Responding to an article in The Times, Steven Baker indicates the origins of our views on the economic situation and its causes, of our prospects and of the best route to sustainable prosperity.

Responding to an article in The Times, Steven Baker indicates the origins of our views on the economic situation and its causes, of our prospects and of the best route to sustainable prosperity.

For the Times, Jim O’Neill, Chief Economist at Goldman Sachs, writes:

Based on the evidence I have seen this month, it looks as though the world moved out of recession in the second quarter. When we see the evidence for this, in the third-quarter data, it is likely that many areas will have returned to close to trend growth.

He goes on to explain the emotional and subjective criticism he has received in response to previous articles, the evidence and his optimistic outlook for the world economy, concluding:

Since March, close to the time that developed stock markets bottomed, our GLI has shown a vigorous bounce and, indeed, for the past two months the monthly increases have been the sharpest we can find. The chart of the monthly changes, as you can see, looks pretty much like a V, not a W. Right now, it suggests a much stronger bounce in the world in the next six months than consensus and, along with other data, is why in our latest forecasts we predict that world GDP will recover by 4 per cent in 2010. This will include the UK because, despite all its challenges, it is an economy small and open enough to be greatly influenced by the rest of the world.

Now, we have already explained why the FTSE is rising, the cause of the appearance of prosperity (also Corrigan) and that uninterrupted growth in the stock market never indicates favourable economic conditions. We have shown that our understanding of the nature of money produces a measure which, in contrast to the Bank of England’s M4, correlates to economic activity. We have introduced a better measure of private prosperity than GDP. We have indicated here and here alternative prognoses for the global economy. Our primer introduces our supporting literature.

Mr O’Neil is a senior economist and Goldman Sachs makes a great deal of money. So why do we disagree?

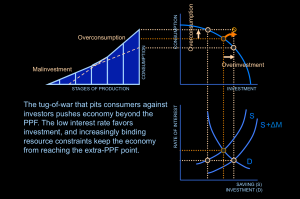

There are three important schools of economic thought: Keynesian, Monetarist and Austrian1. We follow the Austrian School. In contrast to the others, it has a robust capital theory and an understanding of the interest rate as the price which coordinates the economy across time. Unfortunately, Mr O’Neill’s economic thinking causes him to look at the immediate empirical evidence and make pronouncements which, while superficially justified, lack a deep theoretical understanding of the situation, that is, the distortions in the capital structure of production.

Of course, this is not to assert that money cannot be made by bankers in the short term under the present system. The question is whether that system of thinking can explain our predicament and the best route out.

For a technical introduction to capital-based macroeconomics, please see these Powerpoint presentations — based on Roger Garrison’s “Time and Money” — which provide helpful animations explaining how the structure of production changes in response to saving and investment. They show how malinvestment and overconsumption arise when interest rates are deliberately manipulated. See also Hayek’s Prices and Production and Other Works.

For a highly-readable, non-technical exploration of the crisis, see Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and the Government Bailout Will Make Things Worse by Thomas E. Woods Jr with a foreword by Ron Paul, a US Congressman and former presidential candidate.

Meltdown demonstrates, from a US perspective:

- That government created the housing bubble and the culprits were: Fannie Mae and Freddie Mac; the Community Reinvestment Act and affirmative action in lending; government’s artificial stimulus to speculation; a “pro-ownership” tax code; central banking and artificially-cheap credit; and finally the “too big to fail” mentality.

- That the bailouts were a mistake and when the bill comes due, governments will borrow, print or seize the necessary funds.

- How government intervention causes the boom-bust cycle, that Keynes’ permanent boom was a fantasy, and that public works are a misdirection of resources.

- That the rest of the world is now repeating the errors which prolonged the Japanese bust.

- That the Great Depression is surrounded by myths which can be refuted.

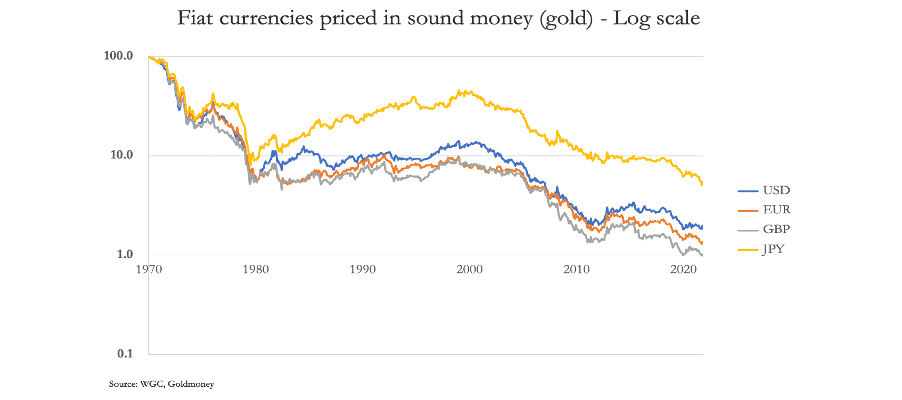

- That the system of money is at the heart of our problems.

This analysis stands in stark contrast to the mainstream but see also Corrigan’s Tangible Ideas – Goodbye to All That, which explains the end of the past economic era in some detail.

Woods presents his policy prescriptions and concludes:

The Austrian approach to understanding what has happened to the economy holds far greater explanatory power than does any competing school of thought…

In short, supporters of the market economy need to decide once and for all whether they really believe their own arguments…

… those who correctly support the free market no longer have a choice: they need to consider the Austrian school, which offers the only intellectually coherent free-market position in light of the present crisis.

The Austrians, surely the fastest-growing school of economic thought in the world, have been neglected long enough. The economic mainstream, so called, told everyone in the 1920s that depressions were thing of the past and in the 1990s that a new economy had arrived. The vast majority of economists likewise failed to see the present crisis coming. In each case, the Austrians saw what everyone else missed….

The best way to avoid the bursting of economic bubbles and to clean up the wreckage caused by artificial booms is to not initiate artificial booms in the first place. We should at last abandon our superstitions about the expertise of Fed officials and their ability to manage our monetary system. It’s about time we listened instead to people who have a coherent theory to explain why these crises occur, saw this crisis coming, and have something to suggest other than juvenile fantasies about spending and inflating our way to prosperity. The choice is a stark one: we can follow the very suggestions that prolonged the Great Depression and gave Japan its slump of nearly two decades, or we can try a different approach, one with an excellent track record and that is based on a theory that actually accounts for what is happening.

No one is arguing that the present interventions by government are not giving the impression of prosperity; we agree that injecting new money creates economic activity. However, these measures create only an illusion which cannot last and which succeeds only in postponing and worsening the unavoidable crash. Society can ill-afford that outcome.

O’Neill is right: things look better. Unfortunately, this is another artificial boom which will not last.

Update

This post was borne out by the economic data, as reported here.

Further reading

- The Austrian Theory of the Trade Cycle

- Economic Interventionism, Banks and the Crisis

- The kindness of geniuses

- Hayek’s 1974 Nobel Prize lecture

- Regrettably, echoes of Marxist economic thinking still reverberate. [↩]