“The sea’s freezing. A man won’t last long in that. We’ve drawn a bad hand this time.”

“I’ve never been a good loser. I intend to get into a boat.”

– Conversation between two card-players on The Titanic, from Eric Ambler’s screenplay, ‘A Night To Remember’.

The Titanic centenary was always going to be the trigger for a plethora of tasteless attempts to cash in on the tragedy. The “best” we’ve seen so far was the Hotel Russell’s promotion of its ‘Titanic breakfast’ – which presumably goes down a treat, though not without a degree of attendant turbulence. Having considered for some time the most appropriate metaphor for the current market environment the cause sometimes seemed lost, but we think we have it now. There are a number of sequences in Roy Ward Baker’s 1958 classic account, ‘A Night To Remember’, that depict a lounge in one of the upper class quarters of the ship as it slowly sinks beneath the waves. Notwithstanding the vessel listing alarmingly, a motley band of toff revellers are determined to go out in the finest Hooray Henry style. Some continue to play at cards with a fatalistic resolve while behind them, a group of braying nobs determinedly quaff spirits direct from the bottle. One may be doomed, but one can still party on.

Jeremy Grantham’s latest market letter (PDF) is well up to his usual high standard. Grantham is particularly good on the professional asset manager’s need to navigate not just irrational markets but to cater to clients hungry for performance and intolerant of the bad kind:

Over the years, our estimate of “standard client patience time,” to coin a phrase, has been 3.0 years in normal conditions. Patience can be up to a year shorter than that in extreme cases where relationships and the timing of their [portfolio’s inception] have proven to be unfortunate. For example, 2.5 years of bad performance after 5 good ones is usually tolerable, but 2.5 bad years from start-up, even though your previous 5 good years are well-known but helped someone else, is absolutely not the same thing ! With good luck on starting time, good personal relationships, and decent relative performance, a client’s patience can be a year longer than 3.0 years, or even 2 years longer in exceptional cases. I like to say that good client management is about earning your firm an incremental year of patience. The extra year is very important with any investment product, but in asset allocation, where mistakes are obvious, it is absolutely huge and usually enough.

We make just one cavil with Grantham’s observations. Like most of the financial services industry, he restricts his asset universe to the two conventionally dominant classes of listed equities and investment grade debt. The problem with this perspective is that the asset management industry tends to view those asset classes as both uncorrelated and representative of the entirety of investor choices available. But the reality is a) that investors can pursue other distinct types of assets (we would single out real assets as an obvious and relevant alternative), and b) that there can and will be times when both debt and equity markets together underperform, in both relative and absolute terms (the relative benchmark being cash since developed government debt can in no way now be considered a risk-free asset class). We may be fast approaching a macro environment that threatens conventional portfolios with exactly that outcome – a bear market in both stocks and bonds simultaneously. In other words, the authorities could attempt to throw a bull market party for both bonds and common stocks, but nobody would show up. (The ticket to entry is simply too expensive.) Having long since exhausted the armoury of conventional policies to keep the unsustainably indebted and now almost randomly deleveraging show on the road, increasingly desperate politicians are doing increasingly desperate things – be that gifting money to the IMF in a brazen display of fiscal denial that we can ill afford (George Osborne) or simply stealing from other sovereigns (Cristina Kirchner).

Project ‘End Up Like Japan’ continues to advance well throughout the western economies. The euro zone continues to perform like a group of drowning men lashed together for buoyancy. Here in the UK the Bank of England has the dubious privilege of being able to print money with abandon, and it is taking every opportunity to duly abuse the purchasing power of Britons with savings. We continue to hear Mr Takashi Ito’s sad refrain, published as a letter to the FT back in August 2010:

..after a huge housing bubble bursts, there is nothing to do except suffer many years of economic indignity.

Politicians, of course, are not in the business of sitting idly by while the country collectively suffers that economic indignity (the savers, at least). They must be seen to be doing something. The ironic triumph of the Keynesians means that in trying to save the economy, our central bank may end up destroying it completely by means of the printing press.

So we now get to experience some of the full-on horror of the Japanese malaise. As the debt burden and currency debauchery game rise together toward some form of climactic end-game, the sense of politicians simply not getting the point is almost comical. Just when it were most needed, evidence of urgency from government is invisible.

So in a portfolio sense, we close all water-tight doors. Debt holdings are restricted to those of only the most objectively creditworthy borrowers. Equity exposure is kept modest and restricted to only the most defensive. (Sustainable and relatively high dividend yields help.) We diversify further into the one actively managed strategy that doesn’t attempt to predict future market performance, namely systematic trend-following. And we diversify further still into the highest quality currency available, namely bullion. That this approach has not necessarily delivered whopping returns over the past 12 months is not an immediate cause for concern to us since we’re most focused on straightforward survival. All we need to do now is ensure that our clients are on message. They should be, because it’s their money at stake.

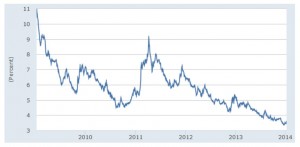

With Grantham’s sensible caveats about investor patience still ringing in our ears, we repeat our increasingly urgent suggestion that investors in debt and equity products (especially debt) enjoy the party but dance near the door. Developed market debt investors have enjoyed a 30+ year bull trend in interest rates (and credit creation) but the fat lady in the next room has started tuning up. In both asset allocation and instrument selection, having diversified well beyond quality credit and defensive equities into what we consider uncorrelated funds and real assets, we have already left the party. Our portfolios are not particularly dependent on the continuation of any kind of bull market environment for either conventional debt or equity markets. We are already sipping non- alcoholic drinks at the after-party. We look with keen interest at our watches to see how many other revellers will end up joining us. To put it another way, the ship is listing badly but has not yet sunk. So what colour is your life-jacket ?

This article was previously published at The price of everything.