“Mark Carney, the new governor of the Bank of England, could hardly have timed his arrival better. Even before he launched his bid to revive the UK economy, following years of little or no growth, data signalled that the recovery is gaining momentum without his help.”

– Claire Jones and Sarah O’Connor, who evidently need to be hosed down with cold water, in ‘Carney eschews car for the Tube and times his arrival to perfection’, The Financial Times, 2nd July 2013.

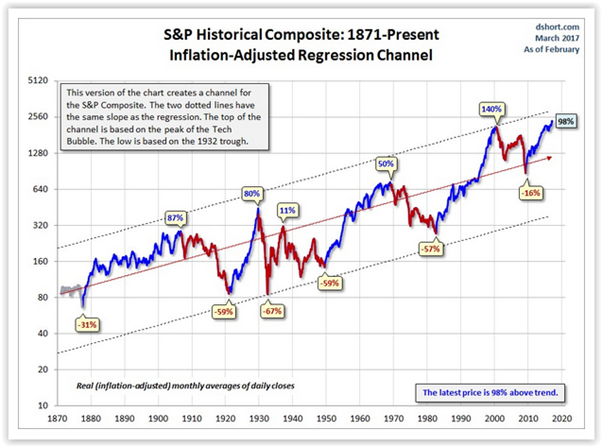

“Everyone loves an early inflation. The effects at the beginning of inflation are all good. There is steepened money expansion, rising government spending, increased government budget deficits, booming stock markets, and spectacular prosperity, all in the midst of temporary stable prices. Everyone benefits, and no one pays. That is the early part of the cycle. In the later inflation, on the other hand, the effects are all bad. The government may steadily increase the money inflation in order to stave off the later effects, but the latter effects patiently wait. In the terminal inflation, there is faltering prosperity, tightness of money, falling stock prices, rising taxes, still larger government deficits, and still soaring money expansion, now accompanied by soaring prices and the ineffectiveness of all traditional remedies. Everyone pays and no longer benefits. That is the full cycle of every inflation.”

– Jens Parsson, ‘Dying of Money’.

It is difficult to know quite where to start in extolling the virtues of this semi-mythical godlike being who has just descended to earth to take up his new position at the central bank of the United Kingdom. His matinée idol good looks? His twinkling, steely, yet strangely compassionate eyes? That cheeky yet cherubic pout? His being appointed senior associate deputy minister of finance effective November 15, 2004 at the Canadian federal Department of Finance? No matter. As legions of otherwise hard-nosed financial commentators dissolve into girlish transports of delight at the arrival of this thrusting young buck at the offices of the Old Lady of Threadneedle Street, there can surely be no likelihood whatsoever that the fatuous hagiographic sycophancy with which all of Fleet Street and the City are greeting his appointment will end in anything other than everyone’s expectations of economic and monetary transcendentalism and an orgiastic recovery in our national finances being spectacularly exceeded.

Our new Governor was born in Fort Smith, Northwest Territories, to Mary Carney and Joseph Carney, a carpenter. Mark began his ministry at Goldman Sachs in its London, Tokyo, New York and Toronto offices. Eschewing the luxury trappings of high office including the company’s limousine service he would regularly cross the Atlantic on foot between the group’s London and New York offices.

After 13 years spent rebuffing the temptations of Satan, Mr Carney went on to drive the money changers from the temple by joining the Bank of Canada. It was there in 2008 that at the height of the financial crisis he performed the miracle of the Calming of the Storm. One evening Mr Carney and his disciples found that the international banking system was nearly underwater. According to the Gospel of Mark, Mr Carney then

..got up, rebuked the wind, and said to the waves, ‘Quiet! Be still!’ Then the wind died down and it was completely calm. Apart from a bit of a bubble in the domestic Canadian property market. And he said to his disciples, ‘Why are you so afraid? Do you still have no faith?’ And they were terrified and they asked each other, ‘Who is this? Even the wind and the waves obey him!’

It was at the Bank of Canada that Mr Carney first developed his reputation for entertaining, his ‘loaves and fish’-themed parties catering to several thousand at a time being particularly notable.

Mr Carney earned various accolades for his leadership during the financial crisis. The Financial Times listed him as one of the “Fifty who will frame the way forward”, displaying their ever-constant grasp of the ungrammatical non-sequitur. Time Magazine named him one of their “2010 Time 100”. Newsweek wrote that

Canada has done more than survive this financial crisis. The country is positively thriving in it. Canadian banks are well capitalised and poised to take advantage of opportunities that American and European banks cannot seize.

The Neasden Courier, on the other hand, simply referred to Mr Carney as “Messiah.”

Central banking is just about everybody’s economic blind spot. Investors who otherwise believe in free markets struggle with the idea that money, its supply and its price should be left to the free market too. This is not a new concept. Two weeks ago we highlighted the conclusions of the 1810 Bullion Committee in Britain:

The most detailed knowledge of the actual trade of a country, combined with the profound Science in all the principles of Money and circulation, would not enable any man or set of men to adjust, and keep always adjusted, the right proportion of circulating medium in a country to the wants of trade.

Or to put it another way, even if Mark Carney was a combination of Albert Einstein, Warren Buffett and Superman, he would be hard pressed to know precisely how much money to print (but we can presume: it will be a lot) whenever he gets round to it, or precisely where UK interest rates should be in the best interests of the economy (but we can presume: they will be held ‘lower for longer’). Of course, UK base rates are not being managed in the best interests of the economy, but in the best interests of the banking system, which is not quite the same thing. Indeed, it would be a strange economy that enjoyed a high savings rate with base rates at nearly zero, and it would be a strange economy that pursued productive investment given the absence of proper savings.

Perhaps interest rates should realistically be much higher than they currently are, with the resulting ‘honest recession’ allowing market prices (not least property prices) to clear, rather than remain gummed up courtesy of the sort of financial chicanery that Mark Carney is about to start practising, probably with even greater zeal than his predecessor ever did. But no central banker will allow any sort of bank failure on his watch, certainly not one with 13 years at Goldman Sachs under his belt. That revolving door between Wall Street and Threadneedle Street / the Marriner Eccles Building isn’t going to revolve itself. And if the job itself is beyond the abilities of any man to execute well, why is almost nobody other than a handful of Austrian school financiers asking whether the institution around the man can ever be fit for purpose either?

This article was previously published at The price of everything.

After creating the credit-money property bubble in Canada (soon to burst) Mr Carney has come to the United Kingdom of Great Britain and Northern Ireland (invited to take over the Bank of England by Mr Osbourne and Mr Cameron).

Here Mr Carney has announced that 0.5% interest rates for borrowers (not for ordinary borrowers of course – for the banks and other favoured people) will continue (for years). This means that bankers and others need not concern themselves with real savers (ordinary people) as they will continue to be subsidised by the government via the Bank of England.

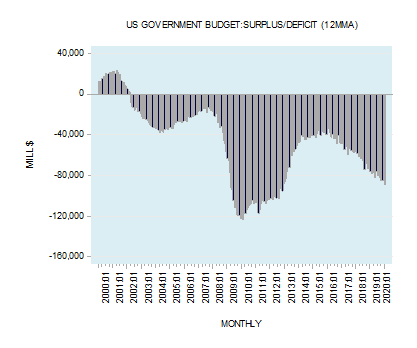

Borrow money from the Bank of England (if you are special person), then lend the money back to the government (to fund its deficit).

Nice work if you can get it.

This is the so called “financial system”.

Recent news appears to suggest that markets are reacting to what central bankers do and say, and that central bankers are reacting to what the markets do and say.

Which is the dog, and which is the tail?

For Mark Carney to revive the British Economy he needs to study what Andrew Mellon did under President Warren G Harding and realise he can and must ‘do nothing’…