In his article “The curse of weak global demand”, Financial Times November 18, 2014, the economics columnist Martin Wolf wrote that today’s most important economic illness is chronic demand deficiency syndrome. Martin Wolf argues that despite massive monetary pumping by the central banks of US and EMU and the lowering policy interest rates to around zero both the US and the EMU economies have continued to struggle.

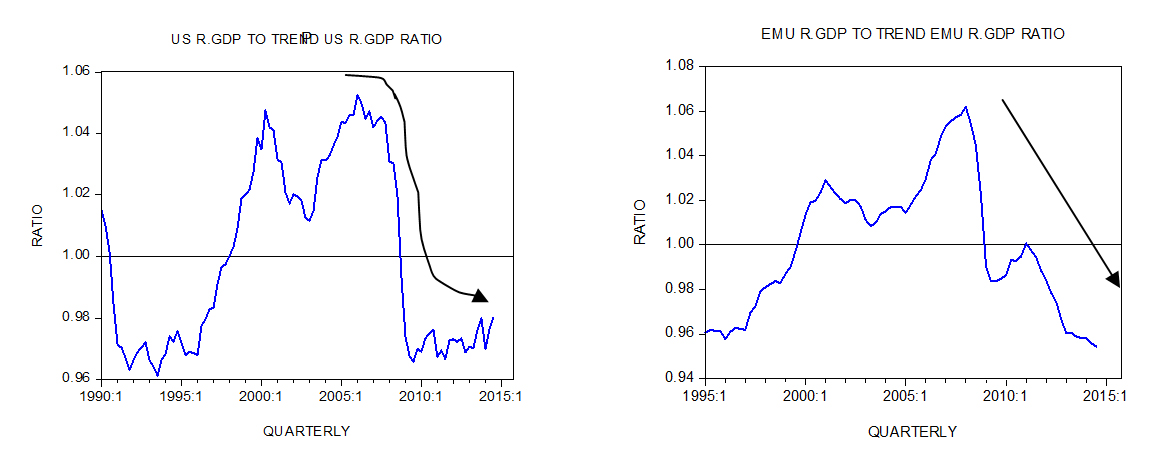

After reaching 1.0526 in Q1 2006 the US real GDP to its trend ratio fell to 0.966 by Q3 2011. By Q3 2014 the ratio stood at 0.98. The ratio of EMU real GDP to its trend after closing at 1.061 in Q1 2008 fell to 0.954 by Q3 2014.

Martin Wolf is of the view that what is needed is to raise the overall demand for goods and services in order to revive economies. He also holds that there is a need to revive consumer confidence that was weakened by the severe weakening of the financial system.

He is also of the view that there is a need for the banks to lift their lending in order to revive demand, which in turn, he suggests, will revive the economies in question. He also blames massive debt for the economic difficulties that the US and the EMU economies are currently experiencing.

Martin Wolf views the current economic illness as some mysterious and complex phenomena, which requires complex and non-conventional remedies.

We suggest that the essence of Wolf’s argument is erroneous. Here is why.

There is no such thing as deficiency of demand that causes economic difficulties. The heart of economic growth is the process of real wealth generation.

The stronger this process is the more real wealth can be generated and the stronger so-called economic growth becomes. What drives this process is infrastructure, or tools and machinery. With better infrastructure more and a better quality of goods and services i.e. real wealth, can be generated.

Take for instance a baker who has produced ten loaves of bread. Out of this he consumes one loaf and the other nine he saves.

He can exchange the saved bread for the services of a technician who will enhance the oven. With an improved oven the baker can now produce twenty loaves of bread. Now he can save more and use the larger savings pool to further invest in his infrastructure such as buying other tools that will lift the production and the quality of the bread.

Observe that the key for wealth generation is the ability to generate real wealth. This in turn is dependent on the allocation of the part of wealth towards the buildup and the enhancement of the infrastructure.

Also, note that if the baker were to decide to consume his entire production i.e. keeping his demand strong, then he would not be able to expand the production of bread (real wealth).

As time goes by his infrastructure would have likely deteriorated and his production would have actually declined.

The belief that an increase in the demand for bread without a corresponding increase in the infrastructure will do the trick is wishful thinking.

We suggest that there is no such thing as a scarce demand. Most individuals have unlimited desires for goods and services.

For instance, most individuals would prefer to live in nice houses rather than in small apartments.

Most people would like to have luxuries cars and be able to dine in good quality restaurants. What prevents them in achieving these various desires is the scarcity of means.

In fact as things stand most individuals have plenty of desires i.e. goals, but not enough means.

Unfortunately means cannot be generated by boosting demand. This will only increase goals but not means.

Contrary to the popular way of thinking we can conclude that demand doesn’t create supply but the other way around.

As we have seen by producing something useful i.e. bread, the baker can exchange it for the services of a technician and boost his infrastructure.

By means of the enhanced infrastructure the baker can generate more bread i.e. more means that will enable him to attain various other goals that previously were not reachable by him.

The current economic difficulties are the outcome of past and present reckless monetary and fiscal policies of central banks and governments.

It must be realized that neither central banks nor governments are wealth generating entities. All that they can set in motion is a process of real wealth redistribution by diverting real wealth from wealth generators towards non-wealth generating activities.

As long as the pool of real wealth is expanding the central bank and the government can get away with the myth that their policies can grow the economy.

Once however, the pool of wealth becomes stagnant or starts shrinking the illusion of the central bank and government policies are shattered.

It is not possible to expand real wealth whilst the pool of real wealth is shrinking. Again a shrinking pool of wealth over time can only support a shrinking infrastructure and hence a reduced production of goods and services that people require to maintain their life and well being – real wealth.

The way out of the current economic mess is to close all the loopholes of wealth destruction. This means to severely cut government involvement with the economy. It also, requires closing all the loopholes for the creation of money out of “thin air”.

By curtailing the central bank’s ability to boost money out of “thin air” the exchange of nothing for something will be arrested. This will leave more real wealth in the hands of wealth generators and will enable them to enhance and to expand the wealth generating infrastructure.

Contrary to Martin Wolf the expanding of bank loans as such is not going to revive the economy. As we have seen the key for the economic revival is the buildup of infrastructure that could support an expanding pool of real wealth.

Banks are just the facilitators in the channeling of real wealth. However, they do not generate real wealth as such.

The lending expansion that Martin Wolf suggests is associated with fractional reserve lending i.e. lending out of “thin air” and in this respect it is bad news for the economy – it sets in motion the diversion of real wealth from wealth generators to non wealth generating activities.

We can conclude that the sooner governments and central banks will start doing nothing the sooner economic revival will emerge. We agree with Martin Wolf that the economic situation currently seems to be difficult; however, it cannot be improved by artificially boosting the demand for goods and services.

Summary and conclusion

Some experts are of the view that today’s most important economic illness is chronic demand deficiency syndrome. It is because of this deficiency that world economies are still struggling despite massive monetary pumping by central banks, or so it is held. We suggest that this way of thinking is erroneous. The key problem today is a severe weakening in the wealth generation process. The main reason for this is reckless monetary and government policies. We hold that the sooner central banks and governments start doing nothing the sooner economic revival will occur.

So investment and better infrastructure leads to more wealth? This is Earth shatteringly original stuff. Shostack deserves Nobel Prize.

As for Shostck’s claim that the fact that the baker and technician swap goods and services, that does not support Say’s law (i.e. the idea that supply creates demand). It is widely accepted that Say’s law works in barter economies. But that law gets into difficulties in money economies – a point which I doubt Shostak will ever understand.

It is widely accepted that Say’s law works in barter economies. But that law gets into difficulties in money economies – a point which I doubt Shostak will ever understand.

The only possible reason that Say’s Law might not work in “money economies” is the government intrusion into trade that results from the unlimited money it can print. In the end, though, it doesn’t really disprove Say’s Law — it only obfuscates it.

Economic law can be ignored, but it doesn’t cease to exist.