[Editor’s note: This article also appears on Detlev Schlichter’s blog here. It is reproduced with kind permission and should NOT be taken to be investment advice.]

Investors and speculators face some profound challenges today: How to deal with politicized markets, continuously “guided” by central bankers and regulators? To what extent do prices reflect support from policy, in particular super-easy monetary policy, and to what extent other, ‘fundamental’ factors? And how is all this market manipulation going to play out in the long run?

New York Stock Exchange 1963 (Photo: Wikimedia; US News and World Report; Library of Congress)

It is obvious that most markets would not be trading where they are trading today were it not for the longstanding combination of ultra-low policy rates and various programs of ‘quantitative easing’ around the world, some presently diminishing (US), others potentially increasing (Japan, eurozone). As major US equity indices closed last week at another record high and overall market volatility remains low, some observers may say that the central banks have won. Their interventions have now established a nirvana in which asset markets seem to rise almost continuously but calmly, with carefully contained volatility and with their downside apparently fully insured by central bankers who are ready to ease again at any moment. Those who believe in Schumpeter’s model of “bureaucratic socialism”, a system that he expected ultimately to replace capitalism altogether, may rejoice: Increasingly the capitalist “jungle” gets replaced with a well-ordered, centrally managed system guided by the enlightened bureaucracy. Reading the minds of Yellen, Kuroda, Draghi and Carney is now the number one game in town. Investors, traders and economists seem to care about little else.

“The problem is that we’re not there [in a low volatility environment] because markets have decided this, but because central banks have told us…” Sir Michael Hintze, founder of hedge fund CQS, observed in conversation with the Financial Times (FT, June 14/15 2014). “The beauty of capital markets is that they are voting systems, people vote every day with their wallets. Now voting is finished. We’re being told what to do by central bankers – and you lose money if you don’t follow their lead.”

That has certainly been the winning strategy in recent years. Just go with whatever the manipulators ordain and enjoy rising asset values and growing investment profits. Draghi wants lower yields on Spanish and Italian bonds? – He surely gets them. The US Fed wants higher equity prices and lower yields on corporate debt? – Just a moment, ladies and gentlemen, if you say so, I am sure we can arrange it. Who would ever dare to bet against the folks who are entrusted with the legal monopoly of unlimited money creation? “Never fight the Fed” has, of course, been an old adage in the investment community. But it gets a whole new meaning when central banks busy themselves with managing all sorts of financial variables directly, from the shape of the yield curve, the spreads on mortgages, to the proceedings in the reverse repo market.

Is this the “new normal”/”new neutral”? The End of History and the arrival of the Last Man, all over again?

The same FT article quoted Salman Ahmed, global bond strategist at Lombard Odier Investment Managers as follows: “Low volatility is the most important topic in markets right now. On the one side you have those who think this is the ‘new normal’, on the other are people like me who think it cannot last. This is a very divisive subject.”

PIMCO’s Bill Gross seems to be in the “new normal” camp. At the Barron’s mid-year roundtable 2014 (Barron’s, June 16, 2014) he said: “We don’t expect the party to end with a bang – the popping of a bubble. […] We have been talking about what we call the New Neutral – sluggish but stable global growth and continued low rates.”

In this debate I come down on the side of Mr. Ahmed (and I assume Sir Michael). This cannot last, in my view. It will end and end badly. Policy has greatly distorted markets, and financial risk seems to be mis-priced in many places. Market interventions by central banks, governments and various regulators will not lead to a stable economy but to renewed crises. Prepare for volatility!

Bill Gross’ expectation of a new neutral seems to be partly based on the notion that persistently high indebtedness contains both growth and inflation and makes a return to historic levels of policy rates near impossible. Gross: “…a highly levered economy can’t withstand historic rates of interest. […] We see rates rising to 2% in 2017, but the market expects 3% or 4%. […] If it is close to 2%, the markets will be supported, which means today’s prices and price/earnings are OK.”

Of course I can see the logic in this argument but I also believe that high debt levels and slow growth are tantamount to high degrees of risk and should be accompanied with considerable risk premiums. Additionally, slow growth and substantial leverage mean political pressure for ongoing central bank activism. This is incompatible with low volatility and tight risk premiums. Accidents are not only bound to happen, they are inevitable in a system of monetary central planning and artificial asset pricing.

Low inflation, low rates, and contained market volatility are what we should expect in a system of hard and apolitical money, such as a gold standard. But they are not to be expected – at least not systematically and consistently but only intermittently – in elastic money systems. I explain this in detail in my book Paper Money Collapse – The Folly of Elastic Money. Elastic money systems like our present global fiat money system with central banks that strive for constant (if purportedly moderate) inflation must lead to persistent distortions in market prices (in particular interest rates) and therefore capital misallocations. This leads to chronic instability and recurring crises. The notion that we might now have backed into a gold-standard-like system of monetary tranquility by chance and without really trying seems unrealistic to me, and the idea is even more of a stretch for the assumption that it should be excessive debt – one of elastic money’s most damaging consequences – that could, inadvertently and perversely, help ensure such stability. I suspect that this view is laden with wishful thinking. In the same Barron’s interview, Mr. Gross makes the statement that “stocks and bonds are artificially priced,” (of course they are, hardly anyone could deny it) but also that “today’s prices and price/earnings are OK.” This seems a contradiction to me. Here is why I believe the expectation of the new neutral is probably wrong, and why so many “mainstream” observers still sympathize with it.

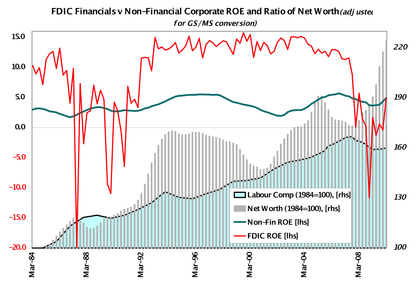

- Imbalances have accumulated over time. Not all were eradicated in the recent crisis. We are not starting from a clean base. Central banks are now all powerful and their massive interventions are tolerated and even welcome by many because they get “credited” with having averted an even worse crisis. But to the extent that that this is indeed the case and that their rate cuts, liquidity injections and ‘quantitative easing’ did indeed come just in time to arrest the market’s liquidation process, chances are these interventions have sustained many imbalances that should also have been unwound. These imbalances are probably as unsustainable in the long run as the ones that did get unwound, and even those were often unwound only partially. We simply do not know what these dislocations are or how big they might be. However, I suspect that a dangerous pattern has been established: Since the 1980s, money and credit expansion have mainly fed asset rallies, and central banks have increasingly adopted the role of an essential backstop for financial markets. Recently observers have called this phenomenon cynically the “Greenspan put” or the “Bernanke put” after whoever happens to lead the US central bank at the time but the pattern has a long tradition by now: the 1987 stock market crash, the 1994 peso crisis, the 1998 LTCM-crisis, the 2002 Worldcom and Enron crisis, and the 2007/2008 subprime and subsequent banking crisis. I think it is not unfair to suggest that almost each of these crises was bigger and seemed more dangerous than the preceding one, and each required more forceful and extended policy intervention. One of the reasons for this is that while some dislocations get liquidated in each crisis (otherwise we would not speak of a crisis), policy interventions – not least those of the monetary kind – always saved some of the then accumulated imbalances from a similar fate. Thus, imbalances accumulate over time, the system gets more leveraged, more debt is accumulated, and bad habits are being further entrenched. I have no reason to believe that this has changed after 2008.

- Six years of super-low rates and ‘quantitative easing’ have planted new imbalances and the seeds of another crisis. Where are these imbalances? How big are they? – I don’t know. But I do know one thing: You do not manipulate capital markets for years on end with impunity. It is simply a fact that capital allocation has been distorted for political reasons for years. Many assets look mispriced to me, from European peripheral bond markets to US corporate and “high yield” debt, to many stocks. There is tremendous scope for a painful shake-out, and my prime candidate would again be credit markets, although it may still be too early.

- “Macro-prudential” policies create an illusion of safety but will destabilize the system further. – Macro-prudential policies are the new craze, and the fact that nobody laughs out loud at the suggestion of such nonsense is a further indication of the rise in statist convictions. These policies are meant to work like this: One arm of the state (the central bank) pumps lots of new money into the system to “stimulate” the economy, and another arm of the state (although often the same arm, namely the central bank in its role as regulator and overseer) makes sure that the public does not do anything stupid with it. The money will thus be “directed” to where it can do no harm. Simple. Example: The Swiss National Bank floods the market with money but stops the banks from giving too many mortgage loans, and this avoids a real estate bubble. “Macro-prudential” is of course a euphemism for state-controlled capital markets, and you have to be a thorough statist with an iron belief in central planning and the boundless wisdom of officers of the state to think that this will make for a safer economy. (But then again, a general belief in all-round state-planning is certainly on the rise.) The whole concept is, of course, quite ridiculous. We just had a crisis courtesy of state-directed capital flows. For decades almost every arm of the US state was involved in directing capital into the US housing market, whether via preferential tax treatment, government-sponsored mortgage insurers, or endless easy money from the Fed. We know how that turned out. And now we are to believe that the state will direct capital more sensibly? — New macro-“prudential” policies will not mean the end of bubbles but only different bubbles. For example, eurozone banks shy away from giving loans to businesses, partly because those are costly under new bank capital requirements. But under those same regulations sovereign bonds are deemed risk-free and thus impose no cost on capital. Zero-cost liquidity from the ECB and Draghi’s promise to “do whatever it takes” to keep the eurozone together, do the rest. The resulting rally in Spanish and Italian bonds to new record low yields may be seen by some as an indication of a healing Europe and a decline in systemic risk but it may equally be another bubble, another policy-induced distortion and another ticking time bomb on the balance sheets of Europe’s banks.

- Inflation is not dead. Many market participants seem to believe that inflation will never come back. Regardless of how easy monetary policy gets and regardless for how long, the only inflation we will ever see is asset price inflation. Land prices may rise to the moon but the goods that are produced on the land never get more expensive. – I do not believe that is possible. We will see spill-over effects, and to the extent that monetary policy gets traction, i.e. leads to the expansion of broader monetary aggregates, we will see prices rise more broadly. Also, please remember that central bankers now want inflation. I find it somewhat strange to see markets obediently play to the tune of the central bankers when it comes to risk premiums and equity prices but at the same time see economists and strategists cynically disregard central bankers’ wish for higher inflation. Does that mean the power of money printing applies to asset markets but will stop at consumer goods markets? I don’t think so. – Once prices rise more broadly, this will change the dynamic in markets. Many investors will discount points 1 to 3 above with the assertion that any trouble in the new investment paradise will simply be stomped out quickly by renewed policy easing. However, higher and rising inflation (and potentially rising inflation expectations) makes that a less straightforward bet. Inflation that is tolerated by the central banks must also lead to a re-pricing of bonds and once that gets under way, many other assets will be affected. I believe that markets now grossly underestimate the risk of inflation.

Some potential dislocations

Money and credit expansion are usually an excellent source of trouble. Just give it some time and imbalances will have formed. Since March 2011, the year-over-year growth in commercial and industrial loans in the US has been not only positive but on average clocked in at an impressive 9.2 percent. Monetary aggregate M1 has been growing at double digit or close to double-digit rates for some time. It presently stands at slightly above 10 percent year over year. M2 is growing at around 6 percent.

U.S. Commercial & Industrial Loans (St. Louis Fed – Research)

None of this must mean trouble right away but none of these numbers indicate economic correction or even deflation but point instead to re-leveraging in parts of the US economy. Yields on below-investment grade securities are at record lows and so are default rates. The latter is maybe no surprise. With rates super-low and liquidity ample, nobody goes bust. But not everybody considers this to be the ‘new normal’: “We are surprised at how ebullient credit markets have been in 2014,” said William Conway, co-founder and co-chief executive of Carlyle Group LP, the US alternative asset manager (as quoted in the Wall Street Journal Europe, May 2-4 2014, page 20). “The world continues to be awash in liquidity, and investors are chasing yield seemingly regardless of credit quality and risk.”

“We continually ask ourselves if the fundamentals of the global credit business are healthy and sustainable. Frankly, we don’t think so.”

1 trillion is a nice round number

Since 2009 investors appear to have allocated an additional $1trn to bond funds. In 2013, the Fed created a bit more than $1trn in new base money, and issuance in the investment grade corporate bond market was also around $1trn in 2013, give and take a few billion. A considerable chunk of new corporate borrowing seems to find its way into share buybacks and thus pumps up the equity market. Andrew Smithers in the Financial Times of June 13 2014 estimates that buybacks in the US continue at about $400bn per year. He also observes that non-financial corporate debt (i.e. debt of companies outside the finance sector) “expanded by 9.2 per cent over the past 12 months. US non-financial companies’ leverage is now at a record high relative to output.”

Takeaways

Most investors try to buy cheap assets but the better strategy is often to sell expensive ones. Such a moment in time may be soon approaching. Timing is everything, and it may still be too early. “The trend is my friend” is another longstanding adage on Wall Street. The present bull market may be artificial and already getting long in the tooth but maybe the central planners will have their way a bit longer, and this new “long-only” investment nirvana will continue. I have often been surprised at how far and for how long policy makers can push markets out of kilter. But there will be opportunities for patient, clever and nimble speculators at some stage, when markets inevitably snap back. This is not a ‘new normal’ in my view. It is just a prelude to another crisis. In fact, all this talk of a “new normal” of low volatility and stable markets as far as the eye can see is probably already a bearish indicator and a precursor of pending doom. (Anyone remember the “death of business cycles” in the 1990s, or the “Great Moderation” of the 2000s?)

Investors are susceptible to the shenanigans of the manipulators. They constantly strive for income, and as the central banks suppress the returns on many mainstream asset classes ever further, they feel compelled to go out into riskier markets and buy ever more risk at lower yields. From government bonds they move to corporate debt, from corporate debt to “high yield bonds”, from “high yield” to emerging markets – until another credit disaster awaits them. Investors thus happily do the bidding for the interventionists for as long as the party lasts. That includes many professional asset managers who naturally charge their clients ongoing management fees and thus feel obliged to join the hunt for steady income, often apparently regardless of what the ultimate odds are. In this environment of systematically manipulated markets, the paramount risk is to get sucked into expensive and illiquid assets at precisely the wrong time.

In this environment it may ultimately pay to be a speculator rather than an investor. Speculators wait for opportunities to make money on price moves. They do not look for “income” or “yield” but for changes in prices, and some of the more interesting price swings may soon potentially come on the downside, I believe. As they are not beholden to the need for steady income, speculators should also find it easier to be patient. They should know that their capital cannot be employed profitably at all times. They are happy (or should be happy) to sit on cash for a long while, and maybe let even some of the suckers’ rally pass them by. But when the right opportunities come along they hope to be nimble and astute enough to capture them. This is what macro hedge funds, prop traders and commodity trading advisers traditionally try to do. Their moment may come again.

As Sir Michael at CQS said: “Maybe they [the central bankers] can keep control, but if people stop believing in them, all hell will break loose.”

I couldn’t agree more.

Well stated. Thank God for the Internet and free-speech which hasn’t yet been banned.

Policymakers are clueless. They continue to repeat the mistakes of the past and expect different results. The so-called macro prudential policies have never worked in the past. Special-purpose entities, off-balance-sheet financing, derivatives are the tools which have allowed all of these regulatory policies to be obviated.

Raising interest rates, the so-called blunt tool, is the only tool that will work to pop bubbles. Thinking people won’t find ways around regulations shows an incredible amount of naïveté and ineptitude.