Around the start of the year, in the course of a routine set of market overviews which we have to set out twice a year for one of our clients, we laid down two themes and a thesis.

The first of these was that the then-rapid pace of growth of money supply proper in the US – already becoming something of an exception on a global perspective – would continue to favour the maintenance of a pace of recovery there, above all in corporate revenues and hence, in all likelihood, in corporate profitability.

Such developments, we said, typically lead not only to an appreciation of stock market valuations, but also lend support to wider economic measures, such as employment and investment, however cautious CEOs and CFOs may be in padding out their balance sheets with cash.

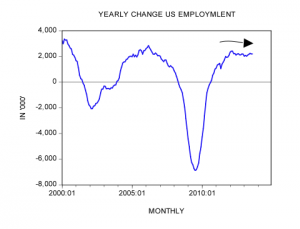

So it proved to be, with the S&P putting in its best first quarter since the rebound from the depths of the 1997/8 Asian Crisis. Lending a certain (if possibly temporary) corroboration to this, operating margins also reached or approached record highs (depending upon whether you take data for the S&P, for all non-financial corporations, or just the domestic subset), as did reported EPS. Given the plain accounting intertwining of profits and investment on the consolidated balance sheet – as well as the motivational nexus on the individual one – it was perhaps no wonder that, even if coming from relatively depressed levels, the growth in capex outstripped that of GDP as a whole, or that manufacturing payrolls enjoyed their fastest percentage gain (subject to later revisions) in almost three decades.

Sadly, there is reason to believe that this creditable performance may have represented a high-water mark. Certainly, since spring turned into summer, there have been signs of a deceleration. Revenue growth has dipped to a two-year low – and in nominal terms has all but stalled – new orders have mostly turned lower, employment gains have dwindled and the rise in the real ‘wage fund’ become suddenly snail-like. This sudden shift to a lower gear was brought home dramatically by the shocking 12.3 unit drop in the ISM index of new orders, a plunge which was both the greatest suffered since 9-11 and the second largest since the second oil shock and which took the measure into contractionary territory for the first time in over three years. Adding to the gloom, this was followed by the steepest fall in two year in the NFIB small business index, suggesting the malaise is becoming widespread – perhaps, in the latter instance, due to the costs associated with Obamacare.

Again, no-one who pays attention to the marked deceleration of money growth these last six months should be too surprised at this. If not yet by any means a tailwind, the raging gale which filled the economy’s spinnaker in the run-up to year-end has lessened to the gentlest of zephyrs since then. With the economy vulnerable to a further deterioration of offshore conditions, it is hard to see the rate of progress doing anything other than diminish while this less extravagantly favourable monetary situation persists domestically.

As Dallas Fed President Richard Fisher so colourfully puts it, the US may well be the ‘best nag in the glue factory’, but that does not mean it is about to earn a place in the winners’ enclosure at the Kentucky Derby any time soon.

Meanwhile, in Asia, our second theme was predicated upon our very Austrian perceptions of the likelihood of anyone being able to engineer an instance of that semi-mythical beast, the ‘soft landing’, in a system as overly dependent on credit-fed, fixed capital spending as is China’s – much less in one where real money supply crashed from a monstrous 38% rate of climb (where it stood 5.7 sigmas above the previous 13 years’ average) to a petrifying minus 1.4% (3.6 sigmas beneath it) in the space of a year!

Those within the policy apparatus can perhaps be forgiven for assuming that they (and they alone) could manage a manoeuvre which has classically proven to lie beyond the compass of their Occidental rivals. Had not, after all, they ‘succeeded’ beyond compare in bringing about a QE-fuelled boom far beyond the envy of a Bernanke, a King, or a Trichet when the world first fell apart in 2008/9? Besides, were their armies of Western apologists and the even more serried divisions of mainstream macro dullards not almost unanimous in declaring that either the slow-down would conform to a gentle glide path or that, conversely, at the first sign the descent was indeed quickening, the afterburners would be lit, the stick pulled back, and the whole, ponderous, creaking, billion-man flying-boat would go round again for another pass in, oh say, 2014 or 2015?

That the first of these assumptions would prove to be amiss was an easy call to make for those with a more established pedigree of economic reasoning: the bet that the second would not even be attempted until far too late in the day was a less certain failure, predicated as it was upon what little we outsiders really know about the political imperatives at work within the confines of the Forbidden City, but it was still where the smart money piled its chips.

To understand why this was the case, consider the phrase a very senior member of the Chinese Communist Party recently employed: ‘the only two things that can threaten the regime are inflation and corruption’. So has it ever been, throughout China’s long history.

Given that, the observation that the 2009-10 stimulus delivered a massive, socially-imperilling dose of both these evils, it did not require too much nerve to hold to the idea that the relief of the monetary stringency gradually imposed (in the official markets for money and credit, at least) last year would be maintained until the fear of an imminent implosion rebalanced the scales of political calculus – above all, in this, a leadership transition year and doubly, trebly so when the Party apparat’s inner schisms were revealed with the dramatic purge of Bo Xilai and his Chongqing henchmen.

Thus, it is that, wherever you look, you see signs of distress in China. Shipbuilding, steel making, aluminium smelting, textiles, construction – even sectors such as these, which are dominated by the privileged oligopolies of the state-owned enterprises, are palpably struggling. Meanwhile, stockpiles of raw materials continue to mount on the wharfsides and in the warehouses, entailing who knows what dangers for those who have raised grey-market funding by using them as collateral and who thus owe monies both at home (in loan-sharked yuan) and abroad in an inconveniently appreciating dollar. Meanwhile, accounts receivable pile up on balance sheets at rates greatly in advance of those at which reported revenues advance and the spreading stench of fraud poisons the waters for those looking to plug the gaps with gullible gweilo money.

The authorities’ response? To insist that the Big 4 accounting firms do not co-operate with the SEC in investigating any such accusations and to issue a media directive that no bad news may be reported without prior approval in the run up to the autumn’s Politburo handover.

Indeed, there are clear signs that some of these dangers are beginning to be realised. Taking the difference between the reported size of China’s forex reserves and the sum of trade and FDI inflows (and making some best-guess reckoning of the effects of reval changes and interest gains), one gets an estimate of hot money movements being diffused across the porous barrier of capital controls – most famously via the metals L/C rehypothecation scam. Between March’09 and February of this year, such ‘unexplained’ flows amounted to no less than $560 billion – roughly two-fifths of China’s total reserve accumulation and a third of its coincident increase in M1.

The last four months of increasing angst about the state of the ‘landing’ have seen a dramatic reversal of these flows, to the point that the discrepancy in the books suggests that China may have lost no less than $128 billion – a flight which exceeds that suffered during the worst of the Lehman crisis. Taken at face value, this implies further, self-reinforcing pressure for the renminbi to weaken, for the Dim Sum bond bubble to deflate, and for commodity loans to be unwound, either suddenly – by means of re-exporting some of the swelling inventories of copper, et al – or gradually – by cutting back on new imports until the excess has worn off and the bills settled.

Either way, a chilling prospect, even if this does not trigger a new financial crisis among China’s complex and shadowy interweaving of ‘loan guarantee’ companies and off-balance sheet ‘wealth management products’

It should go without saying that China is not the be-all and end-all of this story, for it is also the nexus whereat much of the value-added is booked, if not strictly accrued, from the embodiment into the consumer goods we Europeans and Americans so avidly buy off the higher-tech component marvels of its more sophisticated neighbours, especially Japan, South Korea, and Taiwan. Nor is China’s fate a matter of indifference to its suppliers and fellow users of less rarefied inputs, whether directly – e.g., Australia, Brazil, South Africa, and the Gulf – or indirectly, wherever similar goods have their prices boosted by means of China’s disproportionate take-off from world market supply.

China has now begun to react, of course, cutting the effective bellwether, one-year lending rate from 5.9% (6.55% official less the permitted discount of 10%) to 4.2% (6.0% less the widened 30% rebate) in the space of a month. As Wang Shuo, Managing Editor of the influential and highly-regarded Caixin Magazine blogged at once on his Weibo page: “This is an admission that the hard landing is already here.” In this, he only anticipated his sovereign overlord, President Hu, by a few hours, for this latter worthy soon thereafter started bleating that the economy faces ‘severe downwards pressure’.

You bet it does! Take a range of key indicators – from electricity usage, to Shanghai container throughput, to nationwide rail freight ton-miles, to steel output – and you will notice that none of these shows a rate of growth during the second quarter of more than 4% from 2011, and some are as low as 1%. Whatever fictive GDP number we are presented with this week, the message is clear: “Brace! Brace! Brace!”

The trick will now be to avoid re-inflating the property bubble – and information suggesting 125% of June’s overall loan total was comprised of household credit offers little reassurance on that score. It is also imperative that the regime acts to assuage the fears of a populace who were already, in the aftermath of the first rate reduction, responding to official survey questions in a high and increasing proportion that they feared an imminent ‘surge’ in consumer goods prices. Good luck with that, Comrades!

Last of all we come to Europe and here is where, six months ago, we only had a thesis, or rather a litmus test, for, when we last wrote the report in question, we said that the key issue was whether or not the massive LTRO operations then just being enacted would actually stimulate a long-awaited increase in money supply in the Zone.

We know now that the answer was a qualified negative since the bulk of the impact of the operation went towards providing a mechanism through which credit withdrawal and outright capital flight into the core could occur, without collapsing the banking systems of the periphery, there and then. Thus the qualification on the above negative: money supply has continued to shrink in the Olive Belt debtor nations (especially after deducting the wastage due to CPI price rises), while it has begun to accelerate in what is not far from becoming an alarming manner in the creditor nations of the north, thanks to the arcane wonders of the TARGET2 apparatus.

A cynic might point out that such a sub-alpine price and wage suppression, coupled with the converse trends among the supra-alpine elite is exactly what is needed to ‘rebalance’ the Eurozone without breaking the single currency apart.

The problem with the adoption of such a sanguine view comes in two parts. The first is the quibble that a suitable capital base through which to make this shift in relative prices immediately effective is sorely lacking: unemployed Greek school teachers are not going to pose a threat to Dutch petrochemical engineers, nor Spanish carpet-layers to Mittelstand machine tool assemblers, any time soon. The second is that while the debt overhang persists – and, indeed, while it is being made progressively more onerous by the ongoing deflation – any Northern man of affluence or entrepreneurial daring tempted to speed the process through taking up productive assets or property in the afflicted zones will be greatly inhibited both by the knowledge that some highly arbitrary credit revision still lies ahead and by the fear – justified only last week by M. Hollande’s ill-judged razzia – that the state’s roving marauders will be happy to seize any gains made from such investments, however inequitable and retrospective – not to mention ultimately self-defeating – the deed might be.

In contrast to their policy-making peers elsewhere, by continuing to cite the need for ‘structural reform’, much of the European political elite is at least paying lip service to the principles contained in our oft-repeated mantra that there are no macro-economic issues which can be solved other than by micro-economic means (though, for us, that also includes case-by-case debt renegotiation, write-down, and transmutation into equity).

Sadly, while their mouths may be making such pious utterances unto the Gods, their hands – as M. Carmignac so forcefully pointed out in the European press a few days ago – are reaching ever more boldly into the pockets of those who still have reserves of capital and a viable means of support, thus bleeding the healthy in the forlorn attempt to palliate the sick. A case in point here is the latest brainwave of resurrecting the time-dishonoured method of forcing the rich to subscribe to state ‘loans’ – a levy on what might otherwise be productive capital last practiced by arbitrary princes of the ancien régime, as well as by the bellicose proto-republics with whom they were often at war.

With markets showing less and less response to the same, wearily repeated prescription of longer-lowered interest rates and more intrusions into the markets – LIBOR rigging on a universal scale, we cannot refrain from adding – the worry is that the piecemeal expenditure of the wrong sort of ammunition in pursuit of ill-counselled operational objectives will yet see the whole Grande Armée of bureaucrats, technocrats, and corporocrats arrive at its very own Berezina just in time to celebrate the two-hundredth anniversary of the utter dissolution on those pitilessly icy banks of the once-proud remnants of the first.

Although it may be inscrutable to Westerners, it is very likely that Bo Xilai was a victim of corrupt malefactors, and has been settled in a safe place until the malefactors are routed, upon which Bo Xilai will enjoy new found influence. The common reading of these events may very well be exactly backwards.