Jimmy Stewart plays George Bailey who is cast as the “honest” and trustworthy banker in the classic Hollywood film, “It’s a Wonderful Life.” Kotlikoff’s book laments that in the real world of modern banking, such characters no longer exist.

Kotlikoff himself is a Professor of Economics at Boston. Several Nobel Prize winners have endorsed the book: George Akerlof, Robert Lucas, Robert Fogel, Edward Prescott, and Edmund Phelps. I count 36 endorsements from the great and the good of the academic world on the back cover and front pages. I do not recall ever seeing this in a book.

The book is written for the layman. It is very light on economic theory, but does reference some otherworldly models. It is very good at explaining what on the face of it appear to be complex financial phenomena, but are in fact con tricks that in any other industry would earn you a prison sentence. Kotlikoff shows his readers how the financial system has failed in its fiduciary duty, and presents a very simple and elegant solution for its salvation called Limited Purpose Banking (LPB). He also proposes a reduction of the financial service sector regulators in the USA from its current 115 down to one: the Federal Financial Authority (FFA).

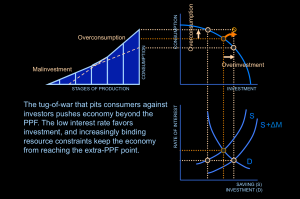

In his opening remarks he discusses the Modigliani-Miller Theorem, written in 1958, showing in elegant maths how in the absence of bankruptcy costs, leverage does not matter. If a company takes on more risk by borrowing more, its owners will offset that risk by borrowing less, leaving total debt in the economy unchanged. Kotlikoff makes no mention of the fact that leverage in itself is not a bad thing if it is made up of people forgoing their consumption today, i.e. saving and committing it to projects that will deliver up goods in the future. This glaring omission does not impede him from telling the story of our financial meltdown and making a solid policy recommendation for this crisis. It does, however, prevent him from seeing the elephant in the room: that the credit creation process itself is the source of the boom and the bust.

The nature of fractional reserve banking is such that if you deposit your cash in a bank, it will lend it out many times over. This means that multiple claims come to exist on the original real money that was deposited. If you deposit £100 in bank A, which lends it to an entrepreneur who deposits it in Bank B, both you and the entrepreneur now have £100! Like magic, we have £200 in the system, with £100 of it created ex novo by the banking system itself! In the UK, with no legal reserve requirement, we have a only £3 on average kept in deposit for every £100 of IOU’s promised by the banking system.

Kotlikoff provides a mainstream justification for fractional reserve banking, citing the Diamond-Dybvig Model, which holds that we value immediate liquidity for emergencies. We do not need that money all the time, so banks can use this and get us a higher return in the meantime. Therefore, governments must do everything to prevent a bank run if more people want their money back than actually exists in the bank vaults.

This is the theoretical understanding we have today and the model is used to justify all sorts of bank bailouts, as we have seen.

Kotlikoff points out that whilst the bailouts have prevented a collapse of the system of fractional reserve banking, the bailouts do not preserve the purchasing power of money. They just guarantee that the money unit will still exist. This is a very good point. All the bailouts are being funded by more claims on the future taxpayer. In the UK, we have a system of money debasement called Quantitative Easing, which will just debase and reduce our purchasing power.

In effect, the bailouts do not do what they say they do on the tin, and daily our purchasing power is getting weaker. It is hard enough to get politicians in the UK to acknowledge the scale of our official national debt, but we owe at least as much again “off balance sheet”, in unfunded pension liabilities and Private Finance Initiative obligations. Debasement will be the most popular way forward for all future governments as they will not want to overtly extract more wealth from us. Dishonesty will be the preferred policy.

Limited purpose banking would be a simple solution to all of this. Banks would be limited to their main purpose of matching savers to borrowers. All financial companies would act as pass though mutual fund companies. They would be middle men, never would they own the financial assets. They could thus never fail in the “run on the bank” sense — i.e. depositors wishing to withdraw money — but only if they were very bad at business. This is thus as near as you will get to risk-free banking. Never again would the economy be held liable to bail out the bankers.

Kotlikoff foresees at least two mutual funds being offered, with custodians holding the assets: one that holds cash and one that holds insurance funds. He does stress that innovation could still happen, with a multiplicity of funds being offered. The Federal Financial Authority (FFA) would regulate the custody element of the safe keeping of the various mutual fund assets. He assumes that regulators will be able to opine, like the current rating agencies, on the soundness of the assets that have been bought by the fund. He would trust the government over the rating agencies. I personally would trust neither! In my industry, selling meat and fish, we have a number of free market created quality assurance bodies such as the British Soil Association for organic certification, the Marine Stewardship Council for fish sustainability that require no government sanction. These have the confidence of both the consumer and producer. I would suggest that this and not a super regulator is the way forward.

Cash funds are nice and easy; they hold cash and are 100% reserved. They can never go up or down in value. These cash mutual funds represent the demand deposits of the new spec banking system. All services such as cheque writing and paying bills is done via this vehicle.

I have written about 100% reserve banking here and Steve Baker has specifically examined the 100% reserve banking proposal of Irving Fisher, to which Kotlikoff refers. He notes that the current economic profession considers these ideas to be “crackpot”; the Diamond-Dybvig model remains dominant. He goes go on to say, “I want to be clear that I am not an advocate of narrow banking in of itself. Narrow banking is a small feature of limited purpose banking and would hardly suffice to deal with today’s multifaceted financial problems.”

He notes that with the many cash mutual funds in place, the money measure in the USA, MI, would correspond exactly with what the government had printed. So to cover all obligations, a massive print up in US dollars would need to take place — many trillions of dollars to truly purge the system. What Kotlikoff misses is De Soto’s insight, based on the work of Fisher, that there will be a unique moment in history when instead of causing debasement, the printed money would cover all unfunded demand deposits, swapping them out for cash. Wipe out or retire these demand deposits and the banking system has no current creditors, only assets. Take out the equivalent amount of assets from the banking system, so the banking system has the same net worth as before, then put these assets into the mutuals and pay off the national debt. This is not inflationary, requires no debasement, and will help deliver up safe banking. This is summarised in our Day of Reckoning article.

Insurance mutuals would have all the other banking instruments such as CDO’s in them and could market these funds to whomever they wished. These are essentially what we would term a hedge fund today, though Kotlikoff proposes that these be closed end. This means you have to sell your shares in the fund to redeem your money. Consequently, long term lending can take place in these funds without the fear of a maturity mismatch. The only money this type of fund can lose is what is invested in it. It could never in itself pull down the banking system.

I sense that the author does not feel comfortable with the 100% reserve label, with its “crackpot” associations. In discussing the transfer of Citigroup he says,

“Here we’d need to swap all of CitiGroup’s debt for equity and prevent it from ever borrowing again to fund risky investments. We can now think of CitiGroup as a huge mutual fund with lots of different assets, one big commercial bank with 100 percent capital requirement, or one LPB with a large number of different mutual funds corresponding to the different Citigroup asset classes.”

He also points out that LPB could not actually be that far away if you take into account all the reserves that have been created already. This is something George Reisman has also pointed out.

Kotlikoff defensively shows how LPB would not reduce liquidity. It would not reduce real credit, i.e. savers forwarding money to borrowers. It would stop credit created out of thin air via the banking system, the prime cause of the crisis, but this is not mentioned in his book. It would lead to an optimal size financial sector. Our cash assets would be safe as you can get. Government could still monetise debt as it could still create cash from nothing. The currency and thus the purchasing power of money could not collapse by the actions of the banking system, but only by the actions of the government.

Kotlikoff concludes,

Limited purpose banking is the answer. This simple and easily-implemented pass-though mutual fund system, with its built in firewalls, would preclude financial crises of the type we’re now experiencing. The system will rely on independent rating by the government, but private rating as well. It would require full disclosure and provide maximum transparency. Most important, it would make clear that risk is ultimately born by people, not companies, and that most people need, and have a right, to know what risks, including fiscal risk, they are facing. Finally, it would make clear what risks are, and are not, diversifiable. It would not pretend to insure the uninsurable or guarantee returns that can’t be guaranteed. In short, the system would be honest, and because of that, it would be safe-safe for ourselves and safe for our children.

Although I think he has failed to identify the state sponsored banking system, with its fractional reserve credit creation point as the cause of booms and busts, his solution has many merits and many similarities with the solution proposed by Fisher, De Soto, and others. He missed what I call the golden opportunity, or unique moment in history, to actually enact a reform that delivers up 100% reserve of LPB and pays off the national debt and other unfunded obligations at the same time. My own solution is the De Soto 100% reserve free banking solution with banks working within the existing commercial law to which all non-bank companies must adhere. However, both systems have the same effects and would do the job needed: to sort out the banking system, provide stability, and let capitalism flourish. Yet another workable solution has been proposed by our very own Paul Birch. Kotlikoff’s contribution to the debate, with all the Nobel endorsements, is timely, and I hope policy makers give due attention to innovative solutions like these.

I described the problem in a slideshow in 2007. I was not then aware of how a solution could be found. But I did say that the money supply would be tightly managed.

Since then I have given this a lot of thought but first I lay another groundwork upon which to build – security of wealth not money.

It is wrong to say “Kotlikoff defensively shows how LPB would not reduce liquidity. It would not reduce real credit, i.e. savers forwarding money to borrowers. It would stop credit created out of thin air via the banking system, the prime cause of the crisis, but this is not mentioned in his book. It would lead to an optimal size financial sector. Our cash assets would be safe as you can get.”

Wealth can be made a lot safer than that. I explain how in my book online here, which one economist described as “Superb” and another seemed to agree and added that it reads like a novel:

http://ingram-dropbox.blogspot.co.uk/p/the-scene-breakfast-table-with-dozen-or.html

Coming now to my latest version of Jimmy is Dead, my Mark II economy which builds on that Mark I economy, in which wealth is lent and repaid, not just the money, (it is a simple new contractual arrangement) there is no need for 100% reserves – I think we can do this another way. My model has all the benefits that Fisher listed and no doubt this author lists. AND it can be implemented NOW without disturbing the economy. So I think it is going to be better. But there are some outstanding issues to be resolved.

Among these is how the Model II will interact with my model III economy – which tackles currency instability.

My total economic model comprising all three sub-models I II and III would do this:

Stabilise wealth and debts, stabilise money supply, and stabilise currency whilst leaving market forces in charge all the time unless some politicians interfered.

Therefore I am proposing that we form a study group comprising all of the authors of all current worthwhile papers on this subject to sort out which way it is best to go.

And how to do it.

I definitely do not like the idea of 100% reserves. What a waste of capital. When reserves are consumed or used, that unbalances something else somewhere, whereas in my model a bankrupt bank being simply an agent, is of little consequence whilst any deposits lost can be replaced by printing replacement money. No run on the bank, and lots of competition because reserves are barely needed.

Mutual funds can also be lenders – the risk goes to the unit holders.