[Transcript of the closing speech at the Seventh Spanish Conference on Austrian Economics. These remarks were delivered Thursday, June 12, 2014 in Madrid.]

Today I would like to speak on a topic very much in vogue. I have entitled my remarks “Anti-Deflationist Paranoia.”

No one can have failed to hear the widespread outcry that for months has been sounding against deflation. In all the media, whether we read ABC or El País, we are met with a dismal, apocalyptic scene in which deflation is the worst of all worlds.

Such is the picture the media are portraying, and there is little use in even mentioning the political sphere. We need only remember the statements of the Spanish prime minister and those of the most prominent European political leaders.

Meanwhile, what is happening in the academic world? Well, three quarters of the same thing. The voices most often heard come from an amalgam of New Keynesians, or of neoclassical economists, or of monetarists… Though they believe their views are diametrically opposed from a theoretical standpoint, they nevertheless all agree that deflation is the worst of all worlds.

Hence, there is a kind of phobia of deflation, a serious psychological illness which I have termed “anti-deflationist paranoia.” What we must do is to study it (if it indeed corresponds to reality, both theoretically and practically speaking), using the analytical tools of Austrian economic theory.

Apart from the sketch I am going to give you here today, I would recommend that you examine both my own work (specifically chapter 6 of the book, Money, Bank Credit, and Economic Cycles, which largely centers on the analysis we are going to discuss today) as well as the doctoral thesis of my disciple Philip Bagus, which is devoted entirely to the Austrian theoretical analysis of deflation.

Also highly valuable in this respect are the contributions of my dear intellectual son, Juan Ramón Rallo (whom I chastised last year for having succumbed to the follies of the new “real bills doctrine,” which you all know is a totally misguided doctrine) on the extremely important role played by an increase in the demand for money in environments where uncertainty is on the rise. Far from being the worst-case scenario Keynesians usually claim it is, this increase in demand permits the flexibility necessary to cope with future events, once they are known.

From an analytical perspective, these would be my recommendations on where to begin a closer study of this very important topic.

According to Mises, deflation is a monetary change which consists of a decrease in the money supply. Or, to put it another way, an increase in the demand for money (to decrease supply is to increase demand).

Any contraction in the supply of any good or service brings about a relative rise in scarcity, and thus also a rise in the price, which is affected by the contraction in the supply. In this case, the contraction is in the money supply, and the effect, other things being equal, is an increase in the price of the monetary unit (the price of money is its purchasing power).

So, the purchasing power of the monetary unit grows, and this growth manifests itself to us visually as a general drop in the prices of the goods and services which are exchanged in the market. It is not really that the prices of goods and services fall: what actually happens is that the purchasing power of the monetary unit, or the price of money, rises as a result of the contraction. In other words, the price of money goes up, and we must hand over more goods for each monetary unit; or rather, we acquire more with each monetary unit, because its price or purchasing power has increased.

This is the scientific definition of deflation.

Colloquially speaking, however, people have simply come to use the word “deflation” for what is actually the typical effect of true deflation: a widespread, greater or lesser decrease in the prices of the different consumer goods and services.

Now I would like to follow up this introduction with an analysis of three types of deflation.

It is important to grasp the differences between them, because then we will be able to better comprehend the events that are occurring around us and those that have occurred in the past. So, this explanation will be extremely useful in an analytical sense.

Before we begin, let us consider that in a purely anarchocapitalist society (with a gold standard, no state,…etc.) it is still possible to conceive of some isolated episodes of deflation, sensu stricto. For example, if the galleon María de las Mercedes sinks with x tons of gold coins inside, there is a contraction in the money supply, because this quantity of gold disappears from the market. This is an isolated event and relatively insignificant. We could also imagine a natural catastrophe or a war that could cause a very sharp increase in uncertainty, and in turn a substantial rise in the demand for money. These are conceivable, but chance situations that do not trigger systematic nor recurrent distortions in market prices.

The three types of deflation I will cover are the following:

First, deflation deliberately provoked by the state.

You already know that the state is the embodiment of evil and the source of all the ills that afflict humanity… One of these ills, as we will analyze in a moment, is deflation deliberately induced for political reasons or caused by errors of the state.

The second type I will refer to is deflation which results from an error of institutional design with respect to the banking system, an error that has allowed banks to act with a fractional-reserve ratio, against general legal principles. This has been the economy’s Achilles’ heel for twenty centuries. As I show in my book, all recurrent, cyclical economic problems spring from this error of institutional design, from this odious privilege granted to banks, by which they can act outside general legal principles and neglect to maintain a 100-percent reserve ratio on demand deposits. Consequently, the money supply behaves like an accordion. Just as easily as it expands, due to the generation of virtual money, it later contracts. This is especially and invariably true when the market uncovers the investment errors committed during the bubble stage.

There is also a third type of deflation, which is “good” deflation. In fact, it is not really deflation, sensu stricto, because it does not derive from a contraction in the money supply nor from an increase in the demand for money, but rather from an increase in the production of goods and services throughout a prosperous market process in which the government does not intervene, and which grows at a faster rate, in general, than the money supply. This is the healthiest process of economic growth conceivable.

With this overview of the three different types of deflation in mind (the most conceptually useful ones in understanding events around us), let us now briefly analyze each one.

The first, as you will recall, is deflation deliberately provoked by governments.

There are different historical examples of this first type, such as the deflation induced following the Napoleonic wars. However, the most talked-about case is the monumental error committed by the Chancellor of the Exchequer of the United Kingdom in 1925, Mr. Winston Churchill. Mr. Churchill insisted on reintroducing the gold standard after the First World War, but at the pound’s gold parity prior to World War I, the centenary of which we commemorate this year.

This was a very grave error, because the First World War was financed, as always, by inflation. The market was flooded with sterling notes, which meant that the de facto parity of sterling banknotes with gold fell dramatically.

I must remind you that the whole debate over whether or not to return to the gold standard in the 1920s and 1930s was a false debate from the outset. Many theorists claim it was a great error, but the error was that their opponents insisted on returning to the gold standard at the pre-World War I parity.

Of course, it was key to return to the gold standard, with all the disciplinary restraint it entailed for authorities, but it was vital to take into account the reality of the tremendous expansion of fiduciary media that had been injected to finance the war.

Hence, those historians of economic thought who assess the debate make the mistake of thinking that those who wished to return to the gold standard were wrong. No. They were right. Nevertheless, they committed the grave error, like Winston Churchill, of insisting on returning to the gold parity prior to World War I, and this return involved a monetary contraction, induced deflation, especially in the United Kingdom, and the consequences were quite severe, because the economic system was subjected to unnecessary tension. England was a great export power, and as a result of this appreciation of the pound, it ceased to export, which caused problems of adaptation, unemployment, etc. Hayek, in one of his most brilliant articles, maintains that just when the English economy had digested this error, England abandoned the gold standard…

Nonetheless, there is a second type of deflation: that which inevitably occurs in a system like ours, which has rested on a fractional reserve ever since Peel’s Bank Charter Act of 1844.

I will refrain from repeating to you the Austrian theory of the economic cycle, which you already know by heart anyway. The bubble leads to systematic errors of investment and seriously distorts the real structure of the market, which is very dynamically efficient (as I explain in my book, The Theory of Dynamic Efficiency) and reveals the investment errors sooner or later.

At that moment, a financial crisis erupts, because it becomes clear that a large number of the loans banks granted during the stage of credit expansion were granted for unviable or unsustainable investment projects. Furthermore, since the collateral for those loans from the bubble stage are deposits created from nothing (which, with all due respect to the new real-bills theorists, are money), it is revealed that banks’ assets have only a fraction of the value that was thought, while banks’ liabilities remain the same, and thus the entire banking system is in a state of failure.

This is where a highly curious phenomenon occurs; I call it “the phenomenon of the pyromaniac firefighter.” For one of the most important conclusions to be drawn from the existence of this fractional-reserve system is that its survival depends on a lender of last resort (or central banker) who, as these errors are regularly discovered, heads off the collapse of the entire monetary system and our ultimate return to the very beginning of the process of monetary development, which would be a social tragedy, because as you know, money is the quintessential social institution, and we cannot do without it, not even in a fractional-reserve banking system like the current one.

In the face of this situation, there is relatively little central banks can do. At most, they can keep private banks from failing, by providing them with all sorts of loans and assistance. And that is about it. However, a process of monetary contraction (that is, a process of deflation) is inevitable.

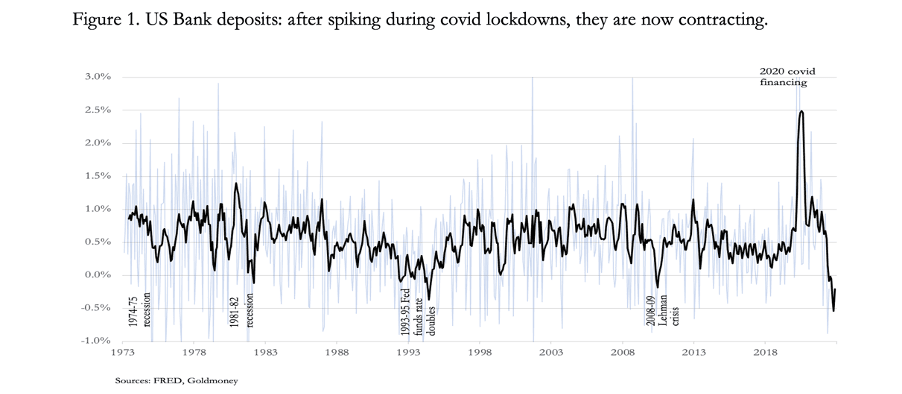

This is the second type of deflation, the type I was referring to when I offered the simile that the current monetary system is like an accordion: just as easily as it expands, it contracts. This is because economic agents discover that many of the investments they so eagerly made during the bubble stage were pointless. To a greater or lesser extent, at all levels, we must get to work and try to salvage what actually can be salvaged: companies are closed down; reorganization takes place; workers are laid off… And everyone tightens their belts to repay loans and to avoid suspending payments or reorganize as painlessly as possible. This process teaches us a lesson, and it comes as no surprise that most loans are repaid to the banking system at a much faster rate than new loans are requested. In short, much of the virtual money created during the bubble stage disappears, and the money supply inevitably contracts in the form of deflation.

Here I would like to make an observation, because we Austrians have been criticized: we have been accused of being “liquidationists” who are immensely pleased with deflation. This is not the case, my friends. It is an unjustified caricature. In several places, Mises reiterates that no Austrian theorist defends such deflation per se. We are not masochists, nor do we wish to inflict unnecessary harm on people. We simply hit a raw nerve when we point out that the origin of the crisis does not lie in deflation (which everyone mistakenly identifies as the cause of the evils), but rather in the previous stage, that of the speculative bubble.

For this reason, the entire banking system must be redesigned and a 100-percent reserve requirement established on demand deposits and their equivalents. These should be treated in the same way as any other deposit of a fungible good, for instance wheat or oil.

Nevertheless, until this goal is achieved, we must ensure the continuance of the monetary system, and then accept as inevitable a certain degree of deflation derived from the very process of reorganization.

Rothbard goes so far as to state that we should see a good side to deflation in stages of depression. On the one hand, he mentions that this deflation helps to liquidate erroneous projects, to accelerate the process, to detect unviable investment projects, and to lay the foundation for the subsequent recovery (which, I repeat, does not earn him the label of “liquidationist”). On the other hand, he indicates that in the stage of unavoidable, relative monetary contraction which follows every bubble, the tables are somehow turned, and the creditors who were at a disadvantage in the bubble stage are now at an advantage with respect to debtors.

This is a far cry from the claim that Austrians love deflation per se and that we are “liquidationists.” Our actual message, I repeat, in positive analytical terms, and without value judgments, is that the origin of the crisis lies in the prior expansion, and that a certain degree of deflation is inevitable following every artificial expansion of credit, regardless of the central bank’s course of action.

So far, we have dealt with the first two types of deflation.

Incidentally, a strong relationship exists between the two. If you read Rothbard’s book, America’s Great Depression (which Unión Editorial just published last year in a Spanish-language edition, with a preface by Juan Ramón Rallo and another by yours truly), you will see how Winston Churchill’s terrible blunder of needlessly provoking deflation in his country by insisting on ignoring the monetary knowledge accumulated since at least Ricardo and returning to the pre-World War I pound-gold parity subjected the British economic system to such pressure that the English, led by the Governor of the Bank of England, Montagu Norman, turned for help to their cousins from the ex-colonies, namely the Americans, whose monetary system was under the direction of the relatively young Federal Reserve (created in 1913), with Benjamin Strong (President of the Federal Reserve Bank of New York) at the de facto helm.

Similar measures are being recommended these days by Europe’s periphery countries, which are experiencing necessary domestic deflation. These countries expect Germany to give in and to expand its credit and spend more. This is just more of the same. There is nothing new under the sun: in the presence of self-induced deflation (Winston Churchill’s shot in the foot), the English resorted to pressuring the United States to inject money and somehow ease the problem facing English exports, especially in the United States, which was their largest market. Benjamin Strong, who even had a permanent office in the Bank of England, went along with the request and arranged a bubble (that of the Roaring Twenties) in the United States, and upon this bubble rested the credit expansion which would end in the famous depression of ’29. So here you see a connection between the first and the second types of deflation.

Incidentally, Milton Friedman created a myth about the depression of ’29. As a myth, it has been one of the most destructive to the economy and consists of the claim that the depression sprang from the monetary-policy errors of the Federal Reserve, which did not inject enough money. In fact, this has been the official, academic version ever since the publication of the book, A Monetary History of the United States, by Anna J. Schwartz and the late Milton Friedman (who I hope spends many years in purgatory).

However, the Great Depression was not “great” due to the errors of the Federal Reserve. There is no doubt that the Fed did what it could; it injected a massive amount of money and kept the entire American financial system from disappearing. Nevertheless, as we have already pointed out, after every bubble, the deflationary process, which can be more intense or less, is inevitable.

Moreover, if deflation was very intense, the cause did not lie in a failure of the Federal Reserve to inject what was needed, but in the monumental errors of economic policy committed by President Hoover and later by President Roosevelt, both of whom focused their efforts on advancing and pushing for higher wages, raising taxes and public spending, making the economy more rigid, and furthering a protectionist agenda of increased tariffs worldwide as had never been seen before. Hence, it should come as no surprise that, under these circumstances, the following spread: discouragement, economic disruption, and thus, further deflation that turned the recession of ’29 into a Great Depression.

Imagine what would have happened in the last cycle, which has just concluded, and from which we are beginning to emerge, if states had reacted just as Hoover and Roosevelt did. We would be in a severe depression with much more serious deflation. And it would not be owing to a lack of money injection by central banks, but to errors of specific economic policy. Or, to put it in today’s language, a failure to have implemented the necessary economic-liberalization reforms.

We also have the famous Japanese example, which is the one always cited to scare us about deflation. We are told that because of its deflation, Japan has spent years without a recovery, and with very insignificant growth. This is the crude, short-sighted, erroneous argument of those who lack training in economics, or who have received inadequate training, or who simply cheer on the champions of inflation for political reasons (and we will discuss them later).

Moreover, if Japan has faced slight deflation (for in today’s colloquial terms, the drop in prices has not been drastic) for over a decade, this deflation has not put the country in its decidedly weak economic state. (Incidentally, the economic weakness is relative, given that Japan has a huge amount of accumulated capital, and any visitor to the country can see how prosperous it is, especially with respect to twenty years ago.)

The slowness of economic growth in Japan, and the fact that it has been losing ground to a number of nearby geographic competitors, stems entirely from its extraordinary degree of rigidity, and particularly, from continuous intervention in the Japanese economy by the government, which has adopted hardly any effective liberalization measures to date.

On the contrary, in Japan, all of the possible interventionary measures have been tried. The Japanese have applied the whole inventory of Keynesian and monetarist absurdities… They have applied them all. And all they have managed to achieve is to become the most indebted country in the world, together with Botswana, and to maintain their rigidity indefinitely.

We now come to the third type of deflation. When we enter the recessionary stage and deflation appears, i.e. the inevitable monetary contraction I referred to before (the disappearance of virtual money in a context of fractional-reserve banking managed by central banks), people gradually begin to discover viable, sustainable opportunities, and because economic agents are not very inclined to request loans, the money supply remains relatively stable, and little by little, an increase in productivity occurs. It is then that the third “deflation” scenario begins to unfold. This is what is referred to as “good” deflation and results from an increase in productivity.

We will now briefly review the arguments the press offers and distinguished economists repeat concerning the terrible nature of deflation. Let us consider and dismantle them one by one.

We can begin with the claim that deflation is the worst that could happen because it affects debtors unfavorably and creditors favorably.

It is time for us to pause and think a moment. If, as a result of a process of productivity growth, particularly in this stage in which the economy begins to recover, the production of goods and services should grow faster than the money supply, which would mean an increase in the purchasing power of the monetary unit, economic agents, who are very nimble negotiators of their borrowing and lending operations, would take these deflation expectations into account and incorporate them when reaching an agreement on the corresponding market interest rate.

Let us recall that a market interest rate has three components:

First, the social rate of time preference. (Between you and me: around 2 percent. You are probably wondering where Professor Huerta de Soto got this percentage. Well, I pulled it out of a hat. Only God can know the social rate of time preference, but as I look up to the heavens, I get a clear sense that it is around 2 percent.) Second, the component for expected inflation or deflation; and third, the risk component for the specific contract or sector in which the exchange of present goods for future goods takes place.

We could go a step further and add, as Mises does, a component for pure entrepreneurial profit. We could even make a concession to the absurd new real-bills doctrine because, sure enough, to the extent that those loans are short-term secondary media of exchange, they will have a negative premium, because they are very liquid, but we will set this topic aside now…

What I mean to say is that, in a deflationary environment, economic agents themselves already have the expected deflation in mind, and they reduce or make negative the premium for changes in the purchasing power of money. If secular deflation of around 1 percent is expected in the coming years, and the social rate of time preference is 2 percent, the nominal market rate in the absence of risk will tend to be 1 percent.

And this is no problem, because it harms no one. Economic agents, both debtors and creditors, negotiate and agree on a nominal interest rate for the corresponding transactions, and thus the first argument has been refuted.

Someone could ask me, “What about credit agreements signed years earlier, in an environment that was not deflationary?” Well, listen, you made a mistake and contracted a debt under different circumstances, and now you have to accept the consequences and repay your loan in monetary units of greater purchasing power: each of us must lie in the bed he or she has made. In this case, a phenomenon does occur in which debtors are placed at a disadvantage and creditors at an advantage, but in a way this compensates for the prior injustice, as Rothbard explained and I mentioned before.

And let no one claim that this situation is very grave, because “aggregate demand” contracts. Spare me the silly arguments! In aggregate terms, nothing contracts, because while it is true that those who took on a debt in the bubble stage are unfavorably affected, and thus their contribution to the aggregate demand is smaller, creditors are favorably affected, and thus their contribution to the aggregate demand is bigger, and aggregately speaking (economists do love aggregates!) the (aggregate) demand does not change. So, we have unraveled the first argument.

However, another argument runs that deflation is horrible because companies sell less as a result of the drop in prices, and a cumulative contraction process is set in motion. This argument is very unsound as well.

In a context of monetary growth under the gold standard, we would generally expect companies’ aggregate sales to grow at around 1 percent. (The world stock of gold has shown secular growth of around 1 to 2 percent per year, as indicated by various studies.)

So then, what comprises the turnover, or sales income, of the companies that grow at 1 percent? The turnover is comprised of a number of units of goods and services, which are produced by each company, and this number grows at a faster rate, 2 to 3 percent, which is precisely why the price of each unit tends to fall.

Nonetheless, a fall in unit price certainly does not harm companies. On the contrary, it is a sign of the healthiest process of economic growth conceivable, that which derives from an accumulation of capital, from innovations, etc. This growth process makes available to economic agents and consumers goods of increasing quality at lower unit prices, though companies’ growth is modest or even very slow and follows the trend of growth in the money supply, around 1 percent. But there is no contraction anywhere.

Besides, remember the entire theory of capital. I could be here for hours, but it is perfectly possible to earn a lot of money even though sales do not increase. Lesson number one in accounting: profit is income less costs. If your income does not grow, or if it grows slowly, you can earn lots of money if you reduce costs by renegotiating them, which is relatively easy if you change your way of thinking as an entrepreneur and accept that you are in a deflationary environment (in colloquial, and not academic, terms) of declining prices. This environment is the setting for the soundest and most prosperous market process of growth imaginable, as I just mentioned.

In fact, even if sales fall for certain companies, particularly those in the sectors closest to consumption, this need not be at all detrimental to these firms. How will the entrepreneurs react? They will reduce costs more intensively. This is called the Ricardo Effect. If I have fewer sales, I must let workers go and replace them in the margin with capital equipment. This occurs mainly because the drop in prices means an increase in real wages. Again, this is the Ricardo Effect: in the margin it is better to replace some labor with capital equipment.

The laid-off workers are freed from the companies closest to consumption and will end up working in companies in the sectors furthest from consumption, precisely those that are going to produce the new capital equipment the first companies needed to cope with the new deflationary environment. Capital Theory 101; these are fundamental principles that unfortunately very few of my colleagues have studied, and thus they completely overlook them.

Another argument goes that when consumers notice prices are starting to go down, they think to themselves, “Since tomorrow the price will be lower, I won’t consume today,” and thus the price drops further. Tomorrow comes, and since the expectation of lower prices persists and was confirmed in the past, consumers again hold off consuming (though they get a little thinner), and the day after tomorrow they delay yet again (and get thinner still), and then … they die of hunger. Deflation appears, and the world collapses. This is the horrific deflation argument. Consumers are idiots, and we quit consuming if prices are expected to fall. Is this true or not?

The prophets of doom issue dramatic warnings about the deflationary catastrophe, but in reality, declining prices do not curtail consumption; they actually stimulate it. And if you do not believe me, there are endless examples. What has happened with iPhones and iPads? Do you know how much the first personal computer I bought cost me? Their price has not stopped falling, nor has their quality stopped rising, and this has not kept demand for them from growing.

In fact, to eliminate this feeble argument, we need not even resort to “Pigou’s wealth effect,” nor to the tendency of the nominal demand for money to decrease as its purchasing power increases. These very strong effects also appear, but in the medium and long term.

There are other, even more absurd deflation arguments, like the one I read the other day, which ran that with deflation, in the end there will have to be negative nominal interest rates in the market. It is impossible for there to be a negative nominal rate in the market. Even in the most deflationary environment imaginable, when the market interest rate approaches zero, because the deflation premium is rising, as the interest rate gets closer and closer to zero, and given that the interest rate is the value used to discount the expected flows of rents from each capital good, what happens? Well, the value of capital goods, which are always on entrepreneurs’ minds in their processes of innovation and imagination for discovering sustainable investment projects to satisfy the future needs of consumers, approaches infinity, and therefore the entrepreneurial opportunities to undertake sustainable investment projects multiply and become increasingly attractive. Moreover, this happens with greater intensity the closer the nominal interest rate gets to zero; but as is logical, in no case will the nominal interest rate become negative.

And you must not say to me, “But Professor Huerta de Soto, who is going to get into an investment project, with all the headaches involved, if he or she is going to receive a very low interest rate?”

Because for me, the valid argument is, “Professor Huerta de Soto, who is going to get into an investment project if Papa State is going to pester him, impose regulations on him, send inspectors to visit his company every other day, fine him; and furthermore, if he earns anything, the state is going to wring it out of him, take 52 percent in income taxes, plus another 8 percent in personal wealth tax, plus estate tax, etc.” This is an argument I accept. Under these conditions, investing is strictly for the birds. However, here the lack of investment, and the unemployment that accompanies it, does not result from deflation, but from the stream of interventions I have just cited.

Nevertheless, in a context free from such assaults on individual liberty, just think what it means to find a sound, sustainable investment project in which your money is returned to you in the future, in one, two, four, or five years, in monetary units of a higher purchasing power, because we are in a deflationary environment. And on top of that, you receive, for example, 0.5 percent more. That project is worth its price in gold. Not only do you recover, with a higher purchasing power, the monetary units you invested, but you receive 0.5 percent more, in the form of interest or profit.

I realize that we must change our mindset, and it takes effort. All of us who are here, and our parents and grandparents, have lived only in an inflationary environment, not in a deflationary one. All economic agents (entrepreneurs, workers, public officials, politicians…) are automatically accustomed to living with inflation, and when inflation is zero or deflation appears, we are disconcerted.

We must change our thinking and our habits. Hayek’s evolutionary theory is very relevant here. This takes time and work, but it is not impossible. Mises has already made it clear in the different studies and papers which he produced as an advisor to the League of Nations during the interwar period, and which you should reread.

Even in the academic sphere, we must admit, as Mises did, that a sound, suitable, and complete theory of deflation is sorely missing. To remedy this academic deficiency, Professor Rallo, Professor Philipp Bagus, and I have devoted our efforts in the writings I mentioned at the beginning.

A person could claim he or she is incapable of thinking differently. I am reminded of a lecture Hayek delivered to the Marshall Society at Cambridge. After he had explained everything, during the question time, someone asked him, “Is it your view that if I went out tomorrow and bought a new overcoat, that would increase unemployment?” “Yes,” said Hayek. “But,” pointing to his triangles on the board, “it would take a very long mathematical argument to explain why.” This biased anecdote has passed from textbook to textbook, in ridicule of Hayek, but it only shows the difficulty of changing deeply rooted convictions and mental habits (regardless of how misguided and harmful they may be).

We need to change the mindset of economic agents, authorities, leaders, and also academic economists, who have a different worldview, one that since World War II, has been exclusively inflationary.

There are also historical examples which, although they do not prove anything (because history, though a very valuable art, at most illustrates theories, but cannot prove nor disprove them), perfectly illustrate today’s analysis of deflation, my criticism of anti-deflationist paranoia.

Do you know that the period of greatest prosperity in the United States began with the end of the Civil War in 1865 and lasted until the beginning of the twentieth century? It was a period of cumulative growth, year after year, of between 2 and 4 percent, with secular deflation, year after year, of around 1 percent. Even Milton Friedman recognizes this and examines it in his book, A Monetary History of the United States. However, after describing the phenomenon, he observes that it baffles him, because it somehow refutes his whole argument. And then on he goes!

Moreover, Alfred Marshall (I quote him in my book) acknowledges the same principle in the United Kingdom during other periods. He declares that growth can take place with deflation. In fact, he goes even further and states that the soundest, most sustainable, prosperous, just, and harmonious model of growth is the deflationary one.

The reason is that with this model, prosperity spreads to all layers of society, across social classes, in the form of lower and lower prices for the goods and services people consume. Continuous tension and conflict between social agents to renegotiate the different contracts upward in nominal terms are no longer necessary. We no longer need unions nor politicians to act as mediators. They are all unnecessary! Perhaps that is precisely why they like inflation so much: none of them wants to end up unemployed and fully exposed.

There is no more favorable environment for the accumulation of capital and for saving than an environment of monetary stability and zero inflation, or deflation. This encourages people to save, and thus, to finance new investment projects, which, when they mature into consumer goods and services in a more or less distant future, will even further boost the prosperity of all economic agents.

Without a doubt, it is the most just, harmonious, efficient, and sustainable process of economic development. It generates the fewest tensions in the market and shows the greatest respect for the environment, which suffers particularly during the bubble stage, when unnecessary strain is placed on it and trees are cut down, mountains are destroyed to make cement to build houses nobody wants, and the atmosphere is filled with carbon dioxide (though I do not support the theory of global warming) to carry out foolish investment projects…

I repeat, the deflationary process is the healthiest process of economic development conceivable.

With the gold standard, during the period I mentioned before in the United States, the money supply grew by around 1 to 2 percent (and since production, given the American entrepreneurial spirit and innovation of the age, grew by between 2 and 4 percent, there was deflation, year after year, of between 1 and 2 percent).

Curiously, in aggregate terms, sales increased (though not by much: by around 1 to 2 percent), but at the same time, the GDP deflator, which reflects the increase in productivity, shows that productivity increased by much more than 1 percent, that real production, in terms of units of goods and services, grew by 2, 3, or even 4 percent (and for that reason, the deflator was negative).

Oddly enough, in an environment of deflation, or zero inflation, like the one we are in, in terms of national accounts and statistics, economic development becomes apparent mainly when the GDP deflator data is given to the official in charge of the corresponding ministry. That is, the nominal figures do not rise, and all the officials are worried and waiting, and it turns out that there is a drop in prices of between 2 and 3 percent. Real GDP is up!

Contrary to popular opinion, in terms of national accounting, a decrease in prices ultimately takes the shape of an increase in GDP.

To wrap up, I would like to pose two questions. One, what are the psychological and sociological reasons for the hostility toward deflation? And two, what lessons can we draw today from our analysis with respect to the European monetary framework and Draghi’s actions on June 5, 2014?

I think I will begin with the second question, because the first one is trickier and more complex, so it will be best handled at the conclusion of my talk this afternoon.

A look at Europe’s monetary figures can lead us to the surprising conclusion that we may be in “the best of all worlds.”

A piece of data: growth in the M3 is around 1 percent (according to the latest report from the European Central Bank). We would see practically the same under the gold standard. Maybe even toward the low end. That’s wonderful! This rate should be maintained indefinitely.

Another piece of data (though you know this is not my favorite type; I much prefer theory to illustrations, but as an illustration): growth in GDP is around 0.5 to 0.6 percent. Our economy is beginning to grow. The largest economies in Europe: Spain, Germany, Italy…etc. finished the last quarter of 2013 with an increase of 0.3 percent. In the first quarter, there was greater volatility; Germany showed more growth, but the average was around 0.5 percent. In Germany, it was 1.5 percent, and in Spain, 0.5 percent. It would be interesting to know the aggregate measure [still unavailable on the day these remarks were delivered], but, approximately speaking, if the current rate of inflation in Europe is around 0.4 to 0.5 percent, this is because the increase in the money supply (which I just mentioned, 1 percent) exceeds GDP growth by precisely that amount.

My point is that if we implement the necessary structural reforms, a task which in Spain has largely been carried out, and we gradually recover our confidence, it is highly probable that production will begin to recover at a rate that exceeds current growth of 1 percent in the M3, and therefore, that we will enter the healthy deflation and declining prices which I have called “the best of all worlds.”

In short, ladies and gentlemen, we are approaching the best of all (possible) worlds. To sum up:

Recent European elections have brought to light people’s ever-increasing disenchantment with regulation from Brussels. This is excellent. It is excellent that 25 percent of the French have voted for an anti-European party. Europe must be limited (speaking as the Eurosceptic that I am) to the free circulation of people, goods, and capital. There must be zero centralized regulation from Brussels, and competition between the different states, and everyone’s voting with their feet, must be allowed to drive down regulation. However, we need a single currency which cannot be manipulated by each nation state, and which somehow simulates the functioning of the gold standard. Nowadays that currency, as you know and I have tried to articulate in various academic papers and, on a popular level, in my article and film, “In Defense of the Euro,” is the euro.

Let us look for a moment at the European Central Bank benchmark figures in place since the Maastricht Treaty: inflation of slightly under, but close to, 2 percent, and growth in the money supply of 4.5 percent. The numbers fit together, because it was conceived that if the GDP grew by 2.5 percent, and money was injected at 4.5 percent, inflation would be 2 percent.

The figures would be much better under the gold standard. Growth in the money supply would be around 1 percent, as it is now in Europe, production would recover (and eventually even exceed that level), and we would have deflation. However, it is not politically acceptable for Mario Draghi and the Germans to go out and declare that they are going to lower by two or three points the benchmarks set in Maastricht, that the inflation objective is no longer going to be 2 percent, but 0 percent, and that growth in the money supply will be between 1 and 2 percent (closer to 1 percent) instead of 4.5 percent.

This would be the ideal way to achieve the best of all possible worlds, given the circumstances. This is what they should do, but they do not do it… They refrain from doing it because of the tremendous pressure exerted by politicians, economic agents, unions… What do all of these people want? To return to the prior inflationary environment as soon as possible.

I will conclude with the following question: What is the origin of this serious psychological illness I have called “anti-deflationist paranoia”?

I commented before on how difficult it is for us to change our habits, especially when, for several generations, the environment we live in has been inflationary and completely different. Inflation is a drug. It is an extremely dangerous drug, a great and deadly temptation for the whole social body.

Politicians love inflation and hate deflation. With deflation, the information they receive from the budget office is that government revenue is not increasing, but flat. Hence, it becomes difficult for them to pay for public spending and continue to buy votes. In addition, they feel pressure, because they no longer wield monetary-policy autonomy. They are obliged to manage public resources faithfully and with effort, something they consider foreign to their profession. Politicians believe their profession consists of buying votes with newly-created money (not even the money of others) and then bequeathing the inflation to their successor within a few years. And they can no longer do that.

Why do you think Jesus Christ left quickly after the multiplication of loaves? Because he saw that people were selfish, that they barely cared about his sermon, and that what they wanted was to make him king in order to live for free and never do a lick of work again. Today the manna and the multiplied loaves seem to be inflation. The only way to make the impossible possible is to rely on inflation or to issue debt that is later monetized.

Yet all of this disappears like a dissolving sugar cube in a deflationary environment with very slow monetary growth and without monetary-policy autonomy. That is why politicians always hate deflation, especially if they are hoping inflation will help them repay public debt (i.e. by swindling their creditors with a masked haircut).

Therefore, the best way to rein in a politician is not to form a political party, nor to debate with him in Parliament. That is all a waste of time. Indeed, the only way to put a stop to the nonsense of politicians is to rely on the discipline imposed by a monetary restraint. The gold standard provided such a restraint in the past, and the closest thing to it we now have is the euro. That is the only true way.

Also delighted with inflation are trade unionists. Inflation covers their backs, since the devastating effects of union policies, which tend to make the labor market more rigid (artificial increases in wages, the minimum wage, etc.), are concealed in an inflationary environment. However, in an environment of zero inflation, or of deflation, these effects are fully exposed, and we immediately realize that such policies are harmful.

I repeat, the only way is to lead politicians and trade unionists, like leading steers do at a bullfight, down the corridor of monetary stability. For as my grandfather used to say, people like to be fooled. You explain a serious, sensible product, with guaranteed savings, a low interest rate… (a classic life insurance policy, for example, like the ones I provide), and then you explain something that looks really good on the surface (“Look, if you put your money into this fund, you’re going to get rich; it’s going to go up in value every year…etc.”), and ten people out of ten take the bait.

In short, entrepreneurs are confronted by countless daily problems in their companies. If you offer them a very cheap and easy short-term loan with flexible repayment options, they all end up falling for it, just like they did during the bubble stage.

That is why inflation is so popular. That is why it is so perverse and does so much damage. That is why it is a drug so lethal to society. And that is why deflation is so necessary.

Thank you all very much for your patience.