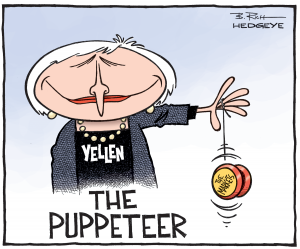

We are living in a time that can only be considered monetary chaos. The U.S. Federal Reserve has manipulated key interest rates down to practically zero for the last six years, and expanded the money supply in the banking system by $4 trillion dollars over that time. And with the true mentality of the monetary central planner, the Fed Board of Governors are now planning to manipulate key interest rates in an upward direction that they deem desirable.

The European Central Bank (ECB) has instituted a conscious policy of “negative” interest rates and planned an additional monetary expansion of well over a trillion Euros over the next year. Plus, the head of the ECB has assured the public and financial markets that there is “no limit” to the amount of paper money that will be produced to push the European economies in the direct that those monetary central planners consider best.

We also should not forget that it was the Federal Reserve that earlier in the twenty-first century undertook a monetary expansion and policy of interest rate manipulation that set the stage for the severe and prolonged “great recession” that began in 2008-2009, in conjunction with a Federal government distorting subsidization of the American housing market.

The media and the policy pundits may focus on the day-to-day zigs and zags of central bank monetary and interest rate policy, but what really needs to be asked is whether or not we should continue to leave monetary and banking policy in the discretionary hands of central banks and the monetary central planners who manage them.

Central Banking as Monetary Central Planning

And make no mistake about it. Central banking is monetary central planning. The United States and, indeed, virtually the entire world operate under a regime of monetary socialism. Historically, socialism has meant an economic system in which the government owned, managed, and planned the use of the factors of production.

Modern central banking is a system in which the government, either directly or through some appointed agency such as the Federal Reserve in the United States, has monopoly ownership and control of the medium of exchange. Through this control the government and its agency has predominant influence over the value, or purchasing power, of the monetary unit, and can significantly influence a variety of market relationships. These include the rates of interest as which borrowing and lending goes on in the banking and financial sectors of the economy, and therefore the patterns of savings and investment in the market.

If there is one lesson to be learned from the history of the last one hundred years – during which the world and the United States moved off the gold standard and onto a government-managed fiat, or paper, money system – is the fundamental disaster of placing control of the money supply in the hands of governments.

Continual Government Abuse of Money

If is worth recalling that money did not originate in the laws or decrees of kings and princes. Money, as the most widely used and generally accepted medium of exchange, emerged out of the market transactions of a growing number of buyers and sellers in an expanding arena of trade.

Commodities such as gold and silver were selected over generations of market participants as the monies of free choice, due to their useful characteristics to better facilitate the exchange of goods in the market place.

For almost all of recorded history, governments have attempted to gain control of the production and manipulation of money to serve their seemingly insatiable appetite to extract more and more of the wealth produced by the ordinary members of society. Ancient rulers would clip and debase the gold and silver coins of their subjects.

More modern rulers – whether despotically self-appointed through force or democratically elected by voting majorities – have taken advantage of the monetary printing press to churn out paper money to fund their expenditures and redistributive largess in excess of the taxes they impose on the citizenry.

Today the process has become even easier through the mere click of a “mouse” on a computer screen, which in the blink of an eye can create tens of billions of dollars out of thin air.

Thus, monetary debasement and the price inflation that normally accompanies it have served as a method for imposing a “hidden taxation” on the wealth of the citizenry. As John Maynard Keynes insightfully observed in 1919 (before he became a “Keynesian”!):

“By a continuous process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method, they not only confiscate, but they confiscate arbitrarily; and while the process impoverishes many, it actually enriches some. The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million can diagnose.”

It is the corrosive, distortive, and destructive effects from monetary manipulation by governments that led virtually all of the leading economists of the nineteenth century to endorse the “anchoring” of the monetary system in a commodity such as gold, to prevent governments from using their powers over the creation of paper monies to cover their budgetary extravagance. John Stuart Mill’s words from the middle of the nineteenth century are worth recalling:

“No doctrine in political economy rests on more obvious grounds than the mischief of a paper currency not maintained at the same value with a metallic, either by convertibility, or by some principle of limitation equivalent to it . . . All variations in the value of the circulating medium are mischievous; they disturb existing contracts and expectations, and the liability to such changes renders every pecuniary engagement of long date entirely precarious . . .

“Great as this evil would be if it [the supply of money] depended on [the] accident [of gold production], it is still greater when placed at the arbitrary disposal of an individual or a body of individuals; who may have any kind or degree of interest to be served by an artificial fluctuation in fortunes; and who have at any rate a strong interest in issuing as much [inconvertible paper money] as possible, each issue being itself a source of profit.

“Not to add, that the issuers have, and in the case of government paper, always have, a direct interest in lowering the value of the currency because it is the medium in which their own debts are computed . . . Such power, in whomsoever vested, is an intolerable evil.”

The Social Benefits of a Gold Standard

Under a gold standard, it is gold that is the actual money. Paper currency and various forms of checking and other deposit accounts that may be used in market transactions in exchange for goods and services are money substitutes, representing a fixed quantity of the gold-money on deposit with a banking or other financial institution that are redeemable on demand.

Any net increases in the quantity of currency and checking and related deposits are dependent upon increases in the quantity of gold that depositors with banking and financial institutions add to their individual accounts. And any withdrawal of gold from their accounts through redemption requires that the quantity of currency notes and checking and related accounts in circulation be reduced by the same amount. Under a gold standard, a central bank is relieved of all authority and power to arbitrarily “manage” the monetary order.

Many critics of the gold standard consider this a rigid and inflexible “rule” about how the monetary system and the quantity of money in the society is to be determined and constrained. Yet, the advocates of the gold standard have long argued that this relative inflexibility is essential to discipline governments within the confines of a “hard budget.”

A Gold Standard Can Limit Government Monetary Abuse

Without the “escape hatch” of the monetary printing press, governments either must tax the citizenry or borrow a part of the savings of the private sector to cover its expenditures. Those proposing government spending must either justify it by explaining where the tax dollars will come from and upon whom the taxes will fall; or make the case for borrowing a part of the savings of the society to cover those expenditures – but at market rates of interest that tell the truth about what it will cost to attract lenders to lend that sum to the government rather than to private sector borrowers, and therefore, at the social cost of private sector investment and future growth that will have to be foregone.

In other words, it prevents the government from “monetizing the debt” to cover all or part of its budget deficits. The borrowed sums cannot be created out of thin air through central bank monetary expansion. The government, under a gold standard, can no longer create the illusion that something can be had for nothing.

As Austrian economist, Ludwig von Mises, expressed it:

“Why have a monetary system based on gold? Because, as conditions are today and for the time that can be foreseen today, the gold standard alone makes the determination of money’s purchasing power independent of the ambitions and machinations of governments, of dictators, and political parties, and pressure groups. The gold standard alone is what the nineteenth-century freedom-loving leaders (who championed representative government, civil liberties, and prosperity for all) called ‘sound money’.”

Milton Friedman’s “Second Thoughts” About the Benefits of Paper Money

It must be admitted that even some advocates of economic freedom and limited government have been advocates of paper money. The most notable one in the second half of the twentieth century was the Nobel Prize economist, Milton Friedman. Over most of his professional career he argued that maintaining a gold standard was a waste of society’s resources.

Why squander the men, material and machinery digging gold out of the ground to then simply store it away in the vaults of banks? It is better to use those scarce resources to produce more of the ordinary goods and services that can enhance the standard and quality of people’s lives. Control the potential arbitrary recklessness of central banks, Friedman proposed, by setting up a monetary “rule” that says: Increase the paper money supply by some small annual percent, with no discretion left in the hands of the monetary managers.

But it less well known is that in the years after Friedman won the Nobel Prize in Economics in 1976, he had second thoughts about this monetary prescription. In a 1986 article on, “The Resource Costs of Irredeemable Paper Money,” he argued that when looking over the monetary mismanagement and mischief caused by governments and central banks during the twentieth century, it was “crystal clear” that the costs of mining, minting and storing gold as the basis of a monetary system would have been far less than the disruptive and destabilizing costs imposed on society due to paper money inflations and the booms and busts of the business cycle brought about by central bank manipulations of money and interest rates.

In his 1985 presidential address before the Western Economic Association on “Economists and Public Policy,” Friedman said that Public Choice theory – the use of economics to analyze the workings of the political process – had persuaded him that it would never be in the long-run self-interest of governments or central bankers to manage the monetary system according to some hypothetical “public interest.”

Those in government or holding the levers of the monetary printing press will always be susceptible to the temptations and pressures of short-run political gains that monetary expansion can fund. He admitted that it had been a “waste of time” on his part to try to get governments and central banks to follow his idea for a monetary rule.

And in another article in 1986 (co-authored with Anna Schwartz) on, “Has Government Any Role in Money?” Friedman said that while he was not ready at that time to advocate a return to the gold standard, he did conclude that “that leaving monetary and banking arrangements to the market would have produced a more satisfactory outcome than was actually achieved through government involvement.”

Monetary Mismanagement versus Markets and Gold

But it is not only the political dangers arising from government mismanagement of paper money that justifies the establishment of a gold standard. It is also and equally the fact that monetary central planning is unworkable as a means to maintain economy-wide stability, full employment, and growth.

Especially since the 1930s, many economists and policy makers influenced by Keynes and the Keynesian Revolution have believed markets are potentially unstable and susceptible to wide and prolonged fluctuations in employment and output that only can be prevented or reduced in severity through “activist” monetary and fiscal policy.

But in reality, the causation runs the in the opposite direction. It is central bank manipulations of money, credit and interest rates that have generated the instability and periodic swings in economy-wide production and employment.

The fact is financial institutions and interest rates have important work to do in the market economy. Banks and other financial intermediaries are supposed to serve as the “middlemen” who bring together those who wish to save portions of their earned income with others who desire to borrow and invest that savings in profit-oriented productive ways that generate capital formation, technological improvements, and cost-efficient production of new, better and more goods and services to satisfy consumer demands in the future.

Market-determined interest rates are meant to bring those savings and investment plans into coordination with each other, so the amount of invested capital and the time-shape of the investment horizons undertaken are consistent with the available real savings to support them to maintainable completion.

Monetary expansion by central banks creates the illusion that there is more actual investable savings in the economy than really exists. And the false interest rate signals generated in the banking system by the monetary expansion not only misinforms potential investment borrowers about the amount of real savings available for capital projects, but creates an incorrect basis for determining the present value calculations that influence the time horizons for the investments undertaken.

It is these false monetary and interest rate signals that induces the misdirection of resources, the mal-investment of capital, and the incorrect allocation of labor among employments in the economy that sets the stage for an inevitable and inescapable “correction” and readjustment that represents the recession stage of the business cycle that follows the collapse of the artificial boom.

The monetary central planners can never be more successful in determining a “optimal” quantity of money or the “right” interest rates to assure savings-investment coordination than all other socialist planners were when they tried to centrally plan agricultural production or investment output for an entire society.

All such attempts at monetary planning and management by central bankers are instances of what Friedrich A. Hayek called in his Nobel Lecture a, “pretense of knowledge,” that they can know better and do better than the outcomes generated by competitive interactions of the market participants, themselves. And as Adam Smith warned, nowhere is such regulatory power “so dangerous as in the hands of a man who had the folly and presumption enough to fancy himself fit to exercise it.”

There is no way of knowing the optimal amount of money in the economy other than allowing market participants in the competitive exchange process to decide what they want to use as money – which has historically been a commodity such as gold or silver. And there is no way of knowing what interest rates should be other than allowing the market forces of supply and demand for lending and borrowing to determine those interest rates through the process of private sector financial intermediation, without government or central bank interference or manipulation.

The Return to the Gold Standard as a Monetary Constitution

Finally, how do we return to a functioning and workable gold standard? Under the current government and central bank-controlled monetary system the simplest method might be for the monetary authority to stop creating and printing money and credit. Over a short period of time a fairly reasonable estimate could be made about the actual quantity of a nation’s currency and checking and related deposits that are in existence and in circulation. A new legal redemption ratio could be established by dividing the estimated total quantity of all forms of these money-substitutes into the quantity of gold possessed by the government and the central bank.

A country following this procedure would then, once again, be on the gold standard. Its long-run maintainability, of course, would require the government and the central bank to follow those “rules of the game” that no increase in the quantity of money-substitutes may be created and brought into circulation unless there have been net deposits of gold in people’s accounts with banking and other financial institutions.

Can we trust governments and central banks to abide by these rules of the game? The temptations to violate them will still remain strong in a political environment dominated by ideologies of wealth redistribution, special interest favoritism, and numerous “entitlement” demands.

It is why the real long-run goal of monetary reform should be the denationalization of money. That is, the separation of money from the state by ending of central banking, altogether. In its place would emerge private, competitive free banking – a truly market-based money and banking system.

But nevertheless, in the meantime, a gold standard can serve as a form of a “monetary constitution” setting formal limits and imposing restraints on those in government who would want to abuse the monetary printing press, similar to the way political constitutions, however imperfectly, are meant to limit the abuses of power-lusting monarchs and the plundering majorities in functioning democracies.

If it fails, it should not be for want of trying. And a gold standard can be one of the positive institutional reforms in the attempt and on the way to a fully free market monetary system.

Source: http://www.epictimes.com/richardebeling/2015/12/paper-money-versus-the-gold-standard/

Managing the quantity of money rather than interest rates is a good idea. Using gold as a means to limit the supply does not stabilise the value of money nor the value of gold. It messes both up.

What is required is a proper constitutional mandate which gives direction to the Money Supply Authority, MSA in regard to their objectives.

The objectives would be to create new money as required to provide sufficient liquidity (printed money of a permanent nature) plus some limited quantity of credit placed onto the money market to compete with savings to be lent. The mandate will include keeping the balance of spending that consumers and spenders have established. The new money will be given to all as far as possible. I’m sure I have explained the mechanism before. Free money is a call upon everyone else’s goods and services in return for nothing but then if everyone gets the new money it is a zero sum game.

The idea that a government would not be able to overthrow any kind of mandate given to any kind of MSA is preposterous. A gold standard is included.

The idea that money can have a stable value is also not proven because it is simply wrong. Value is what people are prepared to exchange money for and it also varies with the speed of spending which is not always determined by what people earn. It varies and so does the population, the proportion of people working ans so forth. No fixed stock of money will do.

What is necessary is that prices must be able to adjust and that interest rates are a price, not an instrument. Look how distorted interest rates are…

Here is my fairy tale to illustrate the points:

SOURCE OF INSTABILITY

The truth about the source of financial instability is reasonably well explained in this short fairy tale:

Think of prices as a flock of sheep. The prices said to the leader, “You lead, we will follow”. The leader led, injecting a small amount of demand and some liquidity into the economy. Basically, that is all it was required to do. The prices tried to adjust. But the wicked witch said, “No you don’t” and cast her spells. The outcome was that the price of bonds was frozen, unable to adjust to anything. The price of monthly payments for housing finance got springs forcing them to leap around instead of just following along behind; and the price of currencies found that international capital was pushing them way off course. What should have been a peaceful scenario of hill climbing over a pretty countryside of gentle hills and vales became chaotic, full of arguments about which prices should do what, each one getting in the way of others and some getting pushed around on different sides by other prices. The farmers had no idea what to do in order to keep the herd together. They simply did not have enough instruments and the instrument which they mostly chose to use was the interest rate price which was supposed to be following like the rest of the herd. They shoved that price around instead of just leading the herd and allowing all prices to follow along behind. Each price disturbance affected some other prices. The knock-on effects as each price bumped into others and shifted their courses, all intermingled, and chaos ensued. There were celebrations that day in the witches’ coven.

So we have more to do than simply to manage the money supply and try to regulate the rate o devaluation of money please – so that there is no shortage of liquidity.

Once we reform the financial framework the MSA will not even need to know exactly how much new money to create, but if they create too little then there will be a problem.

If all prices can adjust properly then the MSA must not target an rate of inflation nor any rate of unemployment. Those prices will adjust – the price of hiring people and the prices index. The outcome will be a lack of financial instability and an economy not held back by insufficient new money.

A loose target would be to get National Average Earnings rising at a low rate not exceeding say 4% p.a. by having enough liquidity and new money in the system at all times.

All my comments are copyright but feel free to quote them along with my name as the source. It will be a book shortly.