I do not doubt that the Government is sincere in its wish to make Britain “open for business” and to deliver greater life chances through reform of the welfare state. I gave some time to the Centre for Social Justice and now I see many of their ideas filtering through to public policy. I support those reforms from both a practical perspective and in view of their moral necessity.

The Prime Minister is correct to talk of the culture we have lost, particularly in respect of private shame. I am put in mind of C S Lewis’ book The Abolition of Man: there is, after all, such a thing as right and wrong. Lewis predicted humanity’s ultimate destiny on the path which embraces subjective morality: a dystopian society in which “we find the whole human race subjected to some individual men, and those individuals subjected to that in themselves which is purely ‘natural’ — to their irrational impulses.”

Some readers will recognise the problem and the dangers but reject the state’s role in finding a solution. However, we do not live in that world where the state is comprehensively rejected. There is a welfare state and it needs reform. The Government is getting on with it, and in the right direction too.

However, what the Government is not addressing is the de-civilising effects of inflation, that is, increasing the money supply.

What is commonly called “inflation” – a rise in the general price level – is an automatic consequence of debasing the currency. And currency debasement has been fierce in our lifetimes: the consequences have been and remain profound.

There is a presentation which, in one form or another, I have given many times. It shows, in a few charts:

- How the state has grown inexorably since 1900,

- How taxation reached an apparent limit at rather less than the scale of state spending, remaining there since 1971 or thereabouts.

- Where our debt projections are heading,

- How our money has been debased, particularly since 1971.

By the end of the presentation, I have explained our banking, fiscal and economic crisis. Given that what it shows is a monetary and fiscal catastrophe, people receive it surprisingly well. As far as I can tell, people can handle the truth and they want it.

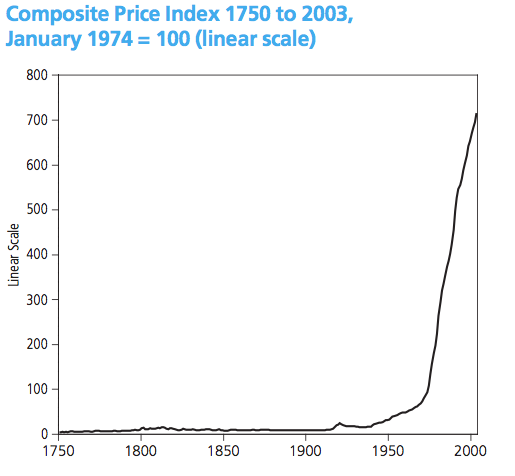

One of the key slides is a price index from 1750-2003:

The grotesque debasement since 1971 – when Bretton Woods finally collapsed – hides the detail of the nineteenth century on a linear scale, so I include the same chart on a log scale. The log chart shows that, despite a number of crises and fluctuations, a pound in 1900 bought about the same basket of goods as a pound in 1800.

In contrast, money has lost almost all its value since the Second World War.

The Ethics of Money Production by Jörg Guido Hülsmann is particularly relevant at this point. Hülsmann writes:

To appreciate the disruptive nature of inflation in its full extent we must keep in mind that it springs from a violation of the fundamental rules of society. Inflation is what happens when people increase the money supply by fraud, imposition, and breach of contract. Invariably it produces three characteristic consequences: (1) it benefits the perpetrators at the expense of all other money users; (2) it allows the accumulation of debt beyond the level debts could reach on the free market; and (3) it reduces the [purchasing power of money] below the level it would have reached on the free market.

While these three consequences are bad enough, things get much worse once inflation is encouraged and promoted by the state. The government’s fiat makes inflation perennial, and as a result we observe the formation of inflation-specific institutions and habits. Thus fiat inflation leaves a characteristic cultural and spiritual stain on human society

He goes on to write of inflation’s tendency to centralise government, to extend the length of wars, to enable the arbitrary confiscation of property, to institutionalise moral hazard and irresponsibility, to produce a race to the bottom in monetary organisation, to encourage excess credit in corporations and to yoke the population to debt. He explains how “The consequence [of inflation] is despair and the eradication of moral and social standards.”

That all sounds familiar.

Hülsmann’s work is not scripture of course, but neither are his ideas isolated. Consider Ayn Rand:

Whenever destroyers appear among men, they start by destroying money, for money is men’s protection and the base of a moral existence.

It is my firm view that inflation – the debasement of money – was the primary cause of the banking crisis. That inflation was a deliberate policy choice of welfare states. You may recall Eddie George’s remarks in 2007 and now Mervyn King has said, “Of all the many ways of organising banking, the worst is the one we have today.”

Moreover, if Hülsmann, Rand and other scholars including Mises and Hayek are to be believed, then inflation is also a major contributor to the moral and spiritual decline of our country. No amount of welfare reform alone will solve that.

All is not lost however. To return to that log-scale price index, money’s value was substantially more volatile in the first half of the nineteenth century than in the second. In 1844, the Bank Charter Act, Peel’s Act, took from the banks the privilege of extending bank notes in excess of specie (coins of inherent worth). It was recognized that this extension of candy-floss credit un-backed by prior production of real value was a systemic cause of economic and banking crises.

Unfortunately, that Act left the banks unmolested in their ability to create deposits. As our system of money and bank credit has evolved, that loophole, combined with central banking and the socialisation of risk, has delivered us into our present predicament.

It falls to our generation to solve this problem and that is why we established The Cobden Centre.

As Martin Wolf wrote in the Financial Times on 9th November 2010, “The essence of the contemporary monetary system is creation of money, out of nothing, by private banks’ often foolish lending.” And then we wonder why house prices have raced out of reach. We wonder why the basement garages in Canary Wharf are full of supercars while what was once our industrial heartland languishes in state dependency.

I admire the Prime Minister and the coming welfare reforms. I will back them gladly. But, until we end inflation as a way to fund the promises of the welfare state, we shall not have done the decent thing. We shall not have established objective morality in banking and in that lifeblood of society: money. Honest money is a prerequisite for social progress and it must be delivered if reform is to succeed.

I second every word of that!

So do I. Bloody hell, a politician speaking both the truth and some sense! Whatever next?

Well said.

More people need to be aware of these facts.

history shows time and again similar results

http://mises.org/books/inflationinfrance.pdf

The mercantile classes at first thought themselves exempt from the general misfortune. They were delighted at the apparent advance in the value of the goods upon their shelves. But they soon found that, as they increased prices to cover the inflation of currency and the risk from fluctuation and uncertainty, purchases became less in amount and payments less sure; a feeling of insecurity spread throughout the country; enterprise was deadened and stagnation followed.

New issues of paper were then clamored for as more drams are demanded by a drunkard. New issues only increased the evil; capitalists were all the more reluctant to embark their money on such a sea of doubt. Workmen of all sorts were more and more thrown out of employment. Issue after issue of currency came; but no relief resulted save a momentary stimulus, which aggravated the disease. The most ingenious evasions of natural laws in finance which the most subtle theorists could contrive were tried—all in vain; the most brilliant substitutes for those laws were tried; “self-regulating” schemes, “interconverting” schemes—all equally vain.[86] All thoughtful men had lost confidence. All men were waiting; stagnation became worse and worse. At last came the collapse and then a return, by a fearful shock, to a state of things which presented something like certainty of remuneration to capital and labor. Then, and not till then, came the beginning of a new era of prosperity.

Just as dependent on the law of cause and effect was the moral development. Out of the inflation of prices grew a speculating class; and, in the complete uncertainty as to the future, all business became a game of chance, and all business men, gamblers. In city centers came a quick growth of stock-jobbers and speculators; and these set a debasing fashion in business which spread to the remotest parts of the country. Instead of satisfaction with legitimate profits, came a passion for inordinate gains. Then, too, as values became more and more uncertain, there was no longer any motive for care or economy, but every motive for immediate expenditure and present enjoyment. So came upon the nation the obliteration of thrift. In this mania for yielding to present enjoyment rather than providing for future comfort were the seeds of new growths of wretchedness: luxury, senseless and extravagant, set in: this, too, spread as a fashion. To feed it, there came cheatery in the nation at large and corruption among officials and persons holding trusts. While men set such fashions in private and official business, women set fashions of extravagance in dress and living that added to the incentives to corruption. Faith in moral considerations, or even in good impulses, yielded to general distrust. National honor was thought a fiction cherished only by hypocrites

As you’d expect I don’t agree with the mud-slinging at fractional-reserves. Or the lauding of the very statist Peel Act.

Apart from that I do agree though. The problem I see is that while an ABCT boom is in progress it appears to create wealth. This makes demands for welfare benefits more affordable. Often electorates seem to think that they can “afford” to elect more socialist governments from time to time. Normally it seems during booms. But, when the bust comes politicians are slow to adjust welfare payments downwards. And, as we have seen, the demand for bailouts come and politicians succumb to them.

I do try to rise above the fray by emphasising that fractional reserves are a problem in combination with all the other salient features of the system, but time is often short and I am merely a humble politician! In most presentations, I say that a free market in money would resolve the question of reserve ratios.

Current

I think the problem is not with fractional reserve banking being a mechanism to increase the money supply, because IF the economy grows then the money supply will need to be increased proportionally(even if it is dividing gold units down). That is non-inflationary. The problem is that under our fractional reserve system the money supply gets increased PRIOR to any economic expansion at the point that money is loaned and before that money has spawned a productive enterprise that grows the economy proportionally. Not all loans are productive, there are always more failed enterprises(unproductive loans) than not, the money supply grows faster than the economy, regardless under this system, even as productive loans are paid off and shrink the money supply. Interest is still charged on unproductive loans, creating a demand for yet more money since only the principal is loaned, and the interest rate which should be connected to the growth rate of the economy has now disconnected causing investors to mal-invest. This is usury. Inflation is baked into the cake, until the periodic crash occurs when the capital has been eroded to the critical point.

The central bank does not target 0% inflation, it targets 2%. Anything above 0% inflation leads to collapse eventually , by mathematic progression. Only the time varies. Boil the frog slowly.

“because IF the economy grows then the money supply will need to be increased proportionally(even if it is dividing gold units down). That is non-inflationary.”

This is untrue. Any increase in the money supply is inflationary and it will benefit one sector of the economy at the expense of another.

Maybe we have lived through this nonsense idea for too long. Nothing wrong with allowing the value of money to increase and eventually, if necessary, redenominating its divisions.

Better not to boil the frog at all, Gary

Wow ! An MP that truly understands the axiom of sound money. Along with Douglas Carswell, that makes 2 out of 650(?) MPs. No wonder we are in such dire economic straights.