The essential idea of a Liquidity Trap as expounded by J M Keynes in this “General Theory” is that there is a point in time, when the interest rate has fallen so low, that investment bonds, be they public or private, are returning so little, that the investor then decides to keep all his money as a cash balance. This then snuffs out any further economic activity that may have been brought about by the former investments. There is a general freezing up in the economy and a Recession becomes a Depression.

It is fashionable in all sectors of the media, politicians and economists to say that they think this event is happening right in front of our very own eyes

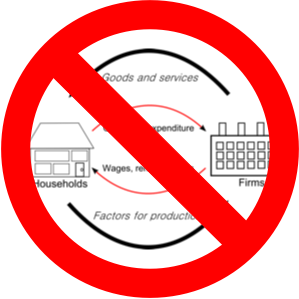

In the famous circular flow of income that the Keynesians adhere to, one man’s spending is a another man’s income.

Is it possible that a person would not spend anything in a Liquidity Trap? I think not. All people have to buy their day to day food stuffs, pay for heating, pay for shelter and other such basics.

Having an excess cash balance simply means that you are choosing to keep your money as cash for later use. You produced goods and services in exchange for money (cash) which you have kept as money, ready to exchange for other goods and services at a moment of your choosing.

Please reflect on this very salient point: a rise in your personal demand for money held as cash does not effect the production of goods and services because money is only employed to exchange things. If it did effect production, an unlimited rise in the demand for money (IE a Liquidity Trap) would mean that no one was exchanging goods and services for other goods and services. Society would cease to be!

We actually have a situation where we have the balance sheets of Central Banks showing cash reserves increasing to startling percentages since the start of the recession in August 2007 with a massive uplift since the Lehman Brothers crash on September 15th 2008 at 07:58. In the USA there are $760 billion of extra cash reserves that now sit in the USA banking system, some 123% more than the same period a year ago. By July of this year, the BoE had increased its balance sheet by £153 billion or 158% over the same time last year.

It would seem that the Keynesians have a point: there is all this cash in the system, untold amounts of liquidity that we have never seen before, and it is not being spent. Is this not the classic Keynesian circumstance in which a Liquidity Trap emerges? This is when silly Monetarist ideas of sprinkling money “from a helicopter” come into vogue: I recently saw a very nutty idea being put forward in the FT by Wolfgan Manchau saying that we should have some electronic devise inserted into money that makes it expire as legal tender after a period of time so people are forced to spend:

Central banks could deploy policies to discourage cash hoarding. One extreme possibility would be to stamp cash, putting an expiry date on banknotes that would force their holders to pay a fee equivalent to the negative interest rates.

Seemingly, people with these views are so divorced from reality they have forgotten, or perhaps never knew, how real wealth is created. I have explained this within Can the Manipulation of Interest Rates Create Wealth?

I find it useful to point out here that if we all spend our salaries on consumption goods only each month, we would not be able to buy any capital goods such as a house or a car, unless we are paid each month a net equivalent to buy a house or a car. Clearly, only a handful of football players and bankers are in a position to do this. No savings would be made if this policy was ever recommended which, in the medium term, would lead to large scale impoverishment of society. From savings, you have the wellspring of investment to produce the new goods and services of the future.

The massive build up of liquidity has come about as the economy has gone into recession. Governments around the world have reacted by putting newly minted money into the economy.

Why did the boom turn into bust? I would always argue that it was the prior large scale expansion of liquidity that led to excessive credit creation under Gordon Brown’s Chancellorship and indeed his Prime Ministry. From 1997 to today, we have seen an increase in money supply (as measured by M4) from £700 billion to £2 trillion.

The bust happened because the structure of production had become so distorted that the production sector was producing goods that the consumer did not want and/or could not afford to buy. How could this collectively happen? For some help with the answers to this, I turn to Hayek which I summarise. I funded the publication of Prices and Production and Other Works, which prints Hayek’s works written during his time at the LSE.

Capital Theory, the Structure of Production and Boom and Bust

From 1931-50, F A Hayek, the 1974 Nobel Price winner in Economics worked out the following in summary and was awarded the Prize for this work;

- A depression is always a shortening of the capital structure of production. Entrepreneurs have invested in things that people do not want in significant numbers such that when people collectively wake up to this fact, the bubble bursts and a realignment of production to the needs of the consumer takes place.

- This is caused by a concept that at the time was called “forced savings” as opposed to voluntary savings. To understand this further, we must look voluntary savings.

- When there are voluntary savings — in my business, using part of my cuts of meat to keep me sustained so I can invest in making a steel to sharpen my knives to “up” my productive output for any given time period — these can support the elongated structure of production that matches, via the interest rate, the prices and thus the needs of the consumers. This increase in voluntary savings causes a larger demand for producers’ goods in relation to consumers’ goods, so goods in the higher stages, those most removed from the production of consumer goods will see an increase in prices relative to the consumer good prices. The consequent narrowing of the spread or margin between the two furthest ends of the production structure and the consumer good end, or in other words, the lowering of the rate of interest, make possible a prolonged and indeed a permanent new process of production. This is steady capitalistic, very safe and very boring non boom growth.

- A lengthening of the structure of production caused by the opposite of voluntary savings — which Hayek called, in keeping with the time, “forced savings” — happens, simply put, when bank credit becomes more available via the demand deposit money creation multiplier described here or through the process known in modern parlance as “Quantitive Easing”. Both credit expansion and QE give the same signals to entrepreneurs that there is now a very low interest rate. This suggests there are plentiful real savings — money is cheap — therefore we can bring those production plans forward that we held at the margin of our thoughts and start investing. However, the consequent elongation of the structure of production is not sustainable because a reversal in the price spread between the producers’ goods and the consumers’ goods takes place as soon as the increase in the supply of cheap money via the private banking or central banking system slows or stops altogether. This is because the spending habits of the consumer have not actually changed.

- This has been compounded in our case by something else Hayek was hot on, if government expenditure rises , more is extracted from the citizens via either taxation or government-induced inflation. This too will cause a shortening of the process of production and a lengthening of the depression.

- If money were kept inelastic — i.e. a fixed supply in relation to the productive needs of the economy, then this could not happen.

In summary, any change in the money supply, through giving new loans to entrepreneurs or to consumers, first lengthens the production structure, then shortens it as real consumer needs have not changed.

Our problem arises from the prior elongation of the structure of production unbacked by real savings, brought about in particular via the low interest rate policy of Gordon Brown’s Government post 2000. This was enhanced by the massive and unprecedented increase in the money supply under his Chancellorship. That caused more investment in the heavy stages of production: the building of houses, or car factories, or to produce consumer goods that indeed, when push came to shove, not enough people could afford. The correction is now taking place. This is when entrepreneurs rebalance or redirect the factors of production that they have under their command to focus on the actual needs and demands of their customers.

There is no Liquidity Trap (I doubt that this is even a meaningful concept), just a badly misallocated structure of production which, despite the government, is in fact slowly but surely fixing itself.

Further reading

- Prices and Production and Other Works, F A Hayek

Comments are closed.