City A.M. reports today Dovish Carney stuns markets:

City A.M. reports today Dovish Carney stuns markets:

EQUITY markets jumped yesterday after the Bank of England shocked investors by indicating that rates would stay at historic lows in the near future, despite recent signs that the British economy is starting to strengthen.

That investors are shocked by the news that Mark Carney plans a further extended period of easy money is more surprising than the news itself. But it turns out markets are good at responding to superficial data over the clearly stated intent of big players in the market, like central bank officials.

Consider the evidence of Lord George, former Bank of England Governor, to the Treasury Select Committee in 2007, in which he confesses his role in seeding economic disruption in an attempt to avoid recession:

Tuesday 20 March 2007 – Treasury – Minutes of Evidence

Q117 Ms Keeble: What makes it worse is that the one tool that the MPC has is interest rates and that filters through to our constituents in the form of higher mortgages. That makes them complain even more; it becomes cyclical.

Lord George: Yes, if house prices are going up. But one has to step back and recognise—I referred to it earlier—that when we were in an environment of global economic weakness at the beginning of the decade it meant that external demand was declining. Related to that, business investment was declining. One had only two alternatives in sustaining demand and keeping the economy moving forward: one was public spending and the other was consumption. It is true that taxation and public spending can influence the demand climate and consumer spending, but confronted with what we saw we knew that we had to stimulate consumer spending. We knew that we had pushed it up to levels that could not possibly be sustained in the medium and longer term, but for the time being if we had not done that the UK economy would have gone into recession, just like the economies of the United States, Germany and other major industrial countries. That pushed up house prices and increased household debt. That problem has been a legacy to my successors; they have to sort it out, but we really did not have much of a choice about what we did unless we accepted that we would yank it back or give up stability altogether. That is the point I am trying to make in answer to Mr Newmark. There are some people—maybe lots—who say that house prices is the biggest problem, that the mortgage rate is going up, housing is not affordable and so on.

And a few weeks ago, the Bank’s Andy Haldane confessed that they “have intentionally blown the biggest government bond bubble in history” (I abridge a little):

Wednesday 12 June 2013 – TRANSCRIPT OF ORAL EVIDENCE

Q41 Mark Garnier: … If you thought that QE was creating financial instability, would you try to warn the MPC and, if so, how would you do it?

Andrew Haldane: I absolutely see it as my one of jobs as an FPC member to alert not just the MPC but this Committee and the wider world if I thought that QE, or monetary policy actions more broadly, was posing significant risks to UK financial system stability. …

To the substance, this is a risk that I feel very acutely right now. If I were to single out what for me would be the biggest risk to global financial stability right now it would be a disorderly reversion in the yields of government bonds globally, for any one of a variety of reasons. We have seen shades of that over the last two or three weeks. Let’s be clear, we have intentionally blown the biggest government bond bubble in history. That is where we are, so we need to be vigilant to the consequences of that bubble deflating more quickly than we might otherwise have wanted. That is a risk. It is one we as FPC need to be very vigilant to.

So, by officials’ own admission, the Bank under Eddie George created levels of debt-fuelled consumption which they knew could not last in the hope of avoiding recession and, following that bubble bursting, they have now deliberately inflated the biggest bond market bubble in history. When I see markets herding in response to the pronouncements of these big players, I think “What could possibly go wrong?”

As I set out in my speech on the Budget (video), Mark Carney has clearly explained his intention to use the Bank of England to manipulate economic expectations to manufacture recovery. This will not work.

It is certainly true that the central banks can alter economic expectations but the idea that they can do so helpfully is fanciful. It is founded on the same errors as socialism and like socialism, it cannot work because the information necessary is not available and because it relies on aggregating away much that makes us human.

We’ve had two confessions from central bank officials. I feel I can predict confidently that Mark Carney will one day confess, more or less, “We thought we could manage the economy by steering the expectations of tens of millions of people using monetary policy to blow various bubbles while making pronouncements about policy. We were wrong.”

One of the great tragedies of our circumstances is that so many people will label this central planning “capitalism”. Eventually, the state will have to get out of money and banking. Mark Carney’s coming failure should accelerate the day.

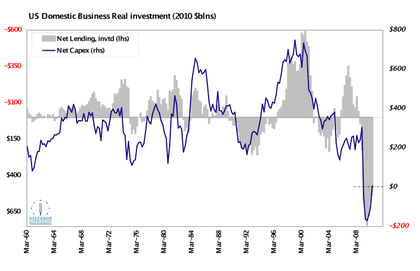

It is the same in the United States – thus cheering the American “recovery” should be reminded that when the flow of funny money from the Federal Reserve stops, the markets will collapse.

In Britain the bond market, and the stock market, and the property market are government credit money bubbles – the products of monetary policy.

Mr O. thinks this “low interest rate” policy is wonderful.

But then he also thinks spending 50 BILLION Pounds (actually it will be many times that) on the absurd HS2 project will be “good for Northamptonshire” (he was in this county recently and said that).

The HS2 train track will indeed destroy more of Northamptonshire – but the trains will not stop anywhere in Northamptonshire.

We are ruled by deluded people – and I am starting to think that “deluded” is not just a slang word in this situation, some of our rulers may actually be suffering from some form of mental illness.

‘It’s Japan all-over stupid’ as Bill would have said.