Via City A.M., Bank official: Bond bubble is the biggest threat to financial stability | City A.M..

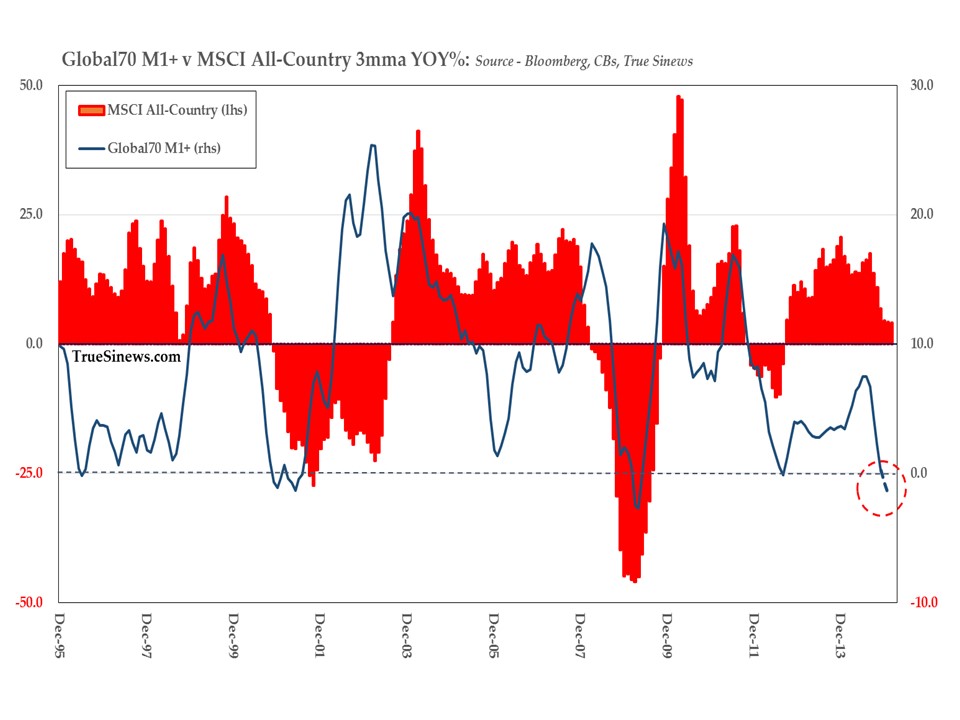

OUTSPOKEN Bank of England official Andrew Haldane warned yesterday that the bursting of a bond bubble is the biggest threat to the world’s financial stability.

Haldane, the Bank’s executive director of financial stability, told the Treasury Select Committee that central banks’ massive asset-buying programmes have created significant risks.

“If I were to single out what for me would be the biggest risk to global financial stability right now, it would be a disorderly reversion in government bond yields globally,” Haldane told the MPs.

“We’ve intentionally blown the biggest government bond bubble in history. We need to be vigilant to the consequences of that bubble deflating more quickly than we might otherwise have wanted.”

It’s at once terrifying and wonderful to see the conversation about the economic crisis move in this direction. Terrifying because it looks increasingly like those of us who have been talking about the massive economic disruption caused by central banks are correct. Wonderful because at last the Bank’s most courageous official has made this explicit.

The FT recently reported on its front page, “Some of the smartest money in America is getting out of US government debt.” Unfortunately, big players in markets like central banks cause herding. It therefore remains to be seen whether it is possible for the bond bubble to deflate slowly.

In any event, interest rates will rise unless central banks take yet further action. The medium term consequences for our system of money, the welfare state and society are likely to be profound.

This article was previously published at SteveBaker.info.

Central Banks produce money (from NOTHING) and use it to (directly or indirectly) buy government debt (“bonds”).

This is vile – utterly corrupt.

“We do not care about morality”.

I know you do not, credit bubble people.

But the “Gods Of The Copybook Headings” make themselves felt.

And it will be soon.