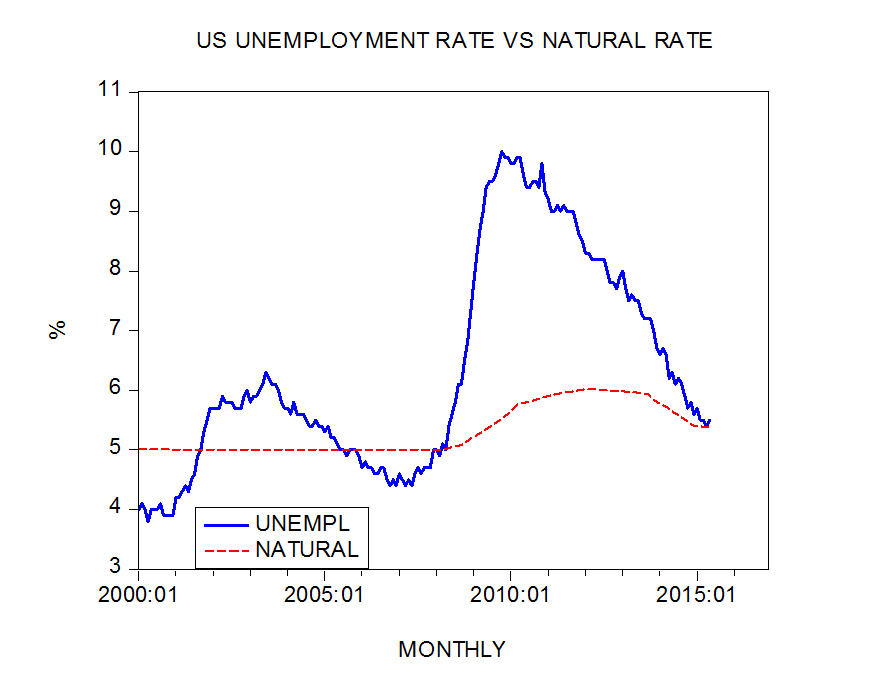

In May the US unemployment rate stood at 5.5% against the rate of 5.3% for the natural unemployment also known as the Non-Accelerating Inflation Rate of Unemployment (NAIRU).

According to the popular view once the actual unemployment rate falls to below the NAIRU, or the natural unemployment rate, the rate of inflation tends to accelerate and economic activity becomes overheated. (This acceleration in the rate of inflation takes place through increases in the demand for goods and services. It also lifts the demand for workers and puts pressure on wages, reinforcing the growth in inflation).

On this way of thinking the central bank must step in and lift interest rates to prevent the rate of inflation from getting out of control.

Recently however, some experts have raised the possibility that the natural unemployment rate is likely to be much lower than the government official estimate of 5.3%. In fact it is argued that the natural unemployment rate since October last year has fallen to 4.3% – (Daniel Aaronson & Arian Seifoddini – The Federal Reserve Bank of Chicago – Chicago Fed Letter 2015 Number 338).

The reasons for this decline are demographic changes and an increase in the level of education. (The natural unemployment rate tends to fall, so it is held, with the rising age of the labour force and with its education).

Experts are of the view that these factors should continue to lower the natural unemployment rate for at least the remainder of the decade.

It is held that a lower natural rate may help explain why wage inflation and price inflation remain low, despite the actual unemployment rate recently reaching 5.5%.

A lower natural rate of unemployment on this way of thinking suggests the Fed can keep interest rates lower for longer without worrying about lifting the rate of inflation.

Why NAIRU is an arbitrary measure

The NAIRU however, is an arbitrary measure; it is derived from a statistical correlation between changes in the consumer price index and the unemployment rate. What matters here is whether the theory “works”, i.e., whether it can predict the future rate of increases in the consumer price index.

This way of thinking doesn’t consider whether a theory corresponds to reality. Here we have a framework, which implies that “anything goes” as long as one can make accurate predictions.

The purpose of a theory however is to present the facts of reality in a simplified form – a theory has to originate from reality and not from some arbitrary idea that is based on a statistical correlation.

If “anything goes” then we could find by means of statistical methods all sorts of formulas that could serve as forecasting devices.

For example, let us assume that high correlation has been established between the income of Mr Jones and the rate of growth in the consumer price index – the higher the rate of increase of Mr Jones’ income, the higher the rate of increase in the consumer price index.

Therefore we could easily conclude that in order to exercise control over the rate of inflation the central bank must carefully watch and control the rate of increases in Mr Jones’ income. The absurdity of this example matches that of the NAIRU framework.

Contrary to mainstream thinking, strong economic activity as such doesn’t cause a general rise in the prices of goods and services and economic overheating labeled as inflation.

Regardless of the rate of unemployment, as long as every increase in expenditure is supported by production no overheating can occur.

The overheating emerges once expenditure is rising without the backup of production – for instance when the money stock is increasing. Once money increases it generates an exchange of nothing for something, or consumption without preceding production, which leads to the erosion of real wealth.

As a rule, rises in the money stock are followed by rises in the prices of goods and services.

Prices are another name for the amount of money that people spend on goods they buy.

If the amount of money in an economy increases while the amount of goods remains unchanged more money will be spent on the given amount of goods i.e., prices will increase.

Conversely, if the stock of money remains unchanged it is not possible to spend more on all the goods and services; hence no general rise in prices is possible.

By the same logic, in a growing economy with a growing amount of goods and an unchanged money stock, prices will fall.

Summary and conclusion

In May the US unemployment rate closed at 5.5% slightly above the official estimate of the natural unemployment rate of 5.3%. Based on this many commentators are of the view that the FED ought to tighten its stance to prevent the rate of inflation getting out of control. Some experts, however, hold that the natural unemployment rate might be 4.3% and hence from this perspective the FED could delay its tightening. We suggest that the natural unemployment is an arbitrary concept. Policy makers by relying on this concept are likely to make things much worse.