It was just past 7:00 a.m. on the morning of Saturday, September 13, 2008. Jamie Dimon, CEO of JP Morgan, went into his home library and dialled into a conference call with two dozen members of his management team.

“You are about to experience the most unbelievable week in America ever, and we have to prepare for the absolutely worst case,” Dimon told his staff..

“..Here’s the drill,” he continued. “We need to prepare right now for Lehman Brothers filing [for bankruptcy].” Then he paused. “And for Merrill Lynch filing.” He paused again. “And for AIG filing.” Another pause. “And for Morgan Stanley filing.” And after a final, even longer pause, he added: “And potentially for Goldman Sachs filing.”

There was a collective gasp on the phone.

– From ‘Too Big To Fail’ by Andrew Ross Sorkin.

I have no problem with the staff of Goldman Sachs earning millions. I have no problem with their 16-hour work days (or the fact that they seem to turn many of their number into Gollum-like bald freaks well before their time). I have no problem with their clannish, hubristic, insular culture, having never wanted to work for the Moonies. My main problem with Goldman Sachs is that if it operated like any other business in the world, when it and its business model effectively failed in 2008 it should have been allowed to fail properly, and closed down.

But that is not what happened. Despite self-serving articles like that from Nader Mousavizadeh in this weekend’s FT (“[the bank] navigated the crisis with far greater skill and discipline than its rivals (and at a far lower cost to taxpayers)”, the reality is that Goldman Sachs was almost certainly just as bust as Lehman Brothers in those dark days of 2008. The difference is that Lehman Brothers wasn’t allowed to convert itself into a bank holding company and borrow emergency funds directly from the Federal Reserve. Goldman was, despite not being a bank in any conventional sense of the word. But that is only to be expected, given that Goldman Sachs and its alumni have managed to infiltrate themselves into every branch of the US administration. The US Treasury Secretary who oversaw the Troubled Asset Relief Programme and who bailed out Goldman Sachs at the time, for example, was former chairman and CEO of Goldman Sachs and, yes, Gollum lookalike, Henry Merritt “Hank” Paulson. The trend is not limited to the US (although the Chief of Staff to the current US Treasury Secretary, Adviser to the current US Treasury Secretary, Deputy Director of the National Economic Council, Chairman of the President’s Foreign Intelligence Advisory Board, Commissioner to the Commodity Futures Trading Commission, Undersecretary for Economic, Energy and Agricultural Affairs, and Ambassador to Germany all previously worked for Goldman Sachs), given that the current President of the European Central Bank, probably the most important person in European finance, Mario Draghi, also used to work for Goldman Sachs – as, coincidentally, did the current Prime Ministers of Greece and Italy. And the current head of Greece’s debt management agency.

Not for nothing, then, did Rolling Stone’s Matt Taibbi memorably refer to Goldman Sachs as “..everywhere.. a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” Back to those alumni. As Taibbi also points out, Goldman is not exactly without political influence. An interesting exercise is to play the old Watergate game of ‘follow the money’ during the worst days of the crisis:

..former Goldman CEO Henry Paulson was the architect of the bailout, a suspiciously self-serving plan to funnel trillions of Your Dollars to a handful of his old friends on Wall Street. Robert Rubin, Bill Clinton’s former Treasury secretary, spent 26 years at Goldman before becoming chairman of Citigroup — which in turn got a $300 billion taxpayer bailout from Paulson. There’s John Thain, the a**hole chief of Merrill Lynch who bought an $87,000 area rug for his office as his company was imploding; a former Goldman banker, Thain enjoyed a multi-billion-dollar handout from Paulson, who used billions in taxpayer funds to help Bank of America rescue Thain’s sorry company. And Robert Steel, the former Goldmanite head of Wachovia, scored himself and his fellow executives $225 million in golden-parachute payments as his bank was self-destructing. There’s Joshua Bolten, Bush’s chief of staff during the bailout, and Mark Patterson, the current Treasury chief of staff, who was a Goldman lobbyist just a year ago, and Ed Liddy, the former Goldman director whom Paulson put in charge of bailed-out insurance giant AIG, which forked over $13 billion to Goldman after Liddy came on board. The heads of the Canadian and Italian national banks are Goldman alums, as is the head of the World Bank, the head of the New York Stock Exchange, the last two heads of the Federal Reserve Bank of New York — which, incidentally, is now in charge of overseeing Goldman..

When you look at Taibbi’s original article, the more recent criticism voiced by Gollum-like former Goldman employee Greg Smith (readable here) is a vicarage tea party by comparison.

But as I say, I have no problem with Goldman Sachs per se, other than that it shouldn’t exist, or that it displays the uniquely biddable qualities of US government: everybody, every policy, everything is for sale at the right price.

Joining those in the orchestra playing the world’s smallest violin for Goldman Sachs was mayor of New York, Michael Bloomberg, who was quoted in the FT as saying that even God would be given a hard time leading Goldman Sachs at this point. By some administrative oversight, Michael Bloomberg never actually worked for Goldman Sachs. (Who dropped that ball ?)

All this Sturm und Drang over Goldman Sachs makes for mildly engaging copy, particularly for those who hate the bank primarily out of money envy. One fears that while Goldman now acts as a lightning rod for anti-banker hysteria, everyone with pitchforks is missing the wider point. Over to a voice of sanity amid the wilderness, Doug Noland:

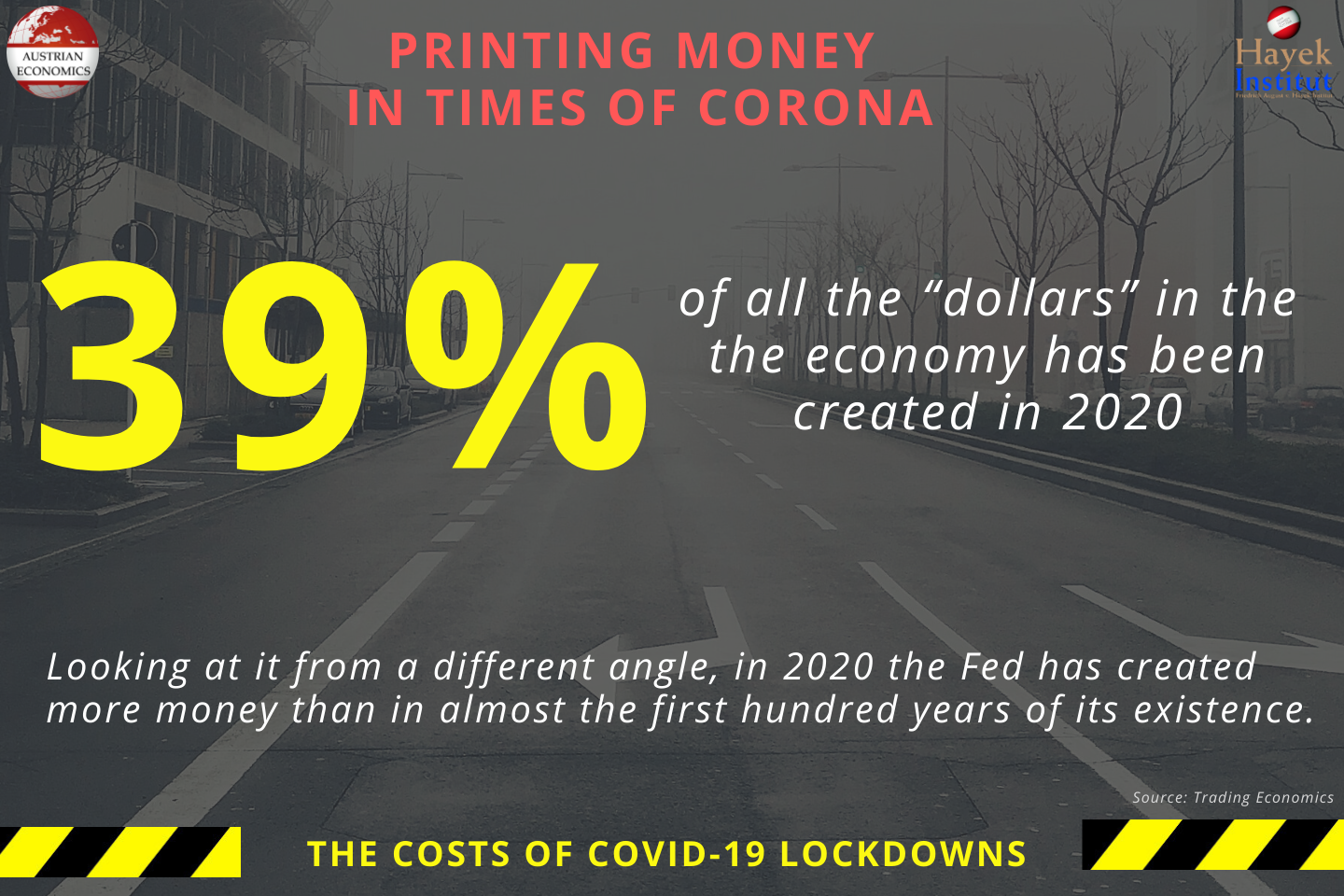

[Greg] Smith has issues with Goldman’s “toxic and destructive” culture – I’ll retort that it’s the “culture” of Wall Street / global securities markets that is today noxious and destructive. And, admittedly, I have a difficult time pointing blame at the Blankfeins, Cohns and Dimons of the world. They just happen to sit at the top of the pecking order for a massive “financial services” infrastructure operating in an environment where “money” and monetary management have gone terribly bad. Uncontrolled monetary inflations have always led to greed, corruption, malfeasance, anger and instability. Credit Bubbles always inequitably redistribute wealth – before their inevitable implosions reveal the massive wealth destructions associated with monetary inflations and financial manias. At the end of the day, unsound “money” will have torn lots of things apart.And I’ll take some poetic licence here. Mr. Smith laments “ripping eyeballs out” of “muppet” clients – the decline of “the firm’s moral fibre.” I believe a crucial facet of what’s unfolding is that employees throughout Wall Street, and global finance more generally, are working diligently to extract as much “money” as quickly as possible before the whole thing blows up. It’s as reprehensible as it is perfectly rational in light of today’s monetary and policymaking environment. In a backdrop where politicians spend as much as they want and central bankers “print” as much as they want – where prudence, fairness and reasonableness have been completely abandoned – of course those working amidst this monetary profligacy will feel perfectly compelled to take as much as they can get. Read monetary history.

Regrettably, most no longer think in terms of a long-term career judiciously serving the interests of their client-base. Instead, it’s dog-eat-dog – everyone working first and foremost for their immediate self-enrichment. Isn’t that the way Capitalism is suppose to function? But it’s a broken incentive structure – powered by the confluence of ultra-easy “money” slushing about the system today and extraordinary uncertainties darkly clouding the outlook for tomorrow. This ensures a destabilizing short-sighted fixation by Wall Street associates, traders, speculators, investors, business executives and society generally. Greed may or may not be good, but it is certainly an upshot of unsound money.

And, I’ll assume, the closer individuals are to the belly of the beast the more jaded they must become. Mr. Smith’s expertise is in derivatives – “to trade any illiquid, opaque product…” If there is one area where I most fear obfuscation and the deleterious effects of monetary inflation, policy intervention and market degradation, it’s in this creature referred to as the “global derivatives market.” This demonstrated – and at times rather corrupt – monster has nonetheless been nurtured and promoted to the epicentre of contemporary global markets. It’s no coincidence that this realm has remained largely impervious to tighter regulatory oversight – even after 2008.

Mr. Smith protested selling products that were wrong for his clients. Whether it’s a derivative salesman, politician, or central banker, obfuscation has become commonplace at this disorienting phase of uncontrolled monetary inflation. After all, how can sound analysis and serving one’s clients remain the devoted focus when the current monetary backdrop incentivizes something quite different? How does one go about modelling future cash flows and valuing assets when there is every indication that the current monetary backdrop is both unstable and unsustainable?

Indeed, the market backdrop has regressed to little more than a “money” game. Speculative dynamics rule, and those that play (or associate with those that play) the game the best attain unimaginable financial wealth. How can one reasonably do analysis these days when so much depends on the extent to which global central bankers will proceed further down the path of unlimited “money” creation? Do you want to bet that the Fed (and ECB, BOE, BOJ, PBOC, etc.) is largely through its crisis-induced money creation operations? Or is the Fed’s balance sheet on the way to $10 trn ? Those provide two altogether different scenarios to contemplate. Clearly, with central bankers propping up markets with Trillions of liquidity injections, one can toss traditional analysis (and market participant behaviour) out the backdoor.

Credit Bubbles and attendant monetary inflations inevitably risk a loss of trust – trust in “Wall Street” and the financial system; trust in politicians and the political process; trust in central bankers and monetary management; trust in institutions and “money” more generally. These dynamics are increasingly on full display, here at home and abroad. And it’s not Goldman’s culture and moral fibre that I worry about.

Our objectives are relatively modest. We seek to preserve and grow our clients’ irreplaceable capital, in real terms. Unhappily for us, we do so in a possibly unique environment of unsound money, unsound finance, unsound credit, unsound banks, and biddable politicians playing to an ever-shifting rogues’ gallery of competing interests. Greg Smith’s cri de coeur will likely be mostly dismissed as the bitterness of a middle-ranking never-would-be and is unlikely to prove a death knell for Goldman Sachs, though of course if that moment comes we will shed few tears at its passing. But if it causes investors (be they muppets or not) to re-examine their sense of trust in the system and reassess those entities most deserving of that trust, it will not have been published in vain.

This article was previously published at The price of everything.

Hi!, Patrons Of The Cobren Centre Et Al:

Parasites; parasites everywhere and not a dime to spare! We peasants live in a no interest rate for our savings environment while the parasites feed on our savings via their inflating schemes. The squeeze is on and people don’t know exactly what to do to escape their captors; while their captors relentlessly continue night and day to steal whatever they can; while all the while the local theives steal from us at our homes like they did when they stole two of my riding lawnmowers perhaps to resell for drugs? My job now is to vote which we have all already done several tmes with things continuing to get worse and worse but better for our captor

parasites ad naseum. Then, finally when you’re made completely poor, even your neighbors begin to look down upon you with restrained suspicions like you’re the thief living next to them. Peace has no chance in this environment and so we prepare ourselves to pay for more wars.

RUSS SMITH, CALIFORNIA

resmith@wcisp.com