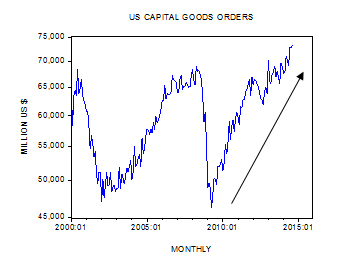

Orders for US non-military capital goods excluding aircraft rose by 0.6% in August after a 0.2% decline in July to stand at $73.2 billion. Observe that after closing at $48 billion in May 2009 capital goods orders have been trending up.

Most commentators regard this strengthening as evidence that companies are investing both in the replacement of existing capital goods and in new capital goods in order to expand their growth.

There is no doubt that an increase in the quality and the quantity of tools and machinery i.e. capital goods, is the key for the expansion of goods and services. But is it always good for economic growth? Is it always good for the wealth generation process?

Consider the case when the central bank is engaging in loose monetary policy i.e. monetary pumping and an artificial lowering of the interest rate structure. Such type of policy sets the platform for various non-productive or bubble activities.

In order to survive these activities require real funding, which is diverted to them by means of loose monetary policy. (Once loose monetary policy is set in motion this allows the emergence of various bubble activities).

Note various individuals that are employed in these activities are the early recipients of money; they can now divert to themselves various goods and services from the pool of real wealth.

These individuals are now engaging in the exchange of nothing for something. (Individuals that are engage in bubble activities don’t produce any meaningful real wealth they however by means of the pumped money take a slice from the pool of real wealth. Again note that these individuals are contributing nothing to this pool).

Now bubble activities like any non-bubble activity also require tools and machinery i.e. capital goods. So various capital goods generated for these activities is in fact a waste of real wealth. Since the tools and machinery that are generated here are going to be employed in the production of goods and services that without the monetary pumping of the central bank would never emerge. (Wrong infrastructure has emerged).

These activities do not add to the pool of real wealth, they are in fact draining it. (This amounts to economic impoverishment). The more aggressive the central bank’s loose monetary stance is the more drainage of real wealth takes place and the less real wealth left at the disposal of true wealth generators. If such policy persists for too long this could slow or even shrink the pool of real wealth and set in motion a severe economic crisis.

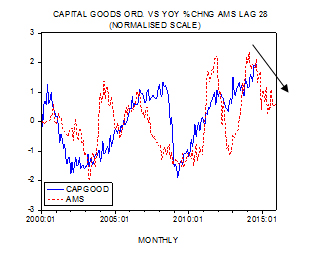

We suggest that the strong bounce in capital goods orders since May 2009 is on account of extremely loose monetary stance of the Fed. Note that the wild fluctuations in our monetary measure AMS after a time lag followed by sharp swings in capital goods orders.

An increase in the growth momentum of money followed by the increase in capital goods orders to support the increase in various bubble activities. Conversely, a decline in the growth momentum of money supply followed by a decline in capital goods orders.

We suggest that a down-trend in the growth momentum of money supply since October 2011 is currently on the verge of asserting its dominance. This means that various bubble activities are likely to come under pressure. Slower monetary growth is going to slow down the diversion of real wealth to them from wealth generating activities.

Consequently capital goods orders are going to come under pressure in the months ahead. (The build-up of a wrong infrastructure is going to slow down – a fewer pyramids will be built).

For instance, during a construction bubble, equipment like cranes, scissor lifts, knuckle booms and such are ordered and purchased for contractor use. When the bubble bursts, this equipment, which is probably still being paid for, sits idle in contractor yards and at rental sites. At the same time, orders for similar items from manufacturers are cancelled. Construction workers aren’t the only unemployeds, manufacturing workers and others associated with the production of the capital goods lose their jobs as well. A good example is manufacturer Schwing America in White Bear Lake, MN who was forced into Chapter 11 bankruptcy: http://www.startribune.com/business/62997347.html

A subsequent boom in Chinese construction led to the purchase of the company by a Chinese equipment manufacturer. Perhaps the cycle will continue. http://enr.construction.com/products/equipment/2012/0507-putzmeister-schwing-become-chinese-owned-companies-.asp