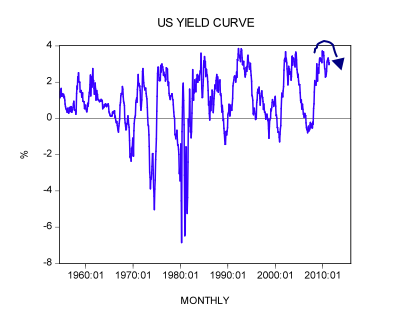

After rising to 3.33% in March, the differential between the 10-year US Treasury Note and the federal funds rate eased to 3.07% at the end of June. Historically a narrowing in the differential, also called the ‘yield curve’, has occurred many months before the onset of a recession.

The most popular explanation of the causes that determine the shape of the yield curve is provided by the so-called Expectation Theory (ET). The key to the shape of the yield curve is that long-term interest rates are the average of expected future short-term rates.

If today’s one-year rate is 4% and next year’s one-year rate is expected to be 5%, then the two-year rate today should be (4+5)/2=4.5. It follows then that expectations for rises in short-term rates will make the yield upward sloping, for long-term rates will be proportionately higher than short-term rates.

Conversely, expectations for a decline in short-term rates will result in a downward sloping yield curve, for long-term rates will be proportionately lower than short-term rates. (Thus if today’s one-year rate is 5% and next year’s one-year is expected to be 4%, then the two-year rate today (5+4)/2=4.5 is lower than today’s one-year rate of 5% – downward sloping yield curve).

According to the practitioners of ET, an economic slump is associated with falling interest rates. Consequently, whenever investors expect an economic slowdown or a recession they shift their money from short-term securities towards long-term bonds. This shift raises short-term rates and lowers long-term rates, i.e. “narrowing in the spread” or the “inversion in the yield curve” emerges.

Conversely, an economic expansion is associated with rising interest rates. Hence whenever investors expect economic expansion they shift their money to short-term securities away from long term bonds. This shift leads to the lowering of short-term yields and an increase in long-term yields.

But is it possible to have a sustained downward sloping yield curve? One can show that in a risk free environment neither an upward nor a downward sloping yield curve can be sustainable.

An upward sloping curve will provoke an arbitrage movement from short maturities to long maturities. This will lift short-term interest rates and lower long-term interest rates, i.e. leading towards a uniform interest rate throughout the term structure. Arbitrage will also prevent the sustainability of an inverted yield curve by shifting funds from long maturities to short maturities thereby flattening the curve.

Another theory called the Liquidity Preference Theory (LPT) seems to have better reasoning for the upward sloping yield curve. According to the LPT, people demand a liquidity premium for longer maturities over the short-term maturities on account of a risk factor. The problem with the LPT, however, lies in its inability to explain inverted yield curves, i.e. when short-term interest rates are higher than the long term rates.

(Now, in a free unhampered market economy, the tendency towards the uniformity of rates will only take place on a risk-adjusted basis. Consequently, the yield curve that includes the risk factor is likely to have a gentle positive slope. It is, however, difficult to envisage a downward sloping curve in a free unhampered market economy – since this would imply that investors are assigning a higher risk to short-term maturities than long-term maturities, which doesn’t make sense).

Even if one were to accept the rationale of ET for the changes in the shape of the yield curve, these changes are likely to be of very short duration on account of arbitrage. Yet historically either an upward sloping or a downward sloping yield curve held for quite a prolong period of time (see the chart above). What, then, is the primary mechanism that causes the curve to slope so consistently? The culprit is the central bank’s tampering with financial markets via monetary policy.

The Fed and the shape of the yield curve

While the Fed can exercise a control over short-term interest rates via the federal funds rate, it has less control over longer-term interest rates. It is this that gives rise to an upward or a downward sloping yield curve. An upward or downward sloping curve develops on account of the Fed’s monetary policies that disrupt the natural tendency towards the uniformity of interest rates along the term structure.

For instance, the artificial lowering of short-term interest rates, which is reinforced by the increase in the monetary pumping of the Fed gives rise to an upward sloping yield curve. This upwardly sloping curve (in excess of the slope that allows for the risk factor) cannot be sustained since it sets in motion forces that are working towards the flattening of the curve.

An easy monetary stance prompts investors to borrow money at lower short-term interest rates and invest in higher yielding longer-term investments. This in turn puts upward pressure on short-term rates and downward pressure on long-term rates.

To sustain the positive sloping curve the Fed must persist with its easy stance. (Should the central bank cease with its monetary pumping the shape of the yield curve will tend to flatten).

The loose monetary policy of the Fed gives rise to various activities that prior to loose policy were never on the cards – an economic boom emerges. (The loose monetary policy leads to a shift of real funding away from wealth generating activities towards less profitable activities).

Whenever the Fed reverses its stance by slowing its monetary pumping and in the process raises short-term interest rates various activities that emerged on the back of the previous loose stance are now coming under pressure – this sets in motion an economic bust.

A tighter stance manifests itself through a flattening or an inversion of the yield curve. In order to sustain the narrowing in the yield spread the central bank must maintain its tighter stance.

Should the Fed abandon the tighter stance, the tendency for an equalisation of rates will arrest the inversion of the yield curve.

Whenever the Fed reverses its monetary stance, which manifests itself through the change in the shape of the yield curve, the effect of this change in the stance doesn’t assert itself immediately on the entire economy.

The effect of a change in monetary policy shifts gradually from one market to another market. It is this that prompts the change in the shape of the yield curve to be seen as a leading indicator of economic activity.

For instance, when during an economic expansion the Fed raises the fed funds rate target, which causes the narrowing in the yield spread, the initial effect is minimal for economic activity is still dominated by the previous easy monetary stance.

It is only later on once the tighter stance begins to dominate the scene that economic activity begins to weaken.

Likewise, when during a recession the central bank lowers the short-term interest rate this steepens the yield curve. However, the effect of this loosening, which is manifested by a steepening in the yield curve only asserts itself after a time lag.

Observe that according to the popular framework of thinking it is not the central bank that alters the shape of the yield curve but people’s expectations.

Consequently, according to this way of thinking via a close scrutiny of the shape of the yield curve, one can establish people’s psychological dispositions and thus the future course of the economy.

To the extent that investors form expectations regarding the future course of monetary policy, this only tends to reinforce the shape of the yield curve as set by the central bank.

Thus in the late stages of an economic expansion investors begin to anticipate a tighter monetary stance and this tends to reinforce the upward slope of the yield curve. Investors begin shifting their money away from long term- securities towards short-term securities. This lifts long-term rates and lowers short-term rates.

During an economic slump investors begin anticipating a further easier monetary stance and the downward slope of the yield curve is reinforced. Investors shift their money towards long term securities away from short-term securities.

This means that the dominant factor behind the shift in the shape of the yield curve is the central banks’ monetary policies and not investors’ expectations as such. At best, expectations can only reinforce the slope of the yield curve.

Hence the reason for the predictive powers of the yield curve is not on account of expectations but rather on account of the monetary policy of the Fed.

Things, however, need not always work this way. For instance, if the pool of real savings is declining, the pumping by the Fed may not lift economic activity.

On the contrary, such pumping will deplete the pool further and make things much worse.

For instance, in such a set-up an upward sloping yield curve will not send a correct signal regarding the future course of economic activity.

We can thus conclude that as long as the pool of real savings is expanding the yield curve will appear to be a useful forecasting device.

Once, however, the pool of real savings becomes stagnant or declining the illusion that the central bank can navigate the economy is shattered.

Hence, commonly accepted signals that emanate from monetary policy are likely to be of a confusing nature as far as the future course of the economy is concerned.

In such a scenario relying on monetary indicators such as the yield curve could lead to a misleading analysis.

This is the most concise and informative article ever written.

When the economy starts falling into recession it is because the pool of savings has shown not to be sufficent to fund all the (mal-)investment created during the preceding (artificial, in this case) boom. This creates a run for funds on the short-term market (entrepreneurs look for sort of bridge-loans to jump the moment) which inverts the curve (i.e. negative 10y-3m spread).

If, during a recession, interest rates are low is only because of the Central Bank interventions who want to falsify market signals (issuing money pretends to hide the real shortness of savings). Approaching the bottom of recession, when enough excess economic activity has been erased (not only malinvestment, probably), the funding market can ease its tensions and interest rates lower.

In Europe, on the onset of the crisis, Euribor jumped upwards and IRS went down (everybody expected a flow of central money to fix the crisis); the ECB stepped in to lower Euribor and re-create an upwards sloped curve (and we know this is just avoiding the necessary Austrian market cleansing). A low curve, be it upwards or not, is not consistent with an ongoing recession (real savings are scarse, their value should increase).

In the USA an increasing debt is coupled with historically low rates, and fears of a double dip are coupled by near-zero fed funds… this is not a market, this is Fed bureaucracy.

With no active Central Banking, the curve would simply be almost stable and upwards sloped (unless some external events – technologic shocks or else – or changes of preferences which can redifine the time-structure of the economy) to reflect the increasing counterparty and liquidity risks.

Yes sir Shostak, Central Banking distorts the price of time.