Equity Strategist Ewen Stewart makes the case that the national debt will within 5 years be over £150,000 per family of 4 with debt repayments of twice the present defence budget, up from £31 billion in 2008/9 to £70 billion in 2013/14. He explains the root causes of our difficulties and indicates a route to recovery.

It’s all over. What a fuss about nothing. The economy will soon be growing again and, look, the FTSE100 is up almost 50% since the March low. Even house prices, according to the Halifax, have risen 6 months in a row. The doom mongers were wrong. Central Banks and Keynesian public spending programmes, together with QE, have worked. Brown indeed has saved the world!

Well that would be one interpretation and a very short sighted one too, for this recovery shows all the hallmarks of a drug addict who claims to be going straight injecting a further mighty dose of the substance that has caused such decay in the first place to prolong the party.

The problem is that the underlying fault lines in the UK economy remain and, thanks to the Government’s response, are even more pronounced.

The underlying problem is, in my view, an addiction to debt, a banking system which is over-leveraged, and now government finances that are out of control. This country that has been living considerably beyond its means for a very long time. Artificial efforts to prop this up, through printing money or inappropriately low interest rates, at best are a short term delaying tactic and at worst risk stoking a loss of confidence and ultimately inflation.

It is my central conjecture that much of the economic growth over the last decade was less the result of genuine private wealth creation but more the result of a number of unique factors which were both unsustainable in their nature and damaging to long term growth. If this view is correct the scale of the over-leverage and the action required to alleviate the problem become even more pronounced.

Firstly, the UK Government adopted an aggressive Keynesian spending strategy during the boom times. This is well known but it is worth just remembering the scale of their largess. Total Government expenditure increased from £364bn in 2001 to £583.3bn in 2007/8 an increase of 60.3% or from £5900 to £9700 a head. If spending over that period had kept pace with RPI spending would have increased to just £431bn not the £583bn out-turn. If it had exactly mirrored GDP growth the scale of the public purse would have risen to £495bn. In other words the Brown Government increased spend by between £100/150bn over and above RPI and GDP. I estimate over that 6 year period that artificially increased GDP (in the short term) by between 0.5-1% pa. It also diverted resources from the productive private sector element of the economy to the less productive state sector, which in the long term will have damaged the competitive position and growth potential of the UK.

Second, over that same period, tax receipts were undoubtedly greatly boosted by the growth in ‘the City’ and real estate prices. Corporation tax receipts, stamp duty and income tax receipts from bonuses grew rapidly. The corporation tax take increased from £28bn in 2002 to £46.3bn in 2008, with no little help from the Banking sector, stamp duty doubled over that period to £14.1bn (largely fuelled by rising real estate prices) and, although stripping out the City bonus windfall is problematic, the £40bn rise in income tax receipts can undoubtedly be partially explained by the success of the Square Mile. In other words it is not unreasonable to assume that the financial sector perhaps added an excess of at least £30bn of receipts over what had been achieved in 2002. This equates to a windfall 6% of total tax receipts.

Third, the regulatory authorities had not checked the unprecedented and unstable growth in bank lending which was behind much of the success of the City and real estate pricing. Taking data from the Bank of England Stability report, average UK Banking Asset leverage increased from 21.8x in December 2000 to 31.7x by December 2008 with the most extreme UK Banks leveraging their asset base over 60x.

Indeed, these ratios flatter the reality of the position as they exclude off balance sheet instruments. There are many reasons for the increase in leverage, which go beyond the scope of this article, but very low interest rates undoubtedly played a major part in this as they encouraged an erroneous belief that the boom/ bust cycle was over and that leverage was an easy way to enhance returns. Further as banking spreads narrowed, as the collective memory of risk was forgotten, profits could only be maintained by ever more aggressive leverage strategies. The population, banks and the Government forgot that these ever increasing tax receipts from real estate and the City were cyclical, and indeed highly cyclical as it would prove. This leverage while greatly enhancing returns in the short term clearly was unsustainable as the recent crisis has shown.

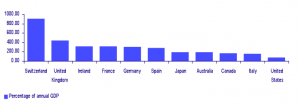

The chart above puts UK lending in a global perspective. UK bank lending assets account for in excess of 400% of GDP. This had increased from 181% of GDP in 2001. While the international nature of the UK banking system does distort the picture presented above, there is no doubt that much of the growth achieved between 2000 to 2008 was as a result of greatly increased banking leverage which manifested itself in substantial asset price inflation. This factor was ignored by the Bank of England. To be fair the rules of engagement of the Bank were set by the Government which saw fit to define inflation in rather narrow terms, in this writers opinion, ignoring real estate and other asset prices. While it is very difficult to ascertain the underlying growth accounted for by the increase in financial services and real estate activity, an estimation of artificially increasing GDP by around 1% is not unreasonable between 2000 and 2008.

Other one-off factors also aided GDP over those years. Unprecedented levels of immigration, be they from Eastern Europe, or further a field, also played a measurable part in our so-called consistent record of growth.

Taking all these factors into account, while GDP may well have increased at around 3% pa, the underlying sustainable rate, particularly adjusted on a per capita basis, was very much lower, perhaps as little as 1% pa.

Brown’s reckless spending in the good times, ignoring the one-off windfalls and treating them as sustainable, left the UK finances in a weakened position prior to the crisis. Post the crisis, this has lead to an unsustainable black hole of proportions never seen outside War.

To put this in context, the National Debt (before PFI or pension liabilities) has increased from £311bn in fiscal year 2000/01 to a staggering £806bn today or from around £20,000 per family of 4 to £53,000. The Treasury forecasts this to rise to £1,370bn by 2013/14 or over £90,000 for each family. What exactly have we to show for this largesse? A well educated population? An exemplary Heath Service?

Unfortunately, the Treasury has a record of unbounded optimism when forecasting thus their estimates are likely to prove to be rather optimistic. They believe the deficit of £175bn in 2009/10 will fall rapidly. See the table below showing current Treasury forecasts.

| Fiscal Year | Deficit £bn | %GDP |

| 09/10 | 175 | 12.4% |

| 10/11 | 173 | 11.9% |

| 11/12 | 140 | 9.1% |

| 12/13 | 116 | 7.2% |

| 13/14 | 97 | 5.0% |

These forecasts are predicated on a substantial pick-up in tax receipts facilitated by a rapid and sustained economic recovery. They forecast a decline of 3.5% in GDP followed by a recovery of 1.25% in 2010 and then trend growth of 3.5%. This seems to me as Alice in Wonderland. Remember our earlier comments about the likely sustainable underlying growth achieved in the so-called golden period of 2000-8.

I have forecast a deficit profile as follows:

| Fiscal Year | Deficit £bn | %GDP |

| 09/10 | 195 | 14.5% |

| 10/11 | 205 | 15.3% |

| 11/12 | 191 | 13.8% |

| 12/13 | 169 | 11.9% |

| 13/14 | 159 | 10.9% |

My forecasts are based on a more muted recovery of 1.5-2% from 2011 They also assume outside debt repayment and ‘social protection’ budgets either flat or declining budgets for all other departments. This would have been an achievement even for the Thatcher Government.

The issue is that borrowing does not come free. Even if we assume current funding costs are sustainable — an heroic assumption in this writer’s opinion — I estimate debt repayment will rise from £31bn in 2008/9 to around £70bn in 2013/14 or more than twice the current defence budget. The social provision budget (currently c£220bn pa) is also highly cyclical. Without substantial changes in the benefit structure (and curtailing certain elements of the long term sick while welcome barely touches the issue) will rise further given the late cycle nature of unemployment.

The truth is, this deficit is embedded and, even with substantial cuts, will prove very difficult to reduce materially. If my maths is correct, the National Debt will be in excess of £1,600bn or over 100% GDP by 2013/4. And again this is before unfunded State pension liabilities, which are generally considered to be between £600bn – £1000bn depending on the actuarial assumption chosen, and PFI liabilities of over £120bn. The total accumulated State debt will within 5 years be likely around, on a best case scenario, £2,300bn or over £150,000 a family of 4. An interesting question is who will buy this massive increase in debt paper and will it be fundable on anything approaching the current repayment terms?

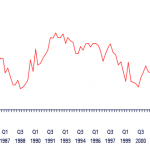

HMG has gone out to lunch and is punch drunk. Sadly the consumer is not much better. Remember our discussion on the banks leverage: another way of looking at this is consumer saving. Well here the cupboard is bare. The chart below shows just how little the average Briton is saving. With a blip at the end of the 1980s, the savings ratio has traditionally been in a range of between 8-12%. Not any more. Steadily since 1997 it has fallen and even went negative in late 2007. We were dis-saving. There has been a modest bounce since the crisis but a savings ratio of 3% is simply not sustainable in the long term.

To solve this problem, you might imagine the Government would encourage thrift. Not a bit. Interest rates were slashed to 0.5% in an attempt to keep ‘the show on the road,’ car scrappage schemes announced, VAT cut. These distortions are little more than bribes to spend. All this has achieved is to bring forward consumption, make long term investment less likely and hence delay the inevitable. Sweeties today — fewer sweeties tomorrow.

Further, with the State cupboard bare through this spend, spend, spend, just like magic our friends at the Bank of England have come up with a cunning new toy: QE, where ‘money’ is magically created to buy outstanding gilts, keep yields low and allow the money to be re-circulated to fund future gilt auctions and government largesse. Well, so clever is the plan that over 50% of all outstanding gilts are now owned by the Bank of England on created QE money. What a wheeze! Run a great deficit, print the money, keep funding costs low and bingo the show is on the road. The Elixir of Life has been discovered.

Well it ain’t that simple, in this writer’s view.

Firstly, while some would argue QE was a reasonable response to the destruction of bank lending, it remains a highly potent and dangerous weapon in the longer term. It allows the Government to maintain, in the short term, its highly imprudent spending policies. However, here is the rub, it allows it so long as global markets will support the policy. There is a substantial risk of a gilt buyers’ strike and a substantial risk to the further depreciation of sterling, and perhaps precipitously so.

It would seem to this writer that the scale of the problem is so great that unwinding QE will prove highly problematic. The consequences could easily be a sharply increase Gilt yield curve with all that means for the cost of debt funding. The chart above shows the yield on a typical 10 year Treasury. QE has artificially decreased the yield, in my opinion.

Prior to this crisis, the outstanding size of the UK Gilt market was around £450bn. Today, almost 50% of that has been bought under the QE scheme. Further between £150-200bn of gilts are going to have to be issued for each of the next 5 years. If QE is unwound, the scale of supply will be greater yet. The risk is that this increased supply impacts yields very materially with great implications for debt funding and asset prices.

So, what should be done?

Immediately, we must recognise the root of the problem which, in my view, is as follows: unsustainable bank lending and leverage, a savings ratio that is far too low, a crowding-out of the productive private sector with a much less productive State sector and a deficit which is utterly unsustainable in anything other than the very short term.

We can continue to delude ourselves that it is business as usually by inflating a burst bubble — which is the current short term policy largely based on political expediency — or we can cut our cloth which, in the long term, will provide the only sustainable route to recovery.

First, the deficit must be controlled with massive cut backs. The obvious areas to target outside undoubted waste are the big spending departments – particularly social protection (which acts as a disincentive to work in many cases). Cancelling an aircraft carrier or a road program is irrelevant to the scale of the problem. Failure to get to grips with this will mean higher long term interest rates, questions from international investors over the UK’s credit-worthiness and a crowding-out of productive elements of the economy.

Second: an end to QE. It has distorted the gilt market. It is a highly dangerous policy, as I believe it will prove near-impossible to unwind. It does not create wealth: it merely debases the currency and confidence in the long term. Under the guise of maintaining the money supply in the face of contraction as the private sector de-leverages, it in reality distorts the market, reduces the need for fiscal prudence and endangers the credit standing of the nation.

Third, much more prudential control over bank lending. Absolutely not micro regulation and interference but an insistence on adequate capital requirements. A starting point would be a UK Glass Steagall Act separating investment banking activity from much less risky retail banking markets. There clearly are grey areas here but it should not be beyond the wit of policy makers to enact a UK version of that repealed piece of US legislation. A further aspect, particularly relating to the retail/ commercial banking activities is suitable capital ratios. While there is no magic formula that dictates if a 10% or 20% capital requirement is appropriate, leveraging over 60x, as RBS did, is clearly unacceptable and imprudent. Banks are different from other private institutions, as they are custodians of your and my hard earned savings. They have no right to gamble it in the reckless fashion seen all too recently. Banking capital adequacy must be substantially increased over the next few years.

Fourth, encourage saving to re-build wealth in the future. Imprudently low interest rates helped create this mess. A current rate of 0.5% does not address this fundamental weakness of the UK economy.

For the long term health of the British economy it is critical that we re-create a sustainable, lower leverage, small state entrepreneurial economy. While my modest proposals above will result in short term austerity they will help provide the building blocks for longer term renewal and greater sustainable growth.

The current policy won’t. It is short term, imprudent and misunderstands the nature of true wealth creation.

Further reading

- The Sub-Prime Debacle – What Will Future Historians Say?

- A day of reckoning: how to end the banking crisis now

- The Staggering Economic Errors Behind The Policy of QE

- Why Budget Deficits are Bad for the Economy and Why Sir Samuel Brittan is Wrong

- What is money? and Irving Fisher, 100% Money, 1935

- Why is the FTSE going up?

via Ex-FSA chief Sir Howard Davies sees ‘dramatic’ risks for Britain – Telegraph.

See also Government debt ‘nearly three times higher than official figure’:

Full report here.