“Giarre, a town in eastern Sicily, sits above the sea on the slopes of Mount Etna. It was once a collection point for the wine produced on the hills above, which was rolled down its main street in barrels to the port below. Today, Giarre bears a far more dubious distinction. The city of 27,000 hosts the largest number of uncompleted public projects in the country: 25 of them, nearly one for every 1,000 inhabitants. So spectacular is the waste that some locals have proposed promoting Giarre’s excess as a tourist attraction.

On an afternoon in September, I toured some of Giarre’s most notorious eyesores with Turi Caggegi, a journalist who has been writing about government waste since the 1990s. Caggegi showed off a partly built, graffiti-covered theater where work has started and stopped 12 times. It has yet to host a show. Not far away stood a hospital that took 30 years to build and was outdated before it was ready to open. Later, Caggegi drove past an Olympic-size swimming pool that was sunk but never completed. “So much money wasted,” he said. “And it wasn’t that they were spending it on productive investments. They were buying votes.

In 2011 the Sicilian regional government ran a €5.3 billion ($6.8 billion) deficit on a €27 billion ($34.8 billion) budget. This year, with the island’s credit rating hovering just above junk status and Italian Prime Minister Mario Monti cutting subsidies to the regions in an effort to shore up the national budget, Sicily has reached the breaking point.

…

“Bread and circuses,” said Caggegi. “That’s what the Romans used to say.” Italians are discovering what happens when the bread runs out.””– From Bloomberg News, ‘Sicily on brink of fiscal collapse is symbol of dysfunction’, by Stephan Faris, 5.10.2012.

“Riot police were out in force in Tehran’s main squares yesterday as merchants kept their shops shut in protest at the falling rial, despite threats of prosecution.. The rial has fallen 30 percent in the past week, raising questions about Iran’s economic health in the face of tightening international sanctions. Wednesday’s strike by bazaar merchants in the capital, accompanied by unexpected protests by currency traders, led to clashes between riot police and demonstrators..”

– From the Financial Times, ‘Iran riot police on alert as merchants step up protest’, 5.10.2012.

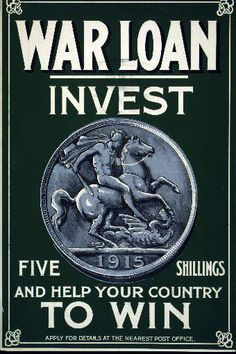

That roaring sound you hear is the noise of chickens coming home to roost across the western world. We have had four decades since President Nixon took the US dollar off gold in 1971, during which time our politicians have happily promised us the earth and made up for the inevitable shortfall by borrowing from the bond markets, and therefore from the future. But even governments cannot live beyond their (taxpayers’) means indefinitely. As the likes of Greece and Sicily are now discovering, the future has caught up with us.

There is a thesis, with which we agree, that suggests that the world now requires constant economic growth solely to service its mountain of outstanding debts. So what happens when that constant economic growth starts to turn into a synchronised slowdown – or worse? So far, with private sector borrowers furiously deleveraging (even at near zero interest rates: NOBODY WANTS TO BORROW – see Japan, last 20 years), the major central banks have aggressively taken the other side of the trade, and pumped money into the banks through the magical money-creation Ponzi scheme known as quantitative easing. The banks aren’t particularly keen on lending it out. That may be because they’re predominantly insolvent, but let’s not go there. So we have a stand-off, of sorts. On the one hand, individuals and corporates, having binged on easy credit for far too long, are now mostly sickened by the stuff. On the other hand, central bank governors don’t want to take the credit for Great Depression II. They’ll get it anyway, because the markets cannot be fooled indefinitely either. Meanwhile, the price signals that would ordinarily be a guide to entrepreneurs and other risk-takers are being hopelessly distorted by money-printing.

One side-effect of QE is that increasingly dangerous sovereign debt (as a shorthand: G7 government debt) optically resembles high quality debt in that the miserly yields available seem to reflect some form of ‘flight to quality’. What those miserly yields actually reflect is financial repression – namely that the government and its regulators are effectively forcing captive investors (not least pension funds) to invest almost exclusively in this garbage. In the process, by happy coincidence, heavily indebted governments are able to fund themselves. The private sector has a word for this policy: extortion.

Another side-effect of QE is that the perception of value in the variously affected currencies swings even more wildly than usual. Somebody intelligent once wrote that paper currencies don’t float, they just sink against each other at different rates. Since 1971 this has undoubtedly been the case. But since the Fed and the ECB went all-in in their pursuit of QE ad absurdum, the risk of disorderly currency collapse has risen markedly.

Don’t just take our word for it. CLSA’s Christopher Wood in his recent ‘Greed and Fear’ commentary writes as follows:

While the central banks have undoubtedly bought some time by creating the newsflow to allow most world stock markets to rally last quarter after the Eurozone-driven risk-aversion seen in the previous quarter, the decision by the Fed to adopt “open-ended” QE, and the overwhelming reaction of the investor consensus to support that decision, has re-enforced the base case long argued by Greed & Fear. That is that the “capitalist” world is on the path to the collapse of the fiat paper system. For once the “open-ended” principle is established, as it now has been, it can be expanded ad infinitum.

..the game will be up when investors cease viewing the relevant sovereign bond as a safe haven and that government bond yields spike as a result of supply concerns. At the point when such turmoil hits the reserve currency of the world, namely the US dollar and its government bond market, quantitative easing will be discredited, and most likely the modern fiat paper monetary system along with it, as well as of course monetarist and Keynesian orthodoxies.

Nor is Christopher Wood alone in a financial wilderness in this bleak prognosis. SocGen’s Dylan Grice in last week’s ‘Popular Delusions’ commentary cited Bernd Widdig and his analysis of Germany’s inflation crisis (‘Culture and Inflation in Weimar Germany’):

Next to language, money is the most important medium through which modern societies communicate.

As Dylan Grice indicates,

His may be an abstract observation, but it has the commendable merit of being true.. all economic activity requires the cooperation of strangers and therefore, a degree of trust between cooperating strangers. Since money is the agent of such mutual trust, debasing money implies debasing the trust upon which social cohesion rests.

And he adds,

I feel queasy about the enthusiasm with which our wise economists play games with something about which we have such a poor understanding.

For students of markets and economics this recalls a quotation by Keynes himself:

But to-day we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time — perhaps for a long time.

Keynes also once wrote that he worked for a government he despised for ends he considered criminal. We would adopt that phrase and direct it to the leading neo-Keynesian economists – overzealous believers in a false science – who are even now leading the delicate mechanism of the western economies into a fatal experiment with unsound money, egged on by bankers whose ethical compass has already been shown to be hopelessly compromised.

Today the currency of Iran. Tomorrow ..?

This argument happens to transcend the mundane and partially subjective business of shepherding pounds, shillings and pence to the safest havens; it touches on issues of fundamental morality. If we are debating with the ignorant, ignorance can ultimately be addressed, given an open mind. If we are debating with the profoundly stupid, that stupidity may admittedly be a barrier to full resolution of the debate. But if we are debating with people who are going to do harm, whether deliberately or inadvertently, the debate should be conducted at the fullest volume and with the widest number of engaged participants.

This article was previously published at The price of everything.

Sicily has been hopeless for a long time.

The much praised “unification” of Italy brought higher taxes (and conscription) to Sicily. And savage violence (for years) which is just dismissed as bandit stuff (if it is mentioned at all.

Corruption?

The bombing from World War II has still not been dealt with – with money being taken to build flats on the outskirts of the cities instead. Whilst some of the central areas of P. are still bombsites.

QE?

It has destroyed real savings – the basis of a honest financial system.

What the world has now is just a farce – with banks and other such dependent on a drip feed of money from the Central Banks (which is what the QE actually is).

Why bother to have private banks at all – if the money comes from the government, not from real savers?

Of course this the point the enemy (the left) make – and their voices are going to get louder and louder.