It is alleged that when the velocity of money rises, all other thing being equal, the buying power of money declines ie the prices of goods and services rise. The opposite occurs when velocity declines.

If, for example, it was found that the quantity of money had increased by 10% in a given year, while the price level as measured by the consumer price index has remained unchanged it would mean that there must have been a slowing down of about 10% in the velocity of circulation.

If the quantity of money had remained unchanged but there has been a 10% increase in the price level in a given period, it would mean that there must have been an increase in the velocity of circulation of money of 10% in that period. It would appear therefore that velocity is an important determinant of the purchasing power of money.

Main stream view of what velocity is

According to popular thinking the idea of velocity is straightforward. It is held that over any interval of time, such as a year, a given amount of money can be used again and again to finance people’s purchases of goods and services. The money one person spends for goods and services at any given moment can be used later by the recipient of that money to purchase yet other goods and services.

For example, during a year a particular ten-dollar bill might have been used as following: a baker John pays the ten-dollars to a tomato farmer George. The tomato farmer uses the ten-dollar bill to buy potatoes from Bob who uses the ten dollar bill to buy sugar from Tom. The ten-dollars here served in three transactions. This means that the ten-dollar bill was used 3 times during the year, its velocity is therefore 3.

In short, a $10 bill, which is circulating with a velocity of ‘3’ financed $30 worth of transactions in that year. Consequently, if there are $3000billion worth of transactions in an economy during a particular year and there is an average money stock of $500 billion during that year, then each dollar of money is used on average 6 times during the year (since 6*$500 billion =$3000).

In short, $500 billion of money is boosted by means of a velocity factor to become effectively $3000 billion. This implies that the velocity of money can boost the means of finance. From this it is established that

Velocity = Value of transactions / supply of money

This expression can be summarised as

V = P*T/M

Where V stands for velocity, P stands for average prices, T stands for volume of transactions and M stands for the supply of money. This expression can be further rearranged by multiplying both sides of the equation by M. This in turn will give the famous equation of exchange

M*V = P*T

This equation states that money times velocity equals value of transactions. Many economists employ GDP instead of P*T thereby concluding that

M*V = GDP = P*(real GDP)

The equation of exchange appears to offer a wealth of information regarding the state of the economy. For instance, if one were to assume a stable velocity, then for a given stock of money one can establish the value of GDP. Furthermore, information regarding the average price or the price level allows economists to establish the state of real output and its rate of growth.

Most economists take the equation of exchange very seriously. The debates that economists have are predominantly with respect to the stability of velocity. Thus if velocity is stable then money becomes a very powerful tool in tracking the economy. The importance of money as an economic indicator however diminishes once velocity becomes less stable and hence less predictable. In short, it is held an unstable velocity implies an unstable demand for money, which makes it so much harder for the central bank to navigate the economy along the path of economic stability.

Does the concept of velocity of money make sense?

From the equation of exchange it seems that money together with velocity is the source of funding for economic activities. Furthermore, from the equation of exchange it would appear that for a given stock of money an increase in velocity helps finance a greater value of transactions than money could have done by itself.

As logical as it sounds, neither money nor velocity have anything to do with financing transactions. Here is why.

Consider the following: a baker John sold 10 loaves of bread to a tomato farmer George for $10. Now, John exchanges the $10 to buy 5kg of potatoes from Bob the potato farmer. How did John pay for potatoes? He paid with the bread he produced.

Observe that John the baker had financed the purchase of potatoes not with money but with bread. He paid for potatoes with his bread using money to facilitate the exchange. In other words money fulfils here the role of the medium of exchange and not the means of payment.

The number of times money changes hands has no relevance whatsoever on the bakers’ capability to fund the purchase of potatoes. What matters here is that he possesses bread that can be exchanged by means of money for potatoes.

How is it that the fact that the same $10 bill used in several transactions can add anything to the means of funding? By what means does the speed of money circulation add to the real pool of funding? Imagine that money and velocity would have indeed been means of funding or means of payments. If this was so then poverty world-wide could have been erased a long time ago. Moreover, since rising velocity is supposed to boost effective funding then it would have been to everyone’s benefit to make sure that money circulates as fast as possible. This implies that any one who holds on to money should be classified as menace to society for he slows down the velocity of money and hence the creation of real wealth.

According to Mises the whole concept of velocity is hollow;

In analyzing the equation of exchange one assumes that one of its elements–total supply of money, volume of trade, velocity of circulation–changes, without asking how such changes occur. It is not recognized that changes in these magnitudes do not emerge in the Volkswirtschaft [political economy, or more loosely‘economy’] as such, but in the individual actors’ conditions, and that it is the interplay of the reactions of these actors that results in alterations of the price structure. The mathematical economists refuse to start from the various individuals’ demand for and supply of money. They introduce instead the spurious notion of velocity of circulation fashioned according to the patterns of mechanics (Human Action p 399).

Furthermore money never circulates as such;

Money can be in the process of transportation, it can travel in trains, ships, or planes from one place to another. But it is in this case, too, always subject to somebody’s control, is somebody’s property. (Human Action p 403)

Why velocity has nothing to do with the purchasing power of money

Does velocity have anything to do with prices of goods? Prices are the outcome of individuals’ purposeful actions. Thus John the baker believes that he will raise his living standard by exchanging his ten loaves of bread for $10 which will enable him to purchase five kg of potatoes from Bob the potatoe farmer. Likewise Bob has concluded that by means of $10 he will be able to secure the purchase of ten kg of sugar, which he believes will raise his living standard.

By entering an exchange, both John and Bob are able to realize their goals and thus promote their respective well-being. In other words John had agreed that it is a good deal to exchange 10 loaves of bread for $10 for it will enable him to procure 5kg of potatoes. Likewise Bob had concluded that $10 for his 5kg of potatoes is a good price for it will enable him to secure 10kg of sugar. Observe that price is the outcome of different ends, and hence the different importance that both parties to a trade assign to means.

In short, it is individuals’ purposeful actions that determine the prices of goods and not some mythical velocity.

Consequently, the fact that so-called velocity is ‘3’ or any other number has nothing to do with averages prices and the average purchasing power of money as such. Moreover, the average purchasing power of money cannot be even established. For instance, in a transaction the price of one dollar was established as one loaf of bread. In another transaction the price of one dollar was established as 0.5kg of potatoes, while in the third transaction the price is one kg of sugar. Observe that since bread, potatoes and sugar are not commensurable no average price of money can be established.

According to Mises, (Human Action p402)

Media of exchange are economic goods. They are scarce; there is a demand for them. There are on the market people who desire to acquire them and are ready to exchange goods and services against them. Media of exchange have value in exchange. People make sacrifices for their acquisition; they pay “prices” for them. The peculiarity of these prices lies merely in the fact that they cannot be expressed in terms of money. In reference to the vendible goods and services we speak of prices or of money prices. In reference to money we speak of its purchasing power with regard to various vendible goods

Now, if the average price of money can’t be established it means that the average price of goods can’t be established either. Consequently, the entire equation of exchange falls apart. In short, conceptually the whole thing is not a tenable proposition and covering a fallacy in mathematical clothing cannot make it less fallacious.

According to Rothbard (Man Economy and State p 730)

The only knowledge we can have of the determinants of price is the knowledge deduced logically from the axioms of praxeology. Mathematics can at best only translate our previous knowledge into relatively unintelligible form.

Even if we were to accept that the essential service of money is its speed of circulation there is no way that this characteristic of money could explain the purchasing power of money. On this Mises explains (Human Action p 400);

Even if this were true, it would still be faulty to explain the purchasing power–the price–of the monetary unit on the basis of its services. The services rendered by water, whisky, and coffee do not explain the prices paid for these things. What they explain is only why people, as far as they recognize these services, under certain further conditions demand definite quantities of these things. It is always demand that influences the price structure, not the objective value in use

Velocity does not have an independent existence

Contrary to mainstream economics velocity has not got a “life of its own”. It is not an independent entity – it is always value of transactions P*T divided into money M ie P*T/M. On this Rothbard wrote (Man Economy and State p 735)

But it is absurd to dignify any quantity with a place in an equation unless it can be defined independently of the other terms in the equation.

Since V is P*T/M it follows that the equation of exchange is reduced to

M*(P*T)/M = P*T, which is reduced to P*T = P*T , and this is not a very interesting truism. It is like stating that $10=$10 and this tautology conveys no new knowledge of economic facts.

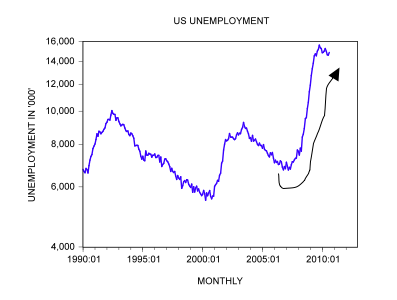

Should we then be alarmed with growing money supply despite the fact that the so called velocity of money is falling? Does the fall in the velocity of money imply that no damage to the economy will occur?

What matters right now is the fact that money is growing at an alarming rate which sets in motion an exchange of nothing for something and hence economic impoverishment and consequent boom-bust cycles. Furthermore, since velocity is not an independent entity it as such causes nothing and hence cannot offset effects from money supply growth.

Finally, does so-called unstable velocity imply an unstable demand for money as the popular thinking has it? The idea of labelling the demand for money as stable or unstable is preposterous. What does it mean? The fact that people change their demand for money doesn’t imply some kind instability. As a result of changes in an individuals goals he may decide that at present it is to his benefit to hold less money. Some time in the future he might decide that raising his demand for money would better serve his goals. So what could possibly be wrong with this? It is simply the same that goes for any other goods and services – demand for them changes all the time.

Conclusions

The recent strong increases in money supply raise the likelihood of acceleration in the rate of growth of prices of goods and services in the months ahead. The effect of these increases cannot be neutralised by the fact that the so-called velocity of money is declining. Contrary to popular thinking the velocity of money doesn’t have a life of its own. It is not an independent entity and hence it can’t cause anything, let alone offset the effect of an explosion in the supply of money on prices of goods and services. The apparent simplicity of the equation of exchange and its consequent widespread acceptance by mainstream economists has been instrumental in the erroneous assessments of the true state of the economy. Hence it is an urgent requirement that this fallacy be removed from the economic literature and from economic textbooks in order to prevent future theoretical confusions and their practical consequences.

This analysis is perfect Austrian Horthodoxy.

But some points are not convincing to me.

In my opinion we must not consider velocity as a determinant of purchasing power, in the sense that velocity itself stems from operators’ choices, is a means to determining P in the end.

We must not mix the theoretical variable V with the way it is esteemed: MV=PQ is an accounting equality, so it is always valid, thus is used to esteem V, but it’s actually M (exogenous) and V (endogenous) who determine T then, given the existing production Q, originate P. P is a result, we cannot take it as a variable whence other variables stem (tho’ during the working of the system, each variable affects all others in a continuous, spontaneous re-organisation of savings and purchasings).

I have written this paper: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1706861

I think that, by an Austrian point of view, reconsidering V as expression of individual choices is possible, or even necessary to deepen Austrian theory into finance. V helps the economy to multiply exchanges to reaching a finer spontaneous coordination, is the means for purposes to get fulfilled given a certain stock of money (via the credit channel), and we must not disregard it as a “residual”.

A declining V has got a meaning: lower economic activity is needed, part of the old activities are mere “inflation”, so they must be liquidated, hence money must run shorter.

Mainstream actully treats V as a constant, and the shrinking of multiplicators is, for them, a surprise. Austrians should make the same mistake.

Sorry for the length (and bad English) of the comment

I basically agree with what you’ve said here. I’ll have a read of your paper when I have the time. Several other Austrian Economists such as Horwitz have said something similar.

I gave my view in a comment here:

https://www.cobdencentre.org/2010/10/qe-errors/comment-page-1/#comment-11502

Thank you Current.

I have just read some pages of Andersson on Fischer’s Equation. It seems that confusing V estimation and determining causal links is an old problem.

Anyway: MV=PQ gives no casual links, it’s just a static representation; causality lies in the head of the economist.

Should you find the paper of some interest (and knew some Italian) I can link some comments on V and causality from my (Italian) blog.