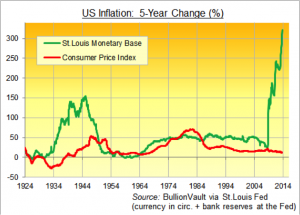

There are lots of reasons why QE hasn’t yet created inflation in the rich West…

SO HEADLINE writers everywhere got to say money really does grow on trees today.

Gold, in fact, has been found in minute quantities in eucalyptus trees in Australia. Analyzing tree leaves and bark could now unearth gold deposits up to 30 metres below ground elsewhere in the world, geochemists say.

Good news perhaps for the mining sector. But unearthing that ore won’t be easy like picking a leaf. Making money is never cost-free. And not even money-printers are making as much profit as you might imagine right now.

UK firm De La Rue today gave its second profits warning of the year. Weird as it sounds, there is over-capacity in note printing worldwide, it claims. That may seem hard to believe, what with quantitative easing still rolling ahead at record levels. But money printing isn’t what it used to be, even without the US Fed daring to taper its $85 billion per month. And De La Rue is lagging profit targets set back in 2010, when asset purchases with newly-minted central bank cash was hitting its stride.

De La Rue Plc is the world’s largest independent printer of banknotes. It has printed 150 different currencies over the last 5 years, and designed two-fifths of all new banknotes issued anywhere in the world since 2008.

You might think that was (ahem) a license to print money. But volumes actually fell this year, De La Rue says, down 10% in the first half of 2013.

Surely quantitative easing means there’s more money around? Near-zero interest rates are also bringing more credit and spending to the economy, right? And what about the revival of real estate prices, most notably in UK housing but also worrying German politicians as even Berlin rents soar?

All that money, however, is electronic, not physical paper. Indeed, the central banks’ printing presses are today an “electronic equivalent” as current Fed chair Ben Bernanke put it way back in 2002. Urging the Japanese to debauch the Yen just as he’s since attacked the Dollar, Bernanke only used “printing” as analogy, however. Whereas it was paper money, not photons blinking on a bank-account balance, which fired inflation in the basket-case economy of Zimbabwe when Bernanke spoke a decade ago, and in Argentina today.

Digitized cash, in contrast, is now the real thing, as military strategist, historian and consultant Edward Luttwak noted this month in an aside on Italian gangsters. Starting in the 1990s, says Luttwak, the Calabrian family gangs pushing cocaine north into Europe as far as the new markets of the old Soviet states found their “Colombian [cocaine] suppliers refused to accept cash, because it was no good for investing in Miami real estate or local hotels or restaurants. The Calabrians needed real money: not bundles of paper but deposits in bank accounts that could be wired.”

Fact is, legitimate businesses cannot use cash. And worldwide, reckons Mastercard (with a vested interest, of course), business transactions now account for 89% of the value of payments. Consumers, meantime, are also moving away from cash (at least, outside the black economy they are; and those immoral earnings still need laundering into the “real money” of digitized bank databases in the end). As a proportion of retail transactions by number, cashless payments now make up 80% in the United States, 89% in the UK, and all but 7% in Belgium according to Mastercard. Even ignoring the plastic PR team, nearly half of UK consumer transactions are now done without cash, with currency payments sinking almost 10% by value in 2012 from the year before, according to the British Retail Consortium. The bulk of non-cash growth came from “alternative” methods, notably PayPal, with “new ways to pay and new ways to shop shaping the retail landscape like never before.”

Might this explain why consumer price inflation hasn’t taken off in the developed West? Yes, there’s lots more money around. Yes, people keep buying gold as protection. Because basic economics says this should push the general price level higher, as the value of each monetary unit is shrunk. But all this extra money sits on hard drives, servers and in the cloud, rather than in purses and wallets. That’s where money is transacted too, in intangible code. Lacking a physical presence, perhaps this wall of money loses its impact.

There are lots of other reasons you could give for why inflation hasn’t surged with the money supply. It’s all locked up in banking reserves, for instance, instead of reaching the “real” economy. Increased spending power since 2008 has gone almost entirely to the richest households, who use it to buy shares, property and fine art rather than Doritos and donuts. Or perhaps central bankers really have kept that credibility which they fought to attain after the 1970s’ inflation. Western households are now sure that the cost of living will never be let loose again.

But the birth of physical money back in ancient Greece changed our brains and our world. Coins made kings of anyone holding them, with the “universal equivalent” marking the beginning of the end of feudal society just as it created an independent yard-stick for all values – mercantile, religious and personal. This is what the myth of King Midas is about, after all.

The human brain and how it conceives of the world is being changed again by digitization today. Just ask a 20-year old (go on, ask them. Ask them anything, and see if they can answer without checking online. Ask a 45-year old come to that). Plenty of people worry that it’s all changing us for the worse, twiddling their fears about the internet by writing, of course, on the internet. Plenty of other idiots think the posthuman world will prove a new joy, with the internet’s jibber-jabber of lies, confusion and stupidity taking us back to some forgotten Eden where everyone’s views are equal. Like, y’know, in the way opinions were freely allowed to medieval peasants who couldn’t read? Today’s infotainment and readers’ comments let knowledge morph and shift just like knowledge was shared and communal pre-Gutenberg. Who needs the Enlightenment?!

Either way, perhaps our brave new digital world also revokes the iron law of money. Perhaps our flood of new cash will never end in higher living costs in the way it always has – always has – in the past. Because money we cannot touch cannot in turn touch prices as surely as paper or metal did.

Yeah right. And money really does grow on trees.

This article was previously published at BullionVault.com.

Perhaps the reason why consumer prices have not been affected by inflation is because wage rates have failed to keep pace with inflation. So long as this persists then consumer prices will not rise however, inflation has indeed been affected by QE.

Take a look at commodities shares and now property to see the effect.

What I think is truly surprising is that if the monetarists and Keynesians now think QE is at worst benign and at best a great contributor to growth, why not issue the unemployed with printing presses and get rid of much of the social security drag?

Perhaps the reason why consumer prices have not been affected by inflation is because wage rates have failed to keep pace with inflation.

I can only speak for the situation in the United States, but nine million fewer people in the workforce is bound to have an effect on spending. It is, I think, the primary reason the housing market has remained, um, lack-lustre.

Our supposed lack of price inflation is not due to electronic money vs. the paper kind — that’s a meaningless distinction. It is a result of a lack of production. People who are not producing are either drawing down their capital, depending on government benefits, or some combination of both.

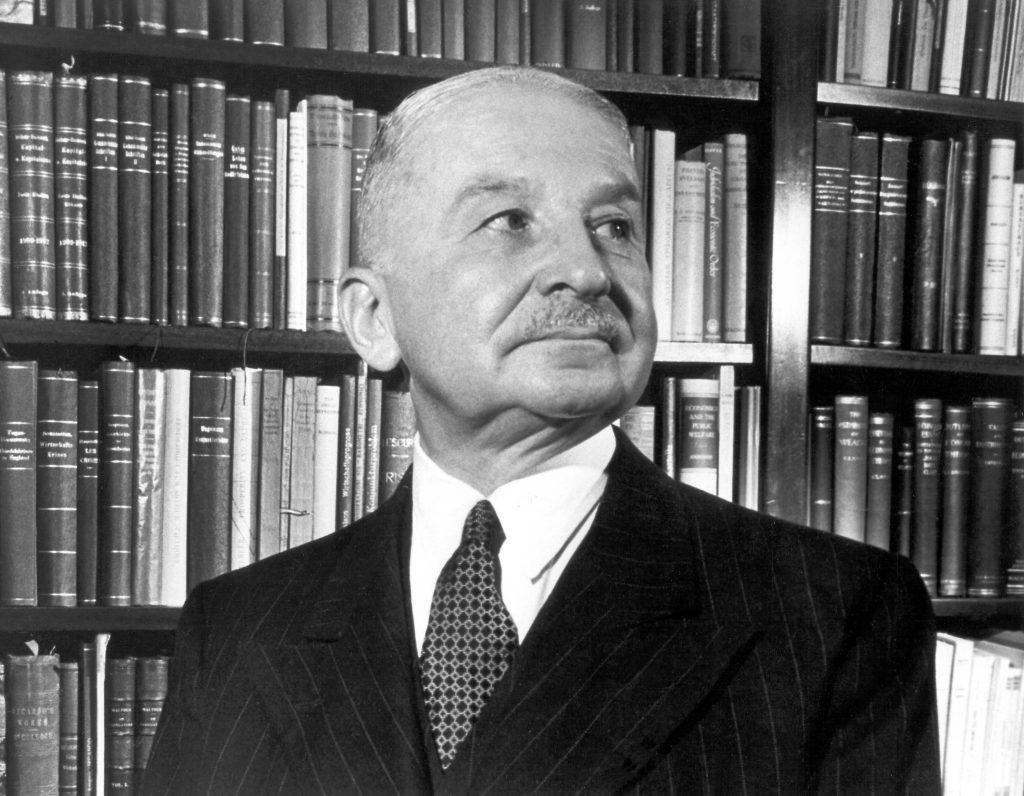

Mises, himself, a century ago, explained how checkbook money could inflate the money supply. In 1912, that virtual money consisted in entries on a paper ledger. That the ledger is now a computer file changes nothing.

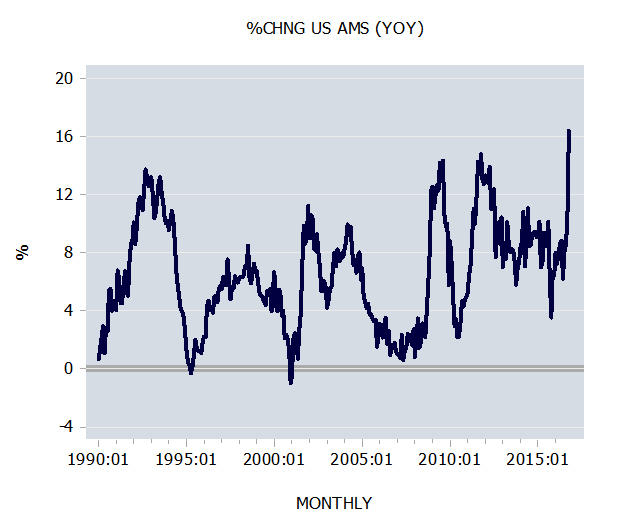

The expansion of “narrow money” has MOSTLY propped up “broad money” (the bank credit bubble). The expansion of bank credit (“broad money”) has been much less than the expansion of the money supply (“narrow money”) directly under the control of government Central Banks.

That is the reason that prices in the shops have not exploded – although they have risen. Government Central Banks increased “narrow money” in order to prevent the collapse of the banking credit bubble (“broad money”) because they (the Government Central Banks) feared DEFLATION.

As for wage rates – falling real wages are the reason that UNEMPLOYMENT has not exploded in countries such as Britain (yes the Keynesian “Demand” people are WRONG – falling real wage rates do not lead to increasing unemployment, they PREVENT it when there is a weak economy).

However, the economy (including the banking system) remains a mess – government (Central Bank) action, might be best understood a building a Welfare State for bankers (and other such) – and like the other Welfare State (the “entitlement programs”) it is unsustainable.

The point that a lot of Central Bank “narrow money” is NOT notes and coins, is also important.

It is a point well made.

At first I thought this was just about how the paper and digital forms of media are working out.

Which is well explained.

But then the culprit becomes that ‘reserves’ are $-denominated digital balances but are not money.

The federal reserve is not able to issue money into our economy.

It can only issue reserves, which have value as settlement media in the interbank payment system, but which are now in excess, and growing all the time.

As such, should the Fed stop issuing more reserves?

Or should the Fed, or somebody, start issuing money?

If a lack of money is the problem, it cannot be solved by the bankers system of money as debt.

That’s the debt-deflation thing.

Money must otherwise come into the economy through incomes and spending.

Its the government’s role to make the money available in the economy.

Either the Fed, or Treasury.

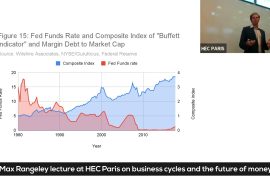

There is no shortage of money in aggregate. The monetary inflation is just not being distributed uniformly. It never is.The largest markets in the world, the bond markets, have risen to record heights and have been rising for 30 years. That did not happen without sucking vast amounts of money into the trade. Both to buy the bonds and to service them. That continues.

When that bursts, as it eventually will, we will be standing knee deep in money and it will be worth nothing. Hyperinflation defined.

When the central banks trumpet that they will put an indefinite lid on rates ie they will buy bonds on an ongoing basis, then speculators lick their lips over the prospect of a risk free trade, and all available money is used to Hoover up bonds to sell to the central banks. This devastates the wider economy as it sucks out all the capital. You end up with a booming financial center (London) and scorched earth(the rest) .

This already bad situation will end in disaster.

The bond trade cannot be unwound without economic collapse, given the gargantuan scale. See how they ran away from taper. The continuation of the bond trade will also cause economic collapse as the country is starved of capital. We are in check mate.

We are in a check mate, indeed.

Too much debt.

Not enough money.

No money but debt.

It’s the money system of the bankers that has us in check.

How it manifests through the markets is mostly situational.

Like the article says – there’s just no way to create any money anymore…

Those banker-digits require a negative attachment, and we’re eyeball-deep in negative balances.

Checked! Mate.

By the money system.

“not enough money” – the classic error.

Sorry Joe but lending should be from REAL SAVINGS – not the printing press.

Printing more money is not real savings.

Thanks, Paul

“not enough money” – the classic error.

Yes, the classic error of incompetent monetary authorities who have neither rule nor law to define ‘enough’ money as that which achieves GDP-potential without inflation or deflation.

Lending should be from real savings but that has nothing to do with where the money comes from.

Money must be created and issued into existence, before it can be saved and invested, from where it can be lent.

Money is a legal social construct.

It cannot be ‘saved’ into existence.

It must be ‘created and issued’ into existence.

That job belongs to those with sovereign monetary powers.

And those hyperbolic printing presses of old.

‘Printing’ more money enables real savings.

And proper lending.

Thanks.

Joe – one thing this world does NOT have a shortage of is money.

As for your idea that printing more money will lead to more real savings…….

The idea is absurd.

It shows a total misunderstanding of what real saving (and investment) actually are.

Real saving is the SACRIFICE OF CONSUMPUTION.

And real wealth is not money.

The idea that there is some short cut or magic spell to creating more real wealth, is nonsense – incredibly dangerous nonsense.

There is only one way to create more real wealth – thrift (self denial) and hard work.

Not printing more money and calling the results “savings”.

Thanks for the clarification, Paul.

So, I know that you know what savings are – unspent income…. you can call them a sacrifice if it ups your standing in the world of liberty.

But I see no sign that you know what money is, or where it comes from in the first place in order for it to be ‘income’ that gets saved, sacrificed if you like, and invested in loan-making.

I would never think that money equals wealth, being a student of Frederick Soddy, author of “Wealth, Virtual Wealth and Debt”.

No, money is not itself wealth – but something used (in exchange) to acquire wealth.

So, we know that money is not wealth – would never say it was.

That ‘magic spell’ nonsense is all your creation.

We know that lending should come from savings ….. always say it is so.

But we don’t seem to know much about The Role of Money – another Soddy Book.

So, here’s a clue. Big picture thing.

YES, more money does lead to more savings and more lending.

As long as that ‘more’ money is spent on things that count as wealth to someone….

What we need right now is more spending, which can only happen – NOT with more debt – but with more money-issuance.

It’s a bit of a wrinkle for Austrian thought generally, I admit, but true nonetheless.

I guess it all depends on what you’re goal is.

If its more austerity, then cry we need more ‘sacrifice’.

But if ‘sacrifice’ will just make the hole deeper and hurt more people, how is it good public policy?

We don’t have a shortage of debt ….. we have debt-saturation, being unpayable in nature.

So, sorry, Paul, but indeed, we do have a shortage of money – if you know what money is.

Thanks.

Joe.

Real savings are a sacrifice of consumption.

Printing more money does NOT increase real savings.

You do not understand the above (in spite of it being repeatedly explained to you) – because you are a collectivist.

It really is as simple as that.

That is why I am against the policy of “reaching out” to collectivists such as yourself. Life is too short to waste in this way.

Paul,

You’re probably right that being a CEO of a multi-million dollar cooperative business enterprise qualifies me as a ‘collectivist’, but I always looked it as each Member a shareholder, and a boss.

Even if I am unreachable by your monetary observations, perhaps you could head off some errant “near-collectivist’ into the values of the ‘capital markets-based’ money system.

Hang in there. I appreciate the effort

Thanks.

Dear Joe.

Thank you for blatantly lying about what I said – your lying confirms what I have been saying about you.

No Joe – your collectivist opinions qualify you as a collectivist.

As for any (sub Marxist) claim that being very rich (being in charge of a multi million Dollar operation) means that you are not a collectivist.

I see so Mr Soros and Mrs Heinz-Kerry and the other donors to the Tides Foundation are not collectivists – because they are very rich.

By the way I have nothing against coops – as long as they are not subsidised by the state.

I have the same view of monastic establishments.

As for Real Savings.

Real savings are a SACRIFICE OF CONSUMPTION.

Not a product of the government printing press.

Geezum, Paul, slipping there again.

Blatantly lying – how?

Mentioning my past co-op experience was not to deny being a collectivist, but to show that I was – agreeing with you.

The last claim I could ever make would be to being very rich, or even close to a little rich, as I live at the bottom five-percent of the income scale, probably closer to the bottom one-percenters.(Social security and an even smaller pension)

What Soros and I have in common today is his belated recognition that there is something wrong with the money system – something I have been working on for forty years.

http://www.youtube.com/watch?v=ZhrY_coLK_k

You’re right that savings are not a product of the government printing press. The government has no printing press. The banks have the printing press. The banks create all the money in our country (c.e.) and 97 percent in the UK, from where it is saved and lent. We do agree on full reserve banking. But, how do we get there?

Why are you all not complaining about the BANKS creating too much money?

Is it because they are merely, again, the interest-rate- following sheep herd, with neither morality nor a sense of the cliff they are taking us over?

We live under the bankers system of money.

Crying about BIG Guv seems a vacuous and one-note response whenever the bankers get just a little too greedy.

Please don’t resort to name-calling again.

Joe I could not care less that you run a coop.

Go and run it.

And spare us any more of your stupid lying.