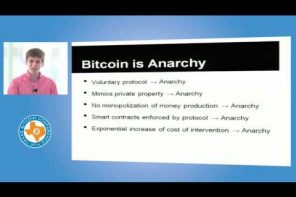

An interesting lecture from Robert P. Murphy, on how time, communication, prices, human time preferences, capital structures, and interest rates, are intimately linked together (or at least, should be intimately linked together), in a free market:

Presented by Robert P. Murphy at “Austrian Economics and the Financial Markets,” the Mises Circle in Manhattan on 22 May 2010 in New York, New York. Includes an introduction by Mises Institute president Douglas E. French.

Look out for the Bernanke joke on the choosing of professions.

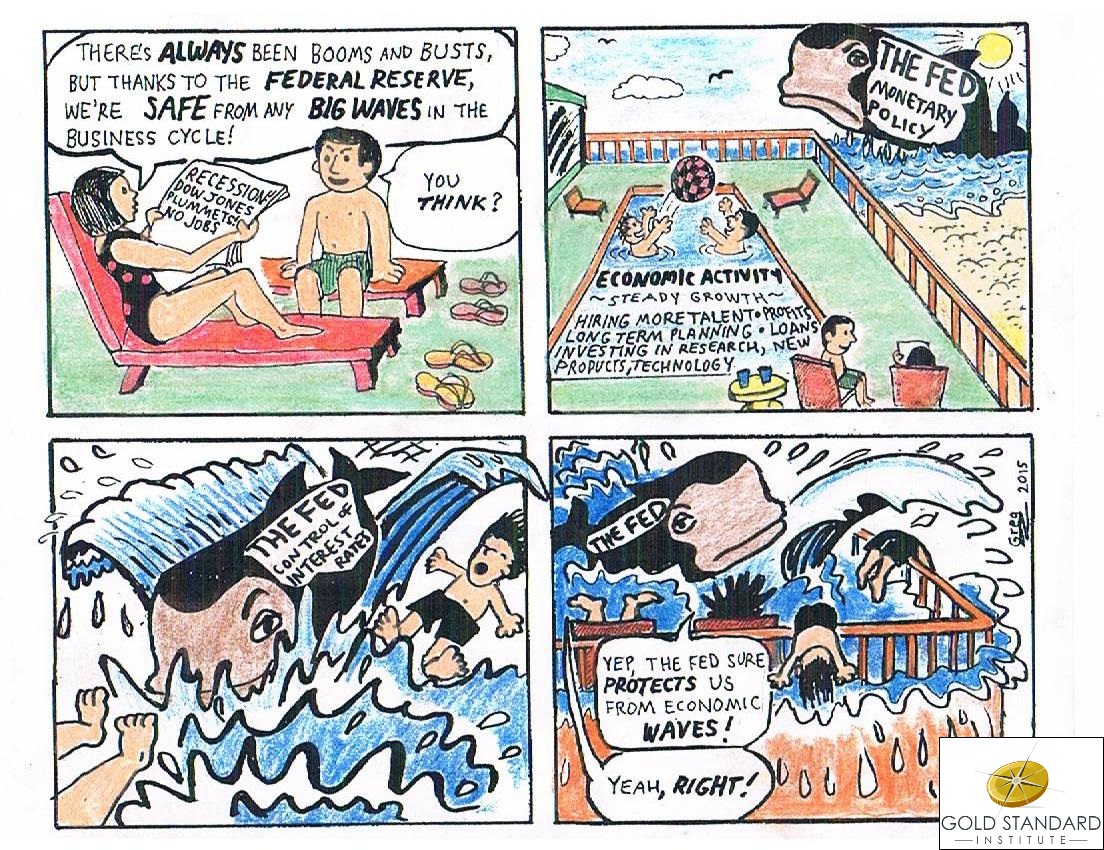

We are in a worldwide economic crisis AGAIN, and “MONEY” is at it’s very center AGAIN. And we have let it happen AGAIN. It is a crisis of money management, and the result of permitting ruthless private international financiers to gain and keep control over “OUR” money AGAIN. Yes, money is a sovereign right that arises from the sovereign right of an individual to enter into contracts. By allowing that right to be usurped by private banking interests we have lost the greatest power a free and democratic people can have – economic power. I would say that 90% of all the people are confused about money. About what it is now, where it comes from, but more importantly, what it should be, and where it should come from.

Wealth often confused with money, can take almost any form, and historically it has, from gold to cattle, from grain to salt, and water to land. These are all forms of wealth, commonly called commodity wealth with the exception of land, which is known as “real wealth” or “real estate” because it has certain distinctions that commodity wealth does not. Notes or deposit receipts (money) for grain, metals, gems, or other items of value have served throughout time as a safer, more convenient means of transferring payment. Here the reputation of the issuer was the key factor in its acceptance.

But the point here is that “money” is a medium, or means of exchange that takes the place of the items being exchanged. When items of value are exchanged that is called “barter”. Money is used in place of barter. Money is not the things themselves. For money to retain it´s integrity it should be free of any intrinsic manipulation which one of them is interest.

Mathematically Perfected Economy NOT ONLY restores our sovereign right to issue our own promissory notes to each other, but also offers a money management system at the same time.

The Austrians tell you, that they want a return to Constitutional money; and to sound money. No bigger lie can be told!

Why not? Check out their forums. Gold bugs everywhere; and what they want is NOT for gold to return to its Constitutionally defined value! They want to make out like the Federal Reserve! Speaking about hypocrits!

Worse then is the lie that they want to “end the Fed.”

Why? As I have described, the fatal fault of the imposed monetary system is interest; and all further faults merely result from further failure to solve inflation and deflation. The Austrians, and Mr. Murphy in particular, not only advocate interest; they advocate ELEVATED RATES OF INTEREST.

Effectively, what they want is to remove the embossed letters which now say “Federal Reserve Bank,” and replace them with “Murphy´s ‘COMPETING’ Bank(s)” — a principle which he refuses to debate, further define, or justify. Of course, any ostensible “competition” would ostensibly, on the contrary, drive interest rates down. But Mr. Murphy tells us that we wouldn’t have borrowed ourselves into this debt mess if higher rates of interest had discouraged excessive/reckless borrowing.

Mr. Murphy has never done the math: he tells you that all of you are going to benefit somehow therefore — oh and we so willingly believe this preposterous notion, don’t we? — he tells us we will benefit paying perhaps 17% interest on our homes than 5%. Sounds really like a good idea, doesn’t it? Especially since the rate of interest is the rate of multiplication of artificial indebtedness — higher rates of which instead necessitate greater rates of borrowing to maintain a vital circulation.

Unfortunately, most people who exalt Austrian “economics” hardly know the first thing about it. They reject math — most of which is little more than counting — as if you could understand otherwise; and they could have possibly determined solution otherwise. In no legitimate discipline or walk of life does such reckless abandonment of principle hold.

But Mr. Hayek, God of the Austrians tells us why they advocate interest and the current banking model — which are our very problem. See Hayek’s article at Mises org: “A Free Market Monetary System,” I think it’s called. Anyway, he thus justifies interest, that it makes banking “an extremely profitable business.”

That’s right. There IS no justification, just an outright confession of the motive.

Businesses are created to make goods or supply services for a profit, so what? Interest is nothing more than a good that is priced by the market(in a free market). Austrians believe that the market(consumer spending preference) should dictate the rate not the crony government colluding with the federal reserve. In a competitive banking system rates would be priced like oil or grain. A bank that advertises a 1.77% return on money would not be able to do so if the market rate is 5%, the bank would soon find itself out of business. Same goes go for oil, Exxon will not be able to sell oil at $300/barrel if shell and the global markets have the oil priced at $80/barrel. This would be no different in the competitive banking sector. The banks or central banks should not control the prices the consumer should. Interest is good for the borrower and lender and YES ITS OK TO MAKE A PROFIT!!! People can make a profit being a doctor or tax accountant or car salesman, heaven forbid they make a profit lending money.