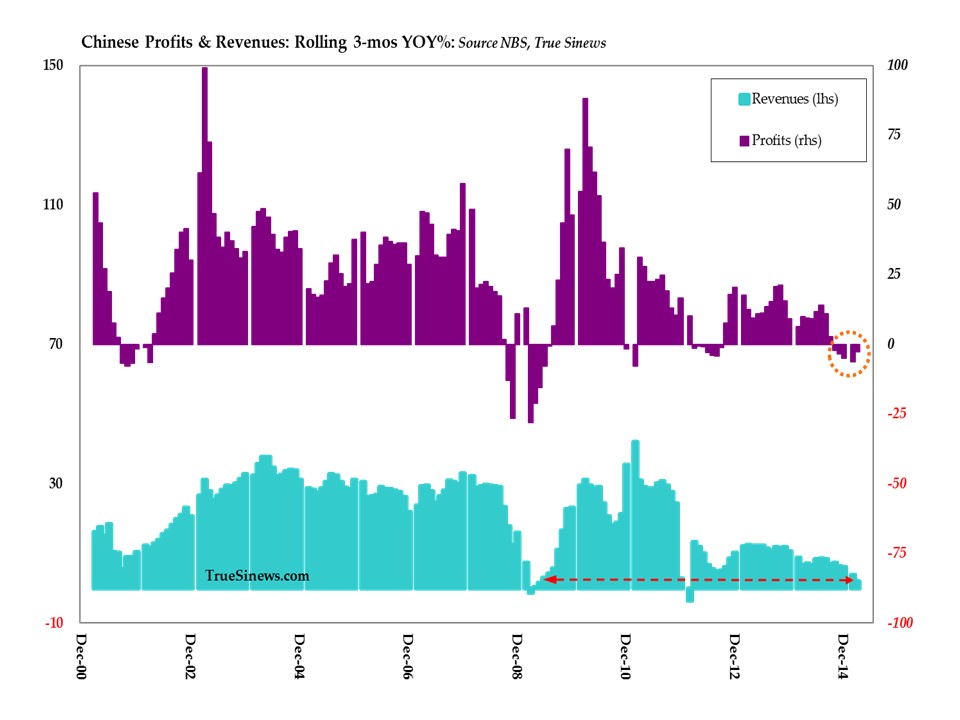

Though the punditocracy has become much more aware of the sheer scale of China’s equity bubble in recent weeks, it is still arguably the case that reality is running ahead of reportage even as more and more evidence emerges of just how dire things are in the world beyond the brokerage screens.

For example, although the latest recorded surge in stock accounts – a cool 3.28 million in a week – made it into the press, it was less widely remarked that no less than 1.2 million fund accounts (some of which may employ significant amounts of leverage) were also opened. nor was it much of a surprise that, having exhausted the number of digits on the exchange’s display only a few days earlier by trading 1 trillion shares for the first time ever, turnover continued to rise, hitting 1.7 trillion at one point in the week.

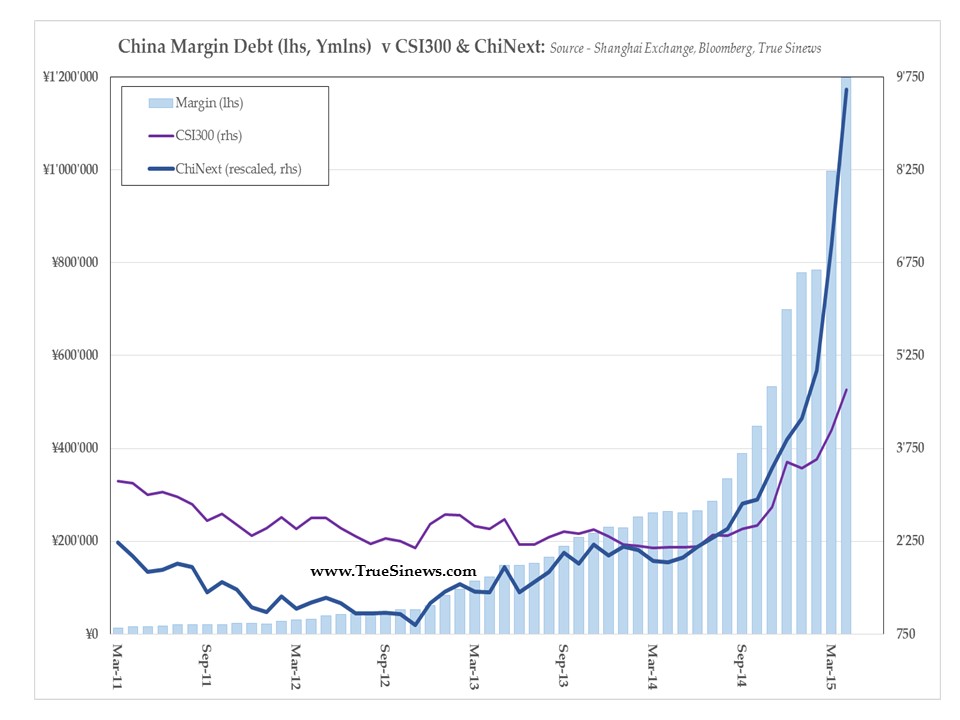

But what was perhaps most remarkable was the ongoing surge in margin finance, which closed the week at a whopping CNY 1.2 trillion, having risen by over CBY500 billion so far in 2015 – a gain which means it has been responsible for CNY1 in every CNY9 in new loans this year and as much as CNY1 in every CNY6 in the past two months alone.

The PBOC clearly faces something of a dilemma as it tries to rejuvenate a flagging supply of money while trying to ensure that only ‘real’ economic demands for credit are being met.

Europe was largely pre-occupied with trying to come to terms with the state of denial which has gripped both Greece and its external creditors – an impasse which has only served to demonstrate yet more clearly that sovereigns are neither ‘risk-free’ nor a sensible assumer of other, more legally-tractable entities’ obligations in a crisis.

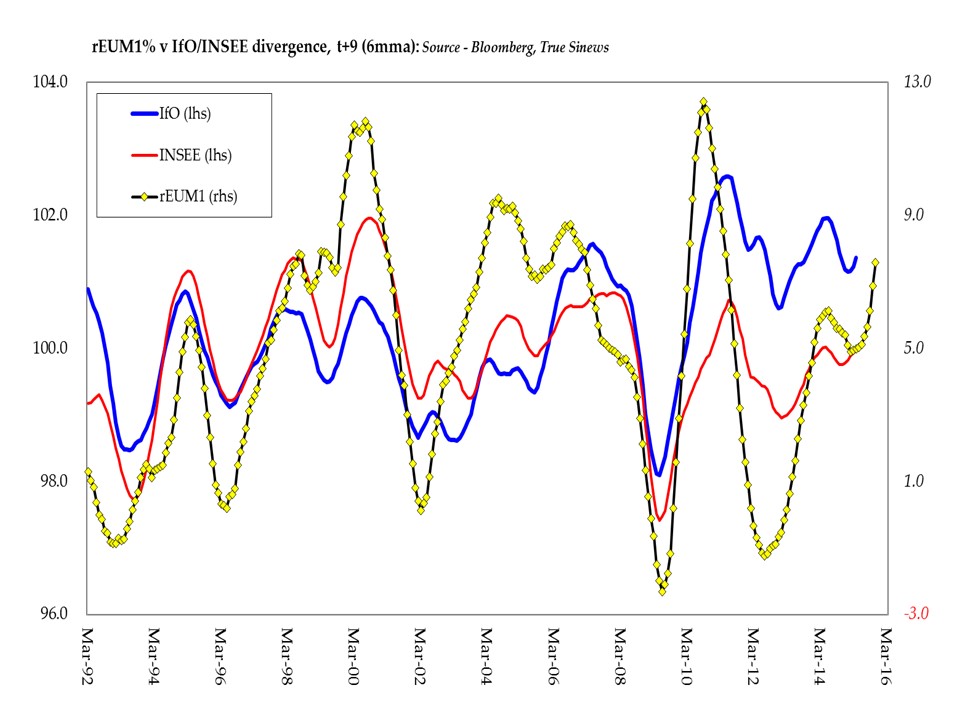

There was however just enough energy left over to raise a wail of despair when the relatively unseasoned (and largely redundant) Markit PMI for Germany ‘disappointed’, with some even wondering whether this meant the ECB needed to do even more in the way of destructive rate-rigging. The irony was, of course, that, just 24 hours later, the much more reliable and far better established IfO survey ‘surprised’ on the upside – though quite how unexpected this really was, given the rapid pace of money supply growth in the Zone, is rather a moot point.

Let us just say once again QEuro = Too Much, Too Late.

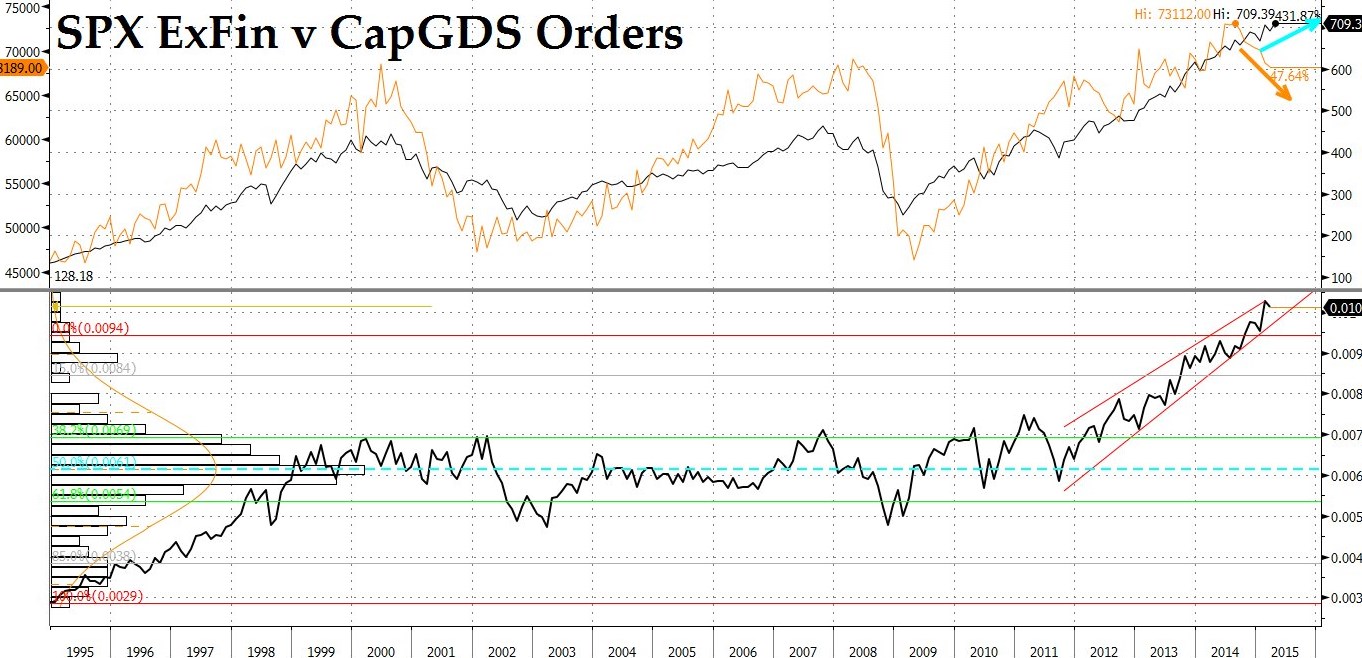

In the US, disappointment this time focused on the durable goods orders, once transport had been stripped out at least, and especially on the weakening trace of core capital goods orders. Given the pullback in the oil patch, this, too, might have been foreseeable though it is not entirely to be ignored as a possible early indication that some of America’s upward momentum may have been lost for reasons other than Western drought, Eastern freeze, and the winter’s industrial unrest.

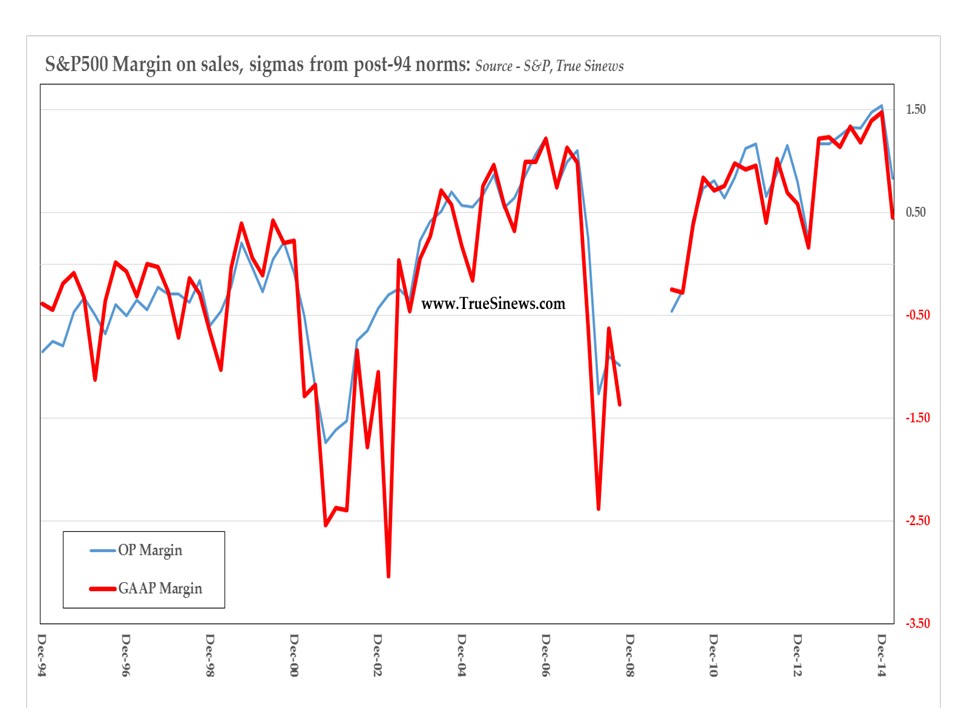

On thing that is for sure, the slippage here has introduced a slightly worrying divergence with the path of the S&P ex-Financials – an index which is also testing the envelope against sales and wages as well as probing ever upward in the more traditional metrics of price to earnings, sales, and book – with all this implicit optimism coming despite a clear drop in GAAP and operating margins for the S&P as a whole.

Oil has been on something of a tear as the first hard(ish) numbers trickle in to confirm that the spectacular drop in the rig count is finally reining in production. This really cannot come soon enough when you take a glance at the pace of inventory builds – especially if you add those for product to that for crude itself.

To get a feel for what has been happening, consider that, since the last week of November when that month’s OPEC meeting broke up without any agreement to try to limit output and ushered in the collapse , the US has produced just less than 1.3 billion barrels of oil of which no less than 1 in 9 – around 140 Mbbl – has gone straight into storage, either as it came out of the ground or in refined form.

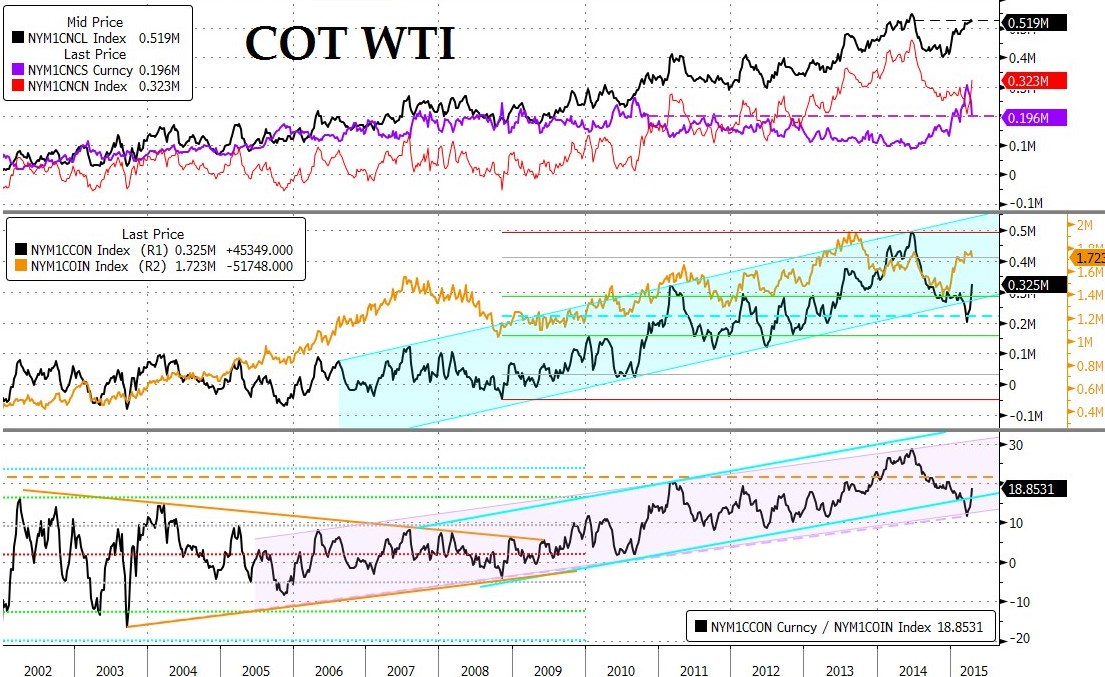

The oil market here is especially intriguing. Front-month short-covering has been significant, with specs buying back 110k contracts from a group of commercials only too happy to supply them on the upswing. This has meant net spec longs have recouped almost half the slide from Midsummer Day’s record high even as the pressure has driven the nearby contract to the very top of the past four months’ nervy consolidation band.

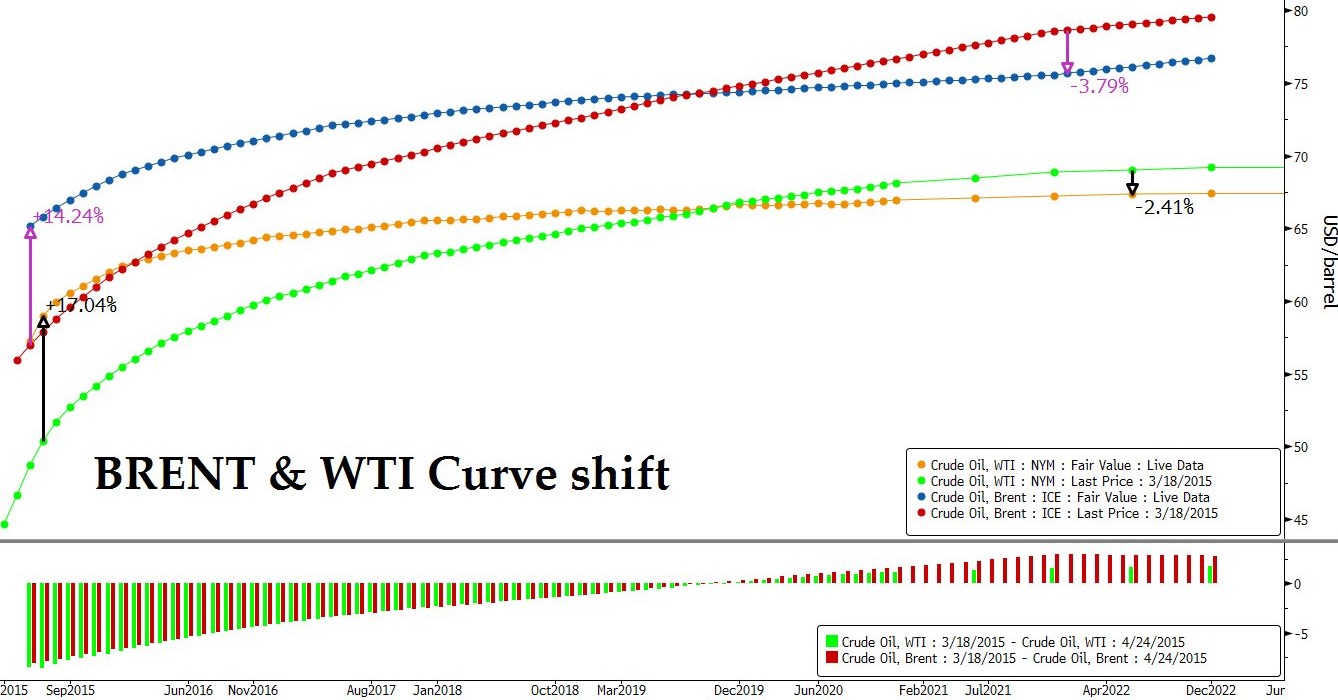

At the same time, the far end of the curve has actually traded lower in a reversal which could actually be contrued as resuming the four-year decline so rudely interrupted in the first half of 2014. Incredible? Not necessarily when you read just how rapidly drilling techniques are advancing in both oil and gas.

Consider that CEO Kyle Mork of ECA regaled us last week with how his (gas) company had lowered costs per foot by 38% in five years, at the same time it had increased gas output per foot drilled by 24%; that it had quadrupled the length of each well while pushing 30 day IP rates up by 3.3 times and achieving ultimate recovery rates five times better than when the comparison period started. Moore’s Law comes to fracking!

Some of this is no doubt an accident of geology and perhaps Mr. Mork has allowed himself the raconteur’s privilege of a little mild cherry-picking of his firm’s experiences, but even after taking cognisance of such caveats, the message is clear: the main impediments to securing more plentiful sources of hydrocarbons at lower costs of production are largely man-made, not God-given.