Revised and updated: reconciling our conflicting views of the market through consistent principle and morality. This post originally appeared on www.stevebaker.info.

A Christian friend is an avowed socialist and another associate is determinedly left wing. I asked them recently what socialism meant to them. The answer was essentially “people being good to one another”: kindness, compassion, fairness and justice, even liberty. Who would oppose that?

But can force make it so?

Though I write with great affection for my friends, when I hear or read “socialism”, I understand a quite different thing: misery. Everywhere Marxist theory was determinedly put into practice, the result was tremendous suffering, not utopia, and yet Marxist ideas persist in our thinking.

Socialism, though formally hopeful, causes misery because a socialist society must force individuals to take particular courses of action for the good of all. For example, Lenin’s acclaimed Marxist philosopher Bukharin wrote:

For a long time yet, the working class will have to fight against all its enemies, and in especial against the relics of the past, such as sloth, slackness, criminality, pride. All these will have to be stamped out. Two or three generations of persons will have to grow up under the new conditions before the need will pass for laws and punishments and for the use of repressive measures by the workers’ State.

And so socialist societies have justified sustained repression.

When the Soviet Union fell, it seemed we all accepted that public ownership of the means of production was a dead end. New Labour and the “Third Way” came to prominence, despite the third way being nothing new, merely the idea that government can successfully intervene in a market economy to bring about positive outcomes. The problem is, it does not work.

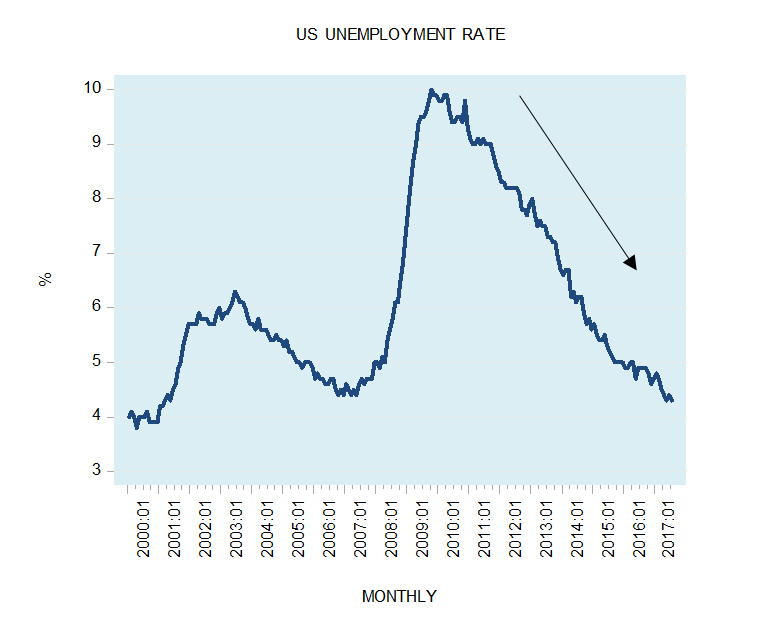

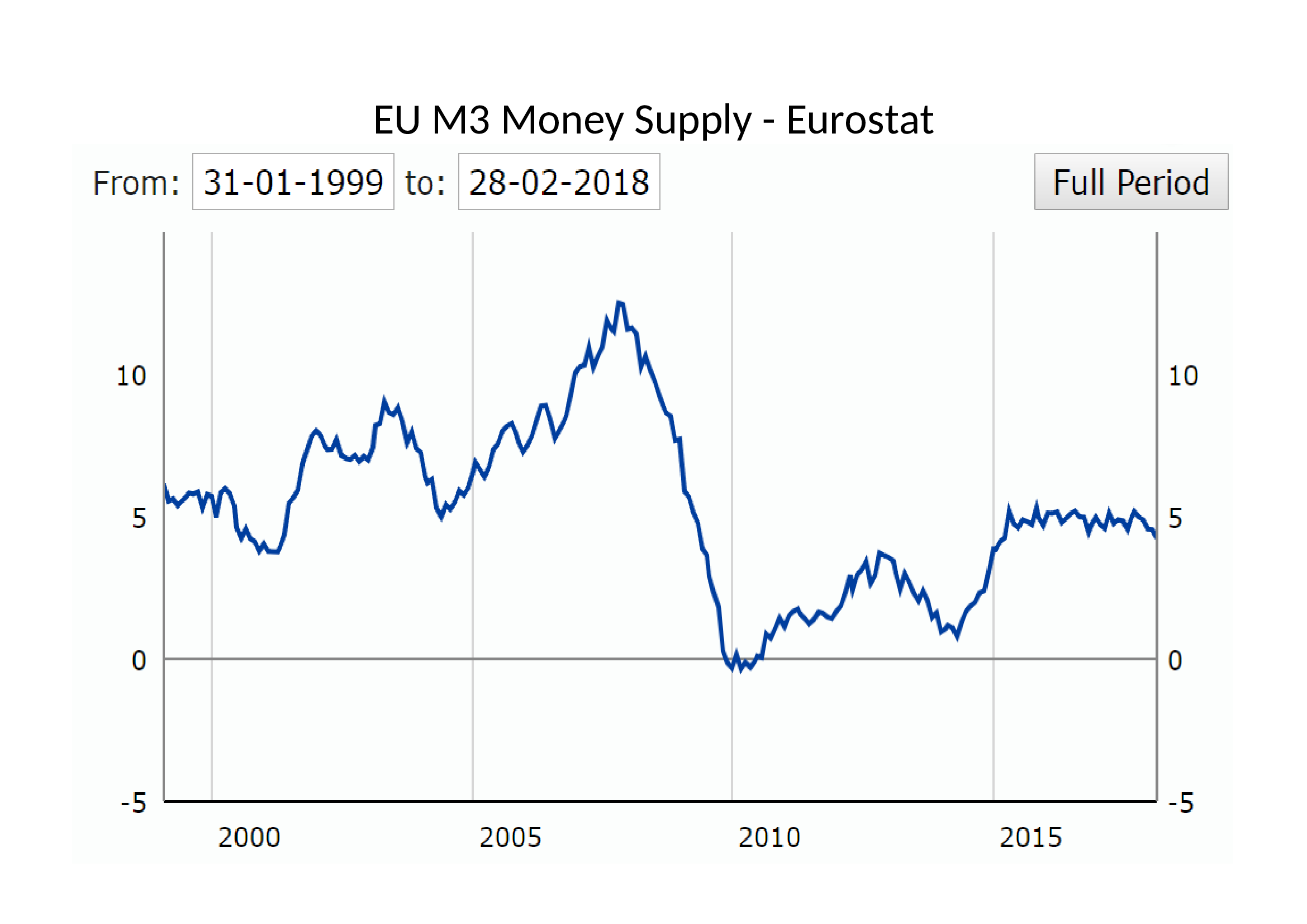

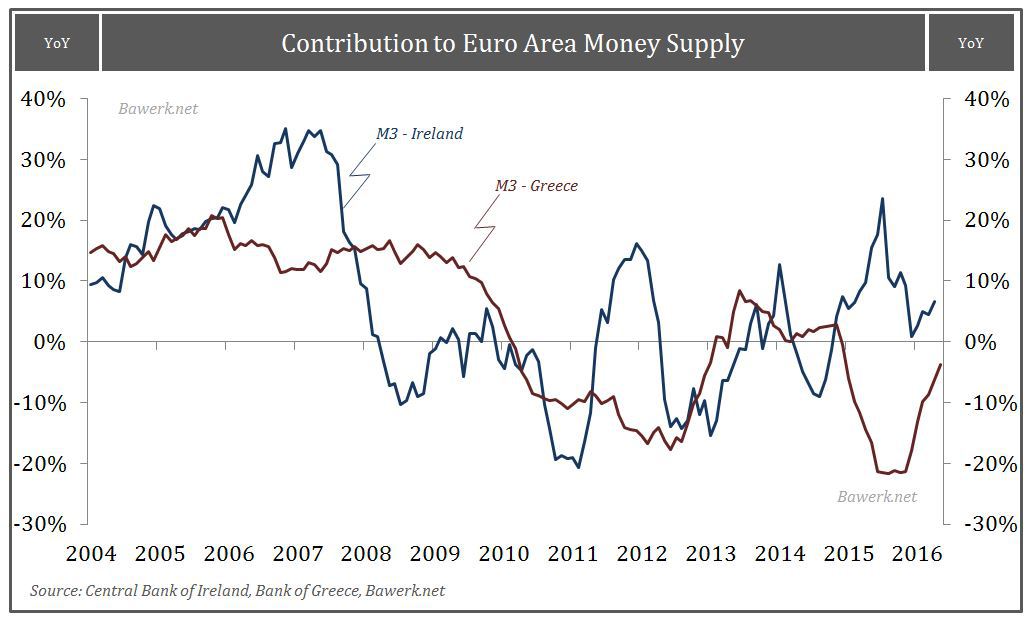

Today, we have a financial crisis, a credit crunch, but few reflect that for a long time we have laboured under the most pervasive price control of all: deliberate manipulation of the rate of interest. Around the world, millions have waited with trepidation for committees of wise men to announce the interest rate. We have had a combination of historically low levels of saving combined with historically high levels of borrowing. Where did this mismatch come from? The rate of interest has been deliberately suppressed, misleading people into saving less and borrowing more than would have been sustainable.

The phenomenon is rather like a gym in which the treadmills may be remote controlled. If just a few people slow down, the central controller does nothing. But imagine the controller sees “too many” people slowing down at once for a break. “This will not do!” he cries, “We must have higher levels of activity!” He turns up all the treadmills at once, and keeps turning them up as exhaustion builds. Eventually large numbers collapse at once. Do we take a break and rebuild ourselves? No! We must inject adrenalin, take sports drinks, anything to get back to peak activity immediately. Eventually, this must end in catastrophe for the participants, but with artificially-low interest rates and quantitative easing, this is what we do to individuals and corporations in the economy.

The consequence is social disaster: high levels of government debt, unemployment and the direct creation of new money, a phenomenon which can only widen wealth inequality because new money is given to the wealthy. Yet this is the consequence of just one intervention in the free market.

When people set out to intervene in the economy by force of authority, they usually fail to realise a simple point: you cannot control the economy without controlling people. The economy comprises the actions of thinking, purposeful human beings with their own ends and means. Socialism requires intervention in that striving, intervention that at best has unintended consequences because the information necessary to intervene successfully is simply not available. Jamie Whyte’s The kindness of geniuses explains charmingly.

Those of us of good faith all want the same thing: prosperity, kindness, compassion, fairness, justice, liberty. People being good to one another. The twentieth century teaches us that state planning of the economy does not deliver these things, so how should society be organised?

Views of the free market

I asked my friends how they reacted to the term free market. They understand this term to mean exploitation. I understand it to mean freely-chosen cooperation for mutual benefit.

As we were sitting in a bar, I asked “Where was the exploitation when you bought that last round?” We wanted a drink, we had earned it in our own ways and the barman was happy to serve it to us. Perhaps the barman was there against his will, but how are we to know? Are we all to approach every transaction with a questionnaire? Should the barman have asked us if we had been exploited before serving us? Are we to invent possible exploitation somewhere up the supply chain for beer? Is it intrinsically exploitative for one man to serve beer to another?

Of course, this is absurd, but people suppose the free market inherently exploits without demonstrating how. This is not to deny the existence of isolated exploitation, but to question how free exchange is inherently exploitative, or corrupting, or the cause of whatever harm is perceived by the commentator. This is Marxist thinking and we know where it leads.

Before me, I have four books which begin to reconcile these difficulties:

- Leviathan, by Thomas Hobbes,

David B Smith’s IEA Hobart Paper Living with Leviathan (download, buy),

David B Smith’s IEA Hobart Paper Living with Leviathan (download, buy),- Moral Markets The Critical Role of Values in the Economy, a collection of articles edited by Paul J. Zak,

- Development of British Monetary Orthodoxy, 1797-1875 by Frank Whitson Fetter.

Leviathan

Leviathan was perhaps the first book of the Enlightenment. It is as pessimistic as it has been influential. In a nutshell, it requires that people should be subject to rule for their own good. Hobbes wrote:

During the time men live without a common Power to keep them all in awe, they are in that condition which is called Warre.

Hobbes rejected Aristotle’s view of man as a naturally social being, claiming that man’s essential nature is competitive and selfish. Hobbes formulates the case for a powerful sovereign – or “Leviathan” – to enforce peace and the law, substituting security for the anarchic freedom he believed human beings would otherwise experience.

Now, surely our experience is that both extremes are caricatures? Isn’t your experience that man is naturally social and competitive and selfish? There will always be those who choose to use violence and fraud to achieve their ends, and they must be restrained by the law. This is Hobbes’ lesson, but can we go further and rely on Leviathan to bring about positive outcomes?

The contemporary idea embodied in our New Labour government and in the European Union appears to be that people will only prosper if the state regulates and exhorts in every area of life from what we eat and how much we exercise, to what we learn, the hours we may work and what constitutes a good way to relax.

We do not have to go far to see what happens when this attitude is taken by government: we need merely look around us, today, at the persistence of poverty (financial and aspirational), at diminishing social mobility, at increasing obesity, at continuing self-harm, depression and suicide, at our broken political system, at our ruined public finances and at our broken debt-based economy.

The idea that Leviathan can enable our high ideals should be at an end.

Living with Leviathan

In Living with Leviathan, David Smith examines the growth of public spending in the UK and its consequences. He identifies various problems including regional injustice and policies which do not promote welfare but which may have prevented post-tax incomes from doubling since the 1960s. He writes in the preface:

The present predominance of the public sector in Europe has made it easy to overlook how much smaller the state was, even in the early 1960s, let alone before the two world wars.

In chapter 7, New Labour, or old fascists?, Smith explores the “apparent similarities between the the more interventionist elements of the Continental European and New Labour approaches and the economic systems of the pre-war fascists”. He emphasises that he is exploring the “economic systems, not the poisonous racial ideology so important to the German Nazis” and that he is not suggesting fascist precedents have been continuously followed.

He writes:

New Labour’s so-called ‘third way’, and the prevalent economic paradigm in much of ‘Old Europe’, appears to correspond to none of these categories [free market, socialist and ‘Butskellite’ mixed]. Instead, it appears to be a system under which the private sector maintains a nominal legal control over its capital and labour, but the returns on these factors of production are so heavily influenced by tax and regulation that the public sector ends up effectively controlling such returns. This sham form of mixed economy, which needs to be distinguished from the British mixed economy of the 1950s, has traditionally been associated with fascist regimes – for example, the gelenkte Wirtschaft (supple or ‘joined-up’ economy) that Goering implemented in Nazi Germany in 1936. Such systems represent an obvious intellectual attempt to reconcile a socialist-inspired desire for a powerful interventionist state with the wealth-creating force of ‘bourgeois-liberal capitalism’, and tend to be popular with politicians and bureaucrats, because they force all sectors of society to kowtow to the state and its functionaries if they are to remain in business. This means that such ‘third way’ systems can easily generate a rich harvest of corrupt favours, and maximise the opportunities for the political and bureaucratic class to acquire plunder and reward their supporters, and seems to explain why politicians who can slip free of democratic control tend to independently rediscover and gravitate towards the fascist model of economic organisation. It is certainly not being suggested that New Labour economic policy is consciously modelled on pre-war fascist precedents but rather that a combination of the Marxist-inspired New Left ideas of the former student radicals of the 1960s and 1970s, who now compose so much of the Labour Party establishment, when combined with an intense nanny-style authoritarianism, and the practical need to get elected, produced a synthesis that ended up with an economic approach that was functionally hard to distinguish from that of fascism.

Smith explains the reasons why such economies start to seize up (and we might bear in mind that we’ll run out of generating capacity in a few years, when just a few years ago there was a windfall tax on energy firms):

The first is that investors and entrepreneurs become aware that regulatory and tax changes that affect their private returns are expropriating their capital and thus they cease to invest or take risks. This is now a serious danger with some of the regulated utilities in the UK…

Second, regulations and controls create inefficiencies, which in turn lead to more regulation and control, until the whole system jams up to the point at which deregulation becomes essential if the system is to survive. …

He goes on to explain that interventionism destroys life chances. In other words, Government intervention by authority may well have good intentions, but it harms us.

Where I fundamentally disagree with Smith is in his assertion that economics is a “positive applied science”.

Economics as a positive applied science

As I have written elsewhere, Hayek and other Austrian-School economists argue that the profession of economics has taken a wrong turn by fundamentally mistaking what it is to be human. The message of Hayek’s Nobel Prize lecture was essentially this:

- Physical scientists can observe and measure the things that drive the systems they are studying.

- Society, and therefore the economy, is not like a physical system: many of the most important factors cannot be seen or measured. (Consider the thoughts and intended actions of millions of people at different times, for example.)

- Economists and other social scientists, in their attempt to be scientific, ignore what they cannot measure.

- Therefore, many of the most important factors affecting the economy are not considered, while some of those factors which can be measured are deliberately controlled.

- The results are incorrect predictions and actions which positively harm society.

In a sentence: society is not a machine to be controlled, but a garden to be cultivated. The methods of the positive applied sciences do not apply to human action, that is, economics. Mises’ Human Action: A Treatise on Economics sets out the arguments in detail, including exposing the lie that aggregates apply to human action on the large scale.

Coming up to date, we discover Jesse Norman’s Compassionate Economics, published by the Cameroon think tank, Policy Exchange:

If the received understanding of economics within government is radically incomplete, how much more so is it within society as a whole. We have been brought up and are daily conditioned to think of human beings as the “agents” of textbook economics: as purely self-interested, endlessly calculating costs and benefits, and highly sensitised to marginal gains and losses. And part of the achievement of economists since Adam Smith is to explain to us why this is OK — how individual self-interest can become social well-being.

But a problem comes when this economic image feeds back into society: when it becomes our default picture of human motivation. For we secretly know this picture is wrong. We are aware that there are routine aspects of our daily lives like volunteering or philanthropy which it cannot properly explain. We know that there are virtues such as loyalty and long-term thinking which seem to run directly counter to it. We fret about the atomisation of society, the commercialisation of human culture and the narrowing of our expectations of others. We over-invest in half-baked prescriptions for happiness. We yearn endlessly for the things money famously cannot buy: love, friendship, joy. Yet without an alternative picture of what a human being is, we cannot free ourselves from our assumptions. This is the intellectual heart of the matter.

And:

In the real world, of course, the key assumptions of textbook economics are rarely even closely approximated. But the effect of this formalisation is to exclude from the theory roughly all of the things that give human life its point and meaning.

Moral Markets

And so we turn to Moral Markets, The Critical Role of Values in the Economy:

Like nature itself, modern economic life is driven by relentless competition and unbridled selfishness. Or is it? Drawing on converging evidence from neuroscience, social science, biology, law, and philosophy, Moral Markets makes the case that modern market exchange works only because most people, most of the time, act virtuously.

Free markets bring remarkable increases in prosperity and liberty: “theory predicts and experience confirms that they are reliable engines of growth and social liberalisation.” We are reminded of the irony that the distorted and incomplete caricature of free enterprise as the pinnacle of amoral self-interest is often advanced by its proponents. We find economic success relies on the coupling of cooperation and restraint with self-interest, and that omitting these features in descriptions of free enterprise is a mistake.

In a very real way, free enterprise must be regarded as values in action.

I recommend the book to advocates of freedom, intervention and socialism alike but ultimately the book makes a predictable error among some deep insights, an error which is easily explained. From chapter 15, What’s a Business For:

With hindsight, in the boom years of the nineties America had often been creating value where none existed, valuing companies at up to 64 times earnings. Her consumers’ level of indebtedness may well be unsustainable along with the country’s debts to foreigners. Add to this the erosion of confidence in the balance sheets and in the corporate governance of some of the country’s largest corporations and the whole system of channelling the savings of citizens into fruitful investment begins to look in question.

And herein lies the error: the link between real savings and investment is broken in the current system of money and bank credit. Real savings are not all that is channelled to investors: our system of fractional reserve banking with a central bank creates deposit money out of thin air, breaking the link between what has really been saved and what is invested while simultaneously misleading savers and investors.

Consider this from Steve H. Hanke’s Panic Time at the Fed (Forbes, May 2008), via Garrison:

With interest rates artificially low, consumers reduce savings in favor of consumption, and entrepreneurs increase their rate of investment spending. And then you have an imbalance between savings and investment. You have an economy on an unsustainable growth path. This, in a nutshell, is the lesson of the Austrian critique of central banking developed in the 1920s and 1930s.

The system of money

Finally we come to Fetter and the Development of British Monetary Orthodoxy, 1797-1875, which explains “the interplay of forces” in the banking controversies of the period and how pre-1914 British monetary orthodoxy was decided. The features of the system were:

- The gold standard,

- A central bank nominally independent of government, with a virtual monopoly of the note issue, holding a major part of the nation’s gold reserve and prepared to act as lender of last resort in time of crisis,

- And other banks, although stripped of the right of [note] issue, virtually unmolested in the creation of deposit currency.

Now, last night, a house guest showed a genuine interest in these issues, so I explained this monetary orthodoxy, including the prohibition of notes over specie in the 1844 Bank Charter Act, implemented beside the continued ability of the banks to issue deposit money to be drawn by cheque. He spotted immediately that cheques perform the same function as notes and coin and that deposit money would produce the same problems of financial instability as the overissue of notes. If only he had been around in 1844…

As Mises wrote:

The monetary explanation of the trade cycle is not entirely new. The English “Currency School” has already tried to explain the boom by the extension of credit resulting from the issue of bank notes without metallic backing. Nevertheless, this school did not see that bank accounts which could be drawn upon at any time by means of checks, that is to say, current accounts, play exactly the same role in the extension of credit as bank notes. Consequently the expansion of credit can result not only from the excessive issue of bank notes but also from the opening of excessive current accounts.

The foundations of free markets are private property and the means of indirect exchange, ie money, but money contains a systematic fault which was not addressed in 1844: the creation of deposit money by private banks. The fact is not lost on all Parliamentarians: the Earl of Caithness said, in the 2009 Banking Bill debate:

My Lords, the Banking Bill which we are currently discussing in the House is very complex and detailed, but it does nothing to resolve the current banking crisis, which lies at the heart of our economic problems. The noble Lord, Lord Peston, has just said that it is the fault of the bankers. I agree with him up to a point, but would go further and say that the fault that really needs correcting is our whole banking system. …

The Banking Bill fails to address the fault which has led to every major banking and currency crisis during the past 200 years, including this one…

The same banking mechanism, which destroyed the gold standard, is now destroying the central banking system…

Why are we trying to save a system that, since 1811, has overcome every attempt to harness it?…

And as Irving Fisher wrote in 100% Money (1935):

Thus our national circulating medium is now at the mercy of loan transactions of banks; and our thousands of checking banks are, in effect, so many irresponsible private mints.

From the book’s Foreword By A Banker:

Our statesmen have consistently declined to study this question and provide a sound monetary system, an adequate permanent currency…

Conclusion

So here is the root of our present difficulties and a contributor to our varying understandings of the market: what pervades all market cooperation, public and private, is a fundamentally corrupt system of money and credit. It distorts the economy, widens inequality and damages virtue.

It is time for those of us who promote the free market under the rule of law to ask if we believe our own rhetoric. We should:

- Recognise that people are mostly moral and mostly desire good outcomes for all.

- Recognise that economics is not a positive applied science with accurate predictive capabilities and therefore intervention by authority — as opposed to law fixed well in advance — in the routine actions of people is counterproductive.

- Understand the systematic problem which permeates the entire economy and its origin in the oversight of 1844: the failure to recognise the equivalence of notes and deposits.

- Understand that the system of money and credit is centrally planned and that it pervades all we do.

- Solve the root problem in all market-based cooperation: reform our system of money.

Happily, as Fisher, Huerta De Soto and Baxendale have shown, making our money honest offers the side effect of paying down the national debt. We could lift our heads to a new beginning.

If our money were honest, we would at last have a basis on which to construct a system of cooperation for mutual benefit which might satisfy us all: moral markets. If we recognised that we need fixed law, not arbitrary authority, and that we cannot abdicate to government our responsibility to our fellows, then we might begin to make genuine social progress.

Further reading

- Insight articles at The Cobden Centre, particularly 100% Money, Bailing out the Banks – Glaring Evidence of Moral Hazard and A day of reckoning.

- Huerta de Soto, Money, Bank Credit and Economic Cycles

- Moral Markets, Zac

- Hazlitt, Economics in One Lesson

Comments are closed.