Via FT.com / Capital Markets – Bank pushed to step up QE:

The Bank of England reached a milestone this week. Its purchases of UK government bonds, or gilts, rose above £100bn as part of its quantitative easing programme – a method of pumping money into the banking system to stimulate the wider economy.

The Bank now owns £103bn of tradeable gilts, or 15 per cent of the entire gilt market, making it by far the most aggressive of the leading central banks in its attempts to revive lending and demand by expanding the money supply.

…

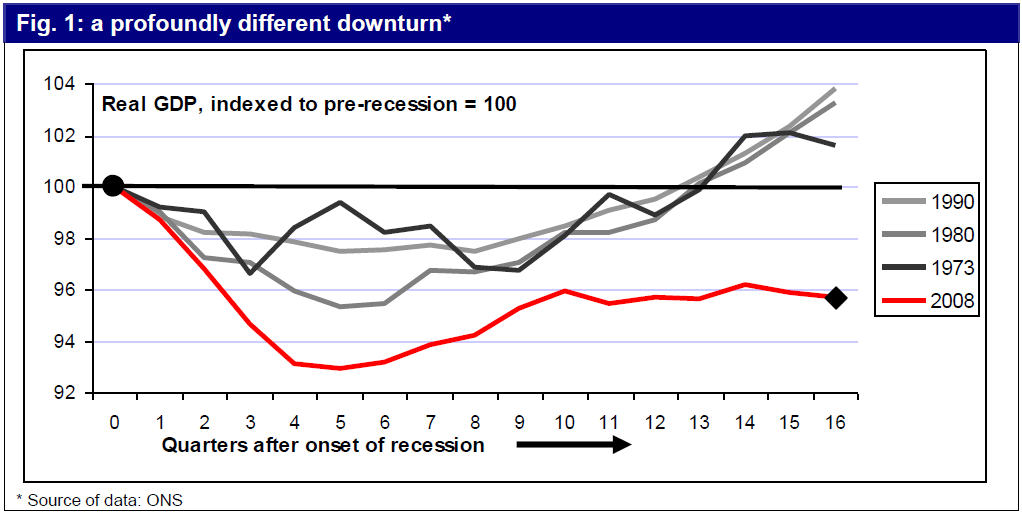

Yet, in spite of its aggression, there is more pressure on the UK central bank to step up its quantitative easing programme, as worries grow in the UK that policymakers may end up being too cautious, leading to an extremely slow and protracted recovery.