“The Checklist Manifesto – How to get things right”, is a masterful book for its narrative and practical application. Written by Atul Gawande, an acclaimed surgeon based in the US, he takes us on a journey of how the simple checklist helps individuals deal with immensely complex situations, where risks can be calculated and often lives protected – skyscraper construction, medicine and investment banking.

First introduced into the US Air Force to assist pilots, the humble checklist in all its simplicity has helped generations of pilots navigate the complexity of flying modern aeroplanes. Gawande himself has introduced the concept into operating theatres and hospitals around the world with astounding success.

At Hinde Capital we have embraced such a concept almost naturally in an attempt to codify both our objective and subjective observations of the market place. Our hope is to eliminate behavioural biases that can lead to a misdiagnosis of events before an investment decision.

It has long been our contention that central bankers have misdiagnosed the dynamics of the global economy, particularly in this last decade. Right up until the implosion of equity markets in 2007 and 2008 Bernanke said there was no housing bubble, that inflation was benign, even though almost every asset price from equities to gold was trending in a succession of levitating new highs. When considering how to guide a system as complex as the global economy with so many independent countries and decision makers, we often wonder what type of checklist a modern central bank was actually employing. The crucial ingredient, though, is not only a checklist but the correct checklist.

Central Bank Checklist Manifesto

In a hospital one of the most basic but effective checklists deployed since the 1960s as introduced by nurses was a vital signs chart – every few hours or so nurses would check the following:

- Pulse

- Blood pressure

- Temperature

- Respiration

Likewise a central bank observes certain vital signs to observe the state of the economy – their patient. To have an understanding of what the ‘vital signs’ checklist is for the Fed, let’s look at their duties as outlined in their manifesto ‘The Federal Reserve System – Purposes & Functions.’

The Federal Reserve’s duties fall into four general areas:

• conducting the nation’s monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates

• supervising and regulating banking institutions to ensure the safety and soundness of the nation’s banking and financial system and to protect the credit rights of consumers

• maintaining the stability of the financial system and containing systemic risk that may arise in financial markets

• providing financial services to depository institutions, the US government, and foreign official institutions, including playing a major role in operating the nation’s payments system

Let’s focus on the first point. The Fed’s objectives include economic growth in line with the economy’s potential to expand; a high level of employment; stable prices (that is, stability in the purchasing power of the dollar); and moderate long-term interest rates. So their vital signs checklist may go something like this:

- Growth

- Employment

- Inflation

- Interest rates

Alan Blinder, a former Fed governor and Vice Chairman (1994-96) wrote an insightful working paper called ‘Monetary Policy Today: Sixteen Questions and about Twelve Answers’. These questions in many ways are a checklist questioning parts of the Fed manifesto. Blinder himself resigned as Vice Chairman under Greenspan as he was in disagreement with his diagnosis of the US and global economy.

Central banks have tried to be omnipotent in guiding economic behaviour rather like a surgeon accustomed to holding centre stage in his ‘operatic’ theatre. The central banker can’t enforce his will on agents in the economy because it does not allow for human beings’ subjective preferences on how to spend and live. Using a policy of market expectations to direct human action, based on assumptions of some rational expectation, has been proven to be flawed. Besides which, who leads? The marketplace or the central bank? – the dog or the dog’s tail?

The great US humourist of the Depression era, Will Rogers once famously said, “There have been three great inventions since the beginning of time: fire, the wheel, and central banking”. His comment, laced with no small amount of irony, may have well been uttered today.

Central Bank CAnniBALism

Central banks are the devil. They are like drug dealers except they administer regular doses of supposedly legally prescribed barbiturates to their addicts. The ‘easy money’ or ‘credit’ they create is an opiate, and like all addictions there is a payback for the addicts, one exacted only in loss of health, misery, and death.

Our reliance on ‘easy money’ as facilitated by credit has become terminal. Like drug users we continue to attempt to find a heightened state of nirvana. We continue to hark for the utopian days prior to the eruption of the post-2008 crisis, even though our well-being was fallacious and based on an illusion of wealth paid for by credit – a creditopia. The abuse of credit is what defined the Great Financial crisis and one that still defines our economic system and one which will define a much worse crisis to come.

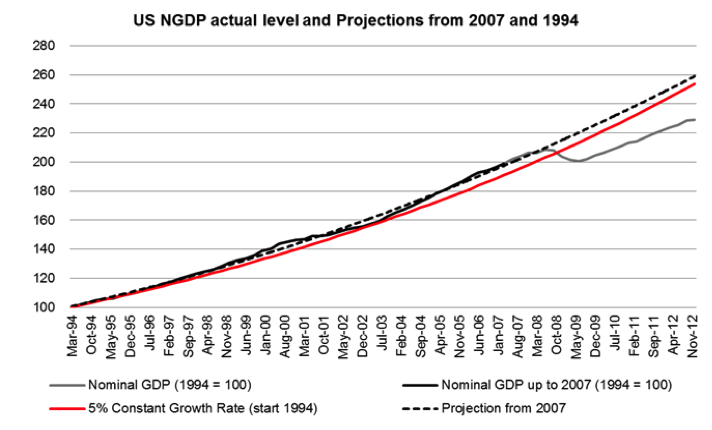

Central bankers have begun a concerted effort to fight the global debt problem which has been stifling growth as tax revenues merely serve to finance debt servicing rather than addressing the repayment of principal outstanding. Omnipotent governors, Bernanke, Carney, Draghi, Svensson and Iwata or Kuroda (either are likely to replace Shirakawa at the BoJ) are to take a far more aggressive and activist role in pursuing a new framework for growth and inflation by seeking an alternative way to conduct monetary policy. It’s called Nominal GDP Level targeting (NGDPLT) and it is in our opinion as significant a moment as Volcker’s appointment to the Federal Reserve governorship in 1978.

Many will recall Volcker’s moment was to engineer a swift monetary contraction and deceleration of the money velocity to try and reign in excessively high inflation and stabilise growth. It worked. Today we are witnessing an ‘Inverse Volcker’ moment, whereby the opposite is likely true.

The question remains: are they all still ‘inflation nutters’ as Mervyn King, the BoE Governor glibly referred to those central bankers who focussed solely on inflation targets to the potential detriment of stable growth, employment and exchange rates.

Are central bankers merely expanding the boundaries of monetary largesse by focusing on a broader mandate and merely evolving the singular variable approach of inflation targeting, or have they finally found a solution to eradicating boom-bust business cycles? This is a question we need to answer as we are currently witnessing a Central Bank Revolution which could portend severe consequences for prices in our economies, and all the attendant misery that comes with very high inflation.

Nominal GDP Level targeting advocates believe they have a plausible case for a change of mandate by central banks and one which is being gradually adopted, but we believe that like central banks they have misdiagnosed the cause of the crisis by failing to examine the impact of credit creation in our global economy. Money matters, but credit matters more.

In our latest HindeSight Investor Letter – The Central Bank Revolution I (Well ‘Nominally’ So) – we explore and counter this new wave of economics called Market Monetarism, which advocates NGDPLT and which appears to be revolutionising central bank monetary policy.

This article was previously published at HindeCapital.com.

The article makes a good point about checklists being important in the science and engineering worlds where cause and effect are well-defined and always true, but not so true in the economy which is based on human action. One gets the scary impression of a mad wannabe scientist Bernanke fiddling with some economic control dials down in the basement of the Federal Reserve building. Lord help us all.