In his usual delicate and roundabout way, in the first of two new videos, Peter Schiff criticises several recent media articles about how a new recessionary dip is impossible, due to the nature of the current upwardly sloping bond market yield curve.

[As Gary North explains, most ordinary US recessions are presaged by a downwardly sloping yield curve, where long-term interest rate yields are lower than short-term ones.]With short-term interest rates at zero, Schiff argues it is impossible for the bond market yield curve to play any meaningful role in such forecasting, because no part of it can go lower than zero.

[You cannot push a man back any further when he is already hard pressed up against a wall; physicists call this a boundary value problem. In the past, the inverted yield curve signal did play a useful part in predicting recessions, because investors knew the Federal Reserve would engage in a standard cycle of first cutting interest rates to please incumbent US presidents, to ‘stimulate’ the US economy at crucial political times. Later, the Fed would then increase interest rates, in timetable fashion, to cut off the ensuing rise in price inflation.]“The job of the Federal Reserve is to take away the punch bowl just when the party starts getting interesting.”

William McChesney Martin, Jr., Federal Reserve Board Chairman, 1951-1970

Things have changed, says Schiff. The Fed has now boxed itself in, because it has reached an end game in maintaining this cyclical ‘heating’ and ‘cooling’ cycle. He explains why the Fed will now keep interest rates at zero for as long as it can, rather than raising them in the old fashion, thus invalidating the chartists’ yield-curve-must-invert prediction tool, based upon the Fed reflexively raising rates in ‘ordinary’ situations.

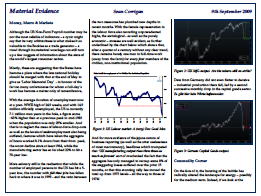

Schiff then argues why the bond yield curve shape actually indicates price inflation ahead, rather than the impossibility of a further ‘double-dip’ recession.

To continue his debt analysis, Schiff then comments upon the various US bond mutual funds being flooded with the savings of American investors, who are betting on US government bonds rather than stocks. Schiff thinks these bets are misplaced, because those savings are being wasted on useless government spending rather than useful productive investment in industry.

[Once again demonstrating that socialism cannot calculate.]The government will not pay the last bond holder back in real purchasing power, says Schiff, but will pay back these bonds in newly printed Federal Reserve currency, when they face the position of being unable to roll US government debt over any more and the Fed steps in with its printing presses to save their day.

“The Fed chairman must do as the President wants or the Fed would lose its independence.”

Arthur F. Burns, Federal Reserve Board Chairman, 1970-1978

Moving on from bonds, Schiff extends his earlier ideas on unemployment benefits and defends his core position on why he thinks the Dollar is going to ultimately collapse:

In his second video, Schiff comments upon the recent news of what the mainstream media thought was an unexpected 27% drop in US housing sales.

‘Why are they surprised?’ asks Schiff. The housing bubble has burst and cannot be reflated. If the government keeps trying to reflate this bubble, they will keep wasting all of the resources employed and it still won’t work.

The video goes on to discuss the continuing plunge of the Dollar against the Yen and also ends with a defence of Schiff’s own predictive record in the face of a hostile US media, all of whom only wish to hear that the Emperor is wearing a full set of rich embroidered clothing tailored from the finest silks and cottons:

Below is also the latest economic commentary article by Peter Schiff, published by Euro Pacific Capital, expanding on several of the issues discussed above. Look out particularly for the single line quote which precisely summarises, in a piquant nutshell, the main reasons behind the multi-decade war-torn hazardous strife of most of the African continent:

By Peter Schiff, August 23, 2010

In a CNBC debate last week, former Labor Secretary Robert Reich presented a set of contradictory beliefs that unfortunately reflect the conventional wisdom of modern economists. In a discussion with Wall Street Journal columnist Stephen Moore, Reich correctly and comprehensively listed the reasons why American consumers could spend so lavishly before the crash of 2008 and why they can no longer keep up the pace. But instead of making the logical conclusion that former levels of spending were unsustainable and that spending should now reflect current conditions, he advocated that government take on additional debt so that tapped out consumers can spend like they used to.

To achieve this, Reich called for lowering taxes on working Americans and raising taxes on the rich. He argued that middle-income Americans are more likely to spend additional dollars while the rich are more likely to save and invest. As a “demand-side” economist, Reich made clear that spending is superior to savings and investing as a catalyst for growth.

To put it simply: Reich believes that the cart pushes the horse. In his worldview, businesses produce goods and services simply because consumers spend. Therefore, anything that increases spending fuels growth. Unfortunately, he fails to see what should be strikingly obvious: capital formation must precede production, which then allows for consumption.

In a complex society like ours, those relationships are hard to see. However, if we break it down to a simpler level, it becomes more obvious (as I try to accomplish in my new book: How an Economy Grows and Why it Crashes). For example, let’s take a look at a simple barter-based economy consisting of only three people: a butcher, a baker, and a candlestick maker.

If the candlestick maker wants cake, he can’t simply demand that the baker hand it over. The cake needs to be produced, and the baker has to expend labor and material to produce it. Unless the candlestick maker offers the baker something of value in exchange, the cakes won’t get baked. The ability of the candlestick maker to demand cake from the baker is a function of his ability to supply candles to trade. Without production, consumption can’t occur.

What if the candlestick maker gets sick and produces no candles? As the baker would be unwilling to give his cakes away, he would likely stop baking cakes for the candlestick maker. Economic activity would naturally contract until the candlestick maker recovers.

But according to Reich, if the candlestick maker doesn’t have anything to trade, the government should step in and give him candles. But where will the government get them? It could take them from the candlestick maker; but if he is not making candles, how will he pay the tax? Even if there were a few candles left to tax, any that the government took would simply transfer demand from the candlestick maker to the government. No new demand is created.

Alternatively,if the butcher is still healthy, the government could tax him, and give his steaks to the candlestick maker to buy cakes. However, this doesn’t create new demand either. It simply transfers demand from the butcher to the candlestick maker.

Some may feel that a barter-based metaphor doesn’t hold water because the ability to expand the money supply and create credit gives an economy far more flexibility. This is a deceptive argument. Although money is more efficient than barter, it doesn’t change the dynamic between production and consumption.

But Reich suggests that printed money can stimulate demand just as effectively as real candlesticks. But what good will the paper offer the baker if there are no candlesticks to buy? All the baker can do is bid up the prices of those goods, like steaks, that continue to be produced. Similarly, if the government simply prints money and gives it to people to spend, no new production occurs. Prices merely rise to reflect the increase in the supply of money relative to the supply of consumer goods.

In a more complex economy, the relationship between production (supply) and spending (demand) still holds. Every consumer either lives off his own productivity or the productivity of someone else. When individuals work, the wages earned result from the productivity of labor. The ability to consume is directly related to the production of goods or services that result from one’s efforts. However, if people waste their labor in unproductive jobs, little real demand is created.

In the Soviet Union, everyone had a job, yet workers had to stand in line for hours for basic necessities. Although everyone worked (for the government), production was too low. This lack of production meant wages delivered relativity little in the way of purchasing power.

Since production cannot be created by government stimulus, neither can demand. To the extent that there are savings, demand can be brought forward by stimulus – but only at the cost of future demand, plus interest. If stimulus could produce demand, then no nation would be poor. Taken to its logical end, Reich’s argument suggests that African poverty would be wiped out if African governments simply printed money more freely. In reality, Africans are not poor because they lack currency to spend; they are poor because their corrupt and inept governments inhibit production by soliciting bribes, denying property rights, abrogating contracts, preventing the accumulation of capital, and nationalizing profits.

Reich is correct about one thing: Americans are indeed broke. But rather than encouraging the country to spend itself deeper into debt, he should call for greater savings so that we have the means to invest in new businesses and new industries. That is the true road back to solvency, but it will only work if we have less government spending, fewer regulations, lower taxes (particularly on those with the highest propensity to save and invest), and higher interest rates.

Unfortunately, Reich and his allies are calling the shots in Washington. The country cannot recover until the only thing politicians stimulate is demand for new economic leadership.

I and another truck driver were puzzled today. We could not figure out exactly why, if two “truck drivers” {not university professors, or politicians. mind you} could understand and agree with Peter Schiff, why cannot everyone…. I mean, … if we are so smart, what the *%!! are we doing driving trucks? Or is it as Gilbert and Sullivan suggest; You’re either a little liberal, or else a little conservative, …and smarts has nothing to do with it.