[Editor’s Note: this piece, by Brendan Brown, first appeared at http://mises.org/library/private-equity-boom-easy-money-and-crony-capitalism]

Amongst the big winners from the Obama Fed’s Great Monetary Experiment has been the private equity industry. Indeed this went through a near-death experience in the Great Panic (2008) before its savior — Fed quantitative easing — propelled it forward into new riches. There is no surprise therefore that its barons who join the political stage (think of the last Republican presidential candidate) have no interest in monetary reform. And the same attitude is common amongst leading politicians who hope private equity will provide them high-paid jobs when they quit Washington.

The ex-politicians are expected by their new bosses to join the intense lobbying effort aimed at preserving the industry’s unique tax advantages (especially with respect to deductibility of interest and carry income) whilst establishing the links with regulators and governments (state and federal) that help generate business opportunity for the varied enterprises within the given private equity group. The special ability of these to take advantage of the monetarily induced frenzy in high-yield debt markets and secure spectacularly cheap funds means they become leading agents of malinvestment in various key sectors of the economy.

What’s Makes Private Equity Run?

Spokespersons for the industry claim that the private equity business is all about spotting opportunities to take over already established businesses, and then using home-grown talent (within the private equity management team) to transform their organization so as to create value for shareholders. And this can all be accomplished, they say, without the burden of frequent reporting requirements as in public equity.

That is all very laudable, but why all the leverage, why all the political connections, and why all the tax advantages? And even before getting to these questions, why should we praise the secrecy? After all, public equity markets are meant to do a good job of incentivizing and disciplining management, especially in this age of shareholder activism, so why is private equity superior?

Perhaps there are instances where companies which are now in the public equity market cannot economically justify the fixed costs of maintaining their presence there (filing reports, auditing, etc.) and there is a net gain to all from being taken private. In practice, though, this public-to-private conversion function of the private equity industry has been dwindling in overall significance compared to private-to-private acquisitions and new ventures.

Why There’s So Much Leverage

But why should there be so much leverage? Why could their economic functions not be achieved on a purely or largely equity basis?

After all, there are reports of private equity groups turning away would-be new participating partners offering to bring in zillions of new funds to the party. If individual investors in private equity wanted high leverage they could do this on their own account without saddling the particular enterprises with large debts.

The obvious answer to this conundrum is that the private equity groups are in fact risk-arbitragers (and tax arbitragers) between what they view as greatly over-priced high-yield debt markets (sometimes described as junk-debt markets) and less overpriced equity markets.

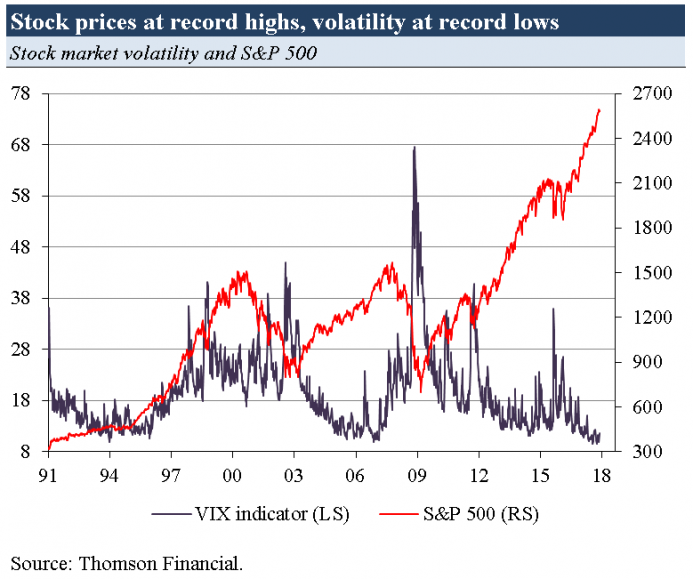

How Easy Money Enables Private Equity

The Great Monetary Experiment has induced such a plague of market irrationality characterized by desperation for yield that the price of junk has reached the sky. On top of this, the US tax-code incentivizes such arbitrage by allowing full deduction of interest from corporate profit. Why are some affiliates of private equity groups buying the junk? Perhaps that has to do with the benefits to be derived in the event of any particular enterprise owned by the group filing for bankruptcy. The private equity group would be in a better position to negotiate a debt-equity swap if it is on both sides of the deal.

The name of the game is achieving as high a leverage as possible and nothing brings success here like success. Specifically, as private equity investments have produced a series of great returns in recent years — as indeed we should expect from highly leveraged strategies in a powerfully rising equity market — the speculative story that their managers really have talent has attracted more and more believers who are willing to back it with their funds. One aspect of this has been the ability of private equity groups to leverage up their businesses to an extent never previously achieved as the buyers of their junk debt believe that unique talents of the partners and their managers make this acceptable. And the cost of equity to the private equity groups falls as a wider span of potential partners believes in their power of magic.

The Crony Capitalist Connection

The new business ventures on which private equity has concentrated in recent years are often in areas where regulatory or political connection is important — whether in finance, real estate, energy extraction, or providing health-care facilities. A private equity group buys the advantages of “connections” (otherwise described as cronyism) for all the small or medium-sized enterprises operating within its fold. If each one were to build up its connections independently that would be much more expensive per unit of enterprise capital.

Hence one essential feature of private equity is the taking advantage of economies of scale in cronyism. And the tax advantages secured by political connections are crucial to the private equity model. The case for a reform of the tax code which would lower the overall rate on corporate profits but end the tax deductibility of interest is strong. But how could this ever make headway against the private equity industry and its deep roots in Washington, DC?

Private Equity, Shale Oil, and Other Bubbles

In thinking about the downside of private equity for economic prosperity there is much more to consider than stalemate on tax reform. There is the specter of the infernal combination of monetary disequilibrium and cronyism producing huge malinvestment. That picture is already emerging in the shale oil and gas industries where private equity with its highly leveraged structures has been prominent. Elsewhere, the finance companies spawned by private equity and outside the ever-more regulated traditional bank sector. These have played a lead role in rapid growth of sub-prime auto-loans which have contributed importantly to the boom in vehicle sales. Private equity owned leasing companies have outsmarted their competition to provide enticingly cheap terms to aircraft carriers especially in Asia and helped fuel a tremendous boom in sales by Boeing and Airbus. Private equity participation in letting apartment blocks has helped fuel the mini-boom in multifamily housing construction.

This is all fine whilst folks are dancing to the music of the Great Monetary Experiment. But what will happen when speculative temperatures fall across a wide range of markets presently infected by asset price inflation, including high-yield debt, equity, and of course private equity? We know much though not all about the disease of asset price inflation from the past 100 years of fiat money experience under the leadership of the Federal Reserve. Each episode of disease is different but there are common elements. One of these is a deadly end phase featuring plunging speculative temperatures, great recession, and the revelation of huge capital squandered in previous years. The private equity story is new, but there is nothing new under the sun.

Fascism, the pinnacle of socialism.