The production process is based on the division of labor. Each manufacturer specialises in obtaining certain products and obtains other goods he needs through the exchange. The world of production based on the division of labor is necessarily an economy of exchange where money performs at the same time the function of unit of account and means of payment. As Karl Marx put it: the chain “commodities against commodities” become the chain “commodities-money-commodities”. Here is the indirect exchange replacing barter. Because money is used as an intermediary in exchange, what ultimately is traded are always goods. As David Hume wrote, “money is the only instrument which men have agreed upon to facilitate the exchange of one commodity for another. It is none of the wheels of trade: it is the oil which renders the motion of the wheels more smooth and easy. ”

The exchange economy is also a community of payments: every purchase gives rise to debts and credits which sooner or later have to be extinguished by money transfer. Hence an exchange economy is also a monetary economy. But this does not alter the underlying reality: goods are redeemed for goods and not for cash. As soon as the exchange crosses national borders, we have an international economy. Long before the economic policies of states took an interest in the international exchange of goods, private economic actors in a country found it convenient to sell goods and services to businesses in other countries and buy from them. It’s clear that the interstate economic relations in the form of exports and imports of goods made it possible to increase the division of labor. The massive and rapid growth in the production of goods in cross border trade over the past 200 years it’s the consequence of the international division of labor. Today the phenomenon of the global market integration is called globalisation.

The fair exchange

At the beginning of the 19th century, David Ricardo made a notable contribution to the concept of the international division of labor with the doctrine of comparative advantage, depicted by the famous example of trade between England and Portugal. If the latter was more efficient in the production of cloth and wine, having an absolute advantage in manufacturing both products, it would be convenient for Portugal to produce only wine where she was comparatively more efficient and import cloth from England. If Portugal did not trade, she would need to produce the cloth locally, therefore devoting part of her capital to the manufacture of cloth. In the Ricardo’s example comparative costs refer to the relative costs between the goods produced in each country.

Basically the theory asserts that when considering the gains to trade it is not absolute advantage that is relevant but comparative advantage. The existence of comparative advantage is always mutual and reciprocal. Both self-sufficiency and protectionism, cutting ties with foreign countries, would result in missed trade opportunities or impoverishment. An implication of the law of comparative advantage is that under free trade no country or region of the world is going to be left out of the international division of labor. For the law means that even if a country is in such poor conditions that it has no absolute advantage in producing anything, it still would pay for its trading partners to allow it to produce what it is least worst at.

It’s worth noting that between the purchase of English cloth through the Portuguese traders and the purchase of wine through English merchants there is no relationship. As Ricardo put it: “Every transaction in commerce is an independent transaction”. The exporter does not sell wine in order to import cloth. He sells to a stranger in order to make money. On the other hand the importer as a debtor can raise money and extinguish his debt only by selling his good. In the Ricardo’s example the import value of cloth equals the export value of wine. But in the real world there cannot be such a perfect coincidence for two countries because this would require that their supply and demand relationships be such that the value of import from one country equals the value of export of the other, which hardly happens.

Such an equivalence of values can exist only at a multilateral level and in the long run: the value of total exports of one country must always equal imports values because in the international trade which is always accompanied by a change in the relations of credits and debts, a community of payments cannot lend or borrow against another indefinitely. They have to be paid off in real terms which means that in the long run exports pay for imports. Under the gold standard, nations were unable to exchange unless buying and selling goods of similar value and this what a fair international exchange is all about.

The unfair exchange

However, globalisation did not have the positive impact on countries it was supposed to bring and real world growth has come to a standstill. Although foreign goods are available in every country now more than ever before, global market integration has delivered negative effects notably in the developed countries: income inequality, lower living standards, economic imbalances and structural vulnerabilities. How is it that the division of international labor and comparative advantage theory did not work? The popular account is that low labor cost advantage of developing countries has eroded developed nations competitiveness. But is this true?

At Ricardo’s time wages in England were comparatively higher than those of the other countries and yet she was a competitive country. The same applies to United States, Germany or Japan in 20th century: even with the highest wages in the world they were competitive nations. So labour cost differentials do not account for competitive disparities. The actual root causes of development gaps lie elsewhere.

When Ricardo expounded his doctrine, international commerce was regulated by a stable currency, gold, and under this regime world trade in relation of output grew immensely with mutual benefits. In a economy based on the division of labor, for wealth to circulate in the form of goods and services, money itself has to be wealth. Only acting as fungible and generic wealth can money be traded for specific wealth measuring its value and allowing exchanges of heterogeneous goods at a fair ratio. Gold played this role. Changes in its value did not interfere with the function of measuring other values because its momentary fluctuations affected all the goods simultaneously – their relative values unaltered although those values were expressed in higher or lower gold prices. With such an intermediary, the exchange ratio between goods exported and imported did not change unless countries’ respective productivities did. In fact it is productivity that is the source of value determining the terms of trade, not gold which is only wealth acting as a neutral means of exchange. A country might settle its contingent trade deficit either by being more productive or drawing out of its gold reserves. But since the late 20th century, international trade has been deprived of real money and disruption started to unfold.

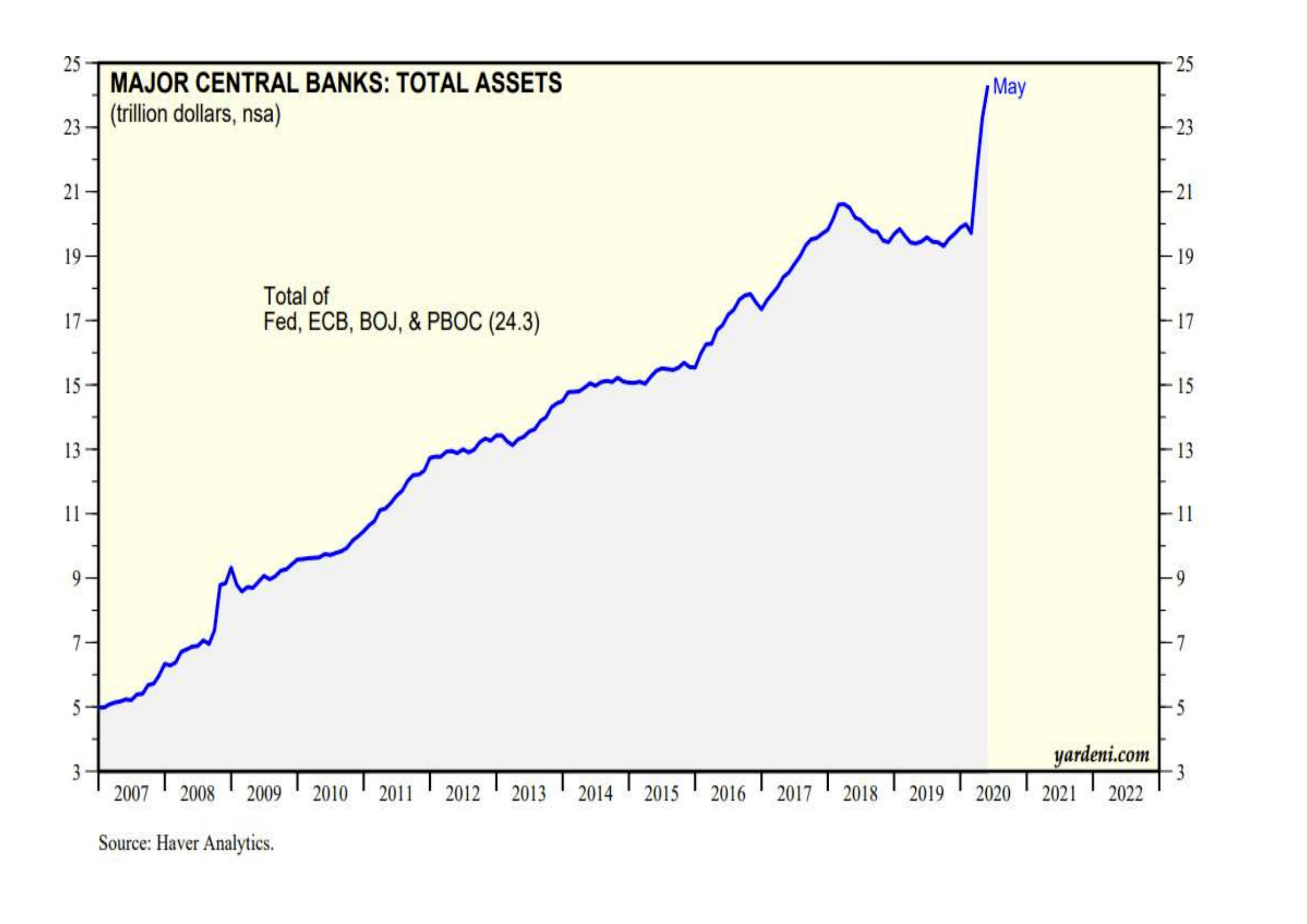

When the dollar standard replaced the gold standard, a universal demand for the American currency was created. Unlike gold, dollars could be produced without limits at virtually no cost. This gave the US a tremendous advantage over its competitors: they could pay for imports not with the proceeds from export but by “manufacturing” irredeemable dollars. As a global reserve currency, the dollar took control over the currency markets and the US no longer settled debts in real terms. On the other hand, emerging countries, notably China, turned the situation to their advantage by trading cheap goods for a currency endowed with the exclusive privilege to buy commodities essential for growth and accumulating paper reserves to buy other valuable goods.

The dollar as a means of settlement of debts without producing made for US deindustrialization. Ironically this capitalist country, once the largest creditor in the world, became the largest debtor and China, a former communist country, the larger creditor. Since the gold standard abandonment practically no debt has been settled in the international trade because all governments have been creating fictitious money at the same speed. And because today the means of payments are credit creations without any backing, the monetary economy has become a debt economy where obligations are never extinguished.

In fact, as already remarked, debts are fundamentally obligations to give not money but wealth. Thus under a regime of fictitious money, products no longer pay for products, exports no longer pay for imports. As soon as gold was demonetized and irredeemable currencies were put under governments’ political authority, international trade has stumbled in a self-feeding vicious circle: deficits have caused currencies to fall in value one relative to the others lowering the value of exports and making them unable to pay for the same value of imports which in turn have boosted trade deficits further. To correct trade deficits, nations are devaluing currencies with the effect not only of distorting terms of trade but of triggering a universal process of deindustrialization which even the emerging countries won’t escape. As long as countries accept inflated currencies for real goods they are financing consumption at the expense of the capital necessary to fund their production process. Falling currencies lower export values relative to imports, and raise demand for exports. But this far from generating growth is causing an unfavorable shift in the terms of trade resulting in a country having to export more to import the same amount of goods. This amounts to producing more for less pay – lowering productivity, real wage rates and purchasing power.

The gold standard tended to equalize the purchasing power of redeemable currencies to terms of trade so that the exchange rate was a transmission mechanism for real productivity gains. But inflated currencies have obscured this process of wealth creation and competitiveness, turning globalisation from social and economic cooperation into a destructive race among nations.

To make globalisation work and restore balanced economic growth, we urgently need to bring real money back into circulation.

How does gold work in relation to oil? Surely small oil producing nations will simply end up with most of the gold?

@Ray

There is a correlation between gold and oil in the sense that monetary inflation will rise both. Both commodities are in fact priced in dollars. There is no direct causation link but an indirect one.

Gerardo

Great article. The process of debauching your currency to gain short term pricing competitiveness for exports at the expense of increasing productivity and innovation is a long term trip to the poorhouse. The Austrian School makes it clear that what is required is a global fixed exchange rate regime and this can only be effectively achieved with a hard currency such as gold. That not to say that gold needs to be the unit of intermediate exchange, but as long as the currency that is used for intermediate exchange is cleared for gold. This could be a Freegold-type system, where, for example, Real Bills could be used as the intermediate currency and gold the currency of account or savings. We have the worst of all currency systems now and it is well on its way to complete collapse.

Who gained in the long run? The US which was consuming without producing (like the British empire before) or China which was producing without consuming but at least was building the capital infrastructure for the future? I think that US win in the short term meanwhile China will win in the lond run !