This report from Arden Partners was originally published on the 24th of September.

Why have house prices rebounded?

In 1776 Adam Smith described Britain as ‘a nation of shopkeepers’. Today, judging by the number of home makeover TV programmes, we are a ‘nation obsessed by property values’. This note seeks to examine the prospects for house prices in the medium and longer term.

Given our view of the likely prospects perhaps we should find a new TV pastime, for we argue that the best case scenario, which is our central case, is that house prices drift downwards, settling in three years time some 10% lower with continuing very low transaction volumes. We also see a tail scenario (25% probability) of a crisis-induced interest rate shock that could hit house values by up to 25%.

Notwithstanding signs of a recent slowdown in UK house prices, property values have confounded forecasts by rebounding sharply. According to Nationwide Survey data, average house prices have increased by 12.7% since the low in Q109. Average prices are now just 8.3% off the Q307 high and, in parts of London and the south east, are actually trading well above the pre-credit crunch high.

This note examines the survey evidence along with the macroeconomic environment and highlights our view of the likely trend in house prices. The chart above, however, in our opinion, neatly emphasises why this recovery has taken place and the dangers surrounding this recovery. In two words: interest rates.

Economics & Strategy

Although housing is credibly valued on the mortgage strain measure, this is only the case due to abnormally low interest rates. The chart on the front page demonstrates that, on more normalised interest rate assumptions, real estate is far from cheap. Further, all other major housing measures from simple house prices to average earnings, credit availability, first-time buyer affordability and, also, in our view, from a macroeconomic perspective, show significant risks exist. Our best case scenario, which is our central case, is for house prices, nationally, to subside by an average of 10% over the next three years. There is a tail possibility that it could be significantly worse. We see little prospect of further increases in property values.

Interest rates: Can they hold the line?

It is well understood that interest rates are currently at their lowest level since the foundation of the Bank of England in 1694. What should happen, in our humble opinion, and what will happen are perhaps two different things.

It is well understood that interest rates are currently at their lowest level since the foundation of the Bank of England in 1694. What should happen, in our humble opinion, and what will happen are perhaps two different things.

In our view, what should happen is that interest rates rise at a relatively gradual pace. We believe this because, despite the steepest contraction in GDP since the Second World War, inflation has remained embedded. This has been the case for a variety of reasons: some technical, like VAT rises and some embedded like the depreciation of Sterling, rising food prices and some debatable and perhaps yet to be seen like QE. Needless to say, we see this current inflation as embedded; hence, our concern over current interest rate policy.

Nevertheless, our thoughts and prejudices matter little compared with the view of HMG and the Bank of England which argue that this recent bout of inflation is a little local difficulty that will subside as the mythical, in our view, output gap exerts a downward pressure on longer-term inflation. More QE is the probable response of the Bank of England to mitigate the risk of a slowdown resulting from required spending cuts. Although the Bank of England denies this, we suspect that it has quietly dropped its official remit, to maintain inflation around 2% with an emphasis on stimulating growth.

As it is the Bank of England that sets interest rates, and not Arden Partners, we believe every attempt will be made to keep rates very low for as long as possible. Our central case is that a rise in rates is not likely in 2011. Rates will only be forced upwards should the economy be hit by further sustained increasing inflation levels, renewed concern over the Coalition’s seriousness (which, incidentally, we do not materially doubt) in tackling the deficit, or some external shock. We ascribe a 25% probability to the rise in interest rates scenario, which clearly would have serious implications for asset values.

There are other tail risks as well. While the Coalition is unlikely to shift materially the tax burden towards property, elements of the Liberal and Labour parties are examining forms of property taxes. It is hard to ascribe a probability to political expediency, but any substantial change in the way property is taxed could have a very material, negative impact on valuations. This is a long term, not short-term risk and would almost certainly be directed at more expensive property.

The current abnormal interest rate policy, coupled with QE, has had the impact of pumping up real asset values well beyond where they would have been under more normalised interest rate conditions. Prospective house purchasers now need not only to consider current affordability, but also need to build in a risk premium for the unpredictability of the government’s and the Bank of England’s policy. Will they maintain QE or won’t they? Will they keep interest rates artificially low, ignore their inflation remit, or won’t they? What will the tax treatment of property be- will there be a mansion tax in a few years or not? Will there be two spoons of sugar in the tea or will it be bitter? Investment decisions are tough enough without having to second-guess policy.

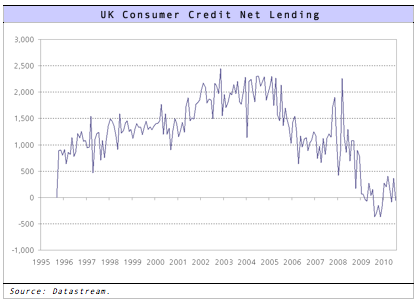

The impact of this interest rate policy can be seen from the chart above. As all are aware, the cost of borrowing has crashed. This has doubtless been the primary factor in stabilising the housing market, in particular, and, also, consumer expenditure in general.

Many other factors are connected and interplay with real estate values. Unemployment and fear of unemployment is clearly a key variable. Again, UK unemployment has surprised many commentators in being relatively subdued. The relative resilience of the labour market has also been a prime beneficiary of the sugar rush of macroeconomic policy.

We remain concerned, however, that unemployment remains embedded. There are three primary reasons for this concern. First, we have argued that the UK economic performance, prior to the credit crunch, was not as splendid as often believed. Much of the growth was a public sector and debt-fuelled binge (see our note ‘A Game of Two Halves,’ February 2010). Secondly, public sector employment (formal and private sector dependent upon public sector) is set to fall sharply – some commentators have suggested by around 600,000 employees (which is still less than the one million increase in public sector employment over the last decade). Thirdly, we are growth sceptics: our 2011 and 2012 growth forecasts remain at 0.75%, which is well below consensus. If we are correct this is not a clement environment for the private sector to pick up the slack.

Unemployment may not spike up to 10% of the working population but it will, in our view, remain embedded and is likely to remain well above 8% until 2012. This is not helpful to housing market sentiment.

A measure of confidence is the savings ratio. In times of collective confidence the perceived need to save is minimal. In times of despair the reverse is true. Later in this note we argue that the UK is addicted to debt and we have failed to save as a nation. However, the above chart demonstrates that UK consumers, despite lamentable savings rates, have started to save again. This is, in our view, positive and part of the ‘healing process’ although the savings ratio needs to remain elevated for years to have any appreciable impact on depleted personal balance sheets.

A measure of confidence is the savings ratio. In times of collective confidence the perceived need to save is minimal. In times of despair the reverse is true. Later in this note we argue that the UK is addicted to debt and we have failed to save as a nation. However, the above chart demonstrates that UK consumers, despite lamentable savings rates, have started to save again. This is, in our view, positive and part of the ‘healing process’ although the savings ratio needs to remain elevated for years to have any appreciable impact on depleted personal balance sheets.

Another manifestation of the pre-2008 boom and the UK’s propensity for low savings is equity withdrawal. Despite the current rebound in real asset values we see a return to equity withdrawal as highly improbable. Banks are likely to remain cautious on lending for equity withdrawal and we believe consumers, too, will be unlikely to use this as a significant form of funds in the medium term.

Another manifestation of the pre-2008 boom and the UK’s propensity for low savings is equity withdrawal. Despite the current rebound in real asset values we see a return to equity withdrawal as highly improbable. Banks are likely to remain cautious on lending for equity withdrawal and we believe consumers, too, will be unlikely to use this as a significant form of funds in the medium term.

HMG has been chastising the banks for not lending. There are three primary aspects to lending: availability of funds; desirability of making the loan in the lenders view, and at what price; and the demand for loans.

In our view, HMG can bang the drum on this as much as it likes – and hang a couple of bankers in the process – but we believe this approach fundamentally misunderstands a) where we start (i.e. with too much leverage) and b) the attitude of consumers.

We see the problem (if it is a problem, which we doubt) as more a lack of demand. If you have a hangover you can either keep on drinking (might be pleasant in the short term but not very wise beyond tomorrow) or you can dry out. We believe consumers are drying out. The two charts above, coupled with the two below, provide some evidence of this, in our opinion.

The UK in an international context

The following chart below shows the Anglo Saxon countries addiction to debt. While one needs to be careful with international comparisons – for reasons of culture, politics and history – the Anglo Saxons do rather stand out with very high levels of personal debt relative to GDP. Not only are the absolute levels high but the direction of increasing leverage is also salutary.

This increasing level of indebtedness seen internationally is bucked by only one nation, from those selected below: Germany. The Germans, for a variety of reasons (perhaps low growth over the decade and the absence of a housing bubble), remain a cautious bunch. Although this is outside the scope of this note this, in our view, leaves them in good stead for the future.

It is also worth noting the low levels of consumer debt of the southern European nations. The Greek interest rate shock has certainly impacted the Greek economy and its public sector, but the impact on its private sector will perhaps be less pronounced than a similar shock would be to the UK.

The chart below also highlights the direction of house prices in a number of selected markets. There is a small prize for the first reader who spots the odd one out.

While the level of Spanish house prices also looks anomalous, given chronic oversupply, the UK does stand out with its sharp recovery. This contrasts with falls in house prices in France, the US and Ireland of around 35%. Can the UK really buck the trend?

UK house prices: the tea leaf

The chart above looks at the Nationwide House Price index changes year-on-year and the real price of the average property: prices have rebounded. However, remembering the very first chart in this note, house prices have been pumped up by the extraordinary interest rate policy. Mortgage strain may be affordable at current interest rates, but on more normalised interest rate assumptions mortgage strain would be highly stretched.

The chart above looks at the Nationwide House Price index changes year-on-year and the real price of the average property: prices have rebounded. However, remembering the very first chart in this note, house prices have been pumped up by the extraordinary interest rate policy. Mortgage strain may be affordable at current interest rates, but on more normalised interest rate assumptions mortgage strain would be highly stretched.

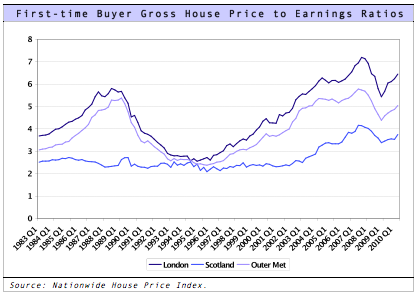

House prices on other measures are currently trading well ahead of their normal valuation ranges. The table above, according to Halifax data, highlights, for example, that the simple house price to average earnings ratio lies close to the 1987-crash high.

House prices on other measures are currently trading well ahead of their normal valuation ranges. The table above, according to Halifax data, highlights, for example, that the simple house price to average earnings ratio lies close to the 1987-crash high.

First-time buyers

According to research by the National Housing Federation (NHF), the average age of first-time buyers joining the property ladder without parental support is escalating. Research suggests that while the average age of unassisted first-time buyers has already risen from 34-years old to 37-years old over the past few years, it is expected to rise even further, potentially to a high of 43-years old for the next wave of first-time buyers. Worse news still for those looking to buy property in London, with the National Housing Federation forecasting that those wanting to live in the capital could expect to save up until the age of 52-years old to be able to afford their own property, unassisted. Recent research from the Council for Mortgage Lenders claims that eight out of 10 current homeowners under the age of 30, receive financial help from their parents in purchasing their first property.

Another recent survey by the property website Rightmove.co.uk warned that the proportion of first-time buyers was currently sitting at around half the level needed for a healthy housing market, with mortgage availability and deposit sizes being the top concerns of the demographic. With the days of 100% mortgages well and truly a thing of the past, the average size of deposit that first-time buyers are required to pay down has jumped from 10 per cent to up to 25 per cent of the property value in the last few years.

Even those who are able and or lucky enough to afford the steep deposit amounts are likely to experience further hurdles, with mortgage lenders being increasingly more selective with whom they lend to, tending to focus on those holding existing mortgages, or those holding mortgages with competing lenders, thus taking less risks.

Despite interest rates being at their all-time low since 1694, the market for first-time buyers remains particularly expensive with many deals for a first-time buyer at around ten times the Bank of England base rate: ie. 4.99%. With interest rates at such historically low levels and first-time buyers still unable to get on the ladder, when will they be able to afford a place of their own?

Taking account of the steep mortgage rates, coupled with the aforementioned deposit barriers, this equates to an almost impossible situation for those eager to own their first home. This is complicated further by the surge of newly-graduated twenty-somethings who are continuing to struggle to gain entry to the graduate job market – thus, pushing the expected age of home ownership even higher as the majority live at home with parents for an extended period.

The chart below illustrates that the elevated house price to earnings ratio is highest for London. Excluding London (Outer Met), the cheapest region is Scotland – calculated using the ratio to the nationwide FTB house price to mean gross earnings per region.

In terms of first-time buyer affordability, the chart below illustrates initial mortgage payments as a percentage of take-home pay for each region, based upon a 90% mortgage loan of the typical house price. Affordability is measured against the long-term average of 1985. The chart reveals that the least financially-affordable area for first-time buyers is somewhat surprisingly in the West Midlands, compared with the more affordable north of England. Towards the end of 2007 the UK average stood at 136.2 – suggesting it was 36.2% harder to access the market for the first time than when it was when the index started back in 1985. While the affordability index started to recover towards the beginning of 2009, with the UK average index value of 91.8 the index began steadily increasing again over the next year, with the most recent reading at the 92.5 level.

Further, while credit markets have improved, the demand for credit remains low. Transactions have picked up slightly but remain around 50% of the long-term average and close to 35% of the peak. The ‘recovery’ in house prices has been based on very thin volumes, few repossessions (as a result of interest rates, average unemployment and benevolent banking policy directed, in principal, by HMG).

Further, the supply of new houses remains at critically low levels as is demonstrated by the chart below. UK house prices have remained elevated partially as a result of the limited supply of housing and a planning policy that bumps up the value of land well above a true free market price. The most recent measure of around 75,000 UK housing starts in 2010, compared with the high of 1999 of around 220,000, represents a decline of 65% and given demographic trends stands well below the long term required equilibrium.

While there may well be positive reasons for controlling the supply of land (environmental and NIMBY etc.) for house building, the impact is clear.

Conclusions

In this note we try to explain why the UK housing market has rebounded so strongly. We also argue that on virtually every measure other than mortgage strain, UK property valuations are highly extended.

Our view is that the Bank of England will maintain interest rates at abnormally low levels in 2011, and possibly into 2012. Under this scenario, we believe house prices will subside by around 10% over the next three years. Transaction levels will remain very subdued and the first-time buyer will remain largely excluded.

We believe the problems faced by the first-time buyer, in particular, are likely to move ‘up the political agenda’. We are in danger of heading towards a real social predicament if the housing market continues in the worrying current trends. The Liberal and Labour parties appear to remain hostile to property-related wealth, and longer term some form of property tax is possible. This would most likely impact higher-end properties. This risk is very hard to quantify, and beyond the short-term investment time horizon as it is unlikely the current leadership of the Coalition would sanction such a change. But investors need to keep this at the back of their minds.

We ascribe a 25% probability to a shock that would force the Bank of England to have to raise rates substantially. Such a shock could come from renewed euro difficulties, concern on UK deficit reduction (unlikely in the short term, more likely on two to three-year view) or persistent and continuing domestic inflation. We estimate that if base rates had to rise to 5%, property values, in aggregate, would correct by at least 25% to reach any semblance of credible valuation. On balance we believe and hope that the authorities will be able to avoid such a scenario.

We find it hard to perceive any scenario where property prices can rise further, given that rates cannot go any lower than current rates, transaction volumes are liable to remain highly depressed and valuations on most measures are well ahead of the long-term average.

An excellent article highlighting what is becoming an increasingly serious problem for first time house buyers. It is good to see we are starting to save again, despite difficult times, and despite the lamentable interest rates available from the banks!

An excellent article highlighting what is becoming an increasingly serious problem for first time house buyers. It is good to see we are starting to save again, in difficult times, and despite the lamentable interest rates available from the banks!