With last week’s report of monetary developments in the Eurozone, we again have evidence both of Draghi’s monetary monomania and of the sheer futility of his constant refrain that the ECB is just buying time until member states undertake the ever-promised, but never-delivered ‘structural reforms’ which they all so patently require.

Just consider that, over the past five months, the monetary base (effectively the new money which the ECB alone creates by printing bank notes and by booking those claims on itself which go by the name of ‘reserves’) has expanded by just over €150 billion (at a 34% annualized rate, no less!). Move up to the next level of the inverted pyramid of money and credit – namely, to M1 which is the money you and I hold both in the form of demand deposits at our own bank and as the cash jingling in our pockets – and you will see that it rose by €378bln (+16% annualized or €104 million an hour!). You will then discover that M3 – which next includes all manner of other, not instantly withdrawable loans made by us to the banks – perversely climbed a lesser €341bln (+8.2% ann.) which means that the sum of these new categories of funds actually declined.

The first increase – the direct consequence of QEuro – is wildly excessive by any standard other than the twisted one of the Bernanke-Kuroda era. The second gain shows us that commercial banks are indeed more than capable of adding their own flood of what the jargon terms ‘inside’ money to the ECB’s ‘outside’ effusions. This, in turn, implies that they are nowhere near as impaired – or as reluctant – as some would have us believe in their ability to undertake one of their primary functions, viz. money creation. Finally, the fact that the increment to M3 was actually smaller than that to M1 shows that we – possibly involuntary – holders of all this money still have little appetite to commit ourselves to any horizon longer than the overnight in storing it – partly, of course, because the rewards for tying it up any longer are so deliberately minimal.

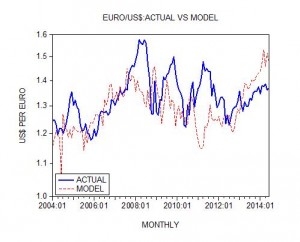

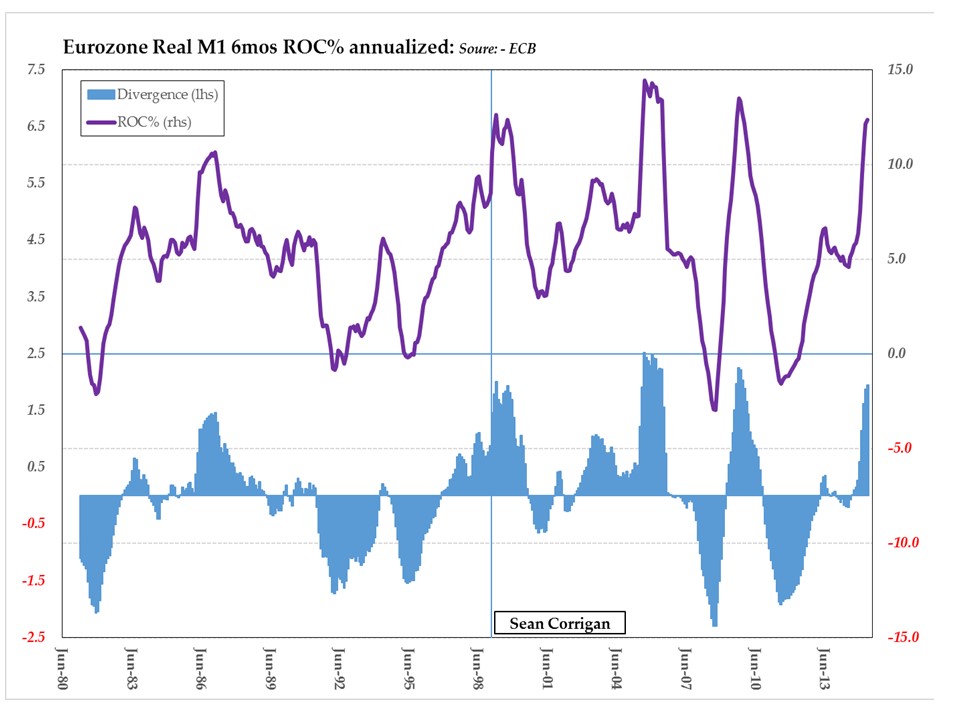

The graph shows just how embarrassing this excess is becoming, especially when we adjust for price changes and hence for that quantity of real goods for which this hoard could theoretically be exchanged (only theoretically since, if it were so mobilized all at once, then those same prices would almost inevitably begin to rise more rapidly as a result).

But it is on the other side of balance sheet that we see not just the redundancy of QEuro, but its malign side effects, too, since there we find that only €120 billion of this flood of new money has found its way into non-governmental borrowing (at a rate of just 2.3% annualized), while the profligate and growth-suppressing state behemoths of the Zone have hoovered up €160 billion in that same time, a blistering pace of increase of 11.3% annualized. As a result of this disparity, almost a quarter of the stock of all Euro bank advances made in the form of loans and securities purchases are now booked to the account of the tax-eaters, not the wealth-creators.

On top of that, we have to add the €138 billion that the ECB itself has bought as part of its programme to deny the citizenry some of the bounties of a lower oil price – sorry, to prevent what it laughingly calls ‘deflation’. Thus, the very same governments which Snr. Draghi so piously enjoins to ‘reform’ have been enjoying from him and his minions a €2 billion-a-day subsidy for their current, utterly unsustainable lifestyles – most, if not all of that sum, coming to them at an historically low interest cost and hence with little immediate disincentive to its use.

You may have heard the Good and the Great bandying about the horrors of the ‘secular stagnation’ to which they tell us we are doomed unless they are allowed to continue to destroy the hopes of savers and the discipline of borrowers. You may therefore have wondered how this dread disease was first contracted. Well, the predominance in the take up of bank credit of the low-, zero-, even negatively-productive public sector over that of the potentially productivity-enhancing private, entrepreneurial sector is certainly a place to start looking.

Mille grazie, Mario!