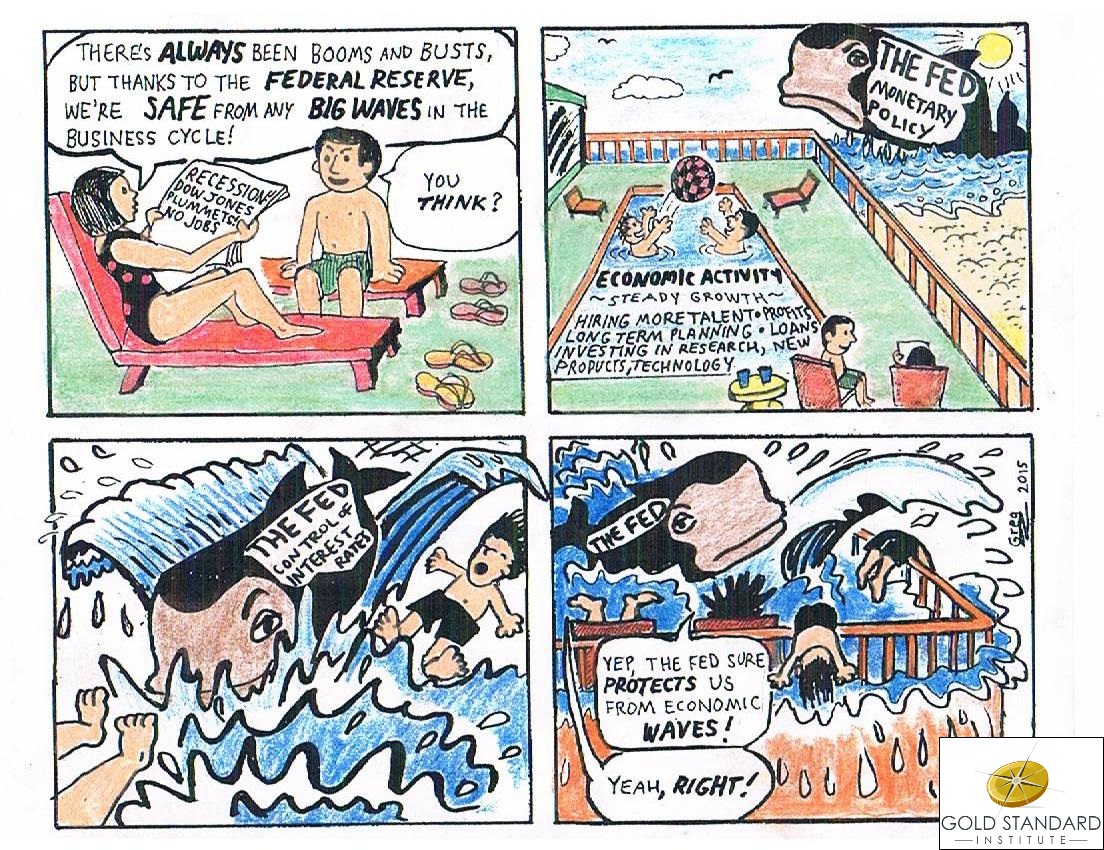

This excellent video from Dominic Frisby is a great place to begin:

There was once a time when the literature about money creation was sufficiently off the mainstream to be dismissed. The Bank of England now explains:

I published a short paper on what is wrong with the current system and what to do about it, first inBanking 2020 and then Jesús Huerta de Soto kindly republished it in his journal Procesos De Mercado Vol.X nº2 2013. A further monetary economist privately reviewed the paper but errors and omissions remain my own. You can download it here:

Recent emergency monetary policy has been dominated by Quantitative Easing: the Bank of England has provided a report on The distributional effects of asset purchases (PDF). However, the financial system has been chronically inflationary throughout my lifetime, ever since the Bretton Woods currency system ended.

If QE has distributional effects, why not all money creation?

Here is a historic price index from the Office for National Statistics and House of Commons Library: Consumer Price Inflation since 1750 (PDF).

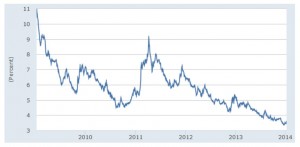

And here is the growth of broad money from 1982 to date via the Bank of England (series LPMAUYM). Note that the money supply stopped accelerating in the course of the crisis, during the period of QE:

No one can argue prosperity has not increased over the period but if distributional effects matter at all, one must ask “Who benefits?” Via Positive Money, here’s where the new money went:

As I said in debate on 6 Dec 2011:

Why are we in this debt crisis? I have just checked the M4 money supply figures—I am sorry to return to aggregates, but needs must. When Labour came to power the money supply was about £700 billion and it is now about £2.1 trillion, so it has tripled over the past 14 years. Unfortunately, most economists talk about money flowing into the economy as if it were water poured into a tank that found its own level immediately, but what if it is like treacle or honey? What if it builds up in piles when poured into the economy and takes a while to spread out? What if that money was loaned into existence in response to individual choices led by the excessively low interest rates pushed by the central bank? What if it was loaned into existence in particular sectors, such as the housing sector, where prices have more than doubled over the same period, and what if it was the financial sector that received the benefit of that new money first? Would that not explain why financiers and bankers are so much wealthier than everyone else, and why economic activity and wealth has been reorientated towards the south-east?

This debate will explore the effects on society of long-term money creation by private banks’ lending in the context of the present financial system.

Further reading:

- The Cobden Centre’s primer, especially the Mises Primer.

- Positive Money, especially their introductory section, How Much Money Have Banks Created?

I back a system under which only government and central banks create money, rather than private banks. However I’m skeptical about Dominic Frisby’s claim that the existing banking system exacerbates inequalities because the well off get hold of new money BEFORE the less well off do, by which time, so Frisby claims, the money has lost a significant amount of its value.

First, given the target rate of inflation of 2%, new money is going to have to arrive in the pockets of the less well off SEVERAL YEARS after its first created for there to be any significant loss of value.

Second, it’s not clear to me that new money does actually go into rich pockets before poor pockets. Take the case of borrowing so as to have a house built or so as to buy a car.

The actual loan to buy the house or car is normally arranged AFTER the house or car has been made. Thus money flows into the pockets of construction workers and car factory workers BEFORE the relevant loan is made or money created.

Great paper Mr Baker.

Ralph.

The rich get the zero interest deals, the poor get the 12% deals… on the same car, at the same time, over the same term…

John

Another good thing about this is the cross party bit. Hopefully this means that Parliament will trend away from the whip system to one where independently minded MP’s make shifting alliances to control the executive.

Now, all we need is out of Europe…