In recent weeks, we have argued strongly against any relapse into Malthusianism or any of the other, fashionable Green neuroses which readily afflict those dealing with the more tangible examples of Man’s ongoing fight against scarcity.

Neither the Gaian prophets, fulminating about planetary exploitation, nor the vacationing engineers, misapplying the narrow rigour of their own profession to a wholly different, open-ended problem of ends, not means, are to be paid heed if we are to think at all clearly about such matters.

In propounding this viewpoint—something we might, after Matt Ridley, term Rational Optimism—we have been mocked in some Peak Oil quarters for believing the world can power itself on ‘green unicorn dust’.

Not that such committed exhaustionists ever look up from their jeremiads to pay attention to the daily drumbeat of discoveries and technical breakthroughs, dismissing these as only amounting to so many hours or days of world use, while forgetting that such bottom-up, piecemeal satisfaction of needs is how we meet all of our material requirements.

Nobody would ever argue that we will one day run out of footwear simply because the latest expansion of output announced by Jimmy Choo will only serve to satiate the fashionistas’ appetite for three-and-a-half shopping days, now would they?

Take but two recent examples of why the boundary conditions of the calculus of depletionism can never be determined accurately enough to serve.

Firstly, BHP has just declared that as a result of (a) a successful drilling programme and (b) the improved economics which go with a higher copper price, it has been able to increase its reported mineral resource estimates in the area surrounding the well-known Escondida mining complex by no less than 129%. At the same time it upped its reckoning at the Antamina mine by a still-impressive 32%.

Assuming that this can in fact be profitably extracted, this would mean that 107 million tonnes of copper are available (a metal, which you should note is also now some 80% recyclable as scrap), where only last year the total was thought to extend to 52.3 Mt. With the caveat that this is not yet definitively an ore body which it would make any economic sense to mine, this one, single announcement has the potential to meet more than six years’ global uptake of primary refined metal.

Not that the market yet cares, of course. It would prefer to bull up the disruption associated with the ongoing labour dispute at the same mine. Who cares about another 50 million tonnes to come when we can focus on the short-term loss of 10 thousand of them instead?

Secondly, take the case of BG Group’s exploration of the Santos basin off the coast of Brazil. Last year, the company estimated it was sitting on 3-4 billion barrels of oil equivalent in reserves and resources. A year on and the size of the pot has been doubled to 6-8 bln boe, adding—potentially, at least—as much and more than the entire proven reserve base of the UK, in one fell swoop.

So, even the experts—the real boots-on-the-ground experts, not the self-appointed global book-keepers pontificating from their ivied groves—were wildly out in an estimate which they were the best placed to make and which it was very much in their financial interest to bid up. How many more of these revisions would it take to restore a little balance to the debate, do you suppose?

In this regard, it was with some amusement that we read the following offering from our favourite Archimandrite of the cult of the Earth Mother, legendary investor-turned-Ecomillennialist, Jeremy Grantham:-

“With hindsight, there are a few additions and qualifications I would like to make regarding my letter on resources of last quarter. I will start with an overview of the prospects for our collective well-being: there is nothing about the resource limitation problem that we cannot resolve. We have the brain power and, especially, the inventiveness. We have some nearly infinite resources: the sun’s energy and the water in the oceans. We have some critically finite resources, but they can be rationed and stretched by sensible, far-sighted behavior (sic) to fill the gap between today, when we live far beyond a sustainable level, and, say, 200 years from now, when we may have achieved true, long-term sustainability. Such sustainability would require improved energy and agricultural technologies and, probably, a substantially reduced population. With intelligent planning, all of this could be reasonably expected. A population reduction could be arrived at by a slow and voluntary decline…”

So, apart from the usual, deplorable hint of Eugenics which is shared by so many privileged members of the global nomenklatura (who are rarely found to have limited their own procreative efforts) and the heavy reliance on that insidious shibboleth of ’sustainability’, one might almost think that Mr. Grantham, too, has been at the unicorn dust and that he might just be confessing that he and the rest of the Exponentialists have been wrong all this time!

As a correspondent of ours (whose otherwise consistent practice of solid good sense we find sadly inoperative in this particular field) responded when your author gleefully pointed out this partial renunciation, the three critical words in the text are ’with intelligent planning’, implying that this is the last thing we should expect. (Here, too, we beg to differ, because such Platonic vanities about ‘planning’ are what have visited many of history’s greater evils on the poor, Planned-Upon masses)

More to the point, the grim irony is that ‘fashionable declinists’ like Grantham—with their substitution of the ‘precautionary principle’ for the pioneering spirit; with their insistence on preferring enormities like tax-grubbing wind-mills to the development of clean, efficient shale gas; or their imposition of capital-destructive carbon taxes instead of enlarging business depreciation allowances—are themselves the biggest impediment to ‘intelligent planning’, at whatever level it is supposed to be undertaken.

In the markets themselves, we are still at something of an impasse, ranging widely in what has been for the DCI total return index (abstracting US dollar weakness) a stationary trend stretching back to the beginning of the year.

In price terms, Emerging Markets (multiplied by the USD TWI) have been essentially static since September, with the BRICS basically unchanged since October-09. The S&P itself, in these terms, is penned in, tight in the apex between two converging trend lines drawn from either extreme of the GFC and meeting right at the mid-point of that span.

For all the hype engendered by the forces of money illusion and shameless salesmanship, that is not a lot to show for three years of hard grind and countless trillions in market interventions, one might think.

As for the outlook, we have to balance several interacting parts, each of which can influence the other, sometimes being driven and sometimes doing the driving.

An increased supply of money and credit can stimulate real business activity (Austrian Business Cycle Theory) and this can obviously engender a demand for commodities. Conversely, an endogenous expansion of business can itself induce the supply of financial means (the ‘real bills’) with which to carry this forward (technology and resource booms are a key case in point).

Money can also flow into resources as an end in themselves (especially if they have been rediscovered as an ‘asset class’) and so can distort both apparent demand and the efforts to meet this, while—as we have frequently pointed out over the past 7-8 years—a hunger for resources is both directly resource-intensive (Roepke’s ‘chicken farm’ analogy) and has income spill-over effects to other areas which, in their turn, may then require more resources.

Finally, given the vicissitudes of the international monetary system (Rueff’s ‘childish game of marbles’), higher resource prices (and quintessentially, higher oil prices) can give rise, not only to pressures to economise, but to greater quantities of debt issuance, and—via FX reserve (mis)management—inflationary emissions of new money, each serving to cushion the impact upon oil’s direct consumers—possibly via the agency of government transfer payments—and to refill the pockets of those who count the oil producers as their clients.

If we accept this broad schema, it then remains for us to determine how fast and in which sense the gears are rotating. All we can say at this point is that the dominant mechanism of the past two years—monetized budget deficits and ‘quantitative easing’ programmes—has been moved to a lower setting, with the Fed seemingly on hold and the Chinese authorities making some efforts (however dubious their efficiency) at checking the runaway horses earlier unleashed to rampage through their vast fiefdom.

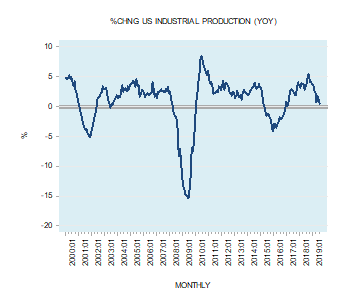

Any endogenous upsurge in industrial demand does not seem easy to identify, not least because the fight against the inflationary consequences of easy money have assumed a greater priority in many of the go-go nations of the New World, while the still unsterilised, toxic legacy of the credit boom is poisoning the wellsprings of growth in much of the Old. As for any New Era emerging, well, those same fiscal restraints are partly hampering the anti-technology boondoggle of wind and solar which was fondly supposed to be the medium for such a movement, in happier times.

Flows into commodities have their role to play, of course, but the evidence of the past few months is that these have become much less committed—as have flows into most speculative markets—being ready to chase the trends in either direction and so giving rise to the whipsaw behaviour with which we have been contending since the bloom started to come off the Bernanke Bubble.

In light of the foregoing, the inescapable conclusion is that the engine has wound down from its high-rev operation of the past two or so years and is now perilously close to the point at which it will either stall out, or crash the gears and begin to rotate in the opposite sense once more, the one where each element pulls the other down, not up, the slope of price against time.

The one thing we can say is that, according to the empirical precedents of the past cycle or two, commodities are already expensive with regard to that faltering pace of output and international trade, meaning that, whatever their short term experience (and a break-out higher in terms of a sickly dollar is still eminently possible on the charts), they offer less and less margin of safety, and hence, less and less value by virtue of that divergence.

Given that the Political Bureau of the CPC Central Committee agreed, last Friday, that China would stick to its ‘proactive fiscal policies in the second half of this year, with stabilizing prices as its main priority’, and that the Indians, Koreans, Brazilians, and others are not yet ready to go back on the accelerator, the longs must hope that they can make out during the brief euphoria which will be unleashed if either a US default is finally avoided, or if they witness a rerun of last year’s plunge protection approach from Chairman Bernanke at Jackson Hole.

Be that as it may, we think the motor is in need of a serious refit: that the faster it runs in the interim, the greater the chance that it drops a rod and shudders to a halt in a cloud of blue smoke.

Play a break higher by all means, but don’t get wedded to those elevated prices along the way. There is nothing which we can presently discern on the horizon which appears to justify the idea that their occurrence will be anything other than a brief, last spasm of misplaced hope crossed with frustrated short-covering.

I am a member of the organic movement but have more sympathy with your view than you might expect (the one exception being shale gas which you really should investigate further theautomaticearth.blogspot.com/2011/07/july-19-2011-fracking-our-future.html is one of the better pieces on the subject.

The adoption of output per man as the measure of efficiency in agriculture after 1947 has lead to an industry that is very efficient by that measure but very inefficient by all other measures such as energy and water consumption and now has to be massively subsidised by government and is very dependant on cheap loans. The alternative measure was output per acre which is almost always higher on small farms with more labour producing a wider range of produce. The suggestion then that without the oil we won’t be able to feed ourselves or that people won’t be able to afford food as oil prices rise is therefore wrong. The next point about declining reserves of phosphate and potash and the even greater decline in the amount available to us in the UK is also not a cause for concern because large reseves of phosphate and potash exsist in farmland soils they’re just not available to crops however new research has shown that buckwheat and lupins can access this reserve and when ploughed in make the nutrients availble to the crops at considerably less cost that the fertiliser factory! the other source is the enormous quantities of the two nutrients flushed down the toilet every day.

It is my belief that we live in interesting times as the Chinese call them when the exsisting order is overthrown. The small finds that you put your hope in will help to support us but I don’t see how they can support growth in consumption. If the purpose of production is consumption (Adam Smith) perhaps social progress can come when the purposes of consumption are met by reduced consumption not an ever greater increase. The Cobden Centre has published many good posts on honest money I would be very interested to learn what you consider social progress.

Would it not be an example of appealing to false authority to inquire of a fellow who well explained the fallacy of “peak-” whatever to opine on a definition of social progress? Isn’t social progress defined by the billions who each day sally forth and define what it is for themselves, the sum total of which ought to satisfy any question?

To be sure, government intervention, and none so awful as dishonest money, misallocate resources and lead to bad results, but we all soldier on, in spite of the efforts of those who arrogate unto themselves, as Weber put it, “a monopoly on violence in a given territory.”

A free market widens the access and lowers the cost of goods and services, and thus promotes peace and prosperity, and best distributes goods and services, but the market is limited to that. There is much more under the heavens dreamt of in your question that contributes to social progress than the market. Like love, altruism and leisure pursuits.