‘And on one occasion I almost got [Keynes] to understand what I mean when I tried to explain to him that in certain circumstances an increase of final demand will discourage investment because it became important to produce quickly , even at a higher cost, while a low demand will force investment to reduce costs. So the relation may be a decrease in demand stimulating investment and an increase in demand discouraging investment.

For the moment he was very interested, and then he said, “ But that would be contrary to the axiom that employment depends on final demand…” Because this was so much an axiom in his life – that there was a positive correlation between final demand and total employment, anything which conflicted with it was dismissed as absurd.’

— Friedrich Hayek interview with Nadim Shehadi LSE Oral History Project 1980-85

‘We now pass to a fourth fundamental theorem respecting Capital, which is, perhaps, oftener overlooked or misconceived than even any of the foregoing. What supports and employs productive labour, is the capital expended in setting it to work, and not the demand of purchasers for the produce of the labour when completed. Demand for commodities is not demand for labour. The demand for commodities determines in what particular branch of production the labour and capital shall be employed; it determines the direction of the labour; but not the more or less of the labour itself, or of the maintenance or payment of the labour. These depend on the amount of the capital, or other funds directly devoted to the sustenance and remuneration of labour.’

— John Stuart Mill, Volume II – The Principles of Political Economy, 1848

To the many mainstream disbelievers in the Austrian vision of economics there is variously something strangely counter-intuitive about it, or hopelessly dated, or – by dint of its deep distrust of the faux-science of casting mathematical abstractions in the role of determinants of human behaviour – ineffably primitive.

The first charge may seem a trifle rich, coming from those Keynesian Red Queens who can believe six impossible – and contradictory – things before the dog’s breakfast of the General Theory.

For its part, the second cavil is something of a straw man in that the only thing truly antiquated about the Austrian approach is the institutional milieu in which its classic expositions were laid out – mostly between eighty and a hundred years ago – a framework to which some of the archetypal descriptions perforce make reference. Conversely, we can be sure that, were Mises alive today, the specifics of his ratiocination might be suitably altered, but that, equally, the substance of his argument would not.

But let us not deal in invective for now. Let us rather try to address the criticisms of our alternative viewpoint and clarify the more individualistic argument which we advance in place of the aggregative reasoning of our opponents.

The first counter to Austrian Business Cycle Theory is that, contrary to what the classic narrative seems to suggest, the dubious fruits of credit expansion are not exclusively the preserve of the thrusting businessman but may also be harvested by the individual shopper or the would-be householder.

But, in truth, no-one really disputes that this is the case: that, during the last two generations, a revolution has taken place in extending new loans to new classes of borrowers, for ever longer periods, for ever more non-remunerative – even trivial – purposes. Nor is it even true that all those who borrow in order to embark upon, or to expand the scope of, their business must be seeking to finance long-maturity, capital-intensive projects: they may simply wish to buy in a greater stock of readily transformed and liquidated goods.

For an Austrian, it is a fairly trite to say that an increase in the availability of the means of purchase will tend to excite more end-spending – if final consumers are the ones being given those means – and, yes, greater efforts at satisfying the associated wants. The crucial point, however, is that such activities of themselves cannot cause a full-blown business cycle, but will preferentially push up the prices of the goods being more avidly sought, as well as those of the factors which give rise to their fabrication.

Indeed, to the extent that these are end-consumer goods and services, subject to rapid exhaustion in use, able to be swiftly replaced (and hence giving rise to an accelerated turnover), such a response will form part of what we might call a ‘simple’ inflation somewhat akin to the effects which follow from the commandeering of food and fodder by an army on the march.

Furthermore, to the degree that everyone becomes more and more intent upon shopping for their supper, everyone in receipt of a dollar will either wish to spend it at once on their personal enjoyment, or in buying in such wares as will be taken from their own shelves in the shortest possible order. They will also lean towards devoting a greater share of any profit so earned to the entrepreneur’s or his financiers’ gratification and against investing of it so as to improve future output.

To a Keynesian, with his simplistic, toilet-flush picture of the economy, this represents a very heaven of ‘aggregate demand’, serving both to ward off the ever-present spectre of underconsumption and to call the greater output called for by the five-year-old-in-a-sweetshop-window mood which easy money episodes generally instil.

The Austrian, however, with his infinitely more nuanced and decidedly less aggregative approach, asks himself instead: “Where does the capital come from to increase or improve the relevant supply? Who can steel himself to step aside from the whirl of buying and selling long enough to build something more efficient or more enduring? Who can keep his workers happy and his suppliers motivated while he slowly lays down the foundations of a less ephemeral, less hand-to-mouth business than that which all those about him are so furiously conducting?”

Burning down the house

Inasmuch as the inflation lends itself to more urgent present demands, to a greater sense of impatience or immediacy – to greater time preference in the jargon – the risk is not that too much capital will be laid down, but too little: that, in the rush to meet orders and to keep the cash register ringing, even those currently in business will concentrate overmuch on keeping the assembly line operating at full capacity today and, conversely, will pay too little heed to the needs of ensuring it runs properly tomorrow.

Not only will the factory boss have no thought of closing down a part of it in order to install new equipment; not only will he set aside his routine of pulling workers off their primary tasks in order to acquire new skills, he may begin to neglect maintenance schedules – promising himself he will catch up as soon as the pace of orders slackens. He may even raid the depreciation fund (a reserve which effectively provides the capital means for the suppliers of his machines to make ready their eventual replacements) in order to pay for more stock and to disburse a swollen payroll.

Without wishing to stretch the analogy too far, we might usefully consider a battle-scarred army unit, desperate to rotate men away from the frontline; needing to refit its armour and strip down its guns; keen to incorporate new insights into its tactical doctrines, but beset by constant assaults from a persistent foe and with no hope of reinforcement or relief. At last, this unit’s fighting capacity will be ground down and its combat effectiveness destroyed, no matter how valiantly the troops meet each successive onslaught.

Thus, a ‘simple’ inflation will tend to shorten time horizons and project lead times, not lengthen them. It will lead to a rundown of the existing capital stock, not a more prevalent (but nonetheless finely differentiated) over-abundance of it.

On this particular road to impoverishment, the present may become the enemy of the future. The legacy of this kind of Rakes’ Progress is not a surfeit of half-leased office blocks, ruinously high-grading mining concerns, and unprofitable – if barely cash-generative – equipment manufacturers. All people will be left with at its end is an excess of money, not a deeper complement of capital means.

The sectors feeling the main attraction of even this ‘simple’ inflation will, of course become increasingly overstrained and wholly at the mercy of its continuation. Like iron filings clinging to an electromagnet, there will be nothing to hold them up against the pull of gravity once the current is interrupted. However, the shortened horizons – even, in extremis, the approach to a subsistence economy – means that the remedy for this form of the inflationary disease – and the restoration of a progressively advancing material well-being – is far more straightforward than is the case for an over-extended, over-engineered one, once the fever has been broken. Take the tale of Ludwig Erhard’s post-war currency reforms in Germany as just one case in point.

What you gain on the roundabout…

For the Austrian, however, the true mischief occurs to the extent that entrepreneurs do tend to dominate the fund-raising which is taking place and that they commit the proceeds to more ‘roundabout’ projects, to use the somewhat vexed, nineteenth-century parlance of Boehm-Bawerk.

With its overtones of a slower delivery of goods – an image which belies the supposedly advanced techniques being employed – this term has led to much, largely unwarranted confusion and is perhaps worthy of some clarification before we resume the main discussion.

In the first instance, we could point out that ‘more roundabout’ really means more indirect. It implies a pathway to the end-user which involves several steps of a characteristically specialized processing and recombination, one that takes many levels of skill and much dedicated equipment to carry out. We are not just talking about Adam Smith’s pin factory or Henry Ford’s assembly line in isolation, but an integrated sequence of them, each passing the results of its labours downward toward their final consummation as finished end-consumer goods.

Once put in place, this more complex productive array may not only turn out more goods (of the same or even better quality) than its less intricate, less capital–intensive precursor, but it may do so according to a much quickened cycle, turning them out faster, too.

The operative phrase here, however, is ‘once put in place’. This represents an achievement which is blithely dismissed as inconsequential by a mainstream content to assume an homogenous – and even an inexhaustible – ‘fund’ of something amorphous mass it calls ‘capital’ and inherently unable to find a role for time in its constructs. In truth, this putting-in-place is no mean undertaking in a world of radical uncertainties, even under the most favourable of circumstances.

It should be apparent to anyone with a sense of the real world that though the establishment of such highly involved and intimately interwoven chains surely leads to greater material possibilities, it also increases their interdependence in a frankly exponential manner. This not only heightens each sub-system’s unique vulnerabilities, but it also reduces its directors’ ability to visualize, much less accurately quantify, the influences all the other members of its network will have on their chances of profitable operation.

Here we might think of the cells in our body, each contributing to the marvellous biochemical whole that is a human being, but each profoundly reliant on the smooth and proportionate functioning of those around it. A life much more replete with potential than that of an amoeba, or the indistinguishable member of a slime mould patently results, but also one riddled with fragilities and doomed to a mortality which the less sophisticated Protista are effectively not subject.

A second way to think more instructively of this key concept of ‘roundaboutness’, this time from a purely business perspective, is that it involves outlays on productive means which will require an extended period to amortize. It is one whose initial price will be recovered (together with due recompense to him who originally helped meet it) only after repeated, profitable applications of the generation of saleable goods and services.

It is in this potentially prolific combination of a more specific – and, hence, much less re-deployable – use for the firm’s equipage and the longer payback time needed to justify its original construction that the seeds of the Boom and Bust are sown by the ill-considered and inescapably coarse monetary manipulation of the central bank, whether its sins be those of commission or omission.

Thus we should begin to grasp why it might be that, should the emission of greater volumes of credit serve to entice a larger number of businessmen into more ‘roundabout’ endeavours and if we can demonstrate the perils inherent in this credit being greater than the amounts that have been intentionally saved, ex ante, the swelling population of those who are so coaxed – and their even more profusely multiplied network interdependence – leads directly to the conclusion that, once the monetary veil is at last lifted, the problems then revealed will be both widespread and exceedingly difficult of redress.

It is in making this claim – one for which we hope to provide further justification by the end of this paper – that we find a reason to excuse what seems like the early Austrians’ fixation upon what transpires when producers are given an artificially lavish access to capital means and, by extension, the lesser stress placed on the effects of consumer borrowing. We do this not just by an appeal to the times in which they were writing, but by analogy to a physician who concentrates his energies upon the elucidation of the progress of a particularly threatening and intractable disease, while passing over the fact that the patient’s simultaneously overweight condition or his weakened immune system might well both complicate the diagnosis and aggravate the ailment’s specific effects.

In fact, we will argue that, to the extent that the credit-card wielding, home-equity extracting end-consumer does indulge in a bout of ‘simple’ inflation at the same time, he will exacerbate the growing disconnect between what far too many business borrowers are attempting and what will ultimately prove rewarding to them and their backers. Even in the received version, however, all the consumer needs to do for the expansion to become unsound and shakily reliant on ever more infusions of credit is to try to spend his greater earned income in his habitual manner – whether or not the consumer himself is borrowing. In essence, this particular road to hell is paved, not so much with good, as with wrongly-signalled intentions.

…You lose on the swings

It must be granted that the archetypal Austrian treatment of this issue is often taken too literally and with too intense a focus on its specifics as a matter of narrow scriptural orthodoxy. This is a particular penchant of those newer proselytes who tend to suspend their own critical faculties and ignore the frequently Tacitean level of compression and ellipsis found in the received texts. Ill-trained but enthusiastic expositors can do just as much harm to a school of logic as can the most unreasoning dogmatists to a faith.

Stripped down to its most Creation Myth basic, the story they relate begins to unfold as follows.

“Fiat pecunia, “says that Mighty Lord of Misrule, the Central Bank and, lo, market interest rates begin to fall. Upon seeing this, entrepreneurs jump to the erroneous conclusion that their customers have suddenly decided not to take delivery of so many goods today as was their wont, but would rather have a little extra prepared for them at some indeterminate day in the future instead

The funds hypothetically spared immediate outlay, as a result, have found their way into the loan market, thereby bringing about that very reduction in rates upon which the businessmen had first remarked, but which they have somehow failed to associate with the avowed manoeuvrings of the central bank. [Perhaps this last was a more reasonable misunderstanding in the days when the communication of such policy shifts was both less overt and more slowly passed on and when the central banks themselves were not the grand, collectivist planning agencies they have become today]

“Fewer sales today mean more sales tomorrow, so let’s get busy while we’re waiting,” the entrepreneurs conclude, en masse, and so rush out to buy more machine tools, to break ground on an extension to the petrochemical plant, and to hire more design engineers and fewer shop assistants, in order to give full rein to their long suppressed dreams of industrial pre-eminence.

Set out in this frankly self-parodic form, it is not hard to see why mainstream brows become furrowed in perplexity, even derisive incomprehension.

After all, that same mainstream has long been lulled into an over-compliant acceptance of a far more Swiftian theory of paradoxical hydraulics in which saving ends up only causing immiseration; where inflation is a valued prophylaxis aimed at warding off the crushing ennui of a looming Edenic surfeit of goods; where the locust creates more wealth than the honey bee; wherein the businessman is an irrational dupe, the investor a cheap card-sharper, the lender an indolent usurer, and where only that vast, tutelary deity, the State – ably assisted by the ex cathedra endorsement of its pet intellectuals and given a sham respectability by their cabbalistic calculus – can steer the milling Herd, farsightedly and disinterestedly, away from the precipice over which it would otherwise rush.

Convinced that, in a Looking Glass world of overabundance which the evidence of their own senses should contradict – no less than should its dissonance with their characteristic Malthusian pessimism, or with their invidious penchant for the tall-poppy redistribution of what they consider to be too meagre a cake – they see it as self-evident that if only enough duly-authorised requisition chits – enough fiat money – can be waved in the marketplace by some importunate beneficiary of government largesse, ‘animal spirits’ will soon be restored and the bogey of ‘liquidity preference’ rapidly dispelled.

Only counterfeit enough money, they hold, and shops and steel mills will spring into being, the first being instantly fitted out with shelving, the latter with smelters, and goods will soon pour along the vibrant new network of roadways, railheads, and dockyards which will have meanwhile materialized to link the two, thus satisfying our alms-recipient’s wants in a swift and mutually enriching testimony to the prescriptions of economic consensus thinking.

To explain to those who have been indoctrinated to believe in the Cargo Cult that he has the Keynesian cart very much before the Hayekian horse is to invite the smart, but ultimately superficial sneer of Richard Kahn to Hayek that the Austrian seems to think that the act of buying an overcoat in the middle of a slump will only serve to throw more men out of work.

It is our remaining task to show instead that – in an environment in which plans had been implicitly framed to incorporate the assumption that people would be happy to go about in shirtsleeves (a dashed expectation which came about thanks to the misinformation transmitted by a falsified structure of interest rates and relative prices) – too great an appetite for outer garments may well have precipitated the crisis in the first place. The implication of this is that any further attempt to obfuscate the degree of disco-ordination which led to the bust – whether by supporting unearned spending or subsidising unprofitable production – is to aggravate, not ameliorate, the crippling discrepancy which it has shown to have arisen between ends and means.

As far as the eye can see

So, without altering the nub of our explanation of the crisis one whit, let us instead change the accompanying Just So story to chime better with an appreciation of modern institutional settings and common intuition, both.

Rather than posit the entrepreneur as some kind of astigmatic, macro-economic Heimdal – with a godlike ability to see right across both time and the economy in one sweep, but strangely unable to correct for the aberrations introduced by the central bank – let us make them men of their time, more gifted than most in buying A and B and selling A+B for a greater sum of money than they cost perhaps, but, nonetheless, ordinary mortals, blessed with a heightened, yet localized understanding of lucrative opportunities to satisfy customer wants, but not necessarily endowed with any over-arching, systemic awareness.

As such, they are no less subject than the rest of us to the perpetual brainwashing that lower interest rates increase consumption and that consumption-in-the-round must lead both to increases in everyone’s revenues and, crucially, to a greater likelihood of their realising higher profits from these.

The flaw in the entrepreneurial thought process may not then be the somewhat contrived one that they mistake unbacked credit for real savings, but – to the extent that they look above their own circumstances and individual hurdle rates at all – that they trust too much in the blandishments of the opinion-makers around them.

The irony here is that the prevailing macro-economic view – though utterly vitiated by the long, sorry record of its own inadequacies – has become so engrained in the collective unconscious that it itself has forged the fetters which bind us to the Sisyphean torment of perennially alternating Boom and Bust.

So, rather than being fooled into relying on the maintenance of a purely fictional higher savings rate (and, hence, a continuation of lower real yields) for the length of their investment timeline, entrepreneurs may actually be putting too much faith in the ability of the authorities to maintain the initially heightened level of consumption, misappraising the risks this will (somewhat counter-intuitively) bring, and expecting such policy corrections as are later deemed necessary to be made gradually and smoothly, with the aim of fine-tuning the inflation and stabilising the whole so as to sustain the boom for as long as possible.

After all, that is effectively what every central bank vouchsafes it intends to do – so who is he, the humble housebuilder or the mere metal-fabricator, to argue with such intellectual luminaries as contribute to its counsels?

Moreover, the entrepreneur has become conditioned to expect ‘growth’ – i.e., serially expanding markets and increasing wealth – into which to market his wares. Nowadays, he also takes comfort from official promises that, no matter how much more efficient he and his peers become in churning out goods, general prices will not only not be allowed to fall, but will be encouraged to rise at some treacherously mild-looking pace. He thus not only looks forward to conducting ever more business, but to doing this at ever higher prices as the chronic inflationary milieu gives him a repeated leg up on his cost base.

Given the operational – as well as the financial leverage – with which many of such men habitually work, once the credit injections begin to effect their malign stimulus, they therefore encounter a volume-driven incentive in addition to the inducement to expand provided by the lower cost of capital itself; factors which each selectively tend to favour longer-horizon, more ‘roundabout’, undertakings.

As business survey responses continually reveal, entrepreneurs are intrinsically more optimistic (more conceited?) about their own prospects than they are about the economy-at-large. They are like local commanders who are confident that their unit will give the enemy a bloody nose even if the chateau generals contrive to lose the wider war. This predisposes many of them to being ’Field of Dreams’ types, willing to build in the hope that the customers will appear if only the cost of borrowing is not too prohibitive or the payback schedules too restrictive in the meanwhile.

They may also be prey to a peculiar form of overabundance fallacy – or, at least ignorant of more esoteric issues of complementarity – in which they assume there will be few binding constraints on the availability (at a similar price) of the factors of production which they aim to use and, just as importantly, on those the people to whom they sell will need to use, in their turn.

Often susceptible to the surrounding buzz created when end-spending picks up and acutely aware of the strength of the direct customer bid they can attract, they may be oblivious to the growing number of pitfalls being dug on the road between the two by the cheap money conditions themselves. They may not only ‘not know their place in the productive structure’ (q.v., Hayek), they may either be unaware of the fact that such a thing exists, or else oblivious to its admittedly unquantifiable influence on their own chances of success, right up until the moment when things fall apart.

Crusoe, after all, knows his own wants and changing schedules of demand and preference, by definition: Crusoe, Inc., may not share such an accurate insight into the whims of Mrs. Crusoe, her customers, her customers’ customers and their millions of friends.

Crusoe also has no money illusion. By catching more fish (or the same number in a shorter time) with the net he has made at the cost of some of his earlier, less prolific fishing time, he increases his real income and makes possible either the enjoyment of his second or lower choice of goods, or for yet greater, enriching investment in tools. Crusoe, Inc., all too often looks at the achievement of a higher money income – a feat which inflation seems to make less challenging – as an end in itself and never stops to ask how his success was attained, nor what its pecuniary reward really now buys.

It cannot be over-emphasized that this whole phenomenon only serves to reinforce the critical importance of acting according to genuinely indicative price signals and monetary settings. Not only government intervention, per se, but also the actions of a hypertrophic and, hence, hyperactive financial sector (itself the bastard child of the State’s default-setting inflationism, its New Deal guarantees, its ‘Greenspan Puts’, and other such affronts to the free market) inevitably interfere with both the generation and dissemination of such information and are therefore profoundly injurious to the entrepreneur’s ability to function and thus to promote genuine material advance.

Get your motor runnin’

So, if we accept that the entrepreneur, for all his undoubted merits, is deliberately keying off the easier credit conditions, as well as his personal assessment of his own particular market, we can begin to tease out what typically takes place and, more importantly, point out what we believe goes wrong when he and his confreres are enticed into committing their livelihoods to a too enthusiastic participation in the upswing.

In response to the initial injection, the chances are that asset prices will rise and that, as a result, their yields will decline. The impetus for this move is usually laid at the door of the central bank, but let us not forget that this is only a convenient shorthand for a whole spectrum of possibilities. In the modern system, this initiative may come instead from those commercial banks who have independently decided that conditions are appropriate for them to leverage up their thin skimming of equity capital and to accept more business risk and so to chase higher returns.

It may also be that non-monetary financial firms, such as investment banks, are at the forefront, extending credit for the purchase of other securities and underwriting new issues of bonds, equities, and all the many hybrids of the two. Other, leveraged entities, such as hedge funds, venture capital outfits, and private equity firms might be at play, too, while there could also be a move towards buying highly-margined participations in such securities through the derivative markets, something which will begin to pull up the prices of the underlying claims behind them.

However it starts, if such a change in sentiment is truly to take hold, it will inevitably require the active abetment of the fractional deposit banks in creating new money to be siphoned off into the slowly forming cyclone of credit. Eventually, the added complicity of the central banks will be required, too, as accessories after the fact if nothing else. Nor, in a world of lazy mercantilism, do these central banks necessarily have to be the ones who have immediate jurisdiction over the lenders in question: borders are porous and FX at least partially fungible while everyone is playing a Rueffian game of marbles.

Then again, various central banks may decide to amalgamate their principle functions and subsume the charge of many diverse nations into one. This way, a number of smaller nations, long starved of cheap credit, thanks to their dubious history of default and devaluation, may be lent a spurious, Teutonic sheen of rectitude by dint of their association with their more reputable confederates. Interest rates will naturally fall well below the levels to which their citizens have been acclimatised, and the serpent will soon be urging the taste of the apple upon one and all.

Meanwhile, a steadfastly Nelsonian eye on the signal shrouds from the relevant regulatory authorities will not hurt, either, in a fractional reserve world built on virtual banking capital where, otherwise, natural, endogenous limitations on expansion are largely absent.

Let us not forget here that ‘looser’ conditions do not just imply lower official interest rates. Mises himself was given to breaking actual, observed rates into an underlying percentage which would ideally reflect the societal expression of time preference (‘originary’ interest, in his words); a surcharge to account for the likely loss of principal value due to price rises over the term of the loan; and an entrepreneurial risk component – not so very far removed from our concepts of a risk-free ‘real’ rate, a break-even inflation rate, and a credit spread, all stacked atop one another.

Any combination of these can be reduced by an intangible change in sentiment, just as a sudden wave of heightened confidence – very prevalent when an exciting new technology finds its expression in the marketplace – can move entrepreneurial assessments higher and increase the borrowers’ own gauge of the margin of safety built into their business plans. In essence, producer, rather than consumer, time preference may have shifted Thus, Wicksellian ‘natural rates’ can rise well beyond the existing activation barrier absent any move in actual market rates, rather than the more commonly described fall of the latter blow an unchanged former. Canal booms, railway manias, radio frenzies, and telecom bubbles are each built of just such epidemics of mass delusion.

Moreover, the final check on borrowing is not just the running meter of interest charges, but also the amortization schedule. If the lender is prepared to stretch such payments out over a more protracted span, forego them altogether for a certain period, or even roll underpaid interest up into a growing principal which will not fall due for reduction until some temptingly deferred, Micawberan posterity, the illusion – if not the reality – of lower interest rates can be created, absent any actual reduction in posted, econometrically-observable yields being made.

This is where the scope for the sorcerer’s apprentices to innovate well beyond the paradigmic Volckerian ATM comes in. This is where we start to play the Red Queen race of ‘regulatory arbitrage’. This is where the state’s porous budgets and its venal corporatist directives work their evil upon the corrupted vestige of the market structure which persists in an unanchored monetary system.

Securitization may not only move risk away from direct, intimately responsible oversight (and move it well beyond a conflict-of-interest horizon), but shift assets to institutions with longer liability structures – or to those who have less obligation to mark-to-market than the Pontius Pilate loan originators possess. It may also advance the fallacy that a loan can be adequately collateralized by a non-earning asset (such as a house), or by hypothecating the sums which borrowers do occasionally remit out of their somewhat uncertain and increasingly alienated income streams.

Derivative ‘insurance’ may be horrendously mispriced by nickel-in-front-of-steamroller sellers of overcheap options (such as the hapless US ‘monolines’ and the indefensible AIG). Implicit government support in the kind of public-private chimera of which Mussolini would be proud can horribly backfire as the multi-millionaire CEOs of Fannie and Freddie found, lamentably not to their own cost. More finance becomes available for less tangible backing: LTVs rise, as do debt-to-EBITDAs and other income multiples.

Even among smaller companies, limited liability status, no-fault bankruptcy, and the fatal temptations of using Other People’s Money means the optionality of leveraged success can far outweigh any likely costs of failure. The added sweetener that, when money is easy, one does not have to run a successful business, only manage the successful passage to a lucrative IPO, means projectors may come to outjostle producers, further riddling the economic organism with a veritable zoo of harmful retroviruses and spreading carcinomas alike

All this collides with the vast agency problem inherent in entrusting your business to those condottieri of the corporate boardroom, the modern ESOP elite, the rock star self-aggrandisers who are all geared to managing the stock price not the stock-room; ever ready to capitalize the future in order to boost the bottom line; and insulated from personal jeopardy by their freemasonry of mutually-awarded golden hellos, golden handcuffs, golden parachutes, and all the other, rich perquisites of executive office.

Added to this, the tax code allows interest payments to be deducted from earnings, while it insists on its full pound of flesh from dividends, effectively biting equity capital twice. Armed with the spurious dogma that debt and equity are intrinsically ‘equivalent’, cynically aware that the easiest way to improve earnings-per-share is to reduce the denominator, and always willing to borrow their own, directors’ remuneration and charge it against the owners’ remaining net worth, the capital structure of the firm soon becomes a vehicle best driven for peculation when credit becomes too freely available.

We have come a long way the ‘stock watering’ days of the Robber Barons to the ‘debt deluging’ practices of the job-hoppers who read Barron’s and ‘leveraged beta’ has come to dominate the drawing office just as much as it does the dealing room, leaving the quest to generate true entrepreneurial ‘alpha’ a forlornly distant second.

All this cheapened credit, all these allurements to put it to less than meritorious use: even if people do still find it impossible to swallow the classic Austrian concept of ‘mass entrepreneurial error’, must they still reject the notion that artificially cheap money is the root of much contemporary evil?

The Reichsminister’s dilemma

So, with the self-fuelling, credit-upon-credit, loan-collateral spiral now well underway – if only among the perpetrators of legalized fraud and neglected fiduciary duty – where do the cracks appear that will doom this Babel of unbacked lending to measure its shadow in the dust?

This is where we get to the original Austrian point about the credit not being backed by saving – even if no-one is fully cognisant of what this actually implies.

It is NOT, as some critics assert, a matter of having to assume the majority of otherwise astute entrepreneurs are fooled about something so painfully evident, nor that ostensibly well-informed bond dealers cannot make the necessary adjustments to discount any emergent discrepancies. It is the much more profound matter that there is nothing in the prevailing mix of prices and rates which allows those who may be theoretically misguided, as well as those whose are naturally none too quizzical, to ascertain that the lack of a sufficient degree of ex ante, intentional, voluntary abstention from exhaustive end-consumption will militate against the completion of a decidedly supranormal proportion of the newly-conceived undertakings.

The lack of saving is, at root, not so much a monetary problem – if it only were, it might be recognised and corrected before to much harm were done. No, it is decidedly a real one: it means that, rather than co-ordinating their call upon the pool of available resources, far too many people have begun to act at cross-purposes, with each wanting a larger piece of the cake than can simultaneously be accommodated. Worse, this is not just a zero sum game, but a negative one: the winner’s curse is that his temporary success will rapidly turn to dust because he is more dependent than he knows on the fate of the man he, by implication, has himself condemned to be counted among the losers.

When low rates arise naturally from a relative lessening of end-consumption, this implies a freeing-up, or a cheapening, of useful factors of production, many of which can henceforth be marshalled into carrying new forms of industrial and commercial organisation through to a profitable, future fruition. It means that some fraction of both capital and labour are no longer being put to their most urgent use, as currently employed. Therefore, they can now be spared for exactly those more ‘roundabout’ dispositions whose genesis the lowered rates will favour, without too much risk of the attempt to secure them sparking an untoward, price-boosting tussle over their disposal to the point that the entrepreneur’s revenue and income projections are rendered fatally invalid.

However, when lowered rates are merely an artefact of a change in banking policy (including the passive choice not to raise rates in the face of a sudden increase in the entrepreneurial demand for funds), not only will this inflation not reflect a change in the composition and immediacy of the demand for existing goods, it will probably intensify its original settings (via the working of ‘simple’ inflation) while overlayering our classic, Austrian, producer’s inflation on top.

The mutually enriching business of exchange now becomes a snarling, Cantillon effect dogfight, where – albeit largely unawares – the game becomes one of hoping to ‘pass the bad, or depreciating, half-crown to the other fellow’, to coin the typically flip phrase of the dilettante aesthete who enshrined this practice at the heart of his disastrous dogma.

You do not even have to be an Austrian to comprehend this. As the Marxist historian and economist Michael Perelman wrote in 1987:-

“The more ‘fictitious capital’ [that which is created through the monetary system without real savings] distorts the price signals, the more important information about the economy disappears. Decisions about production become increasingly unrelated to the underlying structure. Pressures build up in the economy, but they are not visible’”

The addition of more ‘fictitious capital’ means the early recipients of the new funds get to take a larger dip from an unaugmented pot, leaving the later sellers cheated of a due quota of goods, despite what may be an increased nominal cash flow. ‘Forced saving’, in the argot, now rears its ugly head, though many will be myopic enough to see such unspent funds as pile up in their hands as a ‘saving glut’ and will even blame its appearance for the ills to come.

Producers borrowing to build long (and thus not yet contributing any readily-liquidated goods to the teeming emporium); producers borrowing to buy short (and thus drawing more out of an increasingly inadequate stockpile of existing proto-goods); consumers borrowing to spend long (for durable goods, such as housing and cars, are equally interest rate-sensitive forms of ‘roundabout’ gratification); consumers borrowing to spend short: before long the conflict between incompatible plans will lead to an unforeseen price- and time-rationing of resources and will drive many of the new, untested, semi-finished goods off the shopping list of both intermediate purchasers and exhaustive end-consumers.

Note here, too, the essential point that any given entrepreneur – even one high up the structure – may be lucky enough not to have any difficulty in securing what he needs himself (and to do so at a price his budget can bear), but if someone, somewhere downstream – nearer the shop window, if you will – who buys his output, or the output made with the help of his output, runs into difficulties, then his goose will be just as surely cooked as theirs. Indeed, insofar as his core revenues depend upon another’s more discretionary spending (whether consumer ‘luxury’ or producer capital expenditure), his will be burned to a cinder while theirs may only be lightly seared.

Even such a buffoon of a central planner as Herman Goering realized that unenviable choices must be made between guns and butter if the economy is not to snarl up amid its own contradictions, but yet it goes unrecognised that a Boom based on unsaved credit asks both the armourer and the dairyman to put on an extra shift at the same time, using the same workers and the same inputs.

View from a Bridge

Consider, if you will, the travails of an enterprise which has a contract to build a bridge across a gorge. As the structure arches precariously out into the void, the work is suddenly halted for a lack of sufficient material on site. A hurried investigation soon reveals that the men have been purloining the bricks to build themselves a beer hall, while appropriating the timber intended for the scaffolding to construct the lean-tos which they much prefer to the tented accommodation provided by the firm.

Faced with a tight deadline – and with a penalty clause hanging over them if they miss it – the bosses scramble to make good the shortfall, only to find that the brickworks has an order backlog for the construction of a municipal swimming pool and the sawmill has been forced to turn away custom ever since two of its key production line staff quit to take better paid jobs, the one brewing beer, the other playing the piano in the siteworkers’ new saloon.

With the delay costing it dearly for each extra day’s wages it must meet and with a substantial cost overrun looming at it sends abroad for the necessary raw materials, the firm faces ruin. Its first thought will be to borrow the funds necessary to tide it over and get the job done, even if it has now not only foregone all thought of profit, but must eat into its depreciation allowance, and then its equity capital, right down to its very last cent.

In passing, we should note that the effect such an exigency on the loan market – if it takes place on a wide enough scale –is what Hayek called ‘investment that raises the demand for capital’ and is one of the primary causes of an inversion of the yield curve in times of productive stress.

Now, ask yourself if you think it would at all ease the plight of our imaginary Brunel if the Keynesians now stepped in to assist?

After all, what they would urge is that people spent even more money on beer and soon the sawmill would lose another of its team to the local pub. They would also urge the magic of government spending and, before long, the brickworks would be even more backed up as the mayor presided over the ground-breaking ceremony for an imposing – but productively sterile – new town hall. Furthermore, the advice would be to keep all the jobs ‘at home’, by devaluing the currency and erecting barriers to external trade so that the imports of brick and poling that the bridge builders so urgently require would either become prohibitively expensive or simply not allowed past the customs house at any price.

Recalling that lowered interest rates and the spreading delusions intrinsic to the latest New Era will have significantly lowered the price of risk (from price-to-earnings, to price-to-eyeballs, or from qualified borrower to ‘liar loan’ NINJA, to give but two memorable examples), it is clear that these same risks will, in fact, have been made more elevated due to the ongoing dislocation of spending patterns, the lengthening of the productive structure, and the befuddling of entrepreneurial calculation. All this will be taking place long before the economic civil war has been fully unleashed and the subsequent, blundering central bank attempts to bring that strife to an end have given rise to perverse currency shifts, more rapid and more unpredictable price changes, heightened fiscal drag, and, ultimately, catastrophic credit failure.

Now, of course, not all entrepreneurs ‘fail’ in the bust – otherwise private sector unemployment rates would soon be nearer the three-digit theoretical ceiling than the two-digit range they normally enter. But what is indisputable is that a greater number than normal will founder, while even the survivors may incur losses equal to several prior years’ profits. This is a happenstance which becomes all the more likely if the Boom has encouraged the usual aggressive capitalization of highly contingent gains; the inclusion of investment income alongside returns from operations; and the thinning out or eradication of risk buffers, as is all too frequently the case.

As we have already suggested, damage will tend to concentrate back up to higher-order goods manufacturers where operational leverage is higher, where customers are both less varied and more discretionary, and where skills and equipment are highly specialized for the task in hand. Swords of such a bespoke nature are not often beaten easily into ploughshares, alas!

In addition to this, there will be numerous failures among the erstwhile beneficiaries of ‘simple’ inflation, especially if the credit pyramid starts to totter as a consequence of the growing sense of commercial panic. Not the least of these victims will be those producing ‘roundabout’ consumables – those making durable goods such as cars and houses, for instance. But, as more and more firms falter and their payrolls are progressively reduced, the secondary impact will spread to markets for non-essential consumer goods of all kinds.

It is, of course, conceivable – to address another charge against the faithfulness to reality of the Austrian depiction – that some entrepreneurs will succeed in bringing their schemes through to a successful conclusion. Though it scarcely justifies the awful costs involved, there will also be those who, had there not been a Boom, might not have been able to persuade a more level-headed set of backers of the merits of their ideas, but who have since introduced a range of new products which have displaced sufficient old ones and which have established themselves so firmly on customer wish lists that they will be able to weather the growing storm and thrive anew once it has passed.

Others might have been innovative enough within established lines of business to reduce their costs, expand their margins, and build up such a capital buffer, that, when the downturn hits, it is their competitors who founder, not they.

Hoocoodanode?!?

But to point to these rare success stories is to miss the point that the mass of entrepreneurs, while worthy of us wage slaves’ approbation for their courage and resolution, are also journeymen, not commercial, much less economic, geniuses. The majority of them will ape what they see going on around them and will borrow too much to crowd into businesses whose margins will become proportionately thinned, despite the temporarily boosted turnover and artificially reduced financing costs they may enjoy at the outset.

These will not long survive the fluctuations they are about to endure and will fall victim in their droves to what is likely to be the sharp bifurcation between a lowered originary/real risk-free rate of interest – as consumer time preferences fall and a ‘flight to quality’ takes place among those anxious to preserve some of their dwindling stock of capital – and a steeply augmented entrepreneurial risk/credit spread as the Boom’s towering wave of malinvestments rolls over and crashes on the reef of the incompatible aspirations of which it was composed.

Even though this is very much the experience of the Bust – otherwise why would unemployment registers swell and bankruptcy statistics explode? – the Austrians’ critics say it is simply not acceptable to argue that businessmen can succumb to a mass error, not least because this controverts their shibboleths about rationality. “Why do they not learn from their mistakes?” comes the cry.

Well, might it be due to the fact that almost every explanation, every prognostication, every policy prescription the entrepreneurs every hear comes from these very same critics; men and women who deny the whole concept of a structure of production, who dismiss the role of interest rates in allocating resources through time, who denigrate the importance of savings, and who make no distinction between capital means and actual capital goods?

If, on the way up, the supply of credit outstripped that of the goods being produced or willingly spared consumption and credit instruments came to act more and more like money, ‘forced saving’ was occurring. Where there was once some measure of Say’s Law correspondence between buyer and seller, two were now bidding for one, prices were tending to rise and someone was having to go hungry.

Now, on the way down, credit will contract – whether because banks call in their loans, or their debtors rush to pay them off, or expunge them through partial or total default. It will certainly become less acceptable as a money substitute as the prospect of promptly receiving 100¢ on the dollar recedes and an unthinking acceptance of the claim is replaced by a resentful scepticism regarding its worth. Sellers will be much more eager than buyers; prices will tend to go down and those do who want to exchange actual money for goods will no longer go away disappointed with the bargain they are able to secure.

Thus, as the collapse unfolds, many of the broad features of the Boom are unwound. But, just as in thermodynamics we cannot easily unscramble an egg or unmix a cup of coffee, so too in the economy, it transpires that the detailed topology of the downward path will be entirely distinct from that traced out in the upward. Such asymmetries make it highly improbable that there will be any unique correspondence between those who profited inordinately in the Boom and those who lost most heavily in the Bust.

It was on this account that Mises advised against the adoption of a deliberately deflationary policy in order to restore the status quo ante, using the graphic analogy of not being able to aid the man you have just run down in your car by then reversing back over him.

Don’t just do something: sit there!

However, eschewing a deliberate purge of the economy and acting to ensure that the supply of money does not contract unduly from its peak, then allowing matters to take their course by encouraging prices to find their clearing levels, is far, far removed from the sort of active intervention we have now come to expect and which, in the latest slump, has been truly unprecedented in its scale and scope.

Assume, if you will, that in order not to bedevil the adjustment process, we adopt Mises’ counsel to ensure the supply of money (not credit) is kept roughly constant and that we ignore the siren call of the free bankers and even of the later Hayek that what we should really try to stabilize is some ill-defined and immeasurable rate of its circulation by re-monetizing all those ex-substitutes which are now being looked at with so much askance. Further assume that we also remove as many barriers as possible to full price adjustment, arranging for expedited bankruptcy proceedings and speedy loan renegotiation as part of this. Then, this process of Auflockerung will help the conflagration of values burn itself out at the earliest juncture, right at the point when the cash holders realise that their money balances now command a greater volume of goods or assets than that to which they were accustomed (that those balances’ real value has therefore risen).

When people consequently begin to spend a little more freely, this will put a natural floor under prices once again and that selfsame relaxation of the purse-strings will also tend to reduce the perceived need for a larger precautionary reserve. Thus, yet more cash will be put to active use as people see that economic activity has once more begun to quicken and entrepreneurs re-emerge to shape its upward course.

By contrast, the attempt to prop up the volume of credit at its Boom-exaggerated heights inevitably involves the creation of more ‘fictitious capital’ and, moreover, tends to channel it into different hands (not least those of our mayor, who will be gleefully congratulating himself on how diligently he is serving the public good through the debt-financed construction of his fancy new office). How this can be expected to bring about that replication of pre-Crash spending patterns which is the failing firms’ only salvation, is something its most avid proponents never quite get around to explaining.

Furthermore, by maintaining what it has now become fashionable to call ‘zombie’ firms in business, on much the same terms as before, all round returns on capital (and hence all round rewards to labour) will be lowered as these sub-marginal enterprises persist, to the detriment of their more fiercely competitive and well-run peers. This will artificially keep up resource costs and slow the adaptation of wage rates by discouraging a full-bodied rationalization of this still-bloated sector and hence prevent the liberation of scarce productive means for profitable use by others. All in all, a thoroughly retrograde policy for all the impassioned advocacy it attracts.

It will also probably involve a ‘soft budget’ – i.e., it will be an official Ponzi scheme, run on a increasing debt load which the operation itself can never hope to repay – and hence it will come to excite anxieties about the guarantor state’s own finances and so raise stultifying fears over the arbitrary (and, no doubt, nakedly populist) measures it will imminently adopt to restore an approximation to order to these. None of this will prove conducive to a rapid and lasting recovery.

However this is done, even people who have been simply handed bundles of newly-printed money are not likely, on balance, to buy yet greater quantities of things with which everyone has already become glutted. Thus, the assistance this supposed ‘stimulus’ will afford to the overbuilt sectors at which it is aimed will prove nugatory, while the appetite for those goods whose lack of availability played a major role in precipitating the crisis will be subject to a considerable sharpening, increase their scarcity even before they have been put to much use in replacing squandered capital.

Rather than speed up the move to a new, more robust interplay of viable production and its considered use, the intervention will therefore act to drive a bigger wedge between the two and may well give rise to a welter of confusion as a relative ‘deflation’ (i.e., lower or, at least, lagging prices) of the old, boomed–up output takes place alongside the relative ‘inflation’ of the under-supplied and more necessitous items: a situation which will be crying out for that very reallocation of capital and human retraining which the support policies will be manfully striving to impede.

Here is the flipside of the planners’ hubris for, just as their blunt object attempts at social engineering were what either caused the Boom or assiduously fed and watered it after it began to shoot in a more spontaneous fashion, their similarly ham-fisted, Gosplan efforts to repair the damage they have caused is only likely to retard the machinery of self-repair built in to the unhampered market.

Just as prosperity cannot be forced, but must be built one exchange at a time as individuals further their own self-interest by catering to the interests of others, so recuperation must also take place on the finest of scales, with each person, each partnership, each company taking resolute steps to put its own house in order before forcing its solutions on it neighbours, regardless of circumstance.

Just as ‘growth’ is best fostered, not by dirigisme or diktat, but by providing the right framework of transparent law, the swift and impartial arbitration of disputes, by upholding the sanctity of contract, by promoting the security and clarity of title to property, and by giving the firm assurance that money will neither be a plaything of those in power nor an experimental tool of the eager economic Frankensteins who cluster about them – but rather a yardstick of the greatest possible stability – so recovery can only hope to be given the best possible arena in which to play and cannot consciously be orchestrated by those who will, ineluctably, turn out to be both tone deaf and lacking in all sense of rhythm.

A Tale of Sound and Fury

None of this should be construed as fatalism for, if the long, debilitating years of New Deals, Great Societies, and Social Contracts, are to be rolled back and the economic organism suitably re-invigorated by the deeds of responsible self-supporting individuals and underpinned by the spirit of voluntarism, there will be many bonds to be loosed, many deadlocks to be picked, and many creaking joints to be oiled, even if every shackle comes endowed with its own vociferous lobby group, each firmly set upon its preservation and the maintenance of the privileges it unfairly confers upon them.

Nor are we, in fact, ‘Austerians’ in the current pejorative usage: scowling creatures who take a sour delight in seeing past sins punished, railing like a pack of Savonarolas at the excesses of the upswing and demanding universal sackcloth and ashes as a penitence for them.

Not at all. We are just not subscribers to what Albert Hahn tellingly christened the ‘Economics of Illusion’, to the Keynesian belief in the Commissar as Tooth Fairy. Instead we hold that the first steps to a cure for a dangerous over-reliance on credit is, as with that for many other forms of addiction, a full and frank admission of the harm it has done; an honest attempt to make amends for the losses it has imposed upon us and those around us; and a disavowal of its abuse in future.

We are also mindful of the legend of Vortigern, the Dark Age British warlord, who, in seeking to prevent the Pictish sneak-thief from pilfering his household, invited in those brutal Saxon Mafiosi, Hengist and Horsa, to ‘protect’ it and so set in train the subjugation of his entire race, as well as the near extinction of its culture.

If expanding the role of the Provider State and increasing the scope for the exercise of its soft tyranny is a major part of the recommended cure for the ills of the Bust, those who know how hard it will be to prise its jaws off our property and liberty when the danger has passed will be sure that the time has come to seek for another remedy altogether.

It should be self-evident that the search for such an alternative can only begin if we first abandon the quack medicine so widely practiced today. We must move beyond the primitive theory of the humours – of propensities to consume, liquidity preferences, multipliers, aggregate demands, and similar mediaevalisms – and foreswear the crude poultices, purges, and bloodlettings of deficit spending, autarky, and inflationism which they seek to inflict upon the patient.

The goal should be to progress towards a rational therapeutics based upon a detailed understanding of the physiology of the patient, not on a rehashed occultism from the mercantilist and under-consumptionist past. As a first step in this direction, it would help if we could inculcate in policy-makers a proper understanding of the pivotal role of unbacked credit expansion and monetary debasement in both staging the whole tragic peripeteia of the trade cycle and in dragging out its denouement to the point where both players and audience become too enervated to continue.

Appendix I: The Dog That Didn’t Bark (or not very loudly, at least)

With all this talk of unbridled credit expansions and of inflations, both producers’ and simple, there are those who suspect that what we have here is a case of corpus delicti since what they like to think of as ‘inflation’ – generally, a rise in the official consumer price index – has been relatively mild in the West for much of the past two decades, particularly with reference to what went on in the two which preceded them.

After all, we have been arguing that the application of such borrowed-from-nowhere funds by end-consumers has tended to push up the price of the goods they buy directly. Producer borrowing may do much the same, though it is a good deal more subtle in its effect since it is intended to expand supply at the same time that it is adding to people’s incomes and hence to their ability to purchase that new output.

However, if these two facets are misaligned – either in the kind of goods being turned out, or in the schedule of their availability – or if the expansion can only come by pre-empting the input needed to meet the undiminished (and possibly even augmented) call on the existing range of goods, then at least some end prices will begin to rise.

As they do, this will strongly favour those trying to return such factors to their original use, bidding them back away from their erstwhile usurpers. This is what creates the adverse pressure on costs, delivery times, financing, order books, and profit margins which lie at the heart of the frustration of so many new undertakings which occurs as the Boom rolls over into senescence.

In such a state of affairs, it may be difficult to talk of aggregate consumer price rises, since there may be an offset from whatever less-sought after items have finally made it from the new entrant’s assembly lines to the shopping mall; things which, by definition, were conceived according to a falsified assessment of consumer preferences and whose makers and vendors may now be in sufficient distress to sell at or below cost.

More generally, there are several sources of credit ‘leakage’ which may help disguise what we might call naked price index rises, but our problem here is that the case being advanced – since it is partly counter-factual – is inherently not susceptible of the kind of seemingly unequivocal, empirical validation which the positivist mainstream views as the sine qua non of economic argument.

Nevertheless, let us run through our list of extenuating circumstances and, when we have, we will leave it to the reader to decide whether these offer any more than an exercise in special pleading.

The first, general point is that the absence of a substantial rise in the price index may still represent an unnatural state of affairs in that the wider exercise of entrepreneurial endeavour and the greater specialization of function and finer division of labour which this drives should be serially reducing prices.

Thus, a progressive improvement in productive method – which is something the Boom-Bust impairs, but does not necessarily forestall – might be of such an order that prices should be falling by 2%, 3%, or more each year. The fact that they are instead observed to be increasing by such a magnitude may therefore hide the fact that credit expansion is causing, say, a 6% per annum distortion in the overall reckoning of things; a mean which will further conceal even greater potential miscalculations across the gamut of the population’s extensive distribution.

We must remember that the past twenty years have seen dome truly momentous events: the Fall of the Berlin Wall and the liberation of millions from the slavery of Communism; the rapid expansion of the European Union (for all its undoubted failings) and the introduction of the single currency across much of it; the onward march of post-Tiananmen Square China towards some semblance of economic modernity.

Along with these, some semblance of the market order – however far today’s half-baked corporatism falls short of the dreams of us Manchester liberals – has pervaded the lives of hundreds of millions of people previously doomed to penury, peonage, and penal servitude. Far, far more than a hundred flowers have finally blossomed in these more propitious climes and, with them, countless more fledgling entrepreneurs have been drawn into the global economy and a myriad more interconnected neurones have been linked into the frontal cortex of Humanity.

To take but two simple, if telling, statistics: the world’s major ports saw the throughput of container traffic double every seven years from 1987 to the pre-Crisis peak of half a billion standard, twenty-foot equivalent units per annum. While the IMF estimates that world GDP grew by a factor of around 2.8 over the two broad cycles from 1990 to 2008, the WTO figures the simultaneous multiplication of world trade at 4.7 times, swelling it from 20% to 30% of the former.

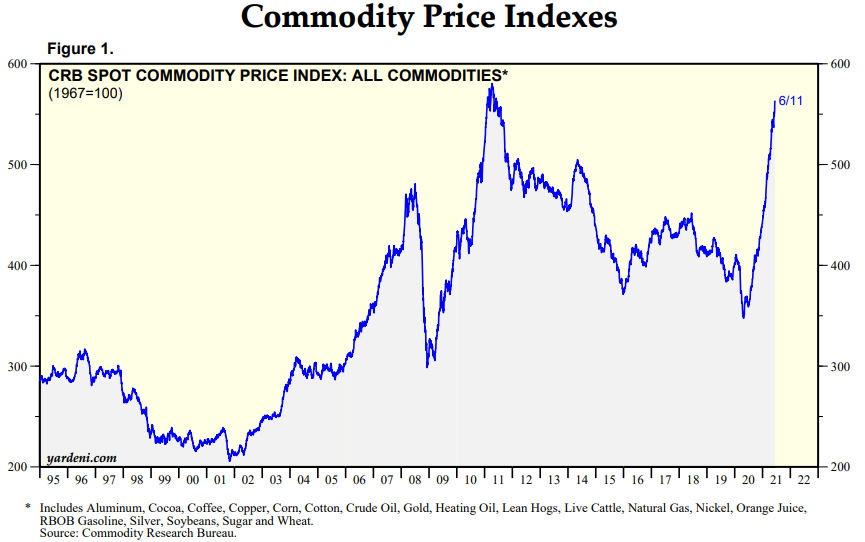

There can be no doubt that such developments have lowered costs, improved efficiencies and incorporated much new ingenuity all across the global productive structure. Should prices have fallen as a result – let us rephrase that – should a goodly number of prices have fallen (for the expansion may itself have taken a toll on certain, temporarily under-provisioned inputs – among them a number of commodities – for which the race to catch up has proved protracted)? With a great deal of conviction – but with not a hint of a time-series with which to support this assertion directly – we would say, categorically, yes!

In fact, we can just about see the footprints of this in making the plot of an index of manufactured trade goods prices (a horrible overarching aggregate, to be sure) relative to one of commodity prices. As today’s Asian heavyweights have gobbled up market share, this ratio has fallen in inverse proportion to the explosion in the trade flows across their borders.

We might also note here that countries which specialised in the production of these commodities suffered some of the greatest ‘Ricardo effects’ – and the most overt CPI increases – in the late boom, with profitability elsewhere in their economies being bled away, and with any labour spared from the resource sector itself being funnelled into serving the consumption needs of its newly-affluent workers – a modern-day Klondike phenomenon sometimes referred to as ‘Dutch Disease’ after stylized descriptions of the Netherlands’ experience during its natural gas boom in the 1960s.

Another, more controversial piece of evidence (again admittedly circumstantial) is that this last cycle has seen the value of manufacturing sales per dollar of wages paid in the US lurch upward in lockstep with the burgeoning trade deficit in goods being recorded at its borders.

Note, too, the official admissions to the business press that the statisticians have no idea how to determine where in the international chain the addition of value actually accrues. Mix in the inconvenient reality that, despite a secularly shrinking workforce where the presumption must be that the poorest performing workers and least profitable firms are constantly being weeded out, the average wage in the sector is losing ground to that paid to service workers. Here, we not only have something which gives the lie to over-aggressive claims of rising American productivity, but possibly something which demonstrates that, rather than credit working inexorably to boost prices, it may simply attract more goods from abroad.

If their overseas seller keeps his currency from reflecting this growing imbalance by lending the money straight back to his cash-strapped customer (possibly through a convoluted process of the official acquisition of buyer-country foreign exchange holdings; perhaps simply by cross-border banking in a spreading currency union), again, there may be ways for the strain to be lessened without a steeply climbing CPI ringing any alarm bells, whatsoever.

While much of this has a benign explanation, there is also just a hint that darker forces may be at work in suppressing the observed prices of final goods in their main, Western markets.

Let us take the example of China and ask ourselves whether the country’s army of exporters are deliberately underpricing their product. While we cannot ignore the fact that venal political expediency might mean the attestation is not a wholly objective one, the recent loud protestation that even a small rise in the exchange rate would suffice to eradicate their profitability might raise eyebrows in this context.

Obviously, we cannot question the fact of the country’s substantial external surplus and, given an import content of 85-90% of everything which later leaves its shores, if any, it must be the domestic inputs which are being sold too cheaply. Either that or, since reported profits are superficially impressive (albeit themselves reflecting the ‘forced saving’ of a massive, producer-directed inflation), this must lead to the further inference that these are either being falsely accounted for, or that they originate in non-operational activities which may be camouflaging poor real returns on the companies’ primary undertakings.

Though China, rather than Russia, is very much today’s ‘riddle wrapped in a mystery inside an enigma’, we do know that firms in the state-owned (or controlled) sector are growing at the expense of less well-connected businesses – a phenomenon which must raise suspicions that capital is being consumed, not accumulated, in much of what goes on across this vast nation.

Cheap, state-directed funding (often advanced at negative real interest rates with no threat of redemption); an absence of dividend payments which adds to the element of capital mispricing; skewed tax policies; preferential, below-cost access to land and energy; the ability to cross-subsidize exports with the monopoly rents and windfalls gained from ‘soft-budget’, government customers at home; an active participation in much of the speculative fever which Beijing’s stimulus efforts have unleashed; the possible padding of inventory or the other capitalization of purchases made below-the-line, in order to lower the reported cost-of-goods above it – who knows the true scale of what is at work in a country where the crude volume of output for output’s sake seems to be the sole benchmark of success?

The Boy who didn’t cry, ‘Wolf!’

Closer to home, another reason why expanded credit may not be causing embarrassing levels of CPI gains is that much of the borrowing may be directed at markets which do not feature in its make-up – most obviously, in housing where an undoubted boom, did indeed take place, but which, if anything helped calm those same CPI changes by increasing home ownership (even multiple ownership) and thus changing the supply-demand equation for those rentals which do loom so large in the index via the ‘owners’ equivalent rent’ component.

Borrowing to buy stocks – or any financial asset – amounts to the same thing for so long as each seller ploughs the proceeds straight back into the market itself, as Cantillon long ago pointed out. The borrowing here may not even take on the formal appearance of margin debt or other security credit, for a householder who earns $100 and buys $100 of groceries, may charge $10 of those to his storecard and use the cash so spared to play the indexes. He may not even be aware of it, but he is then just as much a leveraged speculator as any wannabe-Livermore gambling with his bookie’s capital.

Companies, too, are not averse to borrowing in order to buy back their stock. This may reduce capital costs by substituting tax-deductible interest payments for non-deductible dividends and may even flatter the bottom line more directly by absorbing that stock from executives who are exercising their options grants in lieu of receiving hefty cash payments for their unswerving attention to their shareholders’ best interests.

Another way in which the extra debt may have the paradoxical effect of moderating, rather than magnifying, price trends is when companies borrow in order to finance their own sales. Here, the idea is that the firm sells, say, an automobile to a customer at a relatively attractive price and also extends a loan for the purchase.

Since the firm’s credit rating is likely to be much higher than the individual’s, it can then bundle many such loans together and sell them off in the asset-backed market at a lower associated interest rate, capitalizing the expected cash flow differences between the two and so booking a similar mark-up to that which would have obtained had they simply raised the sticker price. If wrongly-priced credit insurance is being sold by some latter-day Sword Blade Bank, such as AIG, against either the re-packaged loans or the paper floated with which they are financed, then the notorious ‘negative basis’ trade can only enhance the attractiveness of such schemes by widening the achievable interest margins.

As for the customer himself, if the loan appears painless enough in terms of its monthly service costs, he can enjoy all manner of instant goodies without having to spend his time fighting for the higher salary which would otherwise be needed to acquire them. Less wage militancy and more credit narcosis would also mean that companies face lower costs since they may, in effect, be profiting from lending each others’ workers their output in lieu of a giving them a fatter pay packet with which to buy it. In this fashion, that scarcely regarded entity, the balance sheet, may end up taking the strain , rather than that cynosure of the fast money crowd, the income statement.

As part of an ongoing trend, many of the largest global businesses – especially, but not exclusively, in the durable goods industries – had routinely made more money from their finance arms than from their engineering departments as a result of this vendor finance model, suggesting our interpretation is not wholly without substance. Note that nothing booked here would in anyway show up in the official consumer price numbers, despite the fact that the cash-strapped buyer is paying a higher price over the long run than he otherwise would for a completed sale.

To add to this, just as we alluded to in the case of China, Inc., our companies, too, may be using borrowed money to play the markets, by taking stakes in customers instead of invoicing them – customers who also look more viable as a result of capitalizing such purchases, in turn, and then issuing cheap stock against them (a practice widely abused in the tech bubble) – or by gearing up the pension fund and simply assuming the actuarial returns which will supposedly accrue to the strategy.

Some measure of the scope for manipulation can be had from noting that the average US non-financial corporate now has a stock of financial assets around 20% larger than its tangible ones (three fifths of which are themselves comprised of partly inflated real estate holdings) whereas, twenty years ago, they were less than 60% as big. Booking easy gains here avoids the tedium of worrying too much about operating margins on the production line, while the facility with which access can be had to a ready pool of unbacked credit means a much reduced focus on having to realise earnings in the form of cold, hard cash.

While it is impossible to say how far any of these developments may have contributed to the relatively mild ‘inflation’ of measured and aggregated consumer prices, it is also unrealistic to assume they have had no impact whatsoever.

Genuine methodological – and technological – improvements thus seem to have interacted with the subtle sorcery of modern inflationary finance to produce a heady atmosphere of boundlessness; of an Icarian presumption that the basic laws and traditional prejudices might no longer apply, until the wax was fatally loosened around the wing feathers in the harsh glare of scrutiny which began to play upon the perpetrators as the first sub-prime/CDO revelations surfaced, from 2007 onwards.

With the experience of the last two years fully in mind, we might well ponder the lesson that the dog which did not bark might, in fact, have been a ravening wolf who stealthily stalked his prey, before pouncing to devour it; one whose very silence had persuaded the central banking shepherd to pay no heed to his approach, even though the gleam of his fangs had been glimpsed in the moonlight and the reek of his foul breath had been carried on the wind to several of the more restive among the unfortunate flock upon which he was so greedily to feast.

We must also be concerned that the only response our utterly beguiled shepherds seem to be able to make to this calamity is to deliver the survivors among us poor, quaking lambs not just to one, noiseless predator, but to his whole, razor-clawed, fell-eyed pack and that soon, under the dire twin influences of that dreadful, ‘après moi le deluge’ policy of currency devaluation and monetary debasement they so anodynely call ‘quantitative easing,’ our ears will be ringing with a howling, barking, snarling kind of inflation which even our most aurally-challenged detractors will not fail to hear.

Sean,

Thank you for this account – the first in which I have seen explicit mention of simple inflation overlaying producers’ inflation in the current crisis. It makes sense.

Great presentation of the many processes at work, and some fascinating data in the appendix. Many thanks.

I’ve also long wondered how much capital is being consumed within the China juggernaut. Given the extent of dirigisme, not to mention the extravagant stimulus of recent times, the answer might just be “a lot”. If so, the potential for disappointment (particularly, as you say, amongst the commodity producers) is truly exceptional.