The old adage about how to succeed in banking was the formula of ‘3-6-3’: borrow at 3%, lend at 6% and get onto the golf course by 3 o’clock. Oh how quaint and distant such times feel to us now, with the economy still suffering from the fall-out of a banking crisis for which no-one involved seems particularly willing to accept responsibility.

What would be the modern banking formula? It seems more like 0-15-7 – get money for almost nothing, lend it at double-digit rates (in all probability with nasty conditions attached) and trouser your 7-figure “performance-related” bonus at the end of the year. To those of us who have attempted at any point to earn a crust entirely off our own bat, the self-delusion of senior bankers who describe themselves as ‘entrepreneurs’, ‘risk-takers’ and ‘wealth-creators’ would be laughable if it were not so costly to the real enterprise economy. Reward and risk are supposed to go hand in hand – this is at the heart of capitalism. Banks reap the profits but are protected from losses by the broad shoulders of the taxpayer.

But then banking is anything but a normal and competitive free market. The bailout demonstrated this to dramatic effect – Woolworths can disappear from the high street almost overnight, but RBS cannot. But the problem runs deeper than the damage inflicted on taxpayers by the bailout and the impact businesses and workers by the credit crunch and recession.

Banks make too much money. Banks need to earn a reasonable return on capital, but in a recent report ‘Featherbedding Financial Services’ we at nef (the New Economics Foundation) set out several ways in which banks profit excessively at the expense of taxpayers, customers, investors and corporate clients. This allows them to be relaxed on costs, indifferent about customer satisfaction and yet still enjoy margins that would make a manufacturer or a retailer blush. This is bad news for the broader economy. Banks’ profitability has more than doubled and has outstripped non-financial sectors since the 1970s. Why?

To start with, being “too big to fail” is profitable. Based on calculations by Andrew Haldane, the executive director of financial stability at the Bank of England, we estimate the value of this subsidy to UK banks to be around £30bn a year. The subsidy arises because banks, effectively guaranteed by the government, are able to access much cheaper funds than would otherwise be the case.

But this is far from the end of the matter. We also identified windfall profits to banks from the additional trading in gilts required by the Bank of England’s programme of quantitative easing. This is ironic to say the least, as QE was brought in to revive the economy after the banking crash.

Customers are proving a good source of extra profits, too. The interest spread – the difference between the interest rate that banks pay for funds and how much they charge us – has widened dramatically since 2008. Although perhaps too narrow before the crash for some forms of consumer credit, this suggests that the burden of rebuilding banks’ balance sheets is falling disproportionately on customers instead of shareholders, executives and bondholders. SMEs are all but priced out of the market for credit – no wonder many do not even bother applying for a loan.

Investment banking is also something of a cosy club of financial returns wildly out of kilter with real economic contribution. Institutional investors and corporate customers are getting a raw deal. For example, in the case of rights issues we identify a near trebling of investment banking fees since 2000, having been at a steady level for decades. This has reaped an additional £1bn in fees just through a rise in commission rates.

Reform is desperately needed. Until we see genuine competition, and some customer power, in retail and investment banking, and until incompetent and failing banking institutions and executives are guaranteed to suffer the same fate as they would in any other sector of the economy, our banking industry will be a drag on the UK’s prosperity.

“Reform is desperately needed”.

Indeed. However, the solutions that your organisation proposes appear to be treating the symptoms rather than the causes. This crisis has been a failure of central banking and central planning and should be treated as such. However, your organisation takes a statist approach to this, limiting freedoms along the way.

The aim should be to find a system in which the private sector banks are naturally incentivised NOT to blow up the system, rather than keep the same system and watch them like hawks. This puts more power into the hands of the beaurocrats who are – ultimately the source of the problem.

These policy recommendations are particularly offensive:

• Introducing restrictions on speculators and speculative products, especially

in commodities markets.

• Supervising European banks operating in developing countries.

• Permitting prudential capital controls in free trade and investment agreements.

• Tackling tax evasion and tax avoidance, and increasing progressive taxation of wealth.

• Facilitating innovative development financing via a Financial Transactions Tax.

• Pushing for greater international cooperation on exchange rates, trade imbalances and capital flows.

For Cobden Centre bloggers, the full document is here:

http://www.neweconomics.org/sites/neweconomics.org/files/Towards_a_Global_Finance_System_at_the_Service_of_Sustainable_Development.pdf

oops ‘bureaucrats’

I agree that regulation has failed, but in fact I see little evidence of any central planning having taken place rather than central ignorance.

I would not describe our position as statist. We see a strong role for the state in the management of a national state-backed fiat currency – this seems necessary almost a a matter of logic. However, and crucially, we also support local and complementary currencies that can compete with the national fiat currency.

The document below is a much better expression of our philosophy than the one you linked to.

http://www.neweconomics.org/publications/ecology-finance

Dear Mr Greenham,

I have read through the link to which you directed me and see no reason to change my initial view.

While the intention is to make banking fairer for individuals through regulation (through capital controls, increased supervision, new state-led structure such as a proposed post office bank etc. etc.) the evidence of these sorts of schemes are that they take on a life of their own following their creation. Even if I were to grant that the intentions were good, I would have to conclude that creation of these structures effectively hands more power to non-market entities unecessarily, which will likely distort the process of price-discovery that you claim to support. It will also inevitably add a burden of cost.

If the framework of a central bank and a fiat currency are to be continued, then the central ideas of narrow banking, small banks, strict capital controls and an end to inflation targetting are enough. It will be impossible for banks to profiteer at the expense of the populace without the support of the money-creation machine behind them. Excess credit growth was what caused the crisis (and indeed all financial crises). The above framework would not permit such credit growth, making further oversight unecessary, costly and potentially distortionary. To Austrians, this follows from a logical deduction from first principals. However, if you should want empirical evidence of this, I refer you to this paper:

http://www.bis.org/publ/work114.pdf

If one has the stomach to be more radical, an end to the central bank and and an end to legal tender laws would be far more supportive of a fairer system. This would reduce the inequalities between the bankers and the rest. It would also remove the pernicious suspicion that abounds today that those who are wealthy must have made it through legalised theft; under this alternative system, all wealth would have been hard-earned through the market system where only those projects providing goods demanded by consumers are successful. Fewer bounders making off with the loot without working for if would also mean more capital invested in wealth-generating projects and so a higher aggregrate living standard for all. Finally, these two reforms would remove the mechanism through which this could be reversed.

One ticklish side effect of the more radical proposals outlined above are the fact that this would likely necessitate the complete dissolution of the welfare state as we know it and an enormous shrinking of government wince it would eliminate government control of the currency. However, given that there would be fewer injustices for the government to rectify through redistributive efforts (as the biggest sources of “unfairness” are profits made through the banking system or through political gift), this would not be a problem.

@ Tim Lucas

I agree that having diagnosed 99% of the problem in the article above, Mr Greenham’s organisation seem to be asking, essentially, for more of the same ‘big state’ answers, telling banks what they can and can’t do rather than incentivising them to do the right thing, and allowing politicians to direct investment into areas they think will win them votes, e.g. to ‘Green’ plans using the model of the US Community Re-investment Act…. Same old errors.

However I cannot allow you to get away with a couple of points. First, I don’t particularly see why the welfare state would need to be completely dissolved as a result of ending fractional reserve banking and allowing multiple issuers of meaningful asset-backed money – the poor have been given help and handouts in England and the US since the year dot in one form or another.

Secondly I think asking for a revolution, as you are, could put you in the same camp as the nutters smashing up the West End. A couple of steps toward more economically sensible banking is all we can hope for at this time. I would suggest seeking a cross-party concensus platform for the time being on two narrow, achievable policy goals: 1. A return of our money to a form backed by real assets (ideally gold and silver) to stop the inflationary debauching of it by politicians. 2. Support for Douglas Carswell MP’s suggestion that consumers must be given a choice over what type of bank account they are offered, one that charges a fee for money storage and overdraft facility, and all other accounts that deliver an agreed return for an agreed level of lending risk. If you want maximum return you must allow the bank to do what they want with your money (as currently).

Mr Greenham, would you agree to those? Are you and the NEF supporting Carswell’s suggestion?

Hi Croydonius,

Your two issues:

I think that the end to legal tender laws would spell the end of the welfare state given it would be extremely difficult for the government to coordinate taxation. Under this scenario, any attempt to levy tax on one form of currency would result in the market choosing another through which to do business. Given that we’ve never had a situation in which the government has been able to take around half of the average person’s income (which is the case today) under an environment of no legal tender laws, I don’t see how your reference to the year dot has any relevance as to this imaginary situation. I suspect that the convenience of using – say – gold would be quickly eroded once the government attempted to levy more than 10% tax on it.

On your other point with respect to my being a nutter, I’d suggest it doesn’t help build your argument simply to throw insults. I endorse your views with respect to gold and silver of course, as I suspect you know given the views I have espoused above.

Apologies, I was not trying to suggest you are a nutter, but that an advocate of what you propose would certainly be painted as one by those who have a huge interest in maintaining the status quo, i.e. the mainstream media and political class, the 40% plus of the electorate employed by the State, the banking industry etc. You are asking for a revolution, and to take away a great number of people’s livelihoods.

In my view of an ‘Austrian’ economy achievable in the near future, the BoE would still be the one issuer of legal tender but it would be asset-backed. A move to multiple legal tenders would be desirable, but surely not achievable for generations…. How would retailers or consumers today cope with even 3 different ‘legal’ tenders in circulation, all with different institutions behind them? Even shops in airports struggle to facilitate the use of different currencies.

Hi Croydonius.

Thanks for your clarification.

I hope you noticed that I gave a couple of options in my original post, the first of which was actually less radical than the one your suggestion (it keeps fiat money), but would still be an improvement on today’s mess. This would involve keeping fiat currencies.

I think that that the revolutionary aspect of the proposals in the second possibility I recommend are more to do with a transition to a hard currency regime, rather than a change in legal tender laws. Hence, your proposals would end up being JUST as disruptive.

To illustrate this, let me outline what I think would happen if the UK were to take your recommendations and adopt them overnight. It would result in an enormous public sector and banking purge as the central bank would not be able to issue any more currency than it had gold in its vaults.

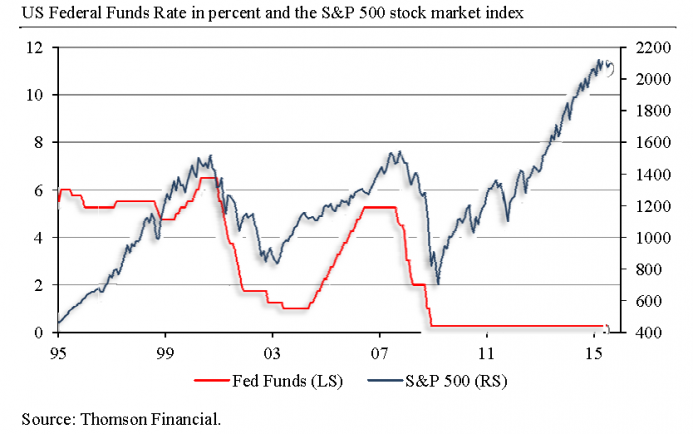

What you are doing is to fundamentally re-price money. Firstly, therefore, interest rates would go up. Financial services firms represent about 30% of UK GDP relative to just 10% 40 years ago. These are only viable under the current system of fiat money/central banking/fractional reserves.

Hence, on a move to a gold standard, probably 20% of the UK economy by activity (less by population) would need to be re-trained (banking sector shrinks from 30% to 10%). In addition, in the short term, the banks would likely go bust as their capital structures could not survive the transition. Hence, umemployment/economic effects would initially be more severe than this.

Interest rates rising, would mean that asset prices would fall, most particularly in the housing market by at least 33% (back to longer term trends of 3x salary from 4.5x salary today), but probably by more as unemployment would also spike given the implosion of the banking sector. Negative equity would be combined with higher interest rates/unemployment. This would mean at least 10%, probably more of all people losing their homes (it would also ensure the insovency of all UK banks).

Public sector debt is only sustainable at the current level on the assumption that the government is subsidised by the bank of England. In addition, falling tax revenues from the banks (and other parts of the economy) would result in worse deficits. To eliminate even the current deficit under fiat money, the government needs to shrink relative to GDP by 10% (it plans to do this over 5 years). If it suddenly had to do it on 30% lower tax-take and without easy money to smooth its path, following a default, then it would need to do this far more quickly and far more deeply.

In addition, it is not even certain that for the first – say 10 years – that gold and silver would prove particularly stable. The movement to monetary gold or silver after so long on fiat money would enormously push up the demand for these metals. Some estimate they would trade at something like 5x today’s prices relative to other commodities. At these levels, it suddenly becomes profitable to extract them once more. If this is the case, then gold and silver – far from being anchors of stability in the short term could be nastily inflationary after the initial deflationary purge.

So while I have no doubt that your proposals would improve the stability and justice in our society over the long term, I would say that you too, are asking for a revolution. Unemployment at 20-30%, huge retraining programmes, enivitable social unrest, mass repossession of homes, total bank failure, massive transfers of wealth from those with assets to those with cash, public sector shrinkage etc. etc.

I do not think that a transition such as the one you outline can be done slowly. Firstly, political will does not last that long. Secondly, any movement in this direction would be anticipated by the markets and change the price of money such that these effects would be felt well before transition even if a slowly-slowly approach were taken.

Hence, a quick transition would be the only way. Given that any move towards a hard money system would result in the above effects, then I think that the new system ought to be structured in the best way possible and I think that this would work best without legal tender laws. Your objections to this being too complicated would be sorted out by the market. If it were – indeed – too complicated to have multiple currencies, then the market would settle on a single currency. However, the benefit of their being no legal tender laws are that it would be harder for the government to monopolise the currency system at some point in the future.

Alternatively, the other way that I outline in my original post is not revolutionary. That would involve keeping fiat currencies, but abandoning inflation-targeting by central banks. The point I was trying to make was that this can be done without the overweening regulation that the New Economics Foundation appears to want.