Steven Horwitz writes

In some free-market circles fractional reserve banking (FRB) is blamed for everything from business cycles to bad breath. Defenders are seen as apologists for inflation and fraud. Thankfully these views remain a minority because they are gravely mistaken. As I, and other Austrian monetary theorists, such as George Selgin and Larry White, have argued, there’s nothing wrong with FRB that getting rid of a central bank can’t cure. Fractional reserve banking works just fine in a free market.

As you’d expect, his post has kicked off a lively discussion. The debate rolls on.

The Financial Collapse has amply demonstrated that increasing the money supply via Credit Creation, Money Printing or Artificially Low Interest Rates does not turn an economy around, create or save jobs nor prevent the tax payer picking up the bill for the Elite who would rather we suffer the cost of their actions than they.

FRB creates inflation as more false money chases reals goods. Bankers and their cronies get to spend this false money first without the inflation that has yet to be added as the money goes through the economy. The last to spend it find their money is worth 20% less as those holding our pound have discovered over the last year in comparison to gold, cotton, wheat etc.

FRB can solve only short term demand for credit. If Credit Creation were not an option then Banks would lose their grip on the economy and power. Merchants would find alternative sources of finance through the savings of others. In the mid and long term credit creation through FRB causes the demand for credit to rise through inflation and interest devaluing the unit of credit. Ultimately rendering the debt it creates unpayable as is debt now. (See ‘Money as Debt 1 & 2 on YouTube as a starter. In fact, email the link to your address book and urge others to do the same) The US debt is $64 trillion – 4 times the GDP of the World. All debt created this way is fictional. False money is created out of thin air as a ledger entry against the item of value (your home, car, land). The debt is repaid with real money the debtor has worked for. If you can rob Peter to pay Paul you can count of Paul working his way up in the Government and Legal System to make it legal to do so.

FRB’s Increasing the money base via credit creation only pushes up prices. If the money base was halved then prices in the mid and long term would adjust down to reflect the amount of currency in circulation as the Gold and Silver Standards demonstrated for centuries. 15,000 ounces of silver would buy the average home in 1930, 1950, 1970, 1980, 1990 and 2000. It’s about £250k today.

FRB may work in a true ‘Free market’ but we have not had free Market capitalism since the late 1800’s. Since Free Markets are unlikely to return any time soon, Selgin, Horwitz and White would have to concede FRB has failed or their original statement must be declared false. I’d go with either or both and then have a Debt Cancellation Jubillee.

This topic must be in the air right now. I’ve got a half-written article on this I’m working on. But Horwitz beat me to it.

I agree with what he’s written. The idea that fractional reserve banks create money “ex nihilo” is confused.

errr, I read that differently, it is created ex nihilo by the private mints. The very good point Steve makes is that they can only do this as they sit on top of a central bank that can allow then more or less reserves and that once created, the new money, it gets it paid back, so if a bank is working to its max reserve limit, it can create no more. Using the Bastiat seen and unseen insight is very helpful.

Toby,

Steve is pointing out two closely connected things here.

* The limitations on creation of money a commercial bank has.

* How a commercial bank creates money when it does create it.

He’s pointing out that in a market that has reached an something close to equilibrium an action by the central bank is needed for new money to be created by commercial banks. But, he’s also pointing out that when the commercial banks can’t produce the money from nothing.

That’s why Steve writes:

“First of all, this claim is ambiguous about where the deposit comes from and what it consists of. For example, if I deposit a $1,000 check in my bank that you’ve written on your bank, what happens? It’s true that my bank gets $1,000 in new reserves, but it cannot create $10,000 in new loans with the money. Why not? Imagine it credited $10,000 to the borrowers’ accounts. What would they then do? They would spend it because that’s why people borrow money! And what happens when it’s spent? The banks in which the funds are eventually deposited ask the original bank for $10,000 in reserves.

The problem is that if the bank was at its 10 percent requirement before the $1,000 deposit came in, it cannot lose $10,000 in reserves without falling below its minimum requirement (or its desired level, in a free-banking system with no such requirement, which would be unacceptably risky without deposit insurance). What can the original bank afford to lose? Well, it has my new deposit of $1,000 against which it has to keep 10 percent, or $100. Therefore it has $900 to loan out. And that’s all. Banking rule #1: No individual bank can lend more than its excess reserves, in this case $900.”

The point here is that the balance a bank creates isn’t from nothing. The bank cannot credit a borrowers account with $10000 as Steve says. It can only credit them safely with $900. But, this also means that the bank must obtain a good loan, because the

bank has been handed $1000 cash which is an asset worth that amount. It cannot spend the $900 it has spare frivolously. It must make a good loan, or it’s overall assets will diminish; it will make a loss. That’s why I often say that bank accounts are backed partly by reserves and partly by assets which are usually debts.

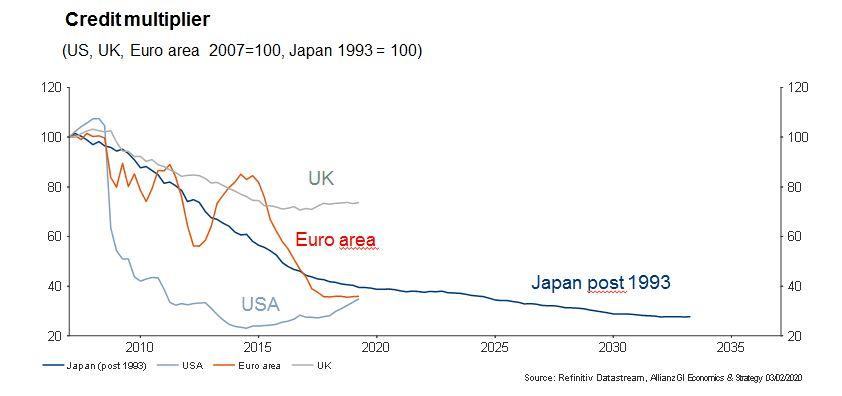

Steve goes on to discuss the money multiplier and what happens when the central bank create new base. Think about what the first part of the article implies for that multiplier process though. When the central bank creates base it may create that out of nothing. But, when the first commercial bank receives the base it must make a loan in order to pass that base on to another commercial bank. The next commercial bank is in the same position.

None of this means that commercial banks can’t make money from the Cantillon effect/account falsification. But, that’s a separate issue.