The Bank of England is considering negative interest rates to “stimulate” the economy, together with more QE. It’s one thing to pay a bank for safe-keeping and other services, another for the central bank to manipulate the credit markets as a whole. It is explicitly a policy of expropriating savers, of which there is much to be said on another occasion. Allister Heath provides sensible comment here.

What the Bank of England is trying to do is restart the money creation process which dropped us into this mess while keeping expectations of inflation low. It’s an extremely dangerous game, one which Hayek explored in his Nobel lecture: it is a policy which cannot create sustainable prosperity but which may create massive inflation, with all its destructive effects.

Having mostly failed to see this crisis coming before failing to predict even the general pattern of events, senior economists now want more of the medicine which already nearly killed the patient. This may look like madness or stupidity to those of us without a high level of formal education in economics. It is neither. Contemporary economists are trapped in an intellectual prison founded on now-old errors of method and epistemology: the knowledge and simplifications necessary to make their mathematical models work are unavailable and invalid respectively.

As a result, economists and central bankers in particular think it is their task to intervene when the choices and actions of tens of millions of people produce aggregate statistics they, and politicians, don’t like. Massive economic disruption and misallocation of resources — ultimately, human suffering — is the result. Unfortunately, it looks like those few who hold the terrible power of monetary policy are determined to test their ideas to destruction.

Following the UK credit rating downgrade, I gave Newsnight an interview. They chose a couple of sentences in which I pointed out the reality that welfare, health, education and debt interest are about 3/4 of spending on 2012 figures and that they will have to be cut eventually if we are serious about the state living within its means. You can find it at 17:00. If I had been given longer, I would have said those things you can find in this interview with RT:

We have been on a merry-go-round of deficit spending, excruciating taxes, heavy borrowing and easy money for most of 40 years. That merry-go-round is now running down and will stop. Attempts to spin it up through monetary policy are extremely dangerous: they will store up worse trouble for later.

If the Government does not act to end expansionist policy in time by a return to balanced budgets, by ending government borrowing from the commercial banks, by stopping quantitative easing and by letting the market determine the height of interest rates, then it will have chosen the German way of 1923.

This article originally appeared on stevebaker.info.

Of course Mr Baker is correct – but a lot of people do not want to here this.

I just has a “free market” person rant at me on another blog – accusing me of being a Marxist (I suppose because my name is “Marks”- how original, that is school playground level), and declaring that I wanted to get rid of his pension.

I had not even suggested cutting government pensions – I just suggested a set of other government spending cuts with the aim of balancing the budget(and thus ending this insane borrowing – which is financed by the Bank of England’s monetary expansion).

Radical spending cuts yes – but with the aim of actually saving the freaking pensions (and so on), by preventing de facto bankruptcy (economic breakdown).

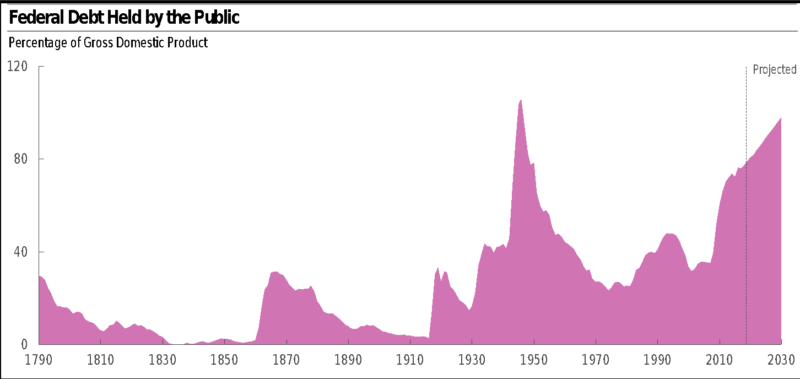

A lot of people just do not want to know the truth – and become hysterical when one(for example) tells them that the government debt (even as a percentage of GDP) is going UP not DOWN.

Hear here – and so on.

My typing is as vile as ever.

Your typing is very laissez faire, but your grammar & spell check has been socialised to the point of predictable failure;-)

I sent a letter to the Financial Times yesterday saying pretty much what Steve Baker said above. It read as follows.

Sir,

In advocating negative interest rates, you seem to have forgotten what an economy is for (“Negative Thinking”, February 28). The purpose of an economy is to produce what people want, both as expressed by what they do with their plastic cards and what types of public spending they vote for.

A six year old can deduce from that that in a recession, ordinary people should be given more to spend plus public spending should be raised, with banks being left to expand lending (or not) as they see fit. But for important people in smart suits in Westminster and the City, ordinary people are viewed with distain. So according to the “suits”, Wall Street and the City must be featherbedded while Main Street starves. Trying to skew the economy towards lending and borrowing while we are still suffering the effects of pre-crunch irresponsible borrowing is mad enough. But negative interest rates are pure lunacy.

Negative interest rates?

I suppose I should have expected it – but thank you, Mr Musgrave, for pointing out just how insane the Financial Times has become.

If one sees a copy of the “FT” in an office (or that they have subscribed to it electronically) one should leave that office.

The Financial Times people, and the rest of the establishment elite, care nothing for economic law (OBJECTIVE REALITY) their madness does not just concern themselves, they are a clear and present danger to everyone else.

I am anticipating complete currency collapse of the UK. Mises spelled it out. This policy is to sacrifice the entire country to bail out the feckless and the reckless. I don’t subscribe that they don’t know what they are doing, they do, they are evil. One day the honest and the just will have their day.