The recent decline in the gold price has sent a few tremors through the gold bugs of the world, though it may be nothing to worry about.

This is the view of Pierre Lassonde, one of the major players in the gold mining industry, and the current Chairman of Franco-Nevada, who was interviewed recently by Eric King in an excellent 14-minute radio piece:

Although the lugubrious verbal style of Mr King takes a little getting used to, the comments by Mr Lassonde are well worth a listen, particularly if you are one of those aforementioned gold bugs.

Lassonde calls the recent decline in gold simply a correction, and although you might have predicted that he would say that, he puts forward several rational arguments to back up his statement.

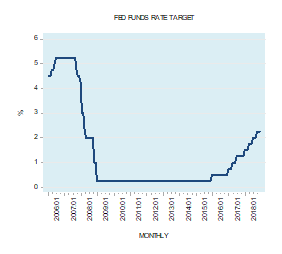

Demand for gold is always weak in either June or July each year, he claims, and has been for many years. However, the fundamental reasons for gold’s overall price growth over the last few years are still with us; quantitative easing by central banks; high debt and spending levels of western governments; and feeble stimulus-based economies. Gold is a shining beacon in a world of uncertainty, thinks Lassonde, and he foresees many more years of sustained demand for the barbarous relic, as global uncertainty continues in the face of sustained government financial meddling.

Lassonde predicts that gold prices will rise again in September, in line with previous years, which may be due he thinks to people in the northern hemisphere coming back from their vacations and reassessing their economic situations in the hard cold light of autumn, after being on the beach in the summer.

The problems in Greece, Portugal, and Spain have failed to disappear, but have merely been resting in the ice cream cooler.

Lassonde then works through his secondary prediction that central banks are going to be buying much more gold over the next few years, despite its growing price, as their fiat paper assets continue their inexorable decline in value.

[We have checked the figures for the past several years, and although gold prices did take a significant dip last summer (2009), this does not hold up entirely for all of the last few years. However, gold has always been a notoriously volatile market — or should we say, that with much central bank manipulation having taken place, that fiat currency has always been a notoriously volatile market, whereas gold is always rock solid? On gold price manipulation, one thinks particularly of Gordon Brown’s woeful move made between 1999 and 2002, in which the late unlamented former Prime Minister lost £7 billion pounds by selling 400 tons of British government gold, as Chancellor, at the bottom of the market, before the price later quadrupled. It would be nice if Mr Brown could apologise for this colossal mistake of market judgement. But then, he is a socialist. And socialists hate the market because socialism cannot calculate.]

Where Pierre Lassonde is involved things go forward. He is a very intelligent and well informed man who really does know his stuff when it comes to mining and the Gold trade.