We know that today’s macroeconomists are very confused about inflation, if only because despite all experience they think they can print money and increase bank credit with a view to generating price inflation at a controlled 2% rate.

Admittedly, most of them will acknowledge there is more hope than reality about the controlled bit. Economic policy should be based on more than just hope.

It is timely therefore to see what the Austrian School had to say on the matter, but first we should define inflation: to the Austrians it is an increase in the quantity of money and credit. Inflation is not defined as rising prices; this is the long-run result of inflation in the quantity of money and bank credit. Common jargon confuses the effect for the cause.

The economist who best defined the inflation relationship was Ludwig Von Mises. Von Mises lived in Vienna during the Austrian hyperinflation of 1921-23, so he saw the problem at first hand both as a resident and as a practising economist. The Austrian government eventually succeeded in taming its hyperinflation beast, approximately ten months before the Germanpapiermark finally collapsed. What is interesting and rarely commented on is that German economists saw the collapse of their currency being played out in advance in Austria, and therefore knew with high certainty what was ahead of them, yet they were still powerless to stop German’s currency collapse.

Plus ҫa change. Von Mises described the effect on prices from monetary inflation as undergoing two distinct phases, between which I insert an extra interim phase[i]:

- The beginning of the inflow of additional money makes the prices of some commodities and services rise; other prices rise later. Generally, people do not expect most prices to rise and even think they might fall. This describes the situation today with economists more worried about deflation and people conserving cash and deposits. However, there is already high inflation in some assets excluded from inflation statistics, but driven by the expansion of money and bank credit nonetheless.

- This is followed by an interim period when price rises become more widespread and people begin to shift their preferences from holding money towards buying goods whose prices they no longer expect to fall. Popular opinion fails to link rising prices to an earlier increase in the quantity of money. It is thought to be a temporary phenomenon, the result of other factors such as economic recovery and supply bottlenecks. As price rises gather pace governments blame speculation and profiteering, and they introduce price controls which inevitably leads to shortages of many basic goods.

- Finally we enter Von Mises’s second phase when the population realises that money is losing purchasing power, and they increasingly dump it for goods as rapidly as possible. This is the flight out of money and into goods, thekatastrophenhausse, or crack-up boom. Once the currency enters this phase the currency is doomed.

The currency-price relationship in most countries today is in the first phase, which can last for many years. So far more than seven years have elapsed since the Lehman crisis led to the initial burst of exceptionally high monetary inflation, more than the five years from November 1918 to November 1923 in Germany. The next two phases can be very short in duration. The second phase may be skipped altogether in a major banking and currency crisis if it is catastrophic enough to collapse the currency as well as the banks. The duration of the third phase is mostly a function of how quickly a population adjusts to the reality that paper currency is becoming worthless, despite all attempts by its government to maintain the contrary as the truth. The electronic money of today can collapse more rapidly than a currency that is physically printed into oblivion such as Germany’s papiermark; so a modern flight to goods faces no physical impediment from the currency side.

The American economist, Murray Rothbard, who continued the Austrian economic tradition in the United States, concluded that if a central bank funds the government directly the consequences would be wildly inflationary[ii]. This is more or less what quantitative easing (QE) does by funding government debt indirectly by buying it from the banks.

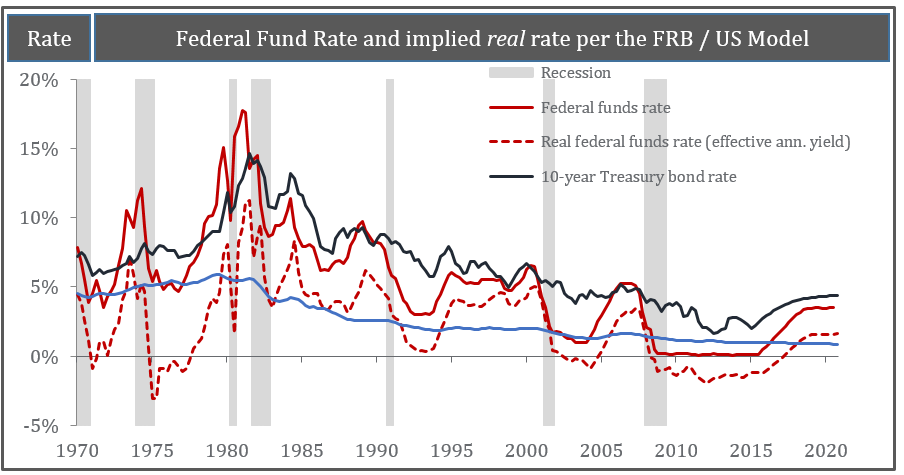

Meanwhile, major central banks have set 2% price inflation as a sort of Rubicon. When it is exceeded, which it will be given the enormous scale of global QE, we will enter the second phase. Preferences will then shift from owning pumped-up quantities of money and inflated bank deposits towards owning relatively scarce goods stocked on a just-in-time basis. The rise in interest rates required to prevent and control too much money chasing too few goods will have to be both anticipatory and large; rises likely to bankrupt governments and wipe out swathes of private sector businesses. Unless this nettle is grasped very firmly and quickly the purchasing power of affected currencies will rapidly collapse as they enter Von Mises’s third phase.

Therefore, the success of monetary policy in achieving its inflation target will itself trigger a crisis. The dynamics of the situation suggest that as soon as the consensus view moves away from expectations of deflation, the progression to the collapse of affected currencies could be very rapid. When this happens don’t be surprised if macroeconomists are taken wholly by surprise, even though the Austrians have already explained it.

Gold prices

Today the price of gold continues to weaken, consistent with the major economies being in the first of Von Mises’s phases. If prices measured in dollars are expected to fall, that includes gold. However, the first warning that the phases two and three are in sight will be a persistent and unexpected rise in the price of gold, even as interest rates are raised by the central banks. The media will doubtless ascribe this development to mine closures, technical positions in the market, or Asian demand. All of these may be valid contributory factors, but they miss the point that the price of gold primarily discounts its future purchasing power relative to the currencies by which it is measured. And if the swing from price deflation to price inflation is as rapid as Austrian economic theory suggests, the rise in the currency price of gold will itself be remarkably sudden and spectacular.

[i] Human Action Chapter 17 Section 8

[ii] The Mystery of Banking Chapter 11 “The process of bank credit expansion”.

Perhaps the situation we have at the moment is slightly different.

The increase in the monetary base has not been finding its way to the average and below average wage earner because of limp union activity.

The money instead has found its way to the banks and to the higher income earners who typically tend to invest surplus income rather than spend it.

Price inflation therefore has been largely restricted to asset and other “investment” prices which will continue to inflate as the Central Banks and commercial banks expand the supply of money.

The collapse will come as bank debtors in large numbers find it impossible to service their debts, maybe as a result of increasing interest rates and perhaps simply as their assets fail to generate a sufficient return.

Then the entire pack of cards collapse as assets are sold for a fraction of their purchase price and money begins to move out of assets and into the retail sector.

No doubt the central banks will be on hand to douse the flames with more petrol but, that is only to be expected.