Anybody with any knowledge of economics should feel uneasy at the sight of a country where half of recorded economic activity is conducted by the state. Are such semi-socialist societies operable, and if so, for how long? That complete socialism is impossible and that any attempt to establish it must fail, we know for sure since Ludwig von Mises explained it in detail in 1922 with his masterly Die Gemeinwirtschaft (Socialism). The only reasons that the Soviet Union did not collapse earlier but managed to drag out its persistent economic decline for seventy-odd years are that it introduced full socialization to no more than seventy percent of its economy, and that it had its bureaucrats constantly peek through the Iron Curtain and observe market prices in the capitalist West to be able to conduct at least a bare minimum of rational economic calculation at home. Without such capitalist crutches Lenin himself would for sure have witnessed the demise of the socialist state in his own lifetime.

On the basis of economic theory and historical experience, the life expectancy of a societal model with 50 percent or more government control over the economy does therefore not look promising. The taxing, resources-consuming state-parasite must constantly weaken and sooner or later kill the productive and wealth-creating market-host. When does this happen? Well, we are about to find out, as we are now all part of some gigantic real-life experiment, bravely conducted by the current policy establishment in Europe and elsewhere at our own expense and that of our children. Across the EU, the share of government spending in the economy is already around 50 percent, depending whose numbers you believe. If we could account for regulation and interventionist legislation, the state’s grip on economic decision-making is certainly larger. To call such an economy capitalist is a joke, albeit perhaps not as cruel a joke as the one the economy itself, with its persistently anaemic performance, is playing on the Keynesian economists and their ridiculous clamour for ever more government spending to boost ‘aggregate demand’.

The only thing you have to believe in is consequences and you will be able to see why we live in economies of stagnant real incomes, lacklustre growth and ever-growing public debt. So when a rating agency such as Standard & Poor’s comes out and knocks the credit ratings of some of Europe’s finest down to AA+, the only sensible reaction is to gasp in shock: “What?! These countries are still AA+!?” –Remember that the AAA-rating used to denote that the issuer was at NO risk of default. Whether that is a sensible assessment of any issuer is a different question but to assume that any of the European states should deserve this credit standing although all of them (and that includes Germany) embrace the European brand of socialism lite and are therefore on a slippery slope to fiscal disintegration, seems bizarre.

The bailout delusion

Yet, the news of the downgrades of France and Austria did shock the political establishment, which is not used to be confronted with the prospect of fiscal finality quite so bluntly and disrespectfully. In and of themselves, the downgrades are, of course, meaningless. They reflect just another opinion, and with its AA+ rating for these countries, Standard & Poor’s is still extremely generous. But the downgrades have now had a knock-on effect on the rating of the European Financial Stability Facility (EFSF) – no snickering please!

The EU bailout bazooka can hardly be rated better than the individual members that, collectively, foot its bill. With more and more countries approaching a fiscal paralysis of their own, the fund is facing a growing number of bailout candidates but a dwindling number of capable sponsors. This is, I would like to advance, pretty straightforward and should not require deep thinking. But for whatever reason this logic has escaped the mainstream up to now. For months and months, media commentators and numerous financial market economists have told us that the solution to the debt crisis involves ‘fiscal integration’. Just like ‘policy coordination’, ‘fiscal integration’ is one of those phrases that come with warm feelings of solidarity and fellowship. “If we all just pull together and help each other we will weather this storm.” Of course, all of this sounds quite different in parts of the English media, where it triggers fears of political centralization and the creation of a European super-state. No question, political centralization and bureaucratization will advance in coming years – at the further detriment of market forces and individual freedom. But in the context of the debt crisis, one thing is clear: ‘fiscal integration’ cannot logically constitute a solution to the current predicament. ALL members of EMU have fiscal issues of their own, and systematic and structural issues at that. ‘Integration’ would be conceivable (which does not mean it would be advisable) if only a few members faced fiscal challenges and the others were healthy. That is not the case.

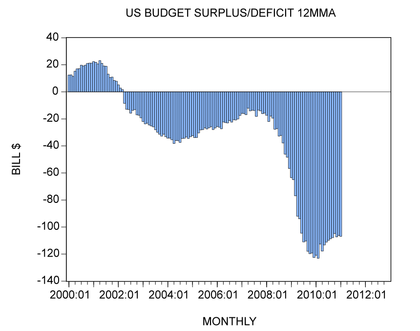

The differences between the fiscal trajectories of the various states are of degree only, not direction. Even the relatively stronger members of the club suffer from habitual overspending and self-inflicted fiscal decay. Last year the German state collected more taxes than ever, yet still ran a budget deficit. The idea that combining a number of sick states makes one healthy super-state is nonsense. Make no mistake, we will certainly get the European super-state but not because it solves the debt crisis, but only because further centralization of political decision-making suits the interests of the political establishment, and because it fits their belief that every problem requires political solutions and thus more government.

Some will argue that what is really happening is not so much ‘fiscal integration’ but ‘austerity’ imposed by Germany. Well, it has to be said that the idea of drastically cutting these countries’ expenditures is a lot less silly than the idea of pump-priming their economies with cheap cash and funding government spending via the printing press. What is needed is indeed a drastic shrinking of the state as this is the only way to lower the debt burden and to reinvigorate the economy. Such a strategy would require wholesale withdrawal of state activity from large parts of the economy (I would recommend withdrawal of the state from all parts of the economy!) but that is not on the agenda at all. Instead, what is being tried is to lower these countries’ dependency on the debt market in the short term through a combination of expenditure cuts and tax increases (or more efficient tax collection and thus more state control over resources). This, it is hoped, should then calm down the bond market and lead to lower borrowing costs. So far, this strategy is not working, in my view, as it has not sufficiently impressed the bond market. These policies are just too little too late, even if they may look draconian against the backdrop of deep-rooted and unrealistic expectations of the limitless welfare state. The sporadic tightening of spreads in recent weeks was most certainly not in response to convincing ‘austerity’ measures but the result of the gigantic injection of new money from the ECB into the banking sector in December. By design a lot of this newly printed money has found its way into the respective local bond markets. It appears to me that most ‘austerity’ policy in troubled nations is conducted not so much for the benefit of bond investors but simply to demonstrate good behaviour to the Germans and to get them to loosen their purse strings further and rubber-stamp some additional QE from the ECB in return.

The ‘no-QE’ deceit

The whole thing is a charade. Merkel appeases her domestic electorate by enforcing allegedly tough ‘fiscal pacts’ on Germany’s ‘European partners’ and by having her local central bank terrier publicly bark against ECB bond buying when fact is that Germany is already on the hook for massive amounts of transfer euros (all commitments will certainly come due) and the ECB is already printing like there’s no tomorrow. One of the most bizarre misconceptions out there, tirelessly regurgitated by the mainstream media and their economic commentators, is that the ECB is somewhat more restrictive than the happy QEers, the Fed and the Bank of England. This is nonsense. The quantitative easing is just indirect, via the banking system. In December, the ECB injected close to €500 billion into Europe’s struggling banks to the cheer of assorted inflationists in politics and media. A lifeline for the banks? A stimulus? Or simply more ‘kicking the can down the road’? Providing further proof that everything is now underwritten by the ECB, which happily accepts every bit of junk as collateral, the Wall Street Journal reported last week that Spanish banks’ present exposure to domestic property developers is unchanged from 2007 levels, and that further property development is being funded. The size of the ECB’s balance sheet (or the consolidated statement of the Eurosystem as of December 31) is already more than 30% of Eurozone GDP. The Fed’s balance sheet is around 20%.

And more money is on its way. In February, another round of money printing will be conducted, again not called QE but ‘long-term refinancing operation’. Rumours are its size is going to be another €500 billion but last week numbers as high as €1trillion were circulated in giddy financial markets. This will continue, and we know how it will end. Just as in the US and in Britain, the printing press is the last line of defence for bankrupt states and insolvent banks.

And apropos ‘kicking the can down the road’: With the EFSF now downgraded, it appears that the IMF is getting ready to provide more bailout money. As this money is also unlikely to be obtained from friendly aliens, it is clear that other governments will borrow it and central banks will print it.

Democratic delusions

When I present my case for the inevitable collapse of the fiat money system and a return to hard and apolitical money, such as a proper gold standard, one of the push-backs I routinely get is that such a system would not be compatible with our democracies. Voters demand that the modern welfare democracy be maintained. The highly interventionist state that has grown in our societies over the past 50 years enjoys the support of majority opinion. Large parts of the public want the state to play a strong role in the economy. They are under the illusion that the state can guarantee growth, stability, security and social equality through its interventions. Restricting the state’s financial maneuverability, as a gold standard would do, is deemed politically unacceptable.

I agree that such may be the expectations and wishes of the voting public. But as an economist I have to ask whether these are realistic expectations. Does modern democracy require us to ignore economic science and simple logic and arithmetic, and assume that whatever the democratic process articulates as the will of the people must somehow be realizable? Reality is not optional, and the laws of economics can be altered by the democratic vote as little as the laws of gravity.

Capitalism is the only tool we have for maintaining and improving our standard of living. Today’s brand of interventionism obstructs market forces and weakens the capitalist system’s ability for wealth-generation. This is to the detriment of everybody, and more and more people are beginning to feel it. That the present system has for so long appeared to so many to be stable – at least until recently -, and sustainable has largely been the result of a deceit. Constant expansion of fiat money, the accumulation of debt and other imbalances have created a mirage of prosperity and economic momentum while undermining the true wealth-generating power of the market economy. The delusion has thus come at an ever higher price, and the bill is due soon. Ultimately, printed money is no substitute for savings, artificially cheap credit no substitute for proper capital creation, and asset bubbles no substitute for entrepreneurship and real growth. But these have increasingly become the crutches of the modern welfare democracy.

Economists should educate the public about what really generates wealth but most of them seem content to come up with new and ever more outrageous schemes to prop up the present system a tad longer with more fiat money, more debt and more asset bubbles. Those who do not want to consider the inevitable endgame of this system but instead prefer to flatter democratic prejudices and feed irrational expectations do not do the public any service.

And by the way, just as democracy has not guaranteed rationality in economic policy, it will also be a poor protector of personal liberty. The democratic masses are now sufficiently conditioned to believe that politics and state action are the solution to every problem, and when the crisis intensifies and anxiety levels rise, the majority will happily sign away the remaining bits of individual freedom and property rights in a desperate but entirely counterproductive bid to stem the tide.

In the meantime, the debasement of paper money continues.

This article was previously published at Paper Money Collapse.

Detlev, thank you for this post.

As a wise old banker said to me, the type who did know his customers, their families, their businesses and could actually make a lending decision himself , never lend money when the borrower is also the guarantor. The bail out fund should be rated accordingly along with its basket case guarantors.

I have often wondered whether the Soviet Union collapsed BECAUSE it peeped through the Iron Curtain and saw the West’s corporatised, cartelised, inflated and debt funded prices and based their calculation upon that. No wonder it was so awful with alcoholism, black market gangsters and ambitions stolen by the State. Now we are becoming the Soviet Union how long do we have?

The Soviet Union collapsed because it was a mathematical certainty. When you have more coming out of the bag than is going in, the bag will eventually collapse.

A lot can be said for capitalism, it allows you to drag yourself up by the bootstraps if you have the will and determination. No issue with private wealth at all. I do however think that cuts to address the deficit in Europe should be even across the socio-economic classes. There seem to be too many cuts to services that benefit the poor and vulnerable in the UK. Because they can’t fight back perhaps? These are people who CAN’T work their way up and exist on fixed incomes through no fault of their own.