Of late, there has been a vigorous renewal of the old debate regarding the advisability or otherwise of allowing free banking institutions – otherwise unanimously preferred to that ubiquitous, illiberal cartel which operates with enormous legal and political privilege under central-bank tutelage – the right to issue their own ‘inside money’ in the form of ‘fiduciary media’ which have less than a 100% backing in whatever form of ‘outside money’ (e.g., precious metal bullion or specie) has come to form the fundamental basis for the currency.

Recasting this question in less esoteric terms, the argument is one of whether free banks should be allowed to increase their stock of demand liabilities (their ‘inside’ or self-created money) – namely, deposit book entries subject to cheque or immediate electronic transfer and their own proprietary issue of bank-notes and E-cards – beyond the sums representative of the stores of – let us say, for the sake of example – silver residing in their vaults (their share of ‘outside’ or exogenously-arisen money).

Though the Fractional Free Bankers (hereafter, the FFBs) generally concede that the stock of outside (or, as we might say, ‘hard’) money should be fixed so as to limit the generation of an undesirable degree of instability in the economy, they have no such scruples about permitting the sum of ‘inside’ monies from varying to a degree determined only by the narrow, actuarial calculus of the individual free bank.

Anything else, they say, is not only an unwarranted intrusion into the voluntary relations conducted between each free bank and its customers – who should have the right to agree even to a contract which the 100% reservists unwaveringly argue is logically inadmissible – but it is actually a sub-optimal economic solution, too.

The reasoning they apply goes something like the following. The ideal money is one whose use does not impair economic calculation because of changes emanating from the money ‘side’ rather than from the goods ‘side’ of each transaction undertaken with it.

Implicit in this asymmetry is the idea that while variations in people’s expressed valuation of a single good – as reflected in its price – send useful, specific packets of information about that one good’s relative scarcity (loosely, the balance between its available supply and the demand it experiences from all those aiming to buy it) and hence about the expense and effort to which people should go in making more of it, money changes affect all goods indiscriminately (since money, the generally accepted medium of exchange has no price of its own, per se) and hence these latter sow as much confusion as they bring disruption into the marketplace.

Running through this discussion are two intertwined sub-debates: firstly, whether money is a good in its own right, or whether it is itself merely a token, a ‘place-holder’, or accounting entry which records some prior contribution to production and, secondly, whether there exists a genuine distinction between that saving which is accomplished by a co-incident act of passing the saved command over present goods to another (i.e., investing it, for however short a time) and that brought about by that simple abstention usually scorned as ‘hoarding’ (which we shall hereafter refer to as the much less emotively-charged business of ‘sparing’).

In fact, one of the arguments the FFB team frequently advances is that since money is indeed ‘just another good’, there are no grounds for erecting a hindrance to entrepreneurs – i.e., fractional free-bankers – if they seek to meet evidence for an increased demand for it with a suitably increased supply.

Yet, this line itself entails both a paradox and something of a non sequitur. The first arises from the fact that, as we were earlier assured, changes deemed to emanate from a differently expressed demand for money were not supposed to be equivalent to those emanating from fluctuations on the goods’ side (perhaps, in this context, we should say the other goods’ side), which somewhat belies this opposing and treacherously bland denial of money’s special role in the economy.

The second failure of logic is the bound up with the idea that if money is just another good then presumably its multiplication cannot be as nearly costless to accomplish as one continues to suspect its grant to be, notwithstanding the FFB advocates’ rhetoric about the burden of such intangibles as establishing and maintaining the issuing bank’s reputation, or of protecting its liquidity, in addition to the firm’s further outlays on buildings, labour, equipment, and marketing, all means by which it promotes public acceptance of its brand and hence earns its lucrative contribution to the overall supply of money. Even if we do concede the fact that the replication of such monies is not completely free, they certainly are among the most easily reproduced of all goods, at least within a wide range of successive, marginal additions to the stock of fractionally-uncovered, ‘inside’ money.

The FFB school further suggests that, absent today’s statist interventions, each bank would not only be stopped from growing disproportionately to its peers – for fear of being presented with more net claims than it can redeem in outside money – but that banks collectively would still be precluded from expanding in concert because the width of the illiquid tail in the distribution of their mutual clearings would grow faster than the height of its expected zero-net mean and hence the costs of prudence would eventually outstrip the benefits of enlargement.

Even if we accept this rather arcane statistical hypothesis, this in itself, however, would still seem to rest largely upon the implicit assumption that a bank caught in that position would not have either formal or informal borrowing arrangements with its peers upon which to fall back in the event of such a statistical misfortune befalling it.

Although we must be of course exercise care in appealing too closely to a system which is perverted by the presence of fiat money, a central bank, state-subsidized deposit insurance, and the moral hazard of ‘Too Big To Fail’, it is nonetheless hard to say that banks have felt unduly cognisant of their basic liquidity needs during these past two decades of reckless hypertrophy. Much as often happened in Victorian banking crises, modern financial institutions – at least prior to 2008’s little embarrassment – came to rely upon the market itself to keep them out of difficulty – banking upon being covered by the highly efficient clearing house, stock lending, and securities repo markets which carry out some $1.5 quadrillion’s worth of annual transactions (some with a 99% netting success rate, in the US alone).

Lulled into a false sense of security by this mirage of systemic liquidity, leverage grew alarmingly, even without counting the mountainous contingent liabilities each bank tried to conceal among the footnotes to its quarterly reports.

Nor can one argue that they spent much time restricting one another’s activities too much by refusing each other credit or dealing lines. In fact, a glance at their aggregate balance sheet shows that, even now, as mistrust has grown and the potential capital costs of the new Basle III regime loom large in their calculations, two-thirds of the entries are made up of bank-bank transactions while in the enormous, off-balance sheet, derivative iceberg which lurks treacherously in the financial shipping lane, more than 90% of the more than half-quadrillion dollars of notionals outstanding involves another financial counterpart.

Be that as it may, the FFB’s reasoning is then often reinforced with an approach which openly relies upon the opposite interpretation of the nature of money – which is to say that it is no more than a datum of economic input, comprised of the counters which some all-seeing recording angel transfers to each individual’s credit whenever he or she sells something they have made, practices their skills, expends their sweat, or lends out their property for use by another.

Now, the argument runs, when a man is struck with a suddenly elevated sense of risk he sells but does not buy – when he ‘spares’ and does not invest what he thereby saves – he has ‘deactivated’ his small share of the medium of exchange and has thus served to make it unreasonably difficult for all his fellows to trade their goods and services with one another, in their turn.

Passing by the implicit aggregatism of much of what follows, we are told that, by not passing the money he has earned immediately back to another he is acting to reduce the ‘carrying capacity’ of the economic network much as if he were selfishly tapping into the electricity grid and draining off much-needed kilowatts simply to charge up his precautionary stack of batteries.

However, this argument only really holds if we also hew to the idea that to avoid a cascade of harmful side-effects, the quantity of utilised ‘money capital’ must correspond one-for-one with the actual physical goods available for purchase (especially where these are destined for purposes of reproductive, rather than exhaustive, consumption) and that it must do so at broadly unchanged prices, into the bargain.

To be fair to our FFB friends, we can perhaps resolve some of this inherent contradiction by an appeal to the overriding importance of the subjective over the concrete in much economic analysis, that is to say, by a much more accurate definition of what we mean by that very overworked, but often ill-defined term, ‘capital’.

As Richard Strigl (among others) made very plain, the mental image we usually conjure up when we hear the phrase is that of some actual capital good – usually a piece of long-lived machinery, but also a tool, a component, a building, and so forth – but it is crucial to realise that this explicitly physical entity only comprises actual economic capital to the extent that it is properly integrated into the structure of and participates in the processes inherent to ongoing production – a test it will meet by routinely generating sufficient net income to maintain itself in operation.

Indeed, the prevalent fetishism attached to such substantial forms and the corresponding lack of attention paid to the manner of their current or prospective employment is a major source of error in matters, not just economic, but investment-related, too.

Similarly, ‘spared’ money – if kept back as a precautionary reserve – may still, therefore, be a good, but it may no longer be considered a capital good. Its withdrawal – or we might better say, its reclassification – may, of course, have wider consequences, much as would a similar alteration in the status or employment of any other entity, since capital formation and, alas, capital consumption are part and parcel of any dynamic economy.

Bah! Humbug!

That having hopefully been clarified, let us look at the alleged difference between saving-investing and sparing to see if we can discover any irrefutable reason why we should favour – indeed, facilitate – the one and yet fight to neutralise the other.

If I save, the first thing I do is abstain from immediate (exhaustive) consumption and, in seeking a home for my increased funds, I may well transfer my potential command over the foregone goods to a third party, via the purchase of a financial claim. Regardless of whether this investment is conducted in the ‘primary’ (or fund raising) or the ‘secondary’ (title transfer) market, it will serve to furnish the claim’s seller with a ready means of purchase in my place.

Alternatively, I may simply leave the balance on deposit at the bank (or at one of that bank’s regular correspondents) which had earlier granted a loan to the man for the very purpose of buying whatever it was I sold to him in order to raise this money. Effectively, via the intermediation of the bank, I have unconsciously lent my customer the means to enjoy current goods which he previously did not possess.

Hopefully, but not necessarily, the man who takes them off the market will transform them into capital – i.e., as discussed above, he will put them to use in a productive act which is intended to bring a net material addition (and an increment of value) into being in compensation for the effort and outlay involved.

Another way I may save is by using my sale proceeds to discharge an outstanding debt. If this debt was part of a book credit offered me by some non-bank entity, it is easy to see that my delivery of money to my creditor similarly promotes him to into my place as a likely customer of someone else.

If I owe the sum instead to the bank, it is true that to pay this back potentially shrinks the outstanding stock of money, though the often overlooked corollary is that this presumably liberates the lending or securities buying capacity of a bank which may now feel it has more reserves, or more capital, than is optimal. Even if the bank decides that an increase in its own prudential ratios is in fact warranted – and so does not seek to replace me as its obligor – far better to allow me to do this voluntarily than for the bank to withdraw its facilities in a summary fashion from some other whose livelihood is still reliant upon them.

However, what I might also do is take delivery of a sum of ‘outside’ money – say a quantity of silver coins – and commit them to safe keeping, whether at home or in a safe deposit box – or I may simply leave untouched the pre-existing demand deposit balance made over to my name in settlement of my unmatched sale of goods, a deposit against which the bank, of course already holds some asset and so which remains similarly passive.

Now, by ‘sparing’, I clearly make no such direct, onward provision for another to take my place in the queue for the checkout desk but – to the extent that whatever goods of my habitual uptake I chose not to consume fall in price on that account (or whatever other goods so decline because their demand was predicated upon my usual vendor’s subsequent use of his receipts from me) I still transfer real purchasing power to all other present holders of money.

Now if, as is often the case, my decision to ‘spare’ has come about because my perception of the degree of economic uncertainty has increased and if this angst is mirrored by others, it is likely that the next most eager buyer of the goods after me may also be chary of offering any lasting lien over the success of his enterprise or the strength of his balance sheet as part of their acquisition. Alternatively, the typical lender or equity investor to whom they might turn might be similarly reluctant to accommodate even those who are not so discouraged.

But if a substitute buyer does now emerge who has decided that, at this newly lowered price, the goods in question cross both the threshold of his list of subjective wants and fall within the limits of his available monetary means, he may be relieved of the need to borrow from me, or anyone else, and the one-off nature of the cost incurred in their purchase (as opposed to the ongoing, riskier one entailed in either selling a stake in his business or giving someone a continuing first charge over its earnings) may make him correspondingly more eager to proceed.

But, in either case, the fact that the goods can now be had without having to give any deeper a commitment than to hazard a diminution in his cash holding, may make their purchase all the more likely and may thus prove a swift and effective counter to any supposed ‘blockage’ in the circulation of goods and services which my actions may have caused.

The only real caveat here is that the good’s seller, disappointed at my lack of custom will not reduce them sufficiently for them to be sold to anyone else; that he resists marking them down to their new clearing price. As W. H Hutt took great pains to elucidate such a process of ‘withholding’ – whether of goods or labour or whatever – is the real cause of economic constipation, not my simple refusal to spend.

The more readily the withholder can persuade himself that some deus ex machina of the credit market will somehow provide him with a better price for his wares, the more likely he is to resist liquidating them. This leads straight to the inference that, once again, the knowledge that money may be manipulated in one’s favour only enhances the natural temptation to shy away from the immediate realisation of a loss and so, often, traps one into suffering a greater one in future. We shall return to this theme later.

To the argument that this is cold comfort to the man whose cashflow I have so callously reduced (or a similarly chilly one for those who depend on subsequent disbursements of the same), all that can be said is that such a disappointment may have occurred even had I save-invested and not spared, or paid down a bank debt since no-one in the world shares my uniquely individual, subjective, ordinal listing of wants and so, by that token, no-one is likely to be an exact replacement for me as a consumer of specific goods, in any case.

Thus, the truth is that even if I had pressed my money into the hands of the next man I bumped into in the street and bidden him to spend it, my favourite bar, or the shop where I regularly buy my groceries would still have been at risk of a drop in their takings. The economic ‘data’ – to use Mises’ somewhat dry terminology – have changed and if someone has been over-reliant on me not contributing to that change, well, they have my sympathies, but do not arouse in me any feeling of guilt, nor to they have me clamouring that either an all-knowing central bank, nor a purportedly more sensitive network of FFBs should immediately step in to compensate for my sudden lack of appetite.

Nor is it entirely clear how ‘hoarding’ money – to give it its full, pejorative flavour – is altogether different to ‘hoarding’ something else of wide-ranging economic significance like petrol or potash. The first ‘hoarder’ of these may also trigger other, precautionary acts of ‘hoarding’; this will increase the scarcity of the ‘hoarded’ entity in a manner few had foreseen; this will bring about economic disruption, plan failures, and a winnowing out of the weak and under-capitalised across the economic structure.

But, ultimately, just like money, the ‘hoarder(s)’ cannot live on fuel or fertilizer alone: they must realize some of their stockpile – albeit, on better terms than before they started (at least at first). Soon, however, it is likely to be the case that they will face the same problems in first maintaining, then liquidating their ‘corner’ that many have experienced before them, viz., that they will have (a) destroyed some of the demand for their product; (b) promoted a discovery process which may reveal a permanent means of economising on its use; (c) stimulated supply (about which more in a moment); and (d) confounded themselves with the challenge of not driving down the exchange value of their inventory, perhaps even more violently than they first elevated it.

To Catch a Falling Safe

FFB supporters will tell us that all this could be avoided if we simply cut to stage (c) by allowing their banks to increase the quantity of money smoothly, proportionately, and on a semi-automatic basis. This is where we both encounter a distinct sense of unease and fall prey to suspicions that the story is just a little too – well – Just So.

The disquiet comes because we insist that for it to be as ‘hard’ as we feel is ideal (in order to avoid the wasteful hysteresis of the business cycle) money must be a good with a cost of production at least commensurate with that of other goods. So, as Mises unequivocally proposed, let people go out and dig more metal from the ground if they really must (so as to provide us with more ‘outside’ money), but let us not allow a narrow community the power to create it with the stroke of a pen or the click of a keyboard.

Nor should we introduce a controversial means of money multiplication – with all its latent dangers of abuse during the upswing – by assuming that this virtuous elasticity will spare us the traumas of the dreaded ‘secondary depression’ and so be well worth the risk. Two aspects of this contention need a closer examination than they usually receive from the FFBers: will their banks actually do what they think they should and expand their unreserved demand liabilities at the height of a money panic rather than scrambling themselves after liquidity and so aggravating the crisis; and, absent a prior, fractionally-pyramided, money and credit bubble to over-extend men’s means, can there even be such a generalized sauve qui peut as is herein imagined?

As for the first of these, let us reiterate that, for its promulgated mechanism to work, the FFB circle implicitly assumes that at this, the point of maximum fear, the bank will quickly recognise my deposit’s likely inertia and will chance its arm to increase its earning assets by supplementing my dormant holding with a newly-created other, something it can only do by extending a new loan or buying a longer term financial claim whose rather more unquestioned marketability during the boom had gilded it with a thin sheen of ‘moneyness’ now cruelly revealed as a sham, with drastic implications for its pricing, here in the bust. Twenty-five years in both the practice and the study of financial markets persuades your author that bankers – famously known as men who offer you the use of an umbrella only when it is not raining – would ever proceed in this manner!

Turning to the second question, we confess to a feeling that if money were really ‘hard’ – and so, for us, 100% reserved and difficult of increase – the amount of credit erected upon its durable foundations would be less prone to a dangerous and even reckless top-heaviness; that the extinction of credit could not itself reduce the supply of money (as the imploding fractional process would do) and so prevent the ‘real balance’ effect from eventually stabilizing prices; and that the acquired understanding of how a hard money system works – complete with its benign, productivity-led, secular fall in prices – would bring about a gradual shift towards an ever greater reliance on equity finance and an equal-and-opposite withdrawal from our endemic inflationary gaming by which we routinely incurring ever more debt to dress up returns, to flatter our income, and to falsely bolster ‘growth’ – and Miller-Modigliani be damned!

Even if we set aside these objections and accept the FFB view, a further difficulty quickly arises regarding the implementation of any stabilization policy – i.e., one aimed at preventing a feedback between the ‘real’ and the money side of the economy whereby the decline in one exacerbates that being suffered in the other – whether this offset is centrally-directed from above or spontaneously-emergent from below.

The centrally-planned solution that we all now have to endure suffers most obviously from the classic Hayekian ‘knowledge problem’ of being ignorant of what signs to monitor, in how timely a fashion they must be gathered and interpreted, and what actions they should then induce as a corrective.

This is too big a topic with which to deal fully here – indeed, it has, in one form or another, comprised the core of the author’s commentaries over the past decade and a half! Suffice to say that many of the more enlightened (if not all the Austrian-inclined) analyses tend to converge on the idea of wondering whether we might stabilise nominal income by an appeal to the tautologous ‘equation of exchange’, MV=PT – that is, that the volume of money turned over in a given period (the product of its supply, M, with its ‘velocity’ V) necessarily equals all money transactions taking place within the economy (exchanges of physical goods, T, weighted by their money price, P).

The first thing to say is that idea of maintaining the volume or even the flux of monetary circulation should not – as some have suggested – be confused with targeting nominal GDP since this clumsy statistical artefact is far too biased towards final, exhaustive consumption (and, worse, to government spending of a fundamentally uncertain value) and to end up promoting excess exhaustive consumption in a bust is only to increase, not to diminish, the destruction of capital, a harsh truth rarely grasped by your average, pull-push hydraulics, mainstream macromancer.

But, even if we widen this to the aim of stabilising a more soundly-based measure of nominal transactions (i.e. of including all those significantly larger, intermediate exchanges largely netted out of the GDP arithmetic)– most easily proxied by non-financial business sales – there is a further caveat that what looks like a ‘hoarding’-led decline in velocity (the rate of money turnover) may, in fact, be a reflection of a monetary surplus brought about by the removal of many higher-order stages in what is, by definition, an overly-extended, far too ‘roundabout’ economic organization.

To see this, imagine that a firm which once bought the grain, milled it, baked it, and retailed it all under one roof only pays its workers and its suppliers of one input and only sells to one set of customers, requiring many fewer monetary interchanges than if each of these stages were hived off into a separate, specialist enterprise. As the over-stretched and under-capitalized layout of the boom economy snaps back into a more sustainable configuration, many such stages, erroneously laid out during the misleadingly easy money conditions of the boom, will be eliminated, reducing the number of sales and purchases as it does. Though many of these will involve only credit, there will inevitably be an extra call on money involved as well

Thus, if velocity falls – something the FFB bank is mooted to register and then counter-balance because of the palpable reduction in the clearings it must undertake – it may not be just because money is becoming immobilized in ‘hoards’ but because actual transactions volume is shrinking as it must if the adjustment is to be allowed to run on unhindered.

Conversely, if many of the boom’s dealings were undertaken outside of the banks – i.e., on the securities markets, or via the direct extension of intercompany trade credit – there may actually be a dash to make avail of those same backstop lines of credit which the fee-hungry banks typically insist its capital and money market customers take up when the skies are cloudless and their utilisation is likely to be scant, indeed.

Thus, the hypothetical negative feedback of lowered money transmission and lesser bank clearings leading to an equilibrating expansion in money liabilities may prove a chimera, since the link between the first and second may not only be broken, but rewired with an opposite polarity.

All in all, we hope we shown that we have sufficient reservations – both in theory and practice – not to cast our lot in with the FFBers on this issue.

No Compensation

Perhaps we should give the last word on the foregoing not to Mises and Rothbard – who were, of course, just as vehemently opposed to fractionalism as they were avidly in favour of free banking – nor to such ‘stabilizers’ as Roepke, or the more Wieserian Hayek (who seemed to become ever more woolly-minded and impractical on this issue as time went on) but to Richard Strigl, a less well-known member of the Pantheon, but one who provided us with one of the most detailed and clearly-worded expositions of the structure of production, the nature of capital, and the business cycle in his 1934 work, fittingly – if unimaginatively – entitled, ‘Capital and Production’.

It is true that in the relevant Chapter 3, section 3, Strigl deals with the standard framework, i.e., one which is dominated by a central bank, but nonetheless his unequivocal distinction between what might happen and what will happen if we attempt to offset hoarding remains, I think, decisive, even when we relax that constraint.

Firstly he makes a case which I think today’s primary FFBers such as George Selgin and Steven Horwitz would share as to why such a move might be desirable.

… An elasticity in the volume of credit can be demanded without the adaptability of the money supply [thanks to ‘hoarding’], thereby leading to an interference of money in the structure of roundabout methods of production… If the central bank could completely oversee the conditions which require the expansion or the contraction of credit from the point of view of the ‘neutrality’ of money… it could [do so].

’Additional credit’ that the central bank grants in order to compensate for the effects of hoarding are not ‘genuine additional credit’, but ‘compensatory credit’ and [ditto] restrictions… However, the central bank has no reliable indicator for such a policy; there is nothing in the economy that can directly inform[it] whether the supply of credit is greater or smaller than the supply of ‘real savings capital’.

In the money and credit economy there is no market on which the ‘artificial’ influencing of the supply of credit would immediately lead to a disruption. Here, the rule holds that the influence on the capital market from the side of money can only be recognised by the effects which [genuine] expansions or… restrictions have.

…As a consequence, an ideal functioning of money in the sense of a neutral money can probably never be expected.

Our contention, argued above, is that this lack of what Strigl terms an ‘omniscient institution’ cannot just be assumed to be made good by its substitution with a multiplicity of FFBs, each concerned only with maximising profit under the constraints holding of the lowest possible reserve consistent with statistical safety, as indicated by their expectations of likely clearing conditions.

Strigl further goes on to warn explicitly of the purely theoretical validity of this business of a neutral money, pointing out in a footnote to the above that:-

… In the stationary economy, monetary influences lead to ‘disturbances’; hence there is a question under which circumstances these… do not occur, i.e., that money is ‘neutral’. Here the question regarding the neutrality of money is hence a question regarding the monetary conditions of the stationary course of a money economy.’

The crucial point here is that the concept of a ‘stationary economy’ is an abstraction of the economist’s mind, adopted so as to hold at least a few of the ceterises briefly paribus in a way that the real world denies him the chance to do. Strigl is thus making clear that what seems logically unimpeachable in this Gedanken experiment should not imply a prescription for how to order matters amid the messy dynamism of the real world.

Strigl further questions the practicality of such measures in a lengthy appendix, ‘On the Problems of Business Cycles’. After dealing here in more detail with the progression of the downturn, we reach the point where “…a withdrawal of money capital from the circulatory flow of the turnover of capital” – our accursed itch to hoard – takes place, implying that “a compensation without damage” – such as the FFBers presuppose – “would seem conceivable here”

But, says Strigl convincingly, this will be just the point where the only ones willing to take up this newly-available credit will be those who, otherwise, “…are forced to liquidate, to make emergency sales or to cease production due to a lack of capital…” for whom “…any credit means at least the monetary avoidance of losses and perhaps even the potential for later improvements.”

“However,” he goes on, “satisfying this demand implies delaying the liquidation of the crisis, lengthening and strengthening it. For it is essential that a significant demand for credit by those who would like to work towards continuing the boom, that is, an ‘unhealthy’ demand for credit, exists along wit a significantly reduced demand for new, sound investments.”

Here we are back to Hutt’ s insights on how voluntary ‘withholding’ – which we could even term, speculative denial – means Say’s Law breaks down and markets no longer clear, perpetuating and propagating the misery of the bust.

“To be sure,” Strigl continues, “ these explanations are highly schematic. However, they can show that the chance of a compensating expansion of credit in the recessive phase of the cycle is in practice very small; that there is hardly any chance of financing production processes which can be lastingly continued: and that the danger, instead, that additional credit prolongs and makes the crisis more severe is very large.”

As for that other canard of modern ‘re-inflation’, i.e., boosting consumer expenditures, our sage is also very forthright about its malign effects:-

“…a cycle policy is also conceivable which, by enlarging consumption would try to avoid those effects of ‘decapitalization’ which consist of the loss of demand for consumer goods. Here, additional money would function such that it would replace the money withdrawn from circulation and would demand consumer goods for pure consumption in its place. The movement of goods would thus be the same as if the money withdrawn… had served consumption.”

“We have already pointed out that withdrawing money from investment and using it for consumption is the same as consuming capital” – a quantity of which, you will recall, the higher orders we are trying to prop up is already suffering a desperate lack.

“In addition, some effect on relationships for cost prices must also surface in the form of support for cost prices…” – are you watching, Mr. Bernanke? – “Thus, the policy of financing consumption must in the end cause the emergence of price relationships that make an improvement in the potential for new investments more difficult… The ‘artificially’ created demand for consumer goods will ultimately also create an increased need of for operating capital (sort-term investments) and will make these… increasingly profitable. This, too, must serve to weaken the forces that work in the direction of removing the obstacles which stand between short-term investments and long-term capital markets.”

“In conclusion, let it be said that a guideline for determining the extent of credit that should operate in this way does not exist.”

We insist that neither does it exist when Fractional Free Bankers, rather than the central bank, are doling out that credit, even if we stretch our credulity to believe they would be so inclined to do, just at the moment when the economic prospects were at their bleakest and the cause of their own survival was therefore paramount.

So, in banking, by all means give us freedom, but also give us freedom from fractions, for we believe that the benefits of their permitting their use within an otherwise demonstrably superior framework to be too largely illusory and their potential drawbacks all too threatening to make the experiment of their introduction a rational one to conduct.

I went cold on reading my argument about precautionary reserve demand dismissed as an “arcane statistical hypothesis.” Neither that phrase, nor the (as usual history-free) conjectures that surrounds it, adds up to a refutation of the theory. Please Scott: either show why the theory is wrong, or offer empirical evidence against it. You do neither; yet these are the usual ways by which people are expected to to dispute theories–though admittedly they don’t seem to be the ways preferred by anti-FRB writers.

Good Afternoon George,

You are a sensitive fellow. I often get called “nutty, mad man, idealist, bonkers” etc. No need to go cold on what Sean says. He was a banker and has been in the capital markets for 2 and a half decades and is one of the most savy Austrian orientated financial observers currently working at Jim Roger’s (Soros ex partner) Diaposon fund. No numpty muppet is he.

You have produced a real contribution to the body of knowledge with the Theory of Free Banking, this is what PhD’s are for. So many people produce utter rubbish or works that will never be read as they are so obscure to me meaningless. Your works are continuing to be debated. This is good. I doff my cap to your orginality, it is a pleasure to know you and to have you comment on this platform. Like Sean I have had two plus decades, not in finance, but at the coal face creating wealth by selling goods people want, not by betting in a rigged banking system.

I have outlined some problems I see with your theory and would urge you take them on board, Sean has said his bit.

1. Make sure there is proper disclosure in contract and the parties enganged have a meeting of the minds and both agree what they want each party to do.

(i) If a bank customer wants safe keeoing of deposits, give that to him, with a fee if need be. Current custody is 9 – 10 basis points per year.

(ii) If they want to lend so you the bank can lend to your clients, great, let the depositor lend to the bank to lend to the banks customer for the time period all parties agree to.

(iii) If they want to have their cake and eat it i.e. a deposit that pays interest and is still on demand, make them aware that by exception the bank can offer this out of its immediate liquidity and by exception it will grant this facility, but you are a timed depositor de jure and this will be enforced in any liquidity crisis. We can have a debate around option caluses (you are still a current creditor) on notes or other bank liabilities or the enforcement of withdrawal notices on deposits (converting a current creditor to a long term, creditor), I prefer automatically making a person de jure timed depositor (long term creditor from the off) and provide liquidity by exception so the bank can never have a liquidity crisis by people pulling money out this way.

In my opinion, the Theory of Free Banking is weak on 2 points that will be resolved by doing the above:

1. I am a business man and squillions of others I know, put money into cash as a precaution. I have shown you some fund managers with 9 figure sums that are put aside to wait for the correction so they can use our money to buy assets cheaper than now. As the deposit is in a FRB, we know it is being mediated and thus preventing or slowing down the correction that should have happened and will certainly come. Our money is being used to hold up assets that have no reason to be. With proper contractual agreement, this would not happen. This menas that the accomodation mechanism written about by you in The Theory of Free Banking will more than likely do what you want it do, adjust to new money demand ex that which people hold as precautionary balances . Spitting out what money demanders want to devote to loanable funds and what they do not want to devote to loanable funds, means your mechanism does not become a blunt tool, I would be confident , it could actually do what you say on the tin.

2. In two and a half decades , I have seen bankers who new you being taken over by “credit people,” this place in the Sky somewhere , where no bankers know of you and they make lending choices in an abstarct way based on crazy Modern Porfolio Theory, very bad PhD’s made by famous economists and no where near as good and relevant as your PhD. Bankers do not lend in any meaningful way at the top of the crises. We need no academic studies to tell us this, this is what we know. They do this as too much prior credit has been made and they are blind to which lending choices are duff and which are not as nobody really knowns anything about who they have lent to. If you correct the above clarification of contract, at least they will only have loanable funds that people want to put out to loans to lend, so their ability to really ramp up credit is curtailed.

You, Horwitz and Evans are the academics, you can do studies, evidence papers, reports , make notes and book lists packed with facts and figures supporting this, to make your Theory better and more accurate and more relevant to real world agents.

I hope the words of Corrigan and I are useful as we both are significant players in our own respective fields who have bothered to read your works and can add value. I write in this spirit.

I urge dialog and understanding.

Toby – in your spirit of dialogue and understanding can I ask that you read this again: https://www.cobdencentre.org/2011/03/a-note-on-the-notice-of-withdrawal-clause/

I think your discussion of option clauses and notices of withdrawal above misrepresent how others view them, and agreeing on common terms is a prerequisite for any dialogue.

I have been wondering if the most effective response to the present lack of finacial sector reform would be an enterpreneurial one. Namely the setting up of a 100% reserve bank. What do you think the chances of success for such an enterprise would be and could you help in setting one up?

The Importance of Debate on Banking Freedom

Samuel, thank you for getting in touch. I would go to the above named article and look at the 80 comments that debate this point, I think you will find some answers there.

AJE, as you know, I have looked at this many times and it tells me nothing new.

Option clause allows a bank to make a current creditor a long term creditor on its notes liabilities. This is now a curiosity of history.

A withdrawal clause is a fact of all loans i.e. there must be some way to trigger a repayment (withdrawal )of the loan, either fixed or variable terms will be applied each stipulating a date or a mechanism to determine a date. If it did not have one in a set of terms and conditions, it would be a gift .

A NOW clause exists today and the loan to the bank with one of these in it makes you a current creditor, with the bank having a 7 day period to enforce if it wishes, but on the whole, no one can ever record a moment when this has happened.

An exception clause , my word as far as I am concerned unless someone can show me otherwise and I will happily conceed, ensures all deposits that are not for custody are timed and that by exception the bank proivides instant access liquidity and does not have to do anything in the eventuality of a run except remind people that they are timed creditors.

This is how I defined a withdrawal clause:

in the case of the withdrawal clause there is a notice period written into the contract – it is technically a timed deposit (where the notice period serves as a minimum term). But if the bank wanted to offer an instant access account it can simply publicise the fact that it does not routinely enforce this notice period and that it satisfies redemptions on demand…. The withdrawal clause means that a de jure timed deposit can be treated as a de facto demand deposit.

Sean,

I have never read a FRFB supporter who has claimed that money has no special role, or that it is just another good and I’ve never said that either. The argument for a supply and demand of money is similar to that for normal goods but not the same.

I get this impression here that you are under the impression that banks can simply create money. He seems to be saying here that though there may be some cost in banking services and maintaining a reputation these are small. Certainly they are small. But I think you have missed the point. Every unit of fiduciary media that a bank makes must be backed by assets, “thin air” is not permissible. The whole fractional reserve argument isn’t about whether FM must be backed at all it’s about how much should be backed with assets and how much with reserves.

Again, we don’t do that. I challenge you to come up with a passage from an FRFBers book that treats money in this way.

Obviously he hasn’t “deactivated” his holding of money. However, because he is holding money that means he has spent less. That would cause prices of things he would have bought to fall. Since prices can’t be changed with perfect flexibility they can’t immediately fall to compensate. As a result output and employment falls.

It need not be an aggregate argument, Steve Horwitz has shown how it has microfoundations.

In a sense this is true and in a sense it is a misconception. It’s not really analogous to stealing electricity from the grid. When that happens the thief obtains a resource by depriving another of it. That’s not what happens when someone increases their holding of money. We’re talking about a person increasing that holding honestly, by selling assets or retaining income. This can be described as an increase in accepted demand for money. Now, when this happens output can fall needlessly as I’ve mentioned. So, why shouldn’t can’t money be created to cope with the extra demand as it is occurring?

I suppose this is related to the difficulty above. We’re saying that although money is special it still has meaningful supply and demand like normal goods.

No, we don’t need to assume that at all.

Prices that take time to change are the essential issue. The idea isn’t that no price adjustment can occur it’s that price adjustment is a relatively slow process.

In an earlier thread on this topic, I put three broad background questions to Toby (and of course anyone else who cared to comment). Unfortunately, the conversation had by then moved on to the next post and thread so they were never dealt with. They seem equally applicable here:

1. Given the freedom to choose, what kind of banking system would naturally evolve?

– The historical evidence suggests specie-based, fractional reserve free banking would be an important and quite likely dominant element of the whole. Narrow banks (i.e. 100% reserve banks) would surely exist as well but probably only at the margin.

(As an aside, it puzzles me that proponents of 100% reserve banking, who invariably see themselves as free marketeers, pay so little attention to what the markets actually did when there was at least some real choice about these matters).

2. Are such specie-based, fractional reserve free banking systems relatively stable?

– Again, I think there’s sufficient historical evidence to answer with a qualified yes. Both theoretically (and it would appear in practice based on the limited examples available) such systems incorporate quite robust automatic stabilisers.

(It’s easy to understand why George Selgin et al become a little frustrated when this real historical record is for the most part simply ignored in the debate).

3. If all of that’s so, would enforcing 100% reserve banking across the board really be the right thing to do?

– Answering yes to this question is surely an odd stance to take for anyone who believes in the markets’ capacity to sort things out. To his great credit, Toby clearly agrees with this and believes the market (given full disclosure of the nature of demand deposits) should be allowed to sort things out.

(As another aside, I suspect structuring and enforcing 100% reserve requirements would not be anything like the straightforward matter most proponents seem to believe).

More generally, in trying to understand why this debate often feels so circular, so resistant to reasoned debate and historical facts, I wonder if fractional reserve free banking hasn’t become, in the minds of those so vehemently opposed to it, fatally tarred with the many sins of the fractional reserve system that’s prevailed in the last 80-100 years.

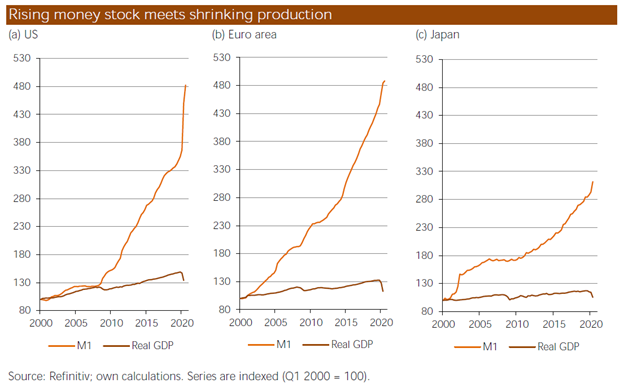

If so, then it’s critical to remind ourselves that in a specie-based, fractional reserve free banking system the sort of never ending, exponential, malignant credit growth we’ve seen in recent decades (together with all of the absurdities that followed) simply could not occur. For that to happen, the monetary base must be able to be continually and quite rapidly expanded, something that’s only possible with a central bank and (ultimately) a fiat currency. It’s no accident that over the course of the 19th century, prices in the US declined by about 30% while the 20th century produced an increase in the CPI of over 20 times.

Good Afternoon Ingolf,

Suggestion to Qu 1

I find it odd that people gamble. Going to a casino, the house takes 75% of your money. It seems irrational to go. Maybe go for a little tipple here and bet on the odd national event with mates there, but partake in this activity on a regular basis, I would pass on that. That said, good luck to all those happy and not so happy gamblers.

I suspect in a free market, with no state involvement and no legal privilege granted to banks not to keep liquid their current creditors , like all other commercial enterprises IN THE WHOLE WORLD have to, there would be some Fractional Reserve Free Banks and some 100% Reserved Free Banks. My preference would always be to know I could have redemption in outside money in full and that only I had one property title to my little bit of that outside money. I suspect there would be many others. I would not think I am in a minority.

Qu 2

“(As an aside, it puzzles me that proponents of 100% reserve banking, who invariably see themselves as free marketeers, pay so little attention to what the markets actually did when there was at least some real choice about these matters).”

I think if you read Checkland, you will see that when the classic example of free choice in banking, it was not quite so free. There were interventions, the system was not quite as stable and enduring , in fact, really since the outset of banking, in the UK at least, I do not think you can say that there was free choice in banking with no distortions. The historical record is qualified. The biggest intervention , the Bank of England has existed in it, since 1694 we must remember. That said, despite this, the free banks of Scotland did have the best run of all the examples given by FB theorists and we have much to learn from that time for sure.

Qu3

If you enforce contract law, you will enforce 100% reserves for a large part of the banking system. For a contract to be binding, one of the key elements is that there has to be a meeting of minds. You say lets to X and the bank says lets to Y does not mean we have a contract. So I would say, tighten up disclosure and make sure those who want safety get it. Those who want lending on what ever maturity get it and those that want to diminish their property title to outside money, get that as well. From an accounting point, I would have all three siloed in legal entities that could not explode on each other. I seek to ban nothing, just enforce good old fashioned common law law of contract. I would also make sure all banks comply with normal commercial reporting standards that every company AROUND THE WORLD other than a bank has to ie, if you have current creditors, keep liquid and do not leave the liquidity that is irreplaceable, of others, in the statistical hands of the law of large numbers! So again, I seek only to enforce the law that applies to us all bar banks.

I cant speak for others more in sympathy with the 100% reserve case.

The move to 100% reserves is straight forward: print cash to cover all demand deposits and swap the cash for the demand deposit. The issuer of cash , the State , can then delete all these bank liabilities they now have as they are nothing more than electronic enteries and the depositor has what he thinks anyway: CASH in his account.

If we still have a central bank and people still preferring inflation, set a monetary rule each year. Then let private issue of commodity currencies etc take over.

Thank you for your kind and informed comments. Forgive any poor English etc, it is Sunday and I am with the kids doing this on my PDA!

Morning Toby. Sorry to hear you were distracted from more important matters like the kids . . . . or perhaps by then you were happy to be briefly pulled away!

Now, to your comments, for which I thank you too. I’ll consider them in the same order:

1. I’m not sure the casino analogy is quite right in this case. If anything, the holder of a fractional reserve demand deposit seems more akin to the house in a casino. In return for a (very?) small chance of substantial loss, they not only save costs but also earn income each day. It’s not, in my view, an irrational bet.

Lest you think I’m a Pollyanna on this issue, I ought to confess that for over a decade I’ve been happy(ish) to pay the costs of allocated gold. It’s a question of degree, I think. For that portion of one’s money holdings (which is how I regard gold) where complete security is paramount, it makes perfect sense to pay for that. Indeed, there’s no other realistic choice. For the rest, more conventional risk/reward considerations take precedence.

2. No argument. There’s been a longstanding argy-bargy about just how “free” the various historical free banking episodes actually were. I don’t have the depth of knowledge to make any sort of definitive comment. Still, from what I have read, there have been many episodes that at least approximated free banking (including less well-known ones such as Sweden and Hong Kong), and each one (with the possible exception of Australia’s) seems to have worked out rather well.

3. As I think you know, I’d be perfectly happy for the relationship between the holder of a fractional reserve demand account and his or her bank being made as clear as possible. Unlike you, I don’t think that knowledge would make much difference to most people, but that is of course simply an opinion. In any case we both agree the market would soon enough give us an answer.

The question about whether different banking functions and types should be forced into different legal silos is a big one. Given a true specie-based free banking environment, I’d say no; let the market decide. I am in any case pretty sure quite a bit of voluntary segmentation would occur.

Even absent such an environment, though, it’s a ticklish question. At first glance it seems a laydown, and it’s one I’ve previously held with some enthusiasm. I’m very nearly persuaded, however, that in anything like our current political and economic environment, it’s just not practical.

For example, let’s suppose deposit taking and non-deposit taking institutions were strictly segregated with the intent of making it clear the latter would on no account be bailed out in the future. It’s an attractive idea, and if I believed politicians could hold to that promise in the event of a massive (and perhaps systemically important) failure in the non-deposit taking financial sector, I’d be (indeed was) all in favour. Trouble is, I don’t think they would; the hue and cry from all those affected would just be too great.

Anyway, that’s part of a very large, and in many ways separate debate. About realpolitik, if you like, rather than about trying to evolve a better understanding of the theoretical ideal, which is what we’re on about here.

AJE, I note your quote. A timed deposit with a withdrawal clause (please take note, all loans with a timed element will have some arrangement for repayment) , does not form any part of the banking systems immediate redemption liabilities such as all demand deposits. Thus, the former are of no concern to us. So an exception clause for people who want to have their own cake and eat it, i.e. interest on a demand deposit, I say, let banks take this as savings on a timed basis and allow by exception, the depositor to have access and make sure he/she is aware of contractually what he/she is doing. In the event of a run, the bank is in the driving seat as all it has to do remind its hyperactive redeemers, that they have no right to as this on demand facility was granted BY EXCEPTION. This also means current creditors ie demand depositors have their money in the bank in custody and timed savers , have their money lent out for a duration agreed. Thus we have the architecture of sound and safe + honest banking that has the flexibility of a FRFB system with regards to instant access and safety for those who want it. Never will the taxpayer be called upon to bail this type of bank out.

You say that since a notice of withdrawal applies to a timed deposit these do not constitute part of the immediate liabilities and therefore you dismiss them as not relevent. But (1) I am suggesting that banks make it known that they routinely don’t enforce the withdrawal notice, in which case they do need sufficient liquidity on hand; (2) you define exception clauses as applying to timed deposits – so based on your criteria for dismissing withdrawal clauses then exception clauses are also of no concern.

I still think we’re talking about the same thing.