In a lecture given at the George Washington University on March 27, 2012 the Chairman of the Fed said that the US central bank’s aggressive response to the 2007-2009 financial crisis and recession helped prevent a worldwide catastrophe. Various economic indicators were showing ominous signs at the time. After closing at 3.1% in September 2007 the yearly rate of growth of industrial production fell to minus 14.8% by June 2009. The yearly rate of growth of housing starts fell from 20.5% in January 2005 to minus 54.8% in January 2009.

Also, retail sales came under severe pressure – year-on-year the rate of growth fell from 5.2% in November 2007 to minus 11.5% by August 2008. The unemployment rate jumped from 4.4% in March 2007 to 10% by October 2009. During this period the number of unemployed people increased from 13.389 million to 15.421 million – an increase of 2.032 million.

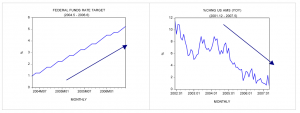

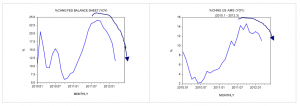

In response to the collapse of the key economic data and a fear of a financial meltdown the US central bank aggressively pumped money into the banking system. As a result the Federal Reserve balance sheet jumped from $0.884 trillion in February 2008 to $2.247 trillion in December 2008. The yearly rate of growth of the balance sheet climbed from 1.5% in February 2008 to 152.8% by December of that year. Additionally the Fed aggressively lowered the federal funds rate target from 5.25% in August 2007 to almost nil by December 2008.

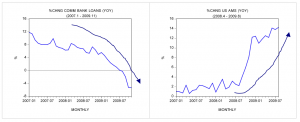

Despite this pumping the growth momentum of commercial bank lending had been declining with the yearly rate of growth falling from 11.9% in January 2007 to minus 5.3% by November 2009. As a result of the fall in the growth momentum of lending the growth momentum of money supply would have followed suit if not for the Fed’s aggressive pumping to the commercial paper market. This pushed the yearly rate of growth of our measure of US money supply from 1.5% in April 2008 to 14.3% by August 2009.

In his speech Bernanke blamed reckless lending in the housing market and financial engineering for the economic crisis. He also acknowledged that the supervision by the Fed was inadequate. According to Bernanke, once the crises emerged the Fed had to act aggressively in order to prevent the crisis developing into a serious economic disaster. The Fed Chairman holds that a highly accommodative monetary policy helps support economic recovery and employment. We hold that various reckless activities in the housing market couldn’t have emerged without the Fed’s previous reckless policies. After closing at 6.5% in December 2000 the federal funds rate target was lowered to 1% by May 2004. The yearly rate of growth of our monetary measure AMS jumped from minus 0.9% in December 2000 to 11.5% by December 2001. In short, the strong increase in the growth momentum of money supply coupled with an aggressive lowering of interest rates set the platform for various bubble activities, or an economic boom.

A reversal of Fed’s loose stance put an end to the false boom and put pressure on various bubble activities. The fed funds rate target was lifted from 1% in May 2004 to 5.25% by June 2006. The yearly rate of growth of AMS plunged from 11.5% in December 2001 to 0.6% in May 2007. As it happened the effect of this tightening was felt in the housing market first before it spilled over to other bubble sectors. (A tighter monetary stance slowed down the diversion of real savings towards bubble activities from wealth generating activities).

Contrary to Bernanke, we suggest that his loose monetary policy of August 2007 didn’t save the US economy but instead saved various bubble activities, which came under pressure on account of the previous tighter monetary stance.

Note that the loose monetary stance has been aggressively diverting real funding from wealth generators towards bubble activities, thereby weakening the wealth generation process. The only reason why loose monetary policy supposedly “revived” the economy is because there are still enough wealth generators that can support the Fed’s reckless policy. Also, pay attention that all the gains on account of the previous tighter stance have currently been wasted to support bubble activities.

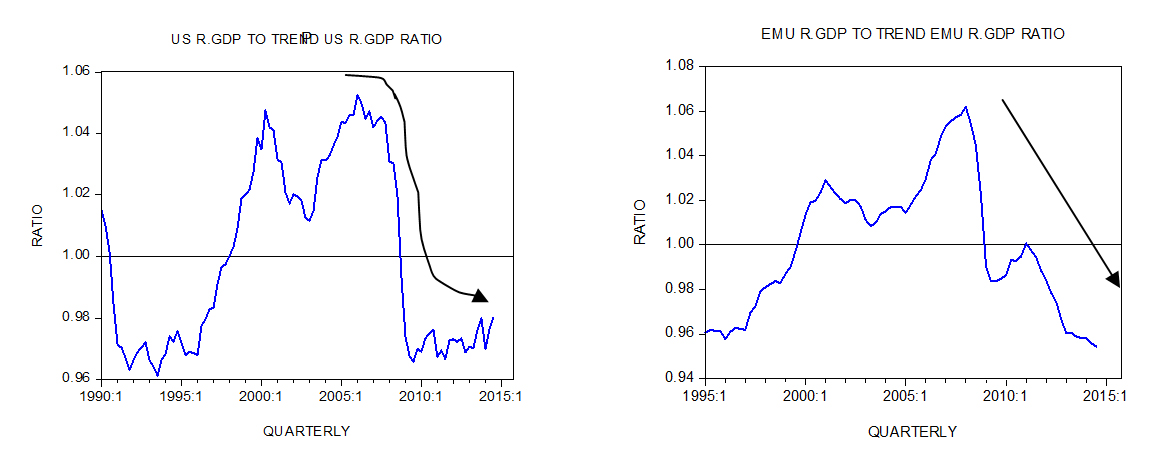

As long as the pool of real savings is still growing, Fed policy makers can get away with the illusion that they have saved the US and the world economies. Once the pool of real savings starts stagnating, or worse declining, the illusory nature of the Fed’s policy is revealed – the economy follows the state of the pool of real savings. Any aggressive monetary policy in this case is going to make things much worse.

The actions of Bernanke to revive the economy run contrary to the basic principles of running a company. For instance, in a company of 10 departments, 8 departments are making profits and the other 2 losses. A responsible CEO will shut down or restructure the 2 departments that make losses – failing to do so will divert funding from wealth generators towards loss-making departments, thus weakening the foundation of the entire company. Without the removal, or restructuring, of the loss-making departments there is the risk that the entire company could eventually go belly up. So why then should a CEO who decides to support non-profitable activities be regarded as a failure when Bernanke and his central bank colleagues are seen as heroes that saved the economy?

Bernanke is of the view that by pumping money he has provided the necessary liquidity to keep the financial system going. We suggest that this is false. What permits the financial sector to push ahead is real savings. The financial sector does not have a life on its own. Its only role is to facilitate the real wealth that was generated by the wealth producers. Remember that banks are just intermediaries; they facilitate real savings across the economy by means of money (medium of exchange).

By flooding the banking system with money one doesn’t create more real savings but on the contrary depletes the pool of real funding. Most commentators are of the view that in some cases when there is a threat of serious damage to the financial system the central bank should intervene to prevent the calamity, and this is precisely what Bernanke’s Fed did.

We suggest the severe threat here is to various bubble activities that must be removed in order to allow wealth generators to get on with the job of creating wealth. If a lot of bubbles must disappear, so be it. Any policy to support bubbles, be it large banks or other institutions, will only make things much worse. As we have seen, if the pool of real savings is not there, a central bank policy to prop up bubbles will make things much worse – the Fed cannot generate real wealth.

Bernanke’s policy, which amounts to the protection of inefficiency, i.e. bubble activities, runs the risk of generating a prolonged slump with occasional rallies in the data. It could be something similar to Japan (which Bernanke has in the past criticized).

In the meantime, a visible fall in the growth momentum of the Fed’s balance sheet (monetary pumping) has already set in motion another bust. Year-on-year the rate of growth of the balance sheet fell to 11.7% in March from 17% in the month before and 24.1% in September last year.

The yearly rate of growth of AMS fell to 11.1% so far in March from 12.6% in February and 14.3% in August last year.

We can conclude that contrary to Bernanke’s claims, his loose policies didn’t save the US economy from a depression but have damaged the process of real wealth generation.

Bernanke’s loose policies have provided support to bubble activities, thereby destabilizing the economy. So in this sense his policies have saved the bubbles, thus undermining wealth generators.

We suggest that the more forceful the Fed’s response to various economic indicators is, the more damage this does to the pool of real savings. This runs the risk that at some stage the US could end up having a stagnating or worse, declining, pool of real savings.

If this were to occur then we could end up of having a severe economic slump. If any one needs examples in this regard, have a look at countries such as Greece, Spain and Portugal.

Over a prolonged period of time the policies of these countries (an ever growing government and central bank involvement in the economy) have likely severely damaged the heart of economic growth – the pool of real savings.

Again, if the pool of real savings is to become stagnant, or worse, starts declining, any attempt by the Fed to make things better is actually going to make things much worse by depleting the pool of real savings, or funding further. If the pool of real funding is stagnating then no matter how much pumping the Fed does banks will not be able to lift lending. Remember, without expanding real funding any expansion in credit could lead to financial disaster.

No great historical event happens twice in the same way.

For example, Herbert Hoover made the economic crises caused by credit bubble bust of 1929 much worse (turned into the Great Depression) by various policies.

By increasing taxes on imports (basically creating a trade war and the breakdown of international trade).

By greatly increasing taxation of the wealthy (so much for Hoover as the tool of the rich – as he is presented in school text books).

And, most importantly, by doing all he could to PREVENT the labour market clearing (keeping up wage rates due to the demented notion that “keeping up demand” was vital).

Actually none of the above policies have, yet, been followed in the present crises.

As for Ben the credit-money bubble man.

Well he is refusing to allow the bubble economy to break.

He thinks this is wonderful – he has prevented 1929 even really happening (let alone turning into a Great Depression).

Actually he is radically misguided.

Credit-money bubbles once created, must bust – the malinvestments must be liquidated and markets allowed to clear.

This is what was allowed to happen after the credit-money bubble bust in 1921 (not 1929) and the economy was recovering in six months.

By preventing this bust – B.B. has not “prevented the Great Depression” as he thinks – because the malinvestments must still be liquidated, and the absurd level of the stock market (and, yes, of the property market) is simply a matter of him propping up artificially high prices.

Also although the follies of Hoover have been avoided, other follies have not been.

For example a vast increase in Federal government SPENDING (both under Bush and under Obama).

Contrary to the Keynesians this “fiscal stimulus” is no more sustainable than the “monetary stiumulus” (the credit-money bubble) that they also favour.

Both will bring on economic collapse.

For in the end (odd for an Austrian to say) whether B.B. has truly prevented an economic crash is an EMPIRICAL question.

And it will become obvious in 2013 that he has not prevented an economic crash.

Because it will be happening.