Now that there is growing evidence of GDP growth, we must consider a new topic: the likely effect on central bank balance sheets, using the US Fed as an example.

Since the banking crisis the Fed has acquired substantial quantities of securities as a result of the assistance it gave to too-big-to-fail banks and subsequently through quantitative easing, most of the assistance to the banks, the Maiden Lane and TALF securitisations, has been repaid. But since then, QE has swelled the Fed’s balance sheet to $3.6 trillion. The financing of this expansion is reflected mainly in excess reserves, which are deposits in favour of depository institutions, in excess of their required reserves.

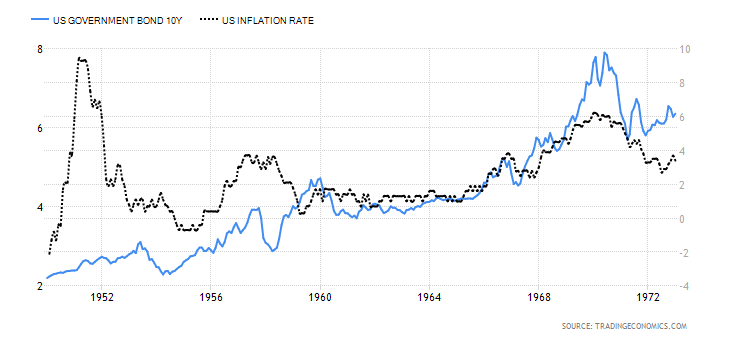

As bond yields rise, it is obvious that the Fed will have to absorb portfolio losses, currently amounting to about $20bn for each one per cent fall in the value of its US Treasuries and $13bn on its mortgage securities (though these are likely to be more stable in price due to their self-liquidating nature). So far, 10-year Treasuries have fallen about 12% since end-April, and the Fed has $522bn of Treasuries with a maturity of over 10 years. In very rough terms the losses on its Treasuries of all maturities are likely to be about $200bn since April, larger than the Fed’s own capital by a very wide margin.

On the face of it, it doesn’t matter if the Fed’s capital is wiped out because it can easily magic up some more. But another problem will come when it has to raise interest rates: what will it do to stop banks withdrawing their excess reserve deposits? Presumably raise the interest rate paid on them. But it will probably appear to the wider public that the Fed is paying the banks not to lend money to businesses and people. At the moment interest on reserve deposits is only ¼%, but what if it has to be raised to 3% or 4% or even more to control bank credit? The banks will be earning between them $60-80bn per annum by leaving their excess reserves at the Fed.

It can be seen that rising bond yields and interest rates will play havoc with central bank accounts. It wasn’t meant to be like this: economic recovery was going to allow the Fed to taper its QE, and government deficits would disappear as tax revenues recover, giving the space for the Fed to unwind its purchases of Treasury debt. Instead, rising interest rates are likely to make it very difficult for the Fed to reduce its holdings of Treasuries, eliminating all those inflationary excess reserves at the same time.

The other major central banks face the same problem, having expanded their balance sheets in the wake of the banking crisis. They will be expected to stabilise the banking system and ensure undercapitalised banks are not wiped out by rising bond yields, or wrong-footed by interest-rate swap exposures. If, at the same time, the central banks are forced to recapitalise themselves to appear solvent, one wonders what the effect will be on the currencies concerned.

We might be about to discover how sound they and their currencies really are.

Their currencies, the Japanese Yen, the British Pound, the American Dollar AND the Euro (look at what the European Central Bank does – not at “the legally binding rules”) are unsound.

Their currencies […] are unsound

Yes. They maintain what’s left of their purchasing power only through the ignorance of the people who use them. The concept of “hard” money has become forgotten knowledge among the world’s population.

I suspect — or am I thinking wishfully — that it may be remembered before too long.

Does the fed have a similar catch 22 issue with its mortgage guarantee purchases, which I presume will become serious liabilities when fed-supported property prices drop…?

A detailed explanation of the central bank omni-shambles, where collateral for new loans has been mopped up by QE repos and replaced by humungeous amounts of bank reserves which are then deployed by the banks into derivative gambling and not into business loans.Unwinding this vast ediface is well nigh impossible without collapse of the risk markets and hyperinflation prices in the hard assets. Probably accompanied by a collapse of the currency.

http://www.zerohedge.com/news/2013-09-22/what-shadow-banking-can-tell-us-about-feds-exit-path-dead-end

“What will it do to stop banks withdrawing their excess reserve deposits?” Excuse me. “withdrawing”???? What does that mean? How do commercial banks “withdraw” reserves? It’s impossible for commercial banks to get rid of reserves, unless the central bank decides to reduce those reserves, e.g. by selling government debt.

As to Alisdair’s more general point, namely that if and when QE is unwound, central banks will probably make a loss and will print their way out of that loss, which could be inflationary, that’s correct. But assuming the authorities know what they are doing, that problem is easily dealt with by raising taxes and simply confiscating money from the private sector, and “unprinting” that money.

Unfortunately it is very debatable as to whether the “authorities” know what they are doing. Thus serious inflation is a possibility: because of incompetence, not because QE is a totally useless way of bringing stimulus.

And I’m not suggesting QE is a GOOD WAY of effecting stimulus: I’m just saying it is not totally useless.

Ralph,

QE is totally useless at stimulating the economy, in fact it is destroying the economy. If that link I posted above is correct. What QE does is mop up collateral that otherwise could be used by the commercial banks to make loans. The central bank , by doing repos, replaced that collateral with reserves that is unable to be used as collateral by the banks to make loans. What is being done by the banks instead is using those reserves to gamble in the derivatives markets. So, you have a starvation of new loans into the productive economy, and a massive bubble in the risk(bond) markets, with the govt forced to be the lender of last resort in the form of appropriation of the productive economy and into the public sector. The EFFECTS of the monetary inflation is all in the bond market now.

We have eye-watering monetary inflation. The reserve requirements have gone from billions to trillions in 5 years, from which there is no benign exit. How do you exit from such a lop-sided trade without killing the bond market and causing a stampede into hard assets ? That is why the taper was cancelled, and will probably remain cancelled until collapse, in any case, does the job for them.