Market Manipulation – ECB Market Operations are simply a Devastating Waste of Taxpayers’ Cash.

The ECB’s May 10th “shock and awe” assault on the bond markets of the troubled Southern European governments is simply a Eurozone variant of quantitative easing on a massive scale.

The Daily Telegraph report (May 11th) of the ECB’s statement is beautifully mollifying on first reading:

The ECB said it was intervening in “those market segments that are dysfunctional”, almost certainly buying Greek, Portuguese, Irish and Spanish bonds. It will sterilise purchases through other means so that the action will not add net stimulus or undermine monetary policy, at least for now.

By what yardstick are these markets “dysfunctional?” The markets appear to be working efficiently and as intended – prices have fallen sharply because there have been a lot more sellers than buyers. This state of affairs stands in sharp contrast to a market that was truly dysfunctional; ie. a market which failed to enable a willing buyer or seller to complete a transaction.

What happens when a purchase is “sterilised”? Combined with the dark reference to “other means” the ECB sounds confident, technical and superior. But it is bluffing. The ECB wishes to be seen as an ace poker player on his “A game”, but deep down Trichet knows he has a weak hand and no viable response in the next hand when the markets react and call to see his cards.

Since the purpose of the exercise is avowedly to squeeze out short sellers, to cause them to panic buy in order to close their positions, thus enhancing the price rise effect initiated by the ECB’s own purchases, what on earth is the term “sterilisation” intended to mean?

Surely “sterilisation” cannot refer to a future planned market operation having the opposite effect. What would be the point of that? This therefore cannot be the intended meaning of “sterilisation”. The term must be a reference to a withdrawal of the liquidity that the purchase operation, if handled by less savvy market practitioners than the ECB, might create.

Now I’m really sitting up and paying attention. Having been inundated with pro QE arguments, we UK citizens can tell the difference between a currency debauching chancellor (serious about QE) from a dandy ECB head who flirts with QE when he mistakenly thinks he is permanently moving markets. The latter is simply in QE denial.

The technical method by which the UK quantitatively eased our way into massive national debt was more or less on all fours with the ECB’s May 2010 methods. In both cases the Central Bank buys unpopular assets at above market prices (see next paragraph) and creates, at a touch of a computer button, new money by way of the settlement mechanism. No banknotes are printed, the operation takes place entirely in a virtual world, and sadly usually causes liquidity jitters throughout the nation’s currency and banking system.

“Ah” say the central bankers, “it’s just a market operation because we’re paying market prices” , but it is common knowledge that these prices would not appear in the market but for the intervention of the central bank; the operation is circular – it is simply a market ‘squeeze’ on a grand scale. Squeeze operations are normally undertaken with a view to short term speculative gains and never have long term or lasting price impacts. The last great UK squeeze was the sad swansong of Norman Lamont in 1992 which enriched Mr Soros and his speculating friends and emptied the reserves of the Bank of England. On the positive side it propped up the sterling exchange rate for about 48 hours.

The ECB Council would have you believe the opposite. Trichet presents himself as a swordsman in a prolonged, attritional and tactical duel. He has spotted now the perfect moment at which to drive his epee through a tiny gap near the market’s breastbone and, having broken this vital defence, he intends to carry on skilfully severing enemy arteries with wristy flicks.

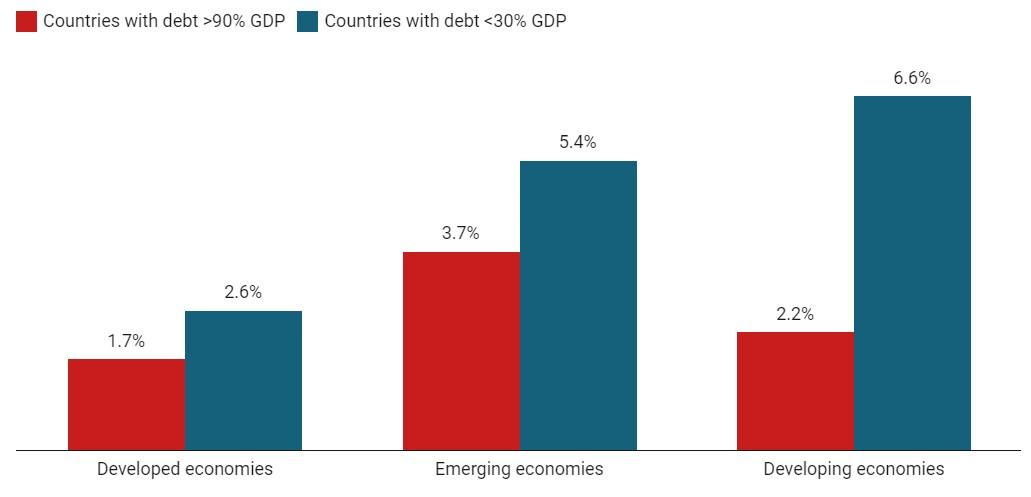

As previously observed, if printing money and giving it to the needy makes economic sense why have we not been doing this for centuries and eliminating world poverty? Sadly this Walt Disney scenario has not unfolded and all QE has achieved in the UK is a transfer of wealth from one sector of society, generally the low income earning taxpaying citizenry, to the wealthier classes.

But the market operation of the ECB now reported is far worse than the UK’s QE. At least the UK’s QE policy was intentional, if poorly thought through.

All that this this bout of ECB QE will achieve is the transfer of wealth from European taxpayers to the owners of the bonds. No doubt some of the beneficiaries of this taxpayer largesse are worthy institutions but most would be classified as wealthy by virtue of the fact that they own multi million euro bond portfolios, so the operation amounts to taxing the ordinary citizens to benefit the wealthy. It will have no more than a short term effect on market pricing levels.

Almost exactly a millennium ago Norway’s King Canute saw through his flattering courtiers who had claimed he was “So great, he could command the tides of the sea to go back”. Having parked his throne on the beach at Bosham and witnessed the tides ignoring his regal command, Canute used the experience to drive some commonsense into his sycophantic entourage.

Had Canute been less honest, and possessed of a working knowledge of QE, he could have raided the nation’s coffers to fund sub sea surface harbour walls. Invisible from the beach, the walls might temporarily have stayed tidal activity. Canute could have, at massive national cost, milked the courtiers’ adulation for months or even years before the powerful tides would in due course silently demolish the walls.

What a pity that even Bundesbank President Axel Weber, who understands these points perfectly, is unable to influence the ECB. There must be a huge number of fawning officials fanning the egos of the ECB’s executive decision makers.

Comments are closed.