One rationale for quantitative easing is that it encourages economic growth. This must be based on the belief that monetary inflation is good for the economy. But as the great economist Ludwig von Mises points out in The Theory of Money and Credit(1912) this is a misconception. In his words: “it is a mistake to think that the depreciation of money stimulates production”. Instead, the economy is distorted, with those closest to the QE engine benefiting most, while those furthest away lose out.

We see this today, with the finance industry doing very well despite on-going problems in many other sectors of developed economies. This spreads out to all the service industries within commuting distance for bankers. In London and New York everything is busy and prices are high, and lucky is the tradesman servicing the wealthy in the suburbs. At the other end of the scale are humble workers and farmers in the provinces, and pensioners whose meagre savings are being depreciated by rapidly rising costs in food, heating and other basics. When Mervyn King, the Governor of the Bank of England, was asked about the plight of savers (mainly pensioners), he expressed sympathy for them but insisted he would not “push Britain into a recession” just to help them.

So let them eat cake. The truth is that monetary inflation distorts markets into winners and losers, and unfortunately pensioners are stuck in their voting habits so are not worth wooing: they lose.

The other Keynesian fallacy is that deficit spending can get economic recovery going by appealing to the private sector’s “animal spirits”. This is true in the sense that false credit, by replacing genuine savings, can get businesses and consumers to accelerate their purchases; but that is a short-lived credit-driven cycle that merely reverses later, and has been tried so often that animal spirits have pretty much evaporated.

The inflationary consequences of these macro-economic experiments will be far more disruptive in the coming months than appears likely today. We are now entering winter for the Northern Hemisphere and energy demand will pick up; and with production constraints (notably Peak Oil) there is only one way for energy prices to go. Furthermore, food is energy-intensive to produce and deliver, requiring considerably more oil-based energy to produce than the calorific output of the food itself.

Higher energy costs will affect other aspects of our lives, and nowhere is this more important than in the production of raw materials, particularly those that are mined. A paper published on ZeroHedge last Monday analyses the impact of energy costs on silver mining. The message is clear: Peak Oil also means Peak Silver, and Peak lots-of-other-things as well.

It is against this background of a growing imbalance between falling supply and static demand for energy and raw materials that central banks are injecting large quantities of new money. It matters not whether the process is done formally through QE, or informally through an open cheque book; the effect on prices for basics from this winter onwards is potentially explosive.

But as von Mises pointed out, it is a mistake to think that the depreciation of money stimulates production. So it will not be demand that chases these prices higher, but expanding quantities of money that have already occurred and are yet to occur.

This article was previously published at GoldMoney.com

Of course peak oil means peak everything else. The adoption of oil in the late nineteenth century was an immense boon to economic growth. Too much of the last 120 years has been pretending that drawing down that capital has been an income stream.

The current economic policies are clearly a method of attacking what neoclassical economists see as the main cause of a prolongation of an economic depression/recession/downturn, namely the downward stickiness of wages, i.e. inflation is intensifying the distribution of national product away from real wages to profits. A trend that has been established in the USA for some 30-40 years.

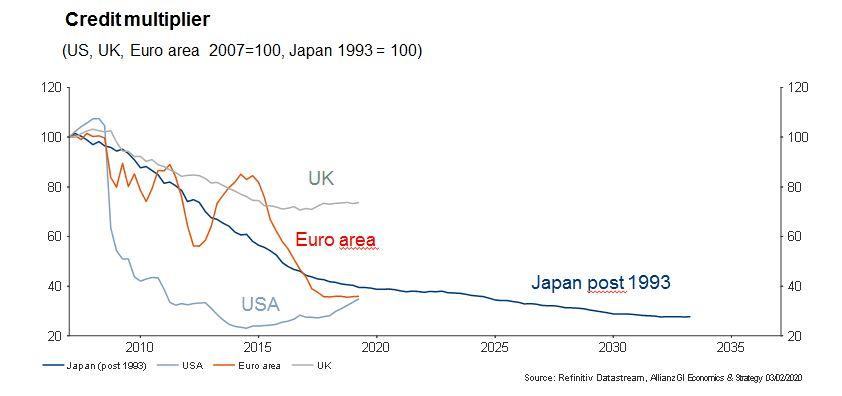

The reason that QE will not work is that the money multiplier model of money creation is entirely false: private banks create money through advancing loans and then sort out their reserves later. In our current situation the creation of money by the private sector occurred in the period (20 years in this country 40 years in the USA) to the bust. They are now sorting out their reserves (and their survival) through the happy (for them) bounty of QE, whilst the Neoclassicals in the Treasury and the Fed still think that it will encourage them to advance credit.

Credit, of course is a social good when used productively. I think it was Schumpeter who pointed out that the people with the productive ideas aren’t necessarily the people with money. The problem arises where credit is advanced for non-productive purposes but to bet on increasing asset prices. When asset prices fall and the hoped for increase in income does not occur then we get in difficulty.

We especially get into difficulty when banks are not allowed to fail because then the credit that should not have been created has to remain in situ because it is an asset of these precious, delinquent and dangerous organisations.

Schumpeter?! more likely Schumacher. Good point though, when production consumes the means of future production most of what are considered captial goods are not. The creation of money through the consumtion of a finite resoure is just as inflationary as printing.