Most people have one principle “asset”: the house they live in. Long gone are the days when your physical house was simply your home and nothing to do with your financial assets.

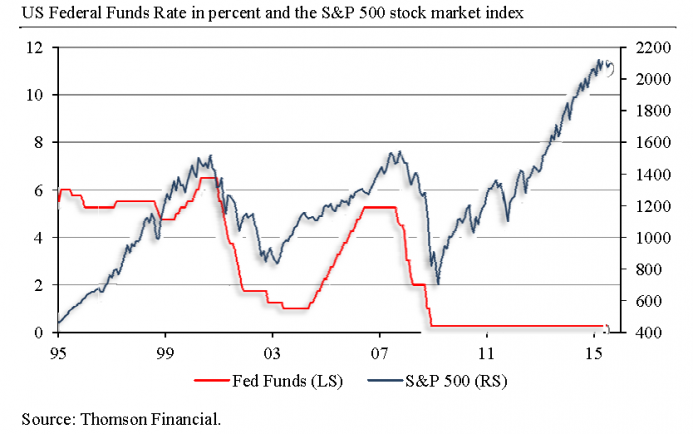

Indeed, as the last boom was manufactured by the low interest rate policies of most of the central banks in the Western World, cheap credit pushed up asset prices, notably houses, which you could then cash in, spending this newly minted credit, drawn down as money to buy the goods and services you desired.

House prices, perversely, are one of the few key costs of living to be celebrated when they rise. If a man from Mars came down to earth, he should surely conclude that this trend was mad and that people supporting a cost of living increase, on such a stupendous scale, were surely punch drunk on inflationist ideology.

Now governments around the world are fully committed to a policy of inflationism. This is when a policy of more cheap money, via exceptionally low interest rates and blatantly “printing” electronic money, is used to create a “recovery.”

Please note: like some doctor of old prescribing a leech to suck out your blood if you had a disease and then doing so again when you started to faint as a result of blood loss, we have the cure of easy money being advocated as the cure for a past easy money policy blunder on a spectacular scale. This policy of inflationism ensures that the creditors of the world will eventually get their debts paid back in nominal terms, but with money of lower purchasing power.

This fleecing of the thrifty, sensible and prudent is thoroughly dishonest. I would prefer to meet a highway robber who at leasts offers me a choice – “Your money or your life?” – rather than the theft of my purchasing power that is taking place now.

Is honest money a lost cause?

I recently read the Bullion Report of 1810, which has a fantastic introduction from the great economist and holder of the Economics Chair at the London School of Economics from 1895 to 1924, Edwin Cannan, prior to Lionel Robbins. He wrote his introduction to this most famous of House of Commons reports in 1919, after the end of the First World War.

Then, our money was debased and the policy solutions were inflationism: dishonestly paying off debt by trying to pass it to the next few generations, covering the misdeeds of the current generation. This was a time in history very similar to the end of the Napoleonic Wars when our money, hitherto being indestructible gold, was replaced by inconvertible paper money and then switched back into convertibility at a lower rate after the conclusion of the peace.

I will leave you with some quotes from Cannan in his Introduction,

But no government involved in a great war is willing to give up so potent an engine for surreptitiously fleecing it’s subjects as an inconvertible currency , whether in it’s own hands or in that of a bank it influences.

Joined with the determination of the public to accept notes, the Act placed in the hands of the Bank the power of creating money without limit for the benefit of it’s shareholders , or Proprietors , as they were called……the Directors had long managed the Bank with one eye indeed on the interest of the proprietors but with the other on that of the “monied interest” generally.

But the bank had found itself comfortable under the Suspension, and felt no enthusiasm for a return to a system which did not guarantee it against being asked to pay it’s debts at a possibly inconvenient moment.

Much as this was written 90 years ago, referring to events of 200 years ago, we should not become despondent that the cause of honest money is doomed: we certainly have sound economic reasoning on our side. We must find better and more persuasive ways to stick up for hard work, thirty management of your affairs and in general for liberty.

This is a core part of the Cobden Centre’s mission and indeed why we set it up.

I am pretty certain that debasement/inflation is irresistible to governments. Thus I believe that the only way we are ever going to deliver ourselves from this evil is to erect a wall of separation between money and state.

The forces wanting governments to retain control of their currencies will fight hard to retain the power of currency, so we will need to use more modern tactics such as open source and distributed manufacturing.

Cannan’s work is full of messages for the modern era. He also wrote when a golden era of free market based prosperity was coming to an end. For example

‘A striking example was furnished by the great depreciation of currencies that took place after the Great War of 1914-1918. These wrecked the fortunes of all who had trusted to what were before quite reasonably supposed to be the safest investments. To foresee the folly of that period was beyond the reach of the highest human wisdom.’ Edwin Cannan. 1948 (3rd edition). Staples Press London; Page 195,