The British media is obsessed with Mark Carney, the new boss at the Bank of England, who, this week, made his first public appearance as governor with a speech in Nottingham. There were adoring comments about his looks (the vague resemblance with George Clooney, supported with plenty of photographs) and his voice (deep, confident, reassuring), and as most journalists are more in awe of money and wealth than they are willing to admit, references to his generous pay package were also not missing. But there was also consternation that the words of the ‘most talented central banker of his generation’ seemed to carry so little weight with the markets.

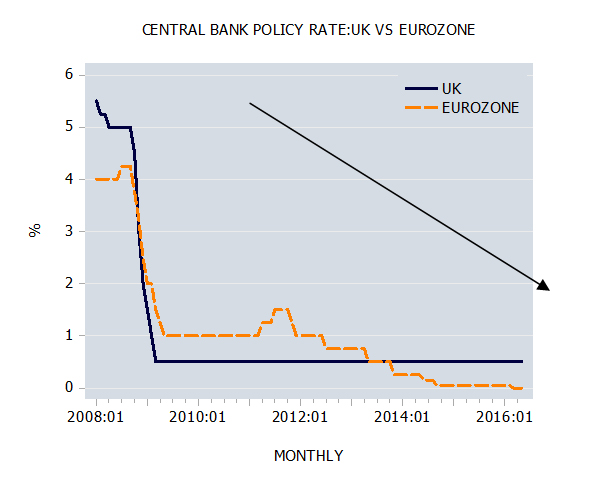

The Wall Street Journal had previously described Carney as ‘a pioneer of forward guidance’. Forward guidance is the allegedly new central bank technique of telling the market where policy will be heading (or rather, assuring the market where it will not be heading), supposedly in order to make policy more effective. Despite Mr. Carney’s repeated assurances that rates will only be moved higher when unemployment drops to a certain level (7% is Mr. Carney’s magic number) and that this will not occur until 2016, the market has recently been happily selling fixed income securities, and in the process, has allowed the forward curve to start pricing in earlier rate hikes. To Mr. Carney’s pledge to keep rates low, the market has practically been saying, in the words of the inimitable Jeffrey “The Dude” Lebowski, ”Yeah, well, that’s just like…your opinion, man.”

Whether the market will be proven right and whether rates really will move higher earlier than Carney contemplates today, is a question we cannot answer. The future will tell. (Personally, I remain of the opinion that the talk of ‘tapering’ in the US is overdone, that central banks will not manage a smooth ‘exit’ from their position of extreme accommodation, and certainly not anytime soon.) But the market is undoubtedly correct to not allow itself to be guided in its assessment of the economy’s future performance, and therefore future policy, by the BoE’s new super-bureaucrat.

The whole idea of forward guidance is, of course, preposterous. The market knows full well that policy will change if circumstances change. Should the economy recover more quickly, should the Fed’s actions put pressures on other central banks to also remove accommodation, should inflation rise faster, or should the pound come under pressure, the policy elite at the BoE will most certainly have to respond. Conversely, if the economy nosedives again or if another financial accident occurs, central bankers will cut rates again (maybe to negative levels?), and throw more money at the problem.

The market is, of course, frequently wrong in assessing the future. Also, the market’s assessment is constantly changing. But the market is still the most awesome machinery for data-collection and data-processing, and it remains unmatched by any institution, individual or group of individuals, even overpaid George Clooney lookalikes.

Most bizarre about this whole episode is the reverence with which the commentariat still treats the central bankers. Based on their exaggerated view of their own powers to do good, and their importance for ongoing growth, and based on their erroneous and self-serving belief that money-printing is costless as long as certain conveniently self-selected measures of consumer prices remain under control, central bankers have, for years, happily fed the housing bubbles and allowed bank balance sheets to balloon beyond all proportion. They then sleepwalked into the crisis of their own making, and once the house of cards had collapsed, they feverishly tried to recreate semblances of stability and solvency, usually by printing more money faster and by manipulating various asset markets through targeted purchases. Recent financial history is a legacy of central bank failure, yet the media remains uninterested in economics and obsessed with personalities. Politicians, bureaucrats and central bankers – no matter the disasters they produce, the hope persists that the next guy will do better and save the world.

Markets, however, are rather less sentimental and much less prone to political romanticism.

In this respect, the ongoing debate about who will be the next Fed chairman, Janet Yellen or Larry Summers, is equally unenlightened and undignified. Summers strikes me as the more interesting and unpredictable thinker and he would probably make a more entertaining chairman. Nevertheless, the impact of the selection on future policy is marginal, in my view.

And one final thought: if the market is correct and economies are presently recovering with more momentum, then this is most likely the result of reflationary monetary policy finally gaining traction and of accelerating credit growth. In that case, prices won’t stay still. (As an aside, farmland in the US keeps appreciating at double-digit clips.) Inflation and inflation expectations could quickly be on the rise. If that is indeed the case, and if central bankers then keep sitting on their hands because of their forward-guiding commitments, the bond market could continue to be in trouble.

The potential for central bankers to do harm remains bigger than that to do good.

This article was previously published at DetlevSchlichter.com.

I thought that I was beyond being shocked by the ravings of Central Bankers (and other establishment types), yet hearing Mr Carney going on about how he would not stop monetary expansion till the number of “jobs” increased to the level he wanted (totally falling into the fallacy that producing more money can produce real prosperity, as opposed to the illusion of prosperity) made me feel ill.

Mr Carney (and those who appointed him) are clueless.

Mr. Marks, Carney sounds suspiciously like the American Fed Chair who said something about continuing QE until he finally gets it right. Given that TARP failed, GM bailout/Bush failed, Stimulus failed, GM bailout/Obama failed, QE-I failed, QE-II failed and QE-monthly is not working as promised, I’m afraid that 5,000 years from now, his clone will be churning out bitcoins in quantity sufficient to fuel QE-MMMCM. There will be a case on the U.S. Supreme Court docket that the bitcoin by its very name passes Constitutional muster (that ‘coin’ money thingy). The Supremes will agree on a 5-4 vote.

It’s looking more and more like a world nuclear war to establish whether or not Assad used WMD on his own people is our safest course.

I certainly hope they’re done with the change. My meds lack the needed dosage.

Unfortunately they are far from clueless. They are saving themselves and their illusory system and making billions in the process. Banks are no longer a utility to facilitate a productive economy but are now being supported BY the economy making it unproductive (‘post-industrial’ is the jargon) by sending the yet unpaid invoices to our grandchildren. Backwards to the Future?

Jeffry (the Dude) Lebowski would make a better Fed or BofE chairman. A couple White Russians in the morning, followed by an afternoon trip to the bowling alley then on to an evening of smoking weed. Undoubtedly a better plan will emerge than the one Carny and Bernanke have adopted.

Mr Thomas – and ablishtheincometax.

As my health is failing I may not be around to watch the end game of this insanity (we shall have to see).

I must say that I do not envy those people who will be around.

I’m eternally grateful to Paul Marks for making the point which is blindingly obvious to the average six year old, namely that money, e.g. £20 notes, are of no inherent value.

Austrians must have made that ultra-simple point about a trillion times.

I have news for Austrians: the rest of the world tumbled to that one decades if not centuries ago.

Mr Musgrove – a six year old may understand this, but many establishment types (including many establishment “economists”) do not.

Actually fiat money has a, DARK (i.e. based upon force and fear), “value” of its own – based on legal tender laws and tax demands (although establishment economists do not even seem to understand even that – for example George S. who seems not to understand that the word “fiat” means “command” “order” as in “by fiat”).

This is in stark contrast to the freely chosen value of a commodity (value chosen by voluntary buyers and sellers) – such as gold or silver.

Nor must the weasel words “based on” be allowed to be slipped in – either the money is a commodity (such as gold or silver) or it is NOT. “Based on” is an open door to fraud – logical fraud, even if court judgements and legislation mean it is not legal fraud.

To turn to something we agree on……..

I think both Mr Musgrove and myself agree that bank credit (i.e. the Pyramid Schemes where the banking system, in its complex interactions, lends out vastly more “money” than physically exists) is not money.

Money must be a store of value (not just a medium of exchange) – so bank credit bubbles are NOT money.

Money and banking credit bubbles are different things (see above).

To take one of George S.’s examples – a promise of a cow is NOT a cow, and a lot of promises of cows is NOT a herd of cattle (astonishingly he appears to believe the opposite – i.e. that bank credit is money).

Establishment economists (such as Kurt S.) deal with these points of basic reasoning – by trying to prevent comments appearing. Or by claiming not to understand such things.

Six year olds are, perhaps, either more knowledgeable than establishment economists – or more honest.