Another week of creeping Euro-consolidation was the backdrop to a further round of severe market stress which briefly saw Spain trade at 500 over, and France at 200 over Bunds.

As the clamour accordingly mounted for the printing presses to be fired up—and with rumours swirling that the latest fudge would have the Bank lend money to the IMF so it could keep the credit junkies safe from cold turkey while preserving the fiction of the ECB’s virginity—Draghi’s boys righteously set themselves foursquare against monetizing any more than—oh, the odd €20 billion in government bonds a week— a figure which is around 60% more than the Fed’s average QE-II add and which laudable stringency would only make room for the small matter of €1,100 billion a year, or more than 10% of Eurozone GDP, in injections!

Thank heavens, they’re not going the Weimar route, then!

Showing just how deep the antipathy to this runs, CSU General Secretary Alexander Dobrindt waxed positively incandescent about Draghi’s actions, telling Die Welt that the Bank risked a ‘toxic shock’ from all the ‘putrescent paper’ he was buying. Dobrindt went so far as to wonder if the man from an over-indebted ‘Dolce Vita land’ would become the ‘most expensive’ President ‘of all time’ and stated bluntly that the Germans would never have agreed to the formation of such a central bank if it had been imagined that ‘Italian principles’ would one day inform its actions!

Meanwhile, pressing on against the opposition of even such allies as Dobrindt and Roesler, Chancellor Merkel seemed determined to exact a major surrender of fiscal sovereignty from all the Zone’s debtor nations, current and future, by setting up a German-led Star Chamber to oversee their finances—as the leak of the Irish budget by an unknown member of the Bundestag (yes, you read that correctly) showed up in exquisitely embarrassing fashion.

Love him or hate him, you have to admit that Sinn Fein’s Gerry Adams had a point when he said that there was little point conducting a 900-year struggle against British hegemony if his countrymen were going to hand the reins straight over to a group of outsiders residing in Brussels or Berlin instead.

All this Teutonic uprightness also excited the public exasperation of Luxembourg’s Junckers who rashly pointed out that even Germany’s fiscal glass house might not withstand too purposeful a shower of stones, but it has also generated a good deal of green-eyed rage in an EU Executive which supposedly wants the nation to ‘pay something back’ for its highly inegalitarian enjoyment of record low interest rates.

There are, of course those whose frustrated inflationism will stop at nothing to whip up popular support for their delusions. We have already been told that ‘austerity’ – i.e., the act of foreswearing the further practice of a disastrous profligacy – is self-defeating, as if living within our means and pricing our services to the level at which the market will buy them is to do nothing but deliver ourselves to the very gates of perdition.

It is so common an approach as almost to be a literary trope that, whenever the talking heads wish to scare us into doing something which we instinctively feel is wrong, they invoke some half-digested – or deliberately slanted – parallel with the 1930s. None of these are so emotive as the supposed disaster which was Heinrich Brüning’s ill-starred Chancellorship of Weimar Germany, a term of office during which he provided the doomed deflationist counterpoint to the mythically successful, unalloyed inflationism of Roosevelt’s New Deal, a failure of vision which was given the blame for the rise to power of Adolf Hitler’s NSDAP.

Yet, if we take a newly objective look at Brüning, with a view to drawing lessons for today, we need to do more than mindlessly intone the verdict, unfailingly delivered with squint-eyed, Keynesian hindsight, that Deflation=Totalitarian horror.

True, the exercise in counterfactuals itself will prove only what all such chains of What-ifs are capable of doing; viz., that history is a tale of inextricable contingency far more than it is one of dull inevitability – whether Whig or Marxian. Nonetheless, the fact remains that if the example of Brüning teaches us anything outside of the narrower economic argument it is that there is nothing so effective in undermining faith in representative institutions as the imposition of unpopular policies by decree under the pretext of ‘national emergency’; nor is it helpful to the cause of their acceptance if such measures are at least partly attributable to pressures being exerted by foreign governments.

‘Technocrats’ and Goldman alumni, this means you!

Indeed, it was Brüning’s recourse to the system of Notverordnungen (Emergency Acts) permitted under Article 48 of the Weimar constitution which set the awful precedent for the Nazi’s later consolidation of their grip on power, however expedient such measures seemed at a time when political consensus could not be achieved – and, to some extent, was actively precluded by President Hindenburg’s visceral distaste for any suggestion that the Social Democrats be included in such discussions.

Outside of this – and playing a role both complicated and complicating – was the issue of the ‘fulfilment’ or otherwise of the reparations imposed under the terms of the Versailles Treaty and the opportunity these offered to the mischievous for decrying any policy of domestic restraint, however advisable that may have been at any given juncture.

Here it should be noted that there are those who see the hyperinflation of the early 1920s itself – an almost inexplicable episode of mass insanity, absent such a hypothesis – as a consequence of a deliberate programme aimed at only paying the victors their tribute in a vastly depreciated mark. Less equivocally, it was the ‘success’ of the Dawes scheme of easier repayments of these exactions under the outside creditors’ supervision of German budgetary policy which encouraged a flood of mostly short-term funds into the country. With a weary, contemporary familiarity, this influx served to ignite a pre-Depression boom which was rife with private malinvestment, public sector excess, and too great a degree of ‘maturity transformation’ on the part of the giant, TBTF banks (the so-called ‘D-banks’, in particular) which had become both over-reliant on such ‘hot’, wholesale deposits and desperately stretched as regards their own capital ratios.

Once again, then, we can see the problems of the 1930s arising not so much in the misplaced application of that inflationist straw man, ‘classical orthodoxy’, but in the vulnerabilities built up during the preceding period of specious prosperity and over-easy money. Thus it was that the world economic structure became ever more distorted in the preceding, ‘Roaring’ decade, thanks to the meddling of a clique of interventionist central bankers – the Fed’s Strong and the BOE’s Norman to the fore. Their abiding aim was to avoid any and all short-run economic sluggishness via a deliberate exploitation of the extra elasticity inherent in the prevailing gold exchange standard in comparison with the tighter constraints of the gold standard proper, and hence, by the concerted suppression of interest rates (each a determined violation of the rules of sound, ‘classical’ finance, you will note).

Amid such a milieu of misplaced optimism and over-extended obligation, a strong case can be made that the critical dislocation which triggered the subsequent worldwide collapse was not so much the fabled Crash of ’29, but the sudden freezing of new credits to a booming German market whose leaders were showing a marked reluctance to accede to the terms of the proposed replacement for the expiring Dawes Plan, as set out under the chairmanship of the eponymous Owen Young. Much as we rediscovered in the aftermath of Lehman’s failure, such a disruption can occasion just as much immediate pain in the current account surplus-lender economies as it can in those of the deficit-borrowers with whom they are fatally intertwined. The repercussions for 1930s USA were of a kind..

Be that as it may, when German business was first forced to face up to the withdrawal of a good deal of the artificial demand which had sustained it though Pharaoh’s seven years of fat, the decision was taken to restore price competitiveness by what is today termed ‘internal devaluation’ – i.e., by a general lowering of prices, wages, and government expenditures, rather than through monetary expansion and currency debauchery. Understandable enough in light of what the country had been through just seven short years earlier.

Though later decried in the most intemperate of terms, in fact the policy initially met with a not inconsiderable degree of success: imports declined in value more than exports and there was even a resumption of international lending as confidence was briefly rekindled by this evidence of a restored competitiveness at home and by a rebound in business activity abroad.

As we all know, this proved to be a false dawn – a cruel disappointment which was not so much the fault of Brüning’s faulty economics as the helplessness of one, lone country trying to counter the effects of a whole series of botched decisions and acts of deliberate malice being practised by its neighbours.

The 1930 passage into law of the infamous Smoot-Hawley tariff made the task of everyone, everywhere, involved in cross-border trade (and in Germany that was perhaps a third of the work force) more difficult – not least those American farmers who were deprived of their overseas custom by those who could not now earn the means by selling goods to them and their countrymen. As the grapes of wrath were trampled out in the fields of heavily-mortgaged agriculturalists, their deepening plight brought down their own bankers by the score.

Next, the proposed German-Austrian Customs Union (or free trade agreement) – which was intended to give both struggling, post-war rump nations a larger market in which to deal – was not only vetoed by the French, but actually saw Paris orchestrate a run on their banks by way of a reprisal which first folded up the long-sickly Austrian Creditanstalt in May of 1931, then the mighty German Danat bank in July.

Despite President Hoover’s forlorn attempts to broker a solution under the aegis of the moratorium he called on war debt payments that June and despite, too, some half-hearted international central bank collaboration intended to tide the nation over its difficulties, this represented another, near-mortal blow for the hopes of any German revival.

As the dominoes toppled, each upon the next, the largest of them all – the British one – started to teeter. Having carried on a sizeable ‘carry-trade’ of borrowing short term French francs to be loaned at a longer-term premium into Germany, British banks were acutely sensitive to conditions there. Worse still, the thinly-capitalized acceptance houses – brokers of short-term trade credits-cum-monoline insurers – were left reeling when all private credits were also locked in, in the wake of the banking collapse.

At this critical juncture, Britain’s exposure was made more explicit by the publication of the parliamentary Macmillan Committee report into the ability of its financial system to foster industrial growth – a report whose findings were heavily influenced by the Beelzebub of Bloomsbury himself and which therefore contained calls for a ‘managed currency’ and for a further diminution of the role of gold. Not surprisingly, a drain began at once which was not, however, addressed by the time-honoured method of tightening domestic policy, a reluctance which only increased doubts as to the Bank of England’s resolve to defend the status quo.

With similarly ill-omened timing, another parliamentary report – this one issued as the result of the investigation of the May committee – almost simultaneously called the nation’s fiscal position into question and proposed a drastic cut in expenditures and government salaries as a remedy. When news of the last of these provoked a short-lived mutiny among the most affected junior ratings of that part of the British fleet then anchored at Invergordon, it seemed as though Britannia’s unquestioned suzerainty over the waves had been cast down; that the existing order was about to be overthrown; and that the world would soon be delivered wholesale to the clutches of Bolshevism.

Amid the tumult this unleashed, the fateful decision was made to take sterling off gold and so one of the twin pillars of the global financial system was allowed to crumble – the one upon whose considerable girth that system had largely been erected over the preceding century and a half of benign liberalism. The shockwaves were truly seismic, even tectonic, not least because of the craven pusillanimity of the British defence. As the news reverberated around the globe, a foredoomed struggle for liquidity set in – not least on the part of those other central banks naïve enough to have taken Perfidious Albion’s assurances of good faith at face value and who had either lost reserves, or indeed, suffered a complete capital loss, as a consequence.

In the chaos which ensued, an already etiolated world trade shrunk further and prices once again plunged as competitive devaluations followed one upon the other, to the accompaniment of rising tariff barriers, unbridled monetary manipulation, the imposition of foreign exchange controls and a widespread descent into autarky.

Is it any wonder that the Brüning programme was swept away in this deluge? That unemployment climbed, the state finances worsened anew, and that the soap-box appeal of extremists, both to the left and to the right, mounted among a citizenry too long denied a say in its material destiny?

Having fallen out with that reactionary old dinosaur, Hindenburg, over the proposal to allow jobless Germans to take holdings in the estates of the most hopelessly-bankrupt of the already subsidy-engorged Prussian Junckers, Brüning was summarily dismissed in May 1932, while awaiting a formal resolution of the reparations issue at the Lausanne Conference and ahead of what seemed the long-awaited trough in business activity.

As the man himself claimed, he was ‘a hundred meters from his goal’ when he was ousted. He may even have been correct: the US stock market was about to engage in a 70% rise as industrial production there rose 15% in the course of a few months. Other countries saw a similar bounce and, had it not been for the fraught nature of the autumn electoral contest between the ‘Great Engineer’ (read: the dirigiste busybody) Hoover and the ‘Great Dissimulator’ (the ineffable and utterly amoral self-aggrandizer) Roosevelt which managed to excite one last wave of currency turmoil and American banking failure, that might very well have been that.

So, should Brüning have cut and run? Perhaps. But then again, perhaps not. Did Brüning pave the way for the Nazis? Perhaps. But perhaps it was the legacy of the industrial slaughter on the Western Front and the radicalization of politics which this entrained among a blighted generation. Perhaps, it was the shockingly vindictive nature of the settlement at Versailles. Perhaps it was the bonfire of Weberian values – and capital means – which was the hyperinflation. Perhaps it was the intrusive nature of government interference in every nature of the economy which existed long before Schacht and Goering were squabbling over its commanding heights.

One thing is for sure, for today’s Europe to follow the dire, plutocratic precedents of the Federal Reserve while eradicating what remains of its loose confederalism is more likely to lead to the successors of the Freikorps and the RoterFrontkämpferbund battling it out on the streets of its cities than is the fearless pursuit of individual solutions to individual problems accompanied by a restoration of budgetary discipline to each of the member states. The alternative, as one of the financial experts of the FDP parliamentary group, Frank Schaeffler told Handlesblatt with a clear Hayekian echo, is a “Road to Serfdom,” charging that Barroso – after all, an ex-Maoist – “wants to create the European super-state, without asking the citizens.”

Meanwhile, our once highly-interconnected markets remain shattered into dysfunctional shards of notional (not always actionable) pricing.

Euribor-OIS spreads have widened out to more than 90bps, the highest outside the Lehman spike itself. EUR-USD basis swaps have lurched southward into a similarly deep –90bps in sympathy. Bid-offer spreads are wide and forward forex doesn’t necessarily arbitrage. The concept of general collateral has been sundered into two, mutually exclusive halves, with Bunds—which everyone wants—trading special and the rest—which they decidedly do not—widening out by the day. It is also reported that access to funding has become so restricted that banks are pledging their loan books to eager US counterparts as security for the repo of paper eligible to be discounted at the ECB in turn.

Amid all this strife, one of the mysteries has been just why the euro itself has not cratered. Whence arose the interruption to the slide from its prior 15% appreciation—a move which was testimony to the destructive power of a Fed whose masters routinely presume to lecture others on the morality of suppressing their currencies? This rise was, in fact, accompanied by a €470 billion borrowing unwind, in the form of a vast flood of money paid back by foreign banks to their creditor US offices, yet even this could not o’etrump the Fed..

This otherwise paradoxical forex move can only be explained if we assume that the borrowings must have been funding US dollar assets, rather than being devoted to a classic carry-trade, per se—a supposition we can further extend by noting the simultaneous explosion of cash assets on the books of the US subs. This replacement entry grew by a similar $500 billion during that period and may thus have reflected the sale into the US of dollar-denominated securities formerly held abroad and either delivered directly to the Fed, or as substitutes to those who had relinquished their own Treasuries to its NY desk and who now wished to disembarrass themselves of some of that newly-created, QE-II cash.

As some in the market still insist—at the disingenuous prompting of Chairman Bernanke himself—this was not an inflationary act, but merely an ‘asset swap’, to which contention we must reply again, ‘Yes! But a swap of non-money for money—i.e., a deliberate act of inflation!’

After all, was the Fed’s avowed intention not to trigger some of its fabled ‘wealth effects’ by boosting asset prices; did it not ramble on about reducing real yields by pushing up both current and expected consumer prices; did it not even fantasise about the supposedly stimulative effects of dearer crude oil?

Be that as it may, as bank stocks have plunged and sovereign spreads ballooned; as European macro data has rolled over and that in the US has received a fillip which may turn out to be no more than a post-Fukushima renewal of car production, why has the Euro’s decline been thus far so limited?

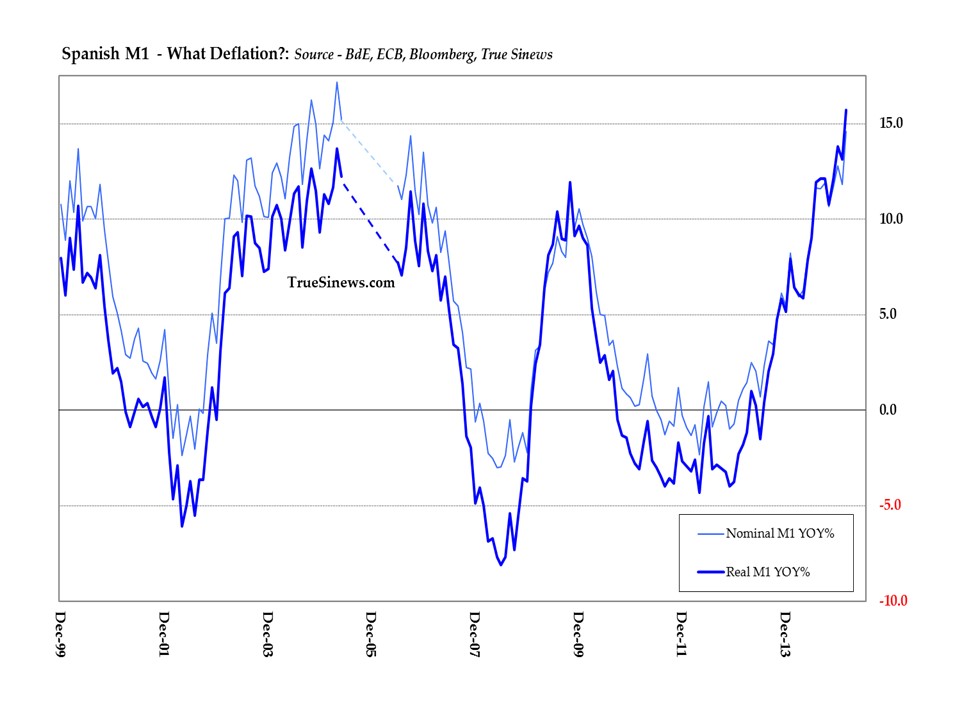

Once clue might lie in the fact that, since August 2010, European money supply has crept, grudgingly upward by a miserly 1.5%, while that in the US has roared away by a massive 16%. Let no-one tell you that Blackhawk Ben has been slacking in his attempts to refloat the economy on a green tide of money illusion while his ECB colleagues have been models of temperance in comparison

In fact, taking a look at the size of the divergences from the long-term, 2.8%-compound, real rate of growth to which US money supply has generally cleaved since the end of the Great Inflation, this particular incarnation of the all-knowing Oz in the Marriner S Eccles building has presided over both a slump to the greatest negative value of that divergence and a rapid reflation to its second highest level in the record.

Is it any wonder that asset market behaviour has been wild; that forex parities have fluctuated sharply; that interest rates and credit spreads, both, have been highly erratic as a result? Is it any wonder that business executives, owner-managers of smaller enterprises, and ordinary folk, too, have been left bemused and befuddled, too fearful of whatever new policy ’fix’ the morning papers might announce to get on with the business of building a genuine, new prosperity amid the Potemkin wastelands of the old, false one? Hardly!

.

Sean, Thank you !!! – this is by far, the most insightful analysis of Weimar’s fiscal and monetary failings I have ever had the pleasure of reading!

I note that Germany did not clear its war reparation debt of WW I until October 3 2010 – and even then nur Pfennige auf dem Mark.

Will it take us at least 92 years to clear the detritus of today’s Augean stables?

Whenever I read your purple prose, I do not know whether I should slit my wrists or construct a bunker. Should we be investing in ammo and canned goods until this Schießerei auf Drei Akten plays itself out?

Of course the European Central Bank (ECB) is already producing money (from NOTHING – by the standard book keeping tricks and so on) to buy government debt – including Italian and Spanish govenrment debt.

What the Economist magazine (and the rest of the British establishment – including the British government) really want is not just for the ECB to buy government debt, but for it to do so (with money it creates from thin air) on an UNLIMITED SCALE.

This must always be kept in mind.

As for the European Union.

Like the modern American government it ignores its own laws.

In the E.U. case….

When Anglo Irish bank went down in flames there was no question of “state aid being illegal” (as it is supposed to be under E.U. law), on the contrary – the Irish govenrment was told (by the Germans and others) that they must stand by Anglo Irish bank (and the rest) even if the cost bankrupted Ireland.

As for the Euro bailout (of Ireland, then Greece then…) they are illegal as well – but again Euopean Union law is ignored.

Just as it is also illegal for the European Central Bank to buy government debt – but, I repeat, it is already doing that. And has being doing it for quite some time.

This is not government by laws – this is government by men, the ARBITRARY WILL of men.

Aristotle would weep.

This is no organization that any nation should be part of.

Paul,

From twenty or perhaps thirty years ago an opinion was being formed that would today change the economic architecture and power structure of the world.

Whereas it is true that Aristotle’s proairesis is the forerunner of the will,

(Hannah Arendt “The Life of the Mind”, San Diego, Harvest Book, 1978 One-volume ed., introduction to Volume II, p.6)

it was only with Jean-Jacques Rousseau (and reading Rousseau, Immanuel Kant) and GWF Hegel that what older authors had described as OPINION (ratio) was substituted by WILL (voluntas).

Opinion became suspected because it was contrasted with incontrovertible knowledge of cause and effect and a growing tendency to discard all statement incapable of proof.

Yet, the order of an Open Society and all modern civilisations rests largely on opinions which have been effective in producing such an order long before people knew why they held them and in as great measure it still rests on such beliefs.

(Friedrich August von Hayek, “The confusion of language in political thought with some suggestions for remedying it”, London, Institute of Economic Affairs, Occasional Paper 20, 1968, p.21)

The problem is of course that the dollar regime is backed up by the industro-military complex.

Let the ECB print out nothing.

FreeGold means that the euro has a gold component and a paper component, and puts a “FIREWALl” between both so that gold’s valuation as a wealth-preserving asset cannot be pulled lower by the inevitable inflation of the paper component of circulating currencies. It is the (quarterly) marking to market (MTM) of the gold reserves of the European System of Central Banks (ESCB) , not to the Bretton Woods model of $42.2 like the USA central bank (originally $35), by the ESCB which provides that wall.

The value of the euro does not depend on the finances of the governments established on euroland.

The value of the euro depends on the gold reserves of the ESCB which are marked to market (-price) on a quarterly basis.

The ECB is the guardian of the euro – not of the governments established on the area where the euro is legal tender.

ECB chief Wim Duisenberg said in 2002 upon receiving the Charlemagne Prize in Aachen that

the euro is the first currency that has not only severed its link to gold, but also its link to the NATION-STATE.

http://www.ecb.eu/press/key/date/2002/html/sp020509.en…html

Upon receiving the same prize in June 2011, his successor, Jean-Claude Trichet, said:

The {Maastricht] Treaty has mandated the ECB to keep safe the money of Europe’s citizens [not the governments established on euroland]

http://www.ecb.int/press/key/date/2011/html/sp110602.en.html

The architecture is in place. Howard Roark, where are you?

Let the europarty begin.

Sean,

Noting a decline in American TWI would seem to indicate that the greenback is depreciating against the currencies of its major trading partners…

I always wondered how America’s “emerging” trading partners (esp China) could be experiencing inflation while America somehow remains immune… this concern is compounded by the realization that America’s trading partners’ own currency appreciation may in fact be masking the real extent of their latent inflation.

I just don’t get it!

You wondered out loud: “..one of the mysteries has been just why the euro itself has not cratered.”

Is not greenback buoyancy even more bewildering?

I just shake my head and purchase physical gold as much as I can, wondering (as I mentioned before) whether I should be purchasing ammo and canned goods while putting a wood stove in the basement.

You mention the Danatbank. Hjalmar Schacht was one of its directors before becoming Germany’s central banker. During the Weimar fiscal and monetary melt-down – this plutocrat was reduced to raising vegetables and keeping a goat in his Berlin backyard in order to keep his family fed.

He was lucky to be one of the privileged few to have a backyard.

Narrating that whole story again and replace the name Hjalmar Schacht with Alan Greenspan or Henry Paulson… gives one pause n’est ce-pas? Your clarion warning of impending violence and bloodshe is most à propos!

“Harare we there yet?”

I do not believe that the European Union will turn out to be a bastion of hard money, compared with the more inflationist US and UK. I think that European Union is now better seen more cynically as a structure whose preservation is in the interest of the administrators of the bureaucracy who extract money and power from it.

In order to cement their dream of a fiscally integrated Europe, the Euro-elite selectively apply pressure on the various different sovereign governments through the bond markets and Intra-euro transfer mechanism, TARGET2. The deal is simple – central bank support of government debt markets in exchange for a fiscal union.

The ECB already has it in its power now to create a full debt-transfer union without permission from sovereigns. This is shown by the repeated breaking of its mandate in its bond purchases as well as the relaxation of collateral requirements from sovereign central banks in the TARGET2 clearance process whereby national central banks are able to effectively pass national debts back to the ECB, thereby socialising them.

The ECB chooses selectively not to purchase bonds not so as to adhere to hard money principles, but in order to pressure national governments to submit to greater and greater fiscal union.

The resignation from the ECB of two Bundesbankers Jurgen Stark and Axel Weber from the boards of the ECB and Bundesbank respectively can be seen as evidence that these two hard-money advocates no longer believed that they could influence policy within the ECB, and felt that resignation was the only remaining way of making their point.

The personalities behind the actions of the ECB are what is currently important. They are all Euro-integrationists from Draghi downwards.

I would also contrast the differing attitudes taken on Ireland and Greece as evidence to support this view.

Ireland nationalised its banks, put into place an austerity package and did as it told. In return, the Eurozone put into place an Emergency Liquidity Assistance measure whereby the Irish banks (through the Central Bank of Ireland) can ask for cash loans from the ECB WITHOUT ANY REQUIREMENT TO PLACE COLLATERAL with the ECB. As a result of this, the Irish debt builds up at the ECB under TARGET2. This imbalance continues to build and the “emergency” facility has now been in place for 2 years.

By contrast, Greece has no such facility though the ECB has been buying some Greek sovereigns directly.

The point is that the Euro – far from being a hard-money zone as – is selectively hard or soft depending upon whether the various sovereigns cede political power.

European nations have had a history of state control, whereas the US and the UK have had a history of trust in the self-coordination of free markets. It would be a strange thing now if it were the case that the UK and the US, in response to similar problems to those of the Eurozone had embraced central bank state-subsidy while those in Europe take the more-difficult, hard-money route out. It is my view that the ECB will be hardline until the point that the peripheral countries give up sovereignty. Following this, easy money will likely flow.

Of course, the Euromasters may have overplayed their hand now that sovereign wealth investors are writing Euro-denominated assets out of their benchmarks. This may be an example of “be careful what you wish for” for them