“We have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand.”

– John Maynard Keynes.

An engineer, a biologist and an economist are washed ashore on a desert island. After a few days without food they are starving. Eventually, they stumble on a can of beans on the beach. They spend a few minutes considering how they might feed themselves. The engineer is the first to speak. “We could hit the can with a rock until it opens.” The biologist counters, “We could suspend the can in a seawater solution and wait for erosion to work its magic.” The economist is last to contribute: “Let us assume we have a can-opener.”

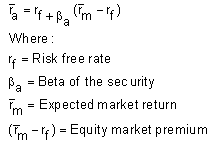

So it’s not the funniest joke in the universe. But it has the ring of truth. Nobel laureate William Sharpe, for example, established the capital asset pricing model in the 1970s in an attempt to establish the sort of risks that can be reduced by diversification. For anybody that cares (a category that does not include this author), the formula is as follows:

So far, so simplistic. But the CAPM (as it became known) also contains a number of assumptions about financial markets that can variously be described as either quaint or ridiculous. For example..

- Financial markets are perfectly competitive;

- Tax does not exist;

- Nor do transaction costs;

- All investors have the same time horizon;

- All investors have the same expectations of returns and volatility; All investors can borrow and lend at one risk-free rate;

- Investors can go short any asset and hold any asset fractionally.

What do you call a model that only works if you make some breathtaking assumptions about how the narrow little universe of that model works ? (A suggestion: it’s not even a model, it’s a hideous troll.) If the natural world we actually inhabit behaved according to the sort of models that economists use, then planes would drop from the sky on a daily basis; cars would routinely crash into each other or randomly explode; there would be a point to Jedward..

In ‘The Origin of Wealth’, Eric Beinhocker makes a convincing case that the rot set in to the then juvenile field of economics when serial French loser Léon Walras, having failed as engineer, novelist, journalist and banker, set his mind to this exciting new discipline:

One evening in 1858, a depressed Walras took a walk with his father, a teacher and writer, discussing what he should do with his life. The elder Walras, a great admirer of science, said that there were two great challenges remaining in the nineteenth century: the creation of a complete theory of history, and the creation of a scientific theory of economics.. Prior to Walras, economics was not a mathematical field.. Walras and his compatriots were convinced that if the equations of differential calculus could capture the motions of planets and atoms in the universe, these same mathematical techniques could also capture the motion of human minds in the economy.

And so erroneous, inappropriate and plain flawed models were lifted wholesale from the world of physics, and made to fit, somehow, jammed and crammed – no matter what pieces broke or flew off – into the unstable and probably unforecastably wild world of the economy. This matters, and may be one of the most overlooked aspects of the financial crisis to date, in that so much of what constitutes accepted economic wisdom may be fundamentally inappropriate to begin with in “the real economy”, and the scope for economic policy errors to scale up to huge potential losses in “the real economy” is almost infinite. A delicate machine, the working of which we do not understand.. Computer scientists coined the phrase “garbage in, garbage out” to describe the vulnerability of computers to process meaningless input data and produce comparably meaningless output. But only a comparative handful of sceptics have drawn attention to the vulnerability of the modern financial system to assumptions equating to economic garbage going in. The English “father of the computer”, Charles Babbage, once made the following observation:

On two occasions I have been asked, – “Pray, Mr. Babbage, if you put into the machine wrong figures, will the right answers come out ?” ..I am not able rightly to apprehend the kind of confusion of ideas that could provoke such a question.

The Austrian school recognised the limitations of economic theory. We cannot model “the market” with precision, because the market is us. Another colossal presumption of mainstream economic theory holds that the economy mean reverts to some form of stable equilibrium; all that is required from our enlightened monetary leaders, we are led to believe, is a gentle nudge of this policy lever or that, and the path back to stability is assured. But what if the analogy is fundamentally wrong at its core ? What if the economy is never destined to reach a stable equilibrium – a state in any case analogous in its cold sterility to the dynamism of air molecules in a perfect vacuum ?

Judging by recent market action (on the part of equities and euro zone government bond yields), investors would appear to believe that the euro zone debt crisis has been largely resolved. The market’s supposed saviour has been the European Central Bank, benignly tipping half a trillion euros of liquidity onto the continent’s banks. In the first instance, making any kind of assumption about financial market dynamics when that same market is a) a plaything of algorithmic machines as much as more traditional human speculation, and b) prone to the sort of distortions that come with, say, half a trillion euros of liquidity, is a dangerous business. More pertinently, a crisis of overmuch credit provision seems to have been resolved through the medium of …more credit provision. Perhaps Ludwig von Mises’ most quoted construction since the crisis began is also amongst his most ominous:

There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency system involved.

Abandoning credit expansion does not seem to be on the ECB’s agenda. So it should come as no surprise that German commentators are watching the ECB’s massive credit expansion with growing alarm. The Frankfurter Allgemeine Zeitung wrote last week:

Government financing may not be the goal of the ECB’s money glut. But the side effect of the massive sums that the bank has released for the second time at the unusual lifespan of three years is that interest rates have sunk on the bond markets. Most countries can now finance their debts at tolerable conditions again. That also stabilizes the banks, which is thoroughly pleasing to the central bank. This is because it aims to eliminate every doubt about the financing of solvent banks with the emergency loans. It has achieved this, in addition to hindering an accelerated downward spiral of emergency asset sales.

But what may have a short-term calming effect can also complicate the recovery of the currency zone through the lowered interest rates on the market. This is because falling risk premiums and cheaper financing conditions could lead some politicians to the erroneous belief that spending policies financed with even more debts is still possible. The ECB must counteract this by creating a timely shortage of money and credit.

FT Deutschland wrote:

Nobody can calm the markets better than the ECB. The three-year tender has already shown that. No rescue packet, no austerity package and no crisis summit has as much persuasive power as the money-slingers in Frankfurt. Since the euro boon in December, the situation has calmed noticeably and confidence has returned. This will surely be strengthened by yesterday’s long- awaited and generous new round of loans from the ECB.

It’s also clear that the loose policies of the ECB are anything but harmless. After all, it wants the money to be invested, perhaps in government bonds, which would be much to the satisfaction of finance ministers — perhaps. Alternatively, the money could be invested in other assets, such as mining, real estate or shares. But the confidence inspired by the ECB goes hand in hand with an increased willingness to take risks. That doesn’t necessarily amount to an investment bubble, but it could become one. In that case, if the bubble were to burst, we would have to start crisis management over again from scratch.

In the financial markets, as opposed to the CAPM model, taxes and brokerage costs exist. They penalise the flighty and those who prefer to make their strategy reactive to market movements as opposed to pre-emptive. We do not have the same time horizon or expectations of volatility (we suspect) that others have. Nor, for that matter, does our core asset allocation (we suspect) remotely resemble those which most of our putative competitors use. Our dependency on the stock market for return is modest, and explicitly biased towards the defensive. Ditto our reliance on debt instruments, where our approach, we like to think, is extremely discerning. We value instruments that we believe will offer decent returns with roughly zero correlation to traditional asset markets. We love real assets. We attach a more or less equal significance to investments that we believe have a strong likelihood of preserving capital in an inflationary environment as we do to those that we believe will hold up in a deflation. This sort of asset diversification may strike some as a capitulation, evidence of a lack of conviction. We prefer to see it as a rational response to the uncertainties of our time – we have very clear views about those instruments we don’t want to hold, and as a result we don’t hold them.

Asset managers, we surmise, are not meant to be equivocal. The investment media have an absolute bias in favour of the grandstanding big prediction. But as Voltaire said, while doubt is not a pleasant condition, certainty, in the present circumstances, is absurd. As the rather wonderful Slog puts it,

There are so many imponderables, unknowns, poison pills and impracticalities involved, so many different geopolitical agendas in play, and so many vested interests breaking or spraining the rules, it can only end in tears: the timing and volume of tears are the only things left. But if I may twist the allusion kaleidoscope just one more time, Greece-guessing is like a passenger on the Hindenburg watching his skin burn, and worrying about that nice new set of luggage he bought specially for the maiden voyage.

This article was previously published at The price of everything.